- Home

- »

- Pharmaceuticals

- »

-

Europe Pharmaceutical Market Size, Industry Report, 2030GVR Report cover

![Europe Pharmaceutical Market Size, Share & Trends Report]()

Europe Pharmaceutical Market (2025 - 2030) Size, Share & Trends Analysis Report By Molecule, By Product (Branded, Generics), By Type (Prescription, OTC), By Disease, By Age Group, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-357-7

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

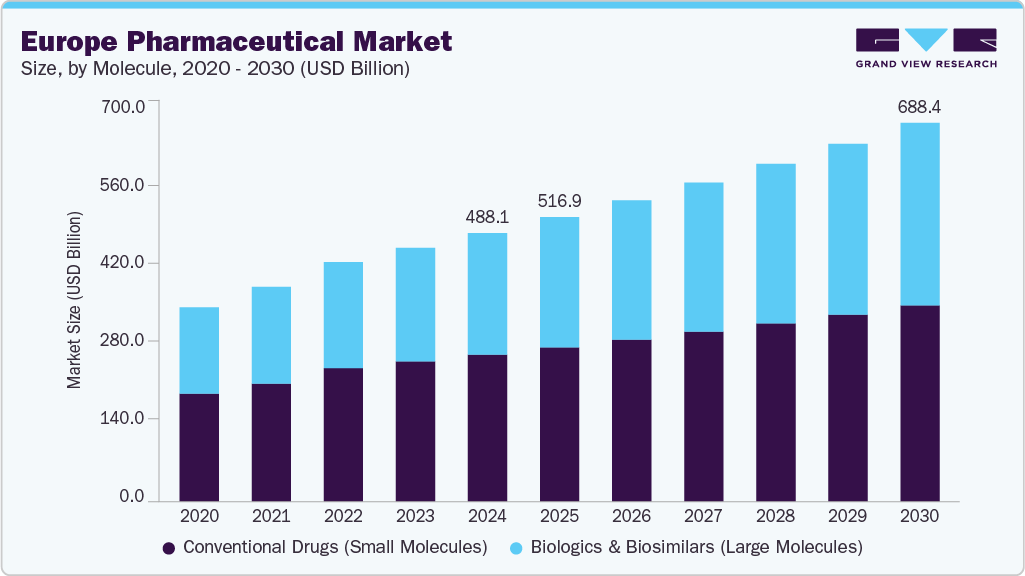

The Europe pharmaceutical market size was estimated at USD 488.05 billion in 2024 and is projected to grow at a CAGR of 5.90% from 2025 to 2030. Several factors, including an aging population, advancements in medical technology, and rising healthcare spending, drive market growth. In addition, the increasing prevalence of chronic diseases, access to innovative medicines, expediting regulations, and growing demand for preventive healthcare contribute to market expansion. Government initiatives and digital health growth further support this trend.

Strategic partnerships and investments in research and development remain key factors driving product innovation and enhancing market competitiveness. The Europe pharmaceutical industry is significantly impacted by advancements in medical technology, particularly in biotechnology and drug development. Innovations such as CAR-T cell therapy, gene therapy, and advanced biologics structure how diseases are treated, often resulting in more targeted, effective, and non-invasive treatments. Biopharmaceuticals, including monoclonal antibodies, immunotherapies, and cell therapies, have revolutionized the market for diseases such as cancer, autoimmune disorders, and rare genetic conditions. The major focus on pipeline products includes innovations such as biologics, biosimilars, and drugs focusing on all therapeutic areas, immunotherapies, and emerging drug delivery systems. By continuously introducing groundbreaking treatments, such as vaccines, biologics, immunotherapies, and targeted therapies, patients may access more effective and personalized care as and when required. The growing focus on orphan drugs for rare and underserved diseases is driving the development of new therapies. The number of pipeline drug candidates for mitigating these diseases is accelerating regulatory initiatives for approval.

