- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Polypropylene Compounds In 3D Printing Market Report, 2035GVR Report cover

![Europe Polypropylene Compounds In 3D Printing Market Size, Share & Trends Report]()

Europe Polypropylene Compounds In 3D Printing Market Size, Share & Trends Analysis Report By Filler Type (Glass Fiber Reinforced, Carbon Fiber Reinforced), By Form (Filament & Powder), By End-use, By Country, And Segment Forecasts, 2023 - 2035

- Report ID: GVR-4-68040-033-4

- Number of Report Pages: 115

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

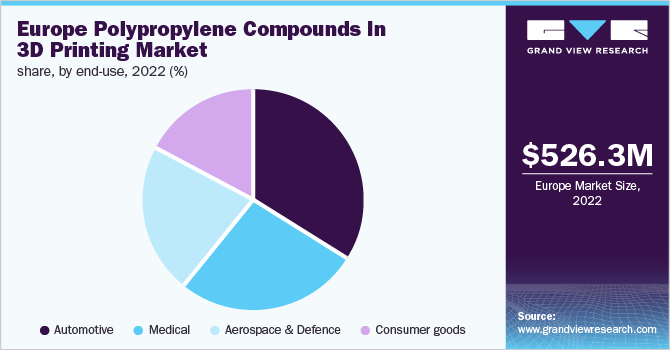

The Europe polypropylene compounds in 3D printing market size was estimated to be USD 526.27 million in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. Increasing investments for modernizing production assets and conducting research and development activities in the automotive industry are anticipated to drive the market's growth across Europe.

Key applications of polypropylene compounds in 3D printing across the medical industry include custom orthodontic implants, prosthetics, shoe insoles, medical instruments, and training models. Furthermore, the surging demand for prosthetics across Europe is anticipated to fuel the consumption of polypropylene compounds used for the 3D printing of prosthetics.

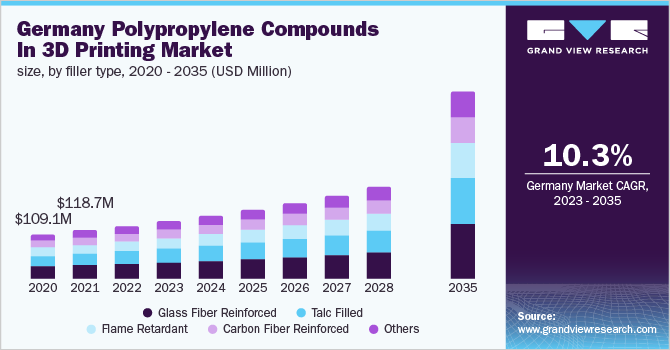

Germany is an automobile manufacturing hub catering to the European automobile market. Several large automotive manufacturers have established their production and R&D facilities in the country, providing lucrative opportunities for the 3D-printed polypropylene compounds market.

Moreover, the growing utilization of high-performance lightweight plastic components by many manufacturers to achieve fuel efficiency and weight reduction in passenger as well as sports cars has augmented the demand for polypropylene (PP) compounds for 3D printing in the region.

According to the International Organization of Motor Vehicle Manufacturers (OICA) in 2021, Germany produced over 15.6 million vehicles. With the rise in demand in the automotive industry, the demand for 3D-printed polypropylene compounds is expected to increase over the forecast period.

Filler Type Insights

By filler type, glass fiber reinforced was the largest segment of the Europe polypropylene compounds in the 3D printing market in 2022, which accounted for a market share of over 27%. Low cost and ease of commercial availability are expected to drive the glass fiber-reinforced segment of Europe polypropylene compounds in the 3D printing market in the forecast period.

Carbon fiber-reinforced PP compounds have replaced many materials and metals in aerospace, consumer goods, sports goods, civil engineering, and automotive industries owing to their physical properties such as mechanical strength, stiffness, and low weight.

Talc-filled polypropylene compounds are commonly used in packaging, automotive, pharmaceutical, household appliances, medical devices, and engineering plastics to combine, stabilize, reinforce, hold, and fasten the products and reduce the risk of damage during usage.

Flame retardant PP compounds are used in labeling, packaging, and cars. They are also used in the manufacture of construction materials such as coatings, door trims, corrugated sheets, and steel structures. Furthermore, the other filler type includes mica and chalk.

Form Insights

By form, polypropylene compounds-based 3D printing filament was the largest segment in the market in 2022, which accounted for a market share of more than 73%, followed by powder as the second-largest segment. Filaments are used in 3D printing owing to their properties such as high heat & chemical resistance, elasticity, and flexibility that can be shaped and molded after cooling.

Polypropylene compound-based powder is the common material used for 3D printing owing to its physical properties including energy, stability, flowability, compressibility, high packing density, and permeability. Powder-based polypropylene in 3D printing is used for manufacturing missiles, rockets, and airplane components that find application in the aerospace & defense industry.

End-use Insights

By end-use, automotive was the prominent segment in 2022, which accounted for a market share of over 34%, followed by medical as the second-largest segment. Polypropylene compounds have become a popular alternative for engineering plastics and metals in automotive applications for the production of various automotive components by 3D printing.

