- Home

- »

- Medical Devices

- »

-

Europe Scar Treatment Market Size Analysis, Report 2030GVR Report cover

![Europe Scar Treatment Market Size, Share & Trends Report]()

Europe Scar Treatment Market Size, Share & Trends Analysis Report By Product (Topical, Laser, Injectables), By Scar Type (Atrophic Scars, Hypertrophic & Keloid Scars), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-201-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The Europe scar treatment market size was estimated at USD 8.2 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.7% from 2024 to 2030. The market is expected to grow due to several factors, such as the growing concern among people regarding their aesthetic appearance, the increasing number of road accidents and burn injuries, and technological advancements supplementing new device launches. The European Commission allows 85% to 100% reimbursement for plastic surgery following severe illness, accident, or deformity.

However, cosmetic plastic surgeries are not reimbursed. Despite this, the demand for aesthetic procedures is increasing in Europe due to rising disposable income and healthcare expenditure. The European Association of Plastic Surgeons promotes awareness through digital conferences and webinars to standardize plastic surgery procedures, which is expected to drive market growth further.

The growing number of road accidents is one of the high-impact rendering factors, raising the demand for scar treatment products. According to the Population Reference Bureau, around 50 million people are injured due to road accidents every year, which frequently leads to the occurrence of scars requiring surgical treatment. Patients who undergo such surgeries develop surgical scars and are provided topical products to improve and reduce their appearance. Hence, the rising number of road accidents coupled with an increasing number of cosmetic surgeries is expected to propel the need for topical products for scar treatment.

The high prevalence of burn injuries is another driving factor supporting the market growth. Burn injuries leave noticeable hypertrophic burn marks, which distort the victim's appearance. Scar removal products are crucial for such injuries. Moreover, post-burn marks cause a hindrance in the routine lifestyle of victims. Plastic surgeries or resurfacing laser therapies are commonly performed to remove these marks.

Market Concentration & Characteristics

The degree of innovation is high in the market. Patients are increasingly seeking out scar treatment options that are minimally invasive and have a shorter recovery time. This is driving the development of new and improved injectables, technologies, and creams. For example, fractional laser skin resurfacing is a minimally invasive procedure that can improve the appearance of scars by stimulating collagen production. Following the latest trends and social media platforms, staying young and beautiful has now become mandatory, and companies are developing new products that satisfy the customer needs. For instance, in March 2020, Lumenis Be Ltd. announced the launch of Stellar M22 platform. It is equipped with treatment capabilities like betterment of skin texture, vascular lesions, hair removal, and tone.

Mergers and acquisitions for companies can enhance the product portfolio, creating a more comprehensive range of scar treatment options for patients.Market players are entering into strategic acquisitions and mergers to gain a higher share via market expansion. For instance, in January 2022, Suneva and Viveon Health Acquisition Corp. entered into a merger agreement. The goal of this agreement was to create a leading regenerative aesthetics company.

Regulation plays a significant role in growth of the market. Regulations can stimulate innovation by pushing manufacturers to develop safer and more efficient scar treatment. For instance, the Medical Device Regulation (MDR), implemented in 2021, sets stricter safety and performance standards for medical devices, including scar treatment lasers and injectables. Moreover, regulatory bodies classify scar treatments as medical devices, cosmetics, or drugs, depending on their intended purpose and claims.

Introducing new products caters to diverse consumer needs and preferences, which would attract new customer segments, thus expanding the overall market size. The growing development of integrated products for providing more scar treatment options with one product is expected to boost the market growth. For instance, Silon-TEX offers a combination of pressure and silicone in one comprehensive treatment, thus enhancing scar treatment.

Expanding into new regions increases the potential customer base, leading to an overall larger market size and higher demand for scar treatment, products, and services. Regional expansion can necessitate efficient logistics and distribution networks to ensure timely and cost-effective delivery of products and services across diverse locations. For instance, in March 2022, CYNOSURE entered into a distribution partnership with Jeisys Medical KK. Under this agreement, Jeisys Medical KK would have exclusive distribution rights of Cynosure’s laser product portfolio in Japan. This partnership was anticipated to expand Cynosure’s geographic footprint.