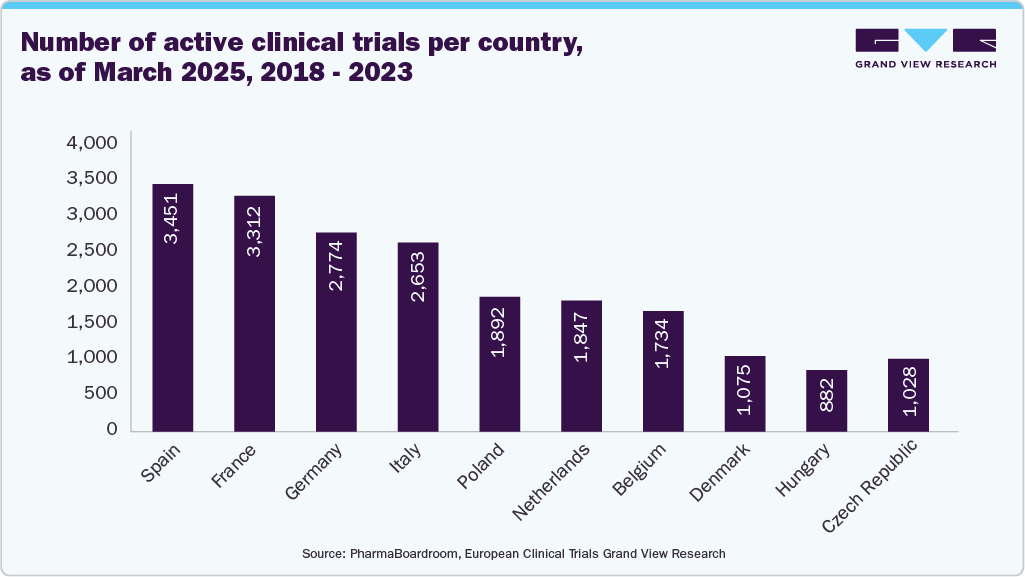

The European Medicines Agency (EMA) plays a critical role in streamlining the drug approval process, ensuring that innovative treatments are accessible to patients while maintaining high safety standards. The regulatory framework in Europe facilitates collaboration between pharmaceutical companies and regulatory bodies, which accelerates the development and commercialization of new medicines. In a report released in 2024, the European Federation of Pharmaceutical Industries and Associations (EFPIA), in collaboration with IQVIA, provides an overview of Europe’s clinical drug trial landscape. The bar graph below summarises the number of active clinical trials per country as of March 2025.

The EU's regulatory framework, had introduced the Clinical Trials Regulation (CTR) in January 2022 for the active participation of patients. Continued efforts to harmonize regulations, streamline processes, and invest in research infrastructure are essential to ensure Europe's competitiveness in the clinical trials arena.

The R&D expenditure in Europe’s pharmaceutical sector has been a key driver of market growth, with continuous investments fueling the discovery and development of new therapies. Europe pharmaceutical industries contributed 15.8% (The top 5 comprised France, Germany, Italy, Spain, and the United Kingdom) for launching new medicines in the market from 2018-2023. Pharmaceutical companies investing heavily in R&D are often seen as more innovative and capable of delivering new, high-demand therapies. As companies advance promising drugs through clinical trials, their market value typically rises, leading to higher trading volumes. In 2024, EU exports of medicinal and pharmaceutical products rose by 13.5% compared to 2023, totaling 338.3 billion, approximately USD 338.3 billion. Leading companies such as F. Hoffmann-La Roche Ltd, Boehringer Ingelheim GmbH, and Bristol-Myers Squibb Company allocate substantial portions of their revenues to R&D, understanding the critical need to develop innovative drugs that address the challenges posed by an aging population and the rising incidence of chronic diseases.

The research-driven pharmaceutical industry is pivotal in driving Europe’s economic recovery and maintaining its competitiveness in an increasingly dynamic economy. According to the European Federations of Pharmaceutical Industries and Associations, it is estimated that in 2023, 56,234 million USD was invested solely in the R&D sector. Many European governments are increasing healthcare budgets to address the growing demand for medical services, particularly as the population ages and the incidence of chronic diseases rises. This financial commitment enables expanding public health programs and increases access to essential medicines, directly benefiting pharmaceutical companies. Countries such as Germany, France, and the UK have dedicated considerable resources to healthcare initiatives, ensuring that a wider array of treatments, including innovative pharmaceutical products, are accessible to patients. As a result, the increase in overall healthcare spending, particularly in pharmaceuticals, creates a favorable environment for market growth as more people gain access to new therapies and treatments.