Polypropylene compounds help reduce the complexity and weight of the vehicle. Furthermore, the growing automotive industry in Europe, on account of the rising demand for electric and lightweight vehicles, is expected to create growth opportunities for regional players in the forecast period.

Amid the global COVID-19 pandemic, the growth of Europe polypropylene compounds in the 3D printing market is primarily driven by the rising demand for head & shoe covers, face masks, surgical masks & gloves, personal protective gowns, and other products to contain the spread of coronavirus.

Besides personal protective wearables, polypropylene compounds in 3D printing have broad applicability in the medical industry including dental & bone implants, leg splints, safety equipment, wearable prosthetics, and other medical devices. Moreover, the rise in respiratory syndrome post-pandemic has led to a growth in demand for 3D-printed N95 disposables and other protective wearables.

For instance, in July 2020, Henkel and Nexa3D announced the commercial supply of a polypropylene material named xMED412, which is suitable for the production of medical devices. The surge in demand and development of 3D-printed products in the medical industry is likely to propel regional growth in the region over the forecast period.

Country Insights

Germany is an automobile manufacturing hub catering to the European automobile market. Several large automotive manufacturers have established their production and R&D facilities in the country, providing lucrative opportunities for the 3D-printed polypropylene compounds market.

Moreover, the growing utilization of high-performance lightweight plastic components by many manufacturers to achieve fuel efficiency and weight reduction in passenger as well as sports cars has augmented the demand for polypropylene (PP) compounds for 3D printing in the region.

According to the International Organization of Motor Vehicle Manufacturers (OICA) in 2021, Germany produced over 15.6 million vehicles. With the rise in demand in the automotive industry, the need for 3D-printed polypropylene compounds is expected to increase over the forecast period.

U.K. has witnessed advancement, in terms of technology, across the medical industry. Polypropylene compound-based filaments in 3D printing offer heat resistance to withstand steam sterilization and therefore, are used to develop containers, patient-specific surgical models, affordable prostheses, custom prosthetics, and others.

In Italy, the aerospace industry is expected to expand at a significant rate over the forecast period resulting in the surged demand for PP compounds in 3D printing for aerospace parts. The Italian company named Leonardo supplies over 14% of components for the commercial airplane of the new Boeing 787 Dreamliner.

Key Companies & Market Share Insights

Strategic partnerships, capacity expansions, and new fillers for polypropylene compound developments are popular strategies adopted by a majority of the players operating in the Europe polypropylene compounds in the 3D printing market. For instance, in March 2022, Braskem announced the expansion of its additive manufacturing in the 3D printing portfolio. The expansion includes polyethylene (PE) and glass fiber-reinforced polypropylene (PP) filaments. The company plans to produce PE and glass fiber reinforced PP filaments that are easier to print with, have less warpage, little shrinking, and have greater interlayer adhesion than other comparable goods on the market. Some of the prominent companies in Europe polypropylene compounds in the 3D printing market are:

-

Lyondell Basell Industries Holdings B.V.

-

BASF SE

-

Braskem

-

Koninklijke DSM N.V.

-

Stratasys

-

3DXTech

-

Owens Corning

-

Formfutura BV

-

HEXPOL AB

-

Magigoo

Europe Polypropylene Compounds In 3D Printing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 570.74 million

Revenue forecast in 2035

USD 1,697.78 million

Growth rate

CAGR of 9.5% from 2023 to 2035

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2035

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2035

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Filler type, form, end-use, region

Regional scope

Europe

Country Scope

Germany; UK; France; Italy; Czech Republic; Poland; Hungary; Romania

Key companies profiled

Lyondellbasell Industries Holdings B.V.; BASF SE; Braskem; Koninklijke DSM N.V.; Stratasys; 3DXTech; Owens Corning; Formfutura BV; HEXPOL AB; Magigoo

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Polypropylene Compounds In 3D Printing Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2035. For this study, Grand View Research has segmented the Europe Polypropylene Compounds in the 3D Printing Market report based on filler type, form, end-use, and country:

-

Filler Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Glass fiber reinforced

-

Carbon fiber reinforced

-

Talc filled

-

Flame retardant

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Filament

-

Powder

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Automotive

-

Medical

-

Aerospace & defence

-

Consumer goods

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2035)

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Czech Republic

-

Poland

-

Hungary

-

Romania

-

-

Frequently Asked Questions About This Report

b. The Europe polypropylene compounds in 3D printing market size was estimated at USD 526.27 million in 2022 and is expected to reach USD 570.74 million in 2023.

b. The Europe polypropylene compounds in 3D printing market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2035 and is anticipated to reach USD 1,697.78 million by 2035

b. The automotive and end-use segment dominated the Europe polypropylene compounds in 3D printing market and accounted for the highest revenue share of over 34.01% in 2021.

b. Some key players operating in the Europe polypropylene compounds in 3D printing market include LyondellBasell Industries Holdings B.V., BASF SE, Braskem, Koninklijke DSM N.V., Stratasys, 3DXTech, Owens Corning, Formfutura BV, HEXPOL AB, and Magigoo.

b. Growing utilization of polypropylene compounds across the automotive industry in Europe and rising demand for prosthetics across the country are the driving factors propelling the demand for polypropylene compounds across the 3D printing industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."