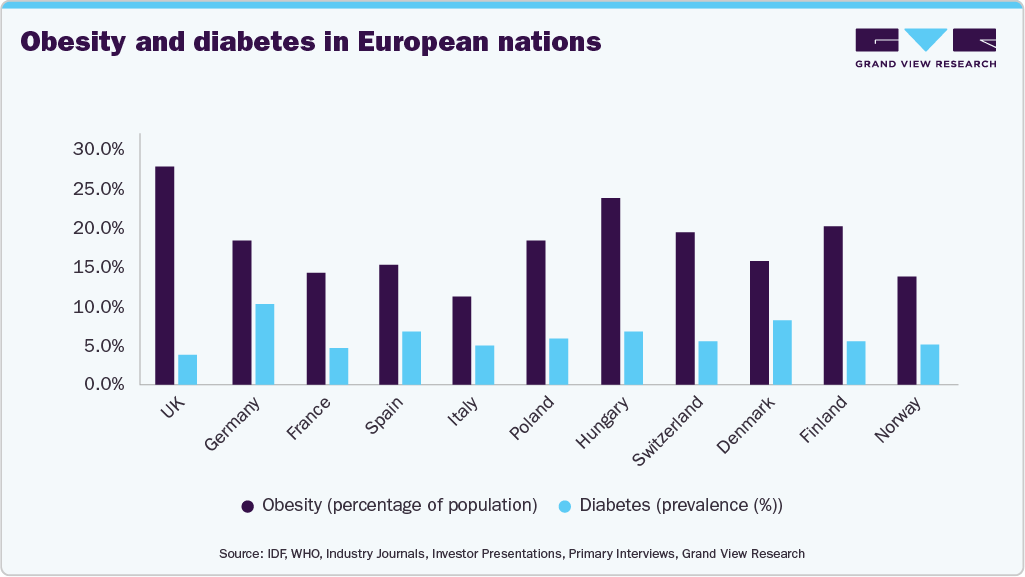

The rising prevalence of chronic diseases such as diabetes, hypertension, cancer, and cardiovascular conditions is a critical driver of the European pharmaceutical market. Shifting lifestyles within the European population have significantly contributed to the rising prevalence of cardiovascular diseases, gastrointestinal disorders, obesity, and metabolic conditions like diabetes. The graph below illustrates the varying rates of obesity and diabetes across different European countries.

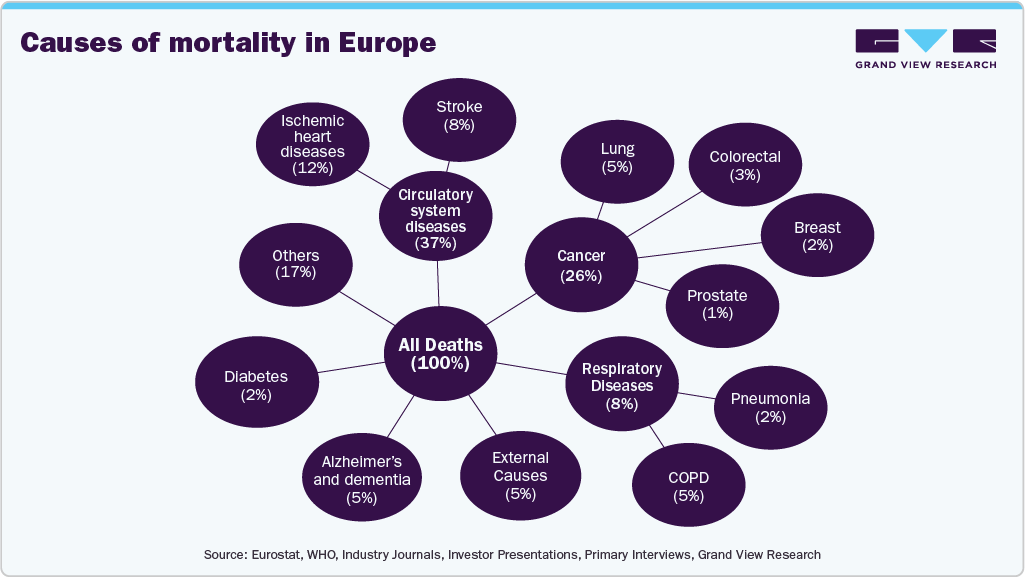

The increasing number of obese and overweight individuals is driving the rise in related preventable diseases. For example, those who are obese are more susceptible to severe infections and other health conditions. Enhancing healthcare infrastructure helps streamline the adoption of pharmaceuticals and innovative treatments for managing these diseases. Chronic diseases are becoming more common due to lifestyle factors such as poor diet, lack of physical activity, and smoking, as well as an aging population. The chart below illustrates the percentage of diseases and their causes of mortality in Europe.

These deadly diseases often require ongoing medication and management, driving demand for pharmaceutical treatments. In response, pharmaceutical companies are investing heavily in developing drugs that offer better outcomes for chronic disease management. The growing number of people living with chronic diseases also puts pressure on healthcare systems to provide better treatment options, which in turn creates opportunities for pharmaceutical companies to deliver novel solutions.

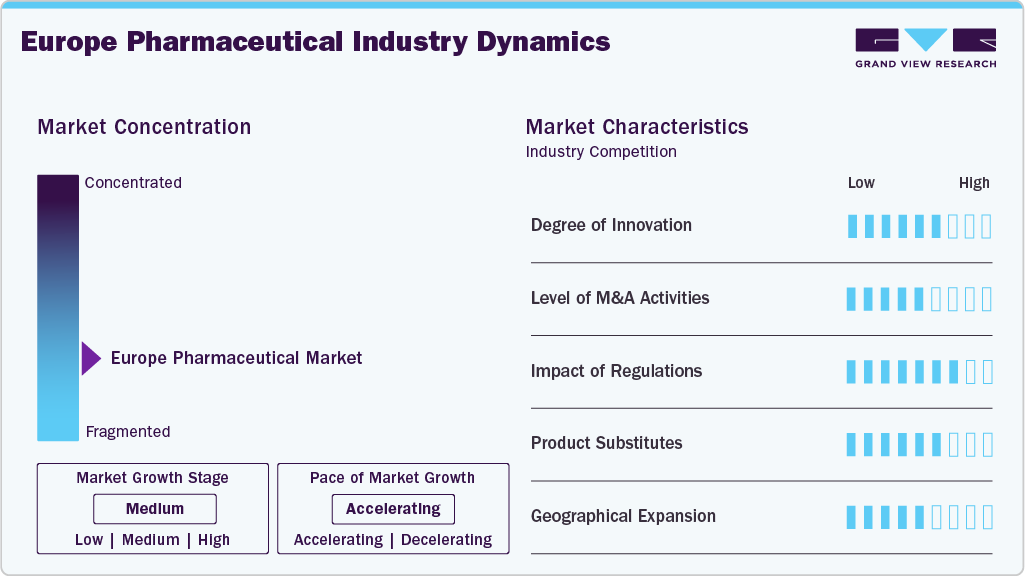

Market Concentration & Characteristics

The Europe pharmaceutical industry is characterized by continuous innovation in drug discovery, formulation technologies, and personalized medicine approaches. Companies invest heavily in R&D to develop breakthrough treatments, particularly in areas such as oncology, immunology, and neurology. Innovation not only enhances patient outcomes but also positions companies as market leaders. The increasing demand for personalized medicine, biologics, and gene therapies in Europe pushes pharmaceutical companies to stay ahead of the curve and deliver novel solutions to address complex health challenges.

Mergers and acquisitions (M&A) are integral to the Europe market’s growth strategy. Pharmaceutical companies engage in M&A to access innovative drug portfolios, expand therapeutic capabilities, and enter new geographical markets. Strategic acquisitions also allow companies to diversify their offerings, strengthen market position, and accelerate the commercialization of new drugs.

The European Medicines Agency (EMA) enforces strict regulatory standards, which impact approval processes, pricing, and market access. While these regulations protect patient safety, they can also create barriers to entry, lengthen development timelines, and add to operational costs. In response, pharmaceutical companies must navigate complex regulations and adapt their strategies to comply with evolving standards, which can influence product development and market dynamics across Europe.

Product substitutes, including generics and biosimilars, significantly impact the European market. As patents for branded medications expire, generics and biosimilars offer more affordable alternatives, increasing price competition and reducing profit margins for originator companies. European pharmaceutical firms focus on developing next-generation therapies, differentiating their products, and expanding into specialized treatments to maintain market share and profitability amidst growing competition.

Geographical expansion is essential for pharmaceutical companies looking to capitalize on growth opportunities within the European market. Expanding into new European countries, especially emerging markets in Eastern Europe, enables companies to access a larger patient base and diversify revenue streams. Successful geographical expansion in Europe requires navigating diverse regulatory environments, understanding local healthcare needs, and forming strategic partnerships.

Molecule Insights

Conventional drugs (small molecules) dominated the market, with the largest share of 54.74% in 2024. These drugs are typically chemically synthesized and designed to target specific biological pathways, often by binding to receptors or enzymes. Small molecules treat various conditions, from cardiovascular diseases to cancer and infectious diseases. Despite the rise of biologics and other advanced therapies, small molecules remain the most commonly prescribed medications due to their proven efficacy, lower production costs, and easier distribution. They also offer the advantage of oral administration, which enhances patient convenience. Small molecules are crucial in addressing chronic conditions that require long-term management, such as hypertension and diabetes. Their ongoing use, particularly in treating common diseases, ensures their central role in European healthcare systems.

Biologics & Biosimilars (Large Molecules) is the fastest-growing segment over the forecast period. Biologics are complex, large-molecule drugs that treat various conditions like cancer, autoimmune disorders, and rare diseases. These treatments have revolutionized healthcare, offering targeted therapies with higher specificity and efficacy than conventional small molecules. However, biologics are expensive, leading to a rising demand for biosimilars, biologically similar but more affordable alternatives. In January 2025, European Medicines Agency (EMA) Committee for Medicinal Products for Human Use (CHMP) issued positive opinions recommending the approval of marketing authorizations for three biosimilar products: Amgen’s PAVBLU and SKOJOY, as well as CuraTeQ Biologics’ DYRUPEG for visual impairment The introduction of biosimilars has improved patient access to critical therapies and is expected to drive cost savings for healthcare systems across Europe. As biologics continue to expand in therapeutic use, the biosimilar sector is poised for further growth, enhancing competition, and broadening treatment options.

Product Insights

The branded segment dominated the market with a revenue share of 66.49% in 2024, driving both innovation and exclusivity. These branded drugs benefit from regulatory frameworks that support their development, ensuring safety and efficacy. These drugs maintain a strong market presence due to their brand recognition, established clinical evidence, and continued demand for novel treatments. Their role in the European pharmaceutical market remains vital, especially in developing new therapies that drive healthcare innovation and improve patient outcomes.

The generic segment is anticipated to experience the fastest CAGR during the forecast period, fueled by a significant number of patent expirations in 2024, growing demand for cost-effective medications, and increasing healthcare expenditures. Supportive regulatory frameworks and cost-control initiatives by governments and healthcare providers also drive the increased adoption of generics. The European Union's regulatory environment, led by the European Medicines Agency (EMA), ensures that generics meet the same quality, safety, and efficacy standards as their branded counterparts. Thus, the availability of generics promotes competition, drives down prices, and increases the overall sustainability of healthcare systems in Europe while still ensuring high standards of patient care.

Type Insights

The prescription segment held the largest share in the market, with a revenue of 86.76% in 2024, driven by rising demand for chronic disease treatments, an aging population, and regulatory support. Governments are implementing strategies to manage healthcare expenditures, including promoting generic drugs and biosimilars, which offer cost-effective alternatives to branded medications. The rise of e-pharmacies and digital health platforms enhances access to prescription medications, particularly in countries with advanced digital infrastructures. The European prescription drug market is poised for continued growth, driven by demographic shifts, the increasing burden of chronic diseases, and supportive regulatory frameworks. Integrating digital health solutions and cost-containment measures further expands the market.

The over-the-counter (OTC) pharmaceutical segment in Europe is experiencing fast growth over the forecast period, driven by increasing consumer preference for self-medication, a rising aging population, and expanding access to OTC products through various distribution channels. Factors such as the aging population, rising healthcare costs, and growing health and wellness awareness contribute to market expansion. In addition, regulatory support for OTC drug approvals and shifting toward e-commerce platforms are shaping market dynamics. Major regional players focus on innovation and expanding product portfolios to cater to evolving consumer needs.

Disease Insights

The cancer segment dominated the market with a revenue share of 18.06% in 2024. The rising prevalence, driven by aging populations, lifestyle changes, and environmental factors, is fueling substantial market growth. The market is characterized by a shift towards personalized medicine, with targeted therapies and immuno-oncology drugs leading the development. In addition, the rise of generic oncology drugs has improved affordability, enhancing patient access to essential treatments. The European Medicines Agency (EMA) plays a crucial role in shaping the market through its approval processes and guidelines. For example, in September 2024, Astellas Pharma Inc. announced that the European Commission (EC) approved VYLOY (zolbetuximab) in combination with fluoropyrimidine- and platinum-containing chemotherapy for the first-line treatment of adult patients with locally advanced unresectable or metastatic HER2-negative gastric cancer. Emerging innovations, such as using artificial intelligence in drug discovery and development, are expected to revolutionize the market further, offering new possibilities for cancer treatment.

The European anti-obesity drug segment is experiencing rapid growth, driven by increasing obesity rates and advancements in pharmacological treatments. With more people seeking effective treatments, there has been a surge in the development of anti-obesity medications, particularly GLP-1 receptor agonists, which have shown promising results in weight loss. For instance, in February 2025, Biocon Limited launched its generic version of liraglutide in the UK, marking a significant milestone in the company's expansion into the European market. Pharmaceutical companies are heavily investing in research and production facilities to meet the growing demand for these treatments. The trend is further fueled by the increasing recognition of obesity as a serious health condition, prompting both public and private sectors to prioritize solutions that address this widespread issue.

Route of Administration Insights

The oral route of administration proved to be a significant contributor to revenue, with a share of 57.53% in 2024. The oral segment remains a cornerstone of drug delivery, encompassing tablets, capsules, and novel formulations like orally disintegrating tablets (ODTs). These dosage forms are favored for their convenience, stability, and cost-effectiveness. Innovations such as osmotic-controlled release systems and buccal tablets are enhancing drug efficacy and patient compliance. The market's growth is further supported by robust healthcare infrastructure and increasing demand for chronic disease management solutions. Regulatory frameworks across Europe continue to evolve, ensuring the safety and effectiveness of oral medications while fostering innovation in drug delivery technologies.

The parenteral route of administration was the fastest-growing segment over the period of 2025 to 2030, driven by advancements in drug delivery technologies and an increasing prevalence of chronic diseases. Injectable medications, including biologics and biosimilars, are becoming more prevalent due to their effectiveness in treating conditions such as cancer, diabetes, and autoimmune disorders. Innovative technologies, such as prefilled syringes, autoinjectors, and wearable devices, are enhancing patient convenience and adherence to treatment regimens. The demand for self-administration of parenteral drugs at home is rising, supported by user-friendly devices and a shift towards patient-centric care models.

Age Group Insights

The adult segment comprises the largest revenue share of 62.84% in 2024 among all other segments, driven by an increasing prevalence of chronic diseases and lifestyle-related health issues. This segment is particularly affected by conditions such as cardiovascular diseases, diabetes, and obesity due to a sedentary lifestyle, leading to a higher demand for effective treatments. Pharmaceutical companies are focusing on developing innovative therapies tailored to the needs of the adult population, including personalized medicine approaches. In addition, there is a growing emphasis on preventive healthcare and early intervention strategies to manage and mitigate the impact of chronic conditions. The expansion of digital health solutions and telemedicine is also enhancing access to healthcare services for adults across Europe.

The geriatric segment will be among the fastest-growing sectors from 2025 to 2030. The market is expanding due to the aging population and the increasing prevalence of age-related chronic conditions. Older adults often experience multiple comorbidities, necessitating complex treatment regimens. Pharmaceutical companies focus on developing age-specific therapies that address the unique physiological changes and polypharmacy risks associated with aging. Regulatory bodies like the European Medicines Agency (EMA) are actively promoting research and development in geriatric medicine, emphasizing the need for clinical trials that include older populations to ensure the safety and efficacy of treatments. This approach aims to improve healthcare outcomes and quality of life for the geriatric population across Europe.

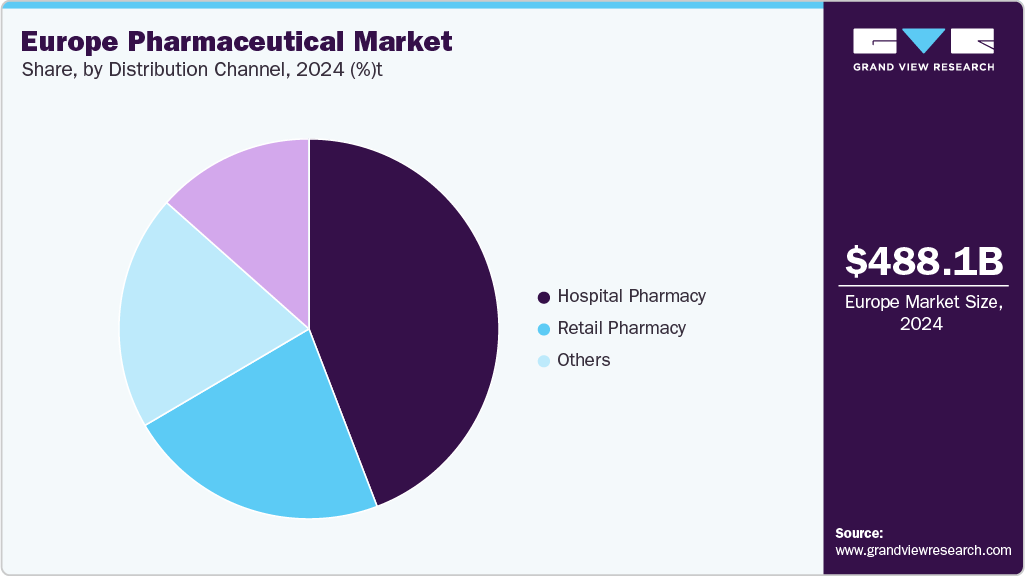

Distribution Channel Insights

Hospital pharmacy reported a revenue share of 53.53% in 2024, the largest share among all other segments. Hospital pharmacies are integral to patient care, ensuring the safe and effective use of medications, particularly for inpatients requiring specialized treatments. They manage a diverse inventory of drugs, including critical care and therapeutic medications across various therapeutic classes. The evolving landscape of hospital pharmacy services emphasizes the importance of clinical pharmacy practice, aiming to optimize therapeutic outcomes and enhance patient safety through expert medication management.

The others segment included the digital health platforms and tele-pharmacies, which is projected to witness the CAGR over the forecast period, driven by increasing consumer preference for convenience and accessibility. With advancements in e-commerce and digital health platforms, patients can now easily purchase prescription and over-the-counter medications from the comfort of their homes. Online pharmacies offer various pharmaceutical products, including medicines, health supplements, and wellness items. The growing trend of telemedicine and the ease of home delivery have further fueled this growth. Furthermore, online pharmacies often provide cost-effective alternatives and enhanced privacy, making them a preferred choice for many consumers.

Country Insights

The European pharmaceutical industry is experiencing significant growth, driven by an aging population, rising chronic diseases, and increased healthcare expenditure. Innovation in biologics, biosimilars, and generics plays a key role in shaping the market. Advancements in digital health, telemedicine, and e-pharmacy are transforming medication access. The adoption of personalized medicine and growing demand for cost-effective treatments also contribute to Europe's dynamic and competitive landscape.

UK Pharmaceutical Market Trends

The UK pharmaceutical industry is characterized by robust growth, driven by an aging population, increasing prevalence of chronic diseases, and significant investments in research and development. Recent advancements include BioNTech's in UK research centers, focusing on mRNA and AI-driven cancer therapies. In addition, the government's support through initiatives for clinical trials further enhances the sector's growth prospects. Strategic initiatives such as partnerships and collaborations are prevalent in the region for instance, in October 2024, Indco Remedies entered partnership with Clarity Pharma of UK to launch approximately 20 products to deliver healthcare solutions to large number of patients.

Germany Pharmaceutical Market Trends

German pharmaceutical industry is a key player in the European region, supported by advanced manufacturing capabilities and significant investments in biopharma research. Key players such as Bayer, Boehringer Ingelheim, Merck KGaA, and Roche lead research and development, focusing on areas like oncology, immunology, and biopharmaceuticals. In May 2023, Tetra Pharm Technologies launched XATEPA, a pain-relieving pharmaceutical drug. Germany has numerous contract manufacturing organizations (CMOs) supporting major drug manufacturers and clinical pharmaceutical companies. Approximately 11.0% of pharmaceutical firms engage in contract manufacturing, providing diverse products and services to meet the industry's growing demands. Germany's robust public healthcare infrastructure drives the pharmaceutical market, ensuring a steady demand for medicines, vaccines, and medical treatments. Advancements include integrating digital health technologies and sustainable practices, positioning Germany at the forefront of pharmaceutical innovation.

Spain Pharmaceutical Market Trends

Spain's pharmaceutical industry is experiencing robust growth, driven by factors such as an aging population, increasing prevalence of chronic diseases, and a strong emphasis on research and development. Generic drugs, providing a more affordable alternative, are gaining substantial momentum, with major players driving this expansion. The rising demand for generics is primarily fueled by government initiatives to control healthcare costs and promote cost-effective treatment options. The Spanish healthcare system focuses on providing comprehensive care and early intervention, which supports the integration of advanced diagnostic and therapeutic approaches. Growing investments in research and development are helping to introduce innovative treatment options, address unmet clinical needs, and improve patient outcomes.

France Pharmaceutical Market Trends

The French pharmaceutical industry is experiencing steady growth, driven by an aging population, rising chronic disease prevalence, and robust government support for innovation. Advancements include significant investments in R&D, with companies like Novo Nordisk committing to expand production capacity for anti-obesity medications. The government's emphasis on reshoring essential medicine production and fostering a favorable regulatory environment further enhances the market's competitiveness.

Italy Pharmaceutical Market Trends

Italy's pharmaceutical industry is experiencing robust growth, driven by an aging population, increasing prevalence of chronic diseases, and a strong emphasis on research and development. Many players are at the forefront, focusing on areas like oncology, rare diseases, and biotechnology. Developments include significant investments in biopharmaceuticals and adopting digital health technologies and artificial intelligence to enhance drug development and patient management. With extensive public hospital coverage, medicine consumption remains high, providing pharmaceutical companies with reliable revenue streams.

Denmark Pharmaceutical Market Trends

Denmark pharmaceutical industry experienced moderate growth in 2024. Key market growth drivers include government initiatives, such as funding allocated for research in the pharmaceutical sector. Denmark experiences increased investment in R&D, fostering the development of new therapeutic options. The country’s ongoing commitment to research and public health initiatives creates a supportive environment for market expansion. With sustained government backing and continuous R&D investment, Denmark is expected to retain its leadership position in developing effective pharmaceuticals and improving treatment accessibility.

Sweden Pharmaceutical Market Trends

The pharmaceutical industry in Sweden is highly regulated, with a strong emphasis on patient safety and ensuring access to innovative medicines. The Swedish Medical Products Agency (MPA) regulates and approves medicines, ensuring they comply with strict standards of safety, efficacy, and quality. Sweden has adopted several measures to manage healthcare costs, including reference pricing and health technology assessments (HTA) that assess the value of new medications. These approaches aim to maintain the sustainability of the healthcare system while delivering cost-effective treatments to the population.

The pharmaceutical industry in Norway is driven by the strong demand for multiple drug delivery forms, including oral, parenteral, inhalation, and topical medications. The market features a competitive mix of multinational and local players, with Nordic Pharma, Boehringer Ingelheim Norge, and Stada Norge holding significant positions. International partnerships validate Norway’s robust biotech community. Local companies are increasingly gaining market share, particularly in generics and biosimilars, by focusing on accessibility, affordability, and efficient healthcare delivery, complementing the expanding presence of multinational corporations. The market is driven by innovation, an aging population, and chronic disease prevalence.

The pharmaceutical industry in the Rest of Europe is rapidly expanding, driven by increasing demand for small molecules, biologics, and advanced therapies. Key growth factors include rising healthcare investments, strategic collaborations, and adopting cutting-edge technologies like AI for drug discovery and manufacturing. Major players include BioNTech, Sanofi, Novartis, and AstraZeneca. Advancements focus on personalized medicine, biosimilars, and digital health integration, enhancing regional efficiency and patient-centric care.

Key Europe Pharmaceutical Company Insights

Leading companies in Europe’s pharmaceutical and drug development sectors concentrate on innovating and refining existing technologies to enhance patient outcomes and healthcare efficiency. Their efforts encompass advancing drug formulations, optimizing delivery systems, and broadening therapeutic uses. Emphasizing research and development, these companies aim to address unmet medical needs while adhering to evolving regulatory requirements.

Key Europe Pharmaceutical Companies:

- F. Hoffmann-La Roche Ltd.

- Bristol-Myers Squibb Company

- AstraZeneca plc

- Novartis AG

- Johnson & Johnson Services, Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc.

- Merck & Co., Inc.

- Pfizer Inc.

- Sanofi

- Boehringer Ingelheim GmbH

Recent Developments

-

In February 2025, Fennec Pharmaceuticals Inc. announced that Norgine Pharmaceuticals Ltd., commercially launched PEDMARQSI (sodium thiosulfate injection) in Germany.

-

In February 2025, Tiefenbacher Pharmaceuticals has successfully prepared the launch of Varenicline, a smoking cessation medication, in the United Kingdom.

-

In January 2025, Lupin Limited and Avas Pharmaceuticals SRL have announced the launch of Lupin’s orphan drug NaMuscla (mexiletine) in Italy. Avas will commercialize NaMuscla for the symptomatic treatment of myotonia in adults with non-dystrophic myotonic (NDM) disorders.

Europe Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 516.85 billion

Revenue forecast in 2030

USD 688.44 billion

Growth rate

CAGR of 5.90% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverag

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Molecule, product, type, disease, route of administration, age group, distribution channel, region

Regional scope

Europe

Country scope

UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Rest of Europe

Key companies profiled

F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; AstraZeneca; Novartis AG; Johnson & Johnson Services; Gilead Sciences, Inc,; GlaxoSmithKline plc.; Merck & Co., Inc.; Pfizer Inc.; Sanofi; Boehringer Ingelheim GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Pharmaceutical Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe pharmaceutical market report based on molecule, product, type, disease, route of administration, age group, distribution channel, and region:

-

Molecule Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded

-

Generic

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s health Diseases

-

Genetic and rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Tablets

-

Capsules

-

Suspensions

-

Other

-

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The global Europe pharmaceutical market size was valued at USD 282.75 billion in 2020 and is expected to reach USD 296.30 billion by 2021.

b. The Europe pharmaceutical market is expected to expand at a CAGR of 5.4% from 2021 to 2028 to reach USD 432.12 billion by 2028.

b. Branded drugs segment dominated the product segment in 2020 with 68.3% of Europe pharmaceutical market share owing to the presence of key drug manufacturers and clinical-based pharmaceutical companies in the region.

b. Some key players in the Europe pharmaceutical market include F. Hoffmann-La Roche Ltd., Pfizer, Inc., Sanofi, Merck KGaA, Novartis AG, UCB S.A., AbbVie Inc., and AstraZeneca, offer strong branded drugs in multiple therapeutic segments.

b. Increasing healthcare expenditure, the surge in R&D investments, the emergence of biologics & biosimilars. Furthermore, supportive regulatory framework and reimbursement policies improve the adoption of pharmaceuticals in this region facilitating Europe pharmaceutical market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.