Product Insights

The topical product segment dominated the market with a revenue share of 58.0% in 2023. The availability of topical creams, gels, and silicone sheets as over-the-counter (OTC) products allows people to use them to treat scars. Topical products refer to various substances, compounds, or formulations that are applied to the surface of the skin, hair, or nails for various purposes. These products are designed to have localized effects on the area of application and are commonly used in skincare, haircare, and other personal care routines. These items are silicone sheets, creams, gels, and others and are frequently purchased as they are easily accessible to consumers as OTC products.

The laser product segment is anticipated to witness the fastest CAGR from 2024 to 2030. The availability of creams, silicone sheets, and topical gels as OTC products facilitates the treatment of scars. The rising adoption of laser products as a noninvasive & painless alternative for treating scars with minimal discomfort drives the market. Resurfacing laser therapies are commonly performed to remove burn marks. Moreover, with the significant impact of burn injuries on the overall market growth, due to the associated incidence of scars coupled with the proven efficiency of laser therapies that are proved to be efficient in scar reduction, the segment is expected to further witness growth.

Scar Type Insights

The atrophic scars segment dominated the market with a revenue share of 37.1% in 2023 due to the rising prevalence of acne scars. Topical creams and gels are commonly used to treat these scars. The treatment of atrophic scars involves topical options, such as creams, gels, and ointments, which are easily available. The treatment used for these scars helps stimulate the skin's natural healing process to replace elastin, collagen, and other fibrous tissues. It enables the surface of the healed lesion to grow around the surrounding region. With such scars resulting from acne, the use of these creams reduces the visibility of the scars. Thus, with the growing demand for esthetic appeal, the need for topical products to treat atrophic scars is increasing.

Hypertrophic & keloid scars is the second-fastest growing segment after atrophic scars, owing to their prevalence among people suffering from wound injuries. Hypertrophic scars can be caused by injuries & wounds due to body piercings, burn injuries, and cuts. Keloid scars are formed because of burns, chickenpox scars, surgical incision sites, and vaccination sites. These scars are mostly visible among dark-skinned people. Both types of scars usually involve noninvasive treatments, such as creams, gels, and silicone sheets, in minor injury cases and laser products in severe cases.

End-use Insights

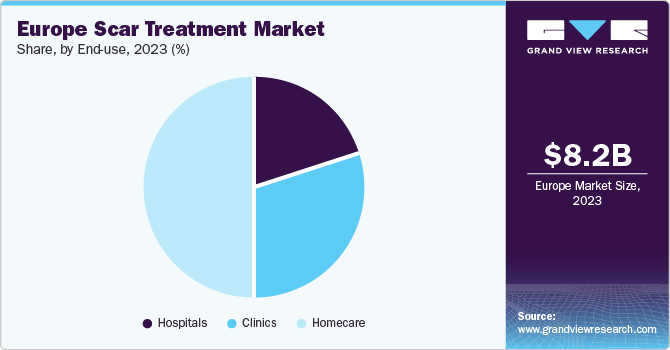

The hospitals segment dominated the market with a share of 42.6% in 2023 owing to the usage of sophisticated infrastructure and the presence of technologically advanced products in these settings for scar treatment. Most of the scar treatment is available in hospitals, giving patients a variety of options for reducing or removing the scar. In many cases, hospitals provide initial emergency care to patients, who frequently have cuts, burn injuries, wounds, and other severe injuries. Hospitals also provide treatment, to prevent further scar formation in patients. Large hospitals frequently have a plethora of sophisticated equipment and technically advanced procedures for patient care. In hospitals, non-invasive techniques are used such as gels, creams, and silicone sheets, as well as laser therapy.

The homecare segment is anticipated to witness the fastest CAGR from 2024 to 2030, owing to the rising cases of acne scars and increased accessibility to at-home scar treatments. As many of the scar treatments do not require individuals to visit physicians for medication, home health care is widely adopted in many countries; hence, it proves to be an easier alternative, which is expected to boost its demand. Moreover, there is a wide range of OTC products in the market that patients can buy from online or offline pharmacies.

Regional Insights

The demand for aesthetic procedures is on the rise in Europe, fueled by increasing disposable income and healthcare spending. The increasing number of accident cases along with the widespread occurrence of burn injuries also bolsters market growth. Post-surgery, patients develop surgical scars and are prescribed products to enhance and diminish their visibility. Therefore, the surge in road accidents, along with the growing frequency of cosmetic surgeries, is anticipated to boost the market demand. The European Association of Plastic Surgeons is further driving market growth by promoting standardization of plastic surgery procedures through digital conferences and webinars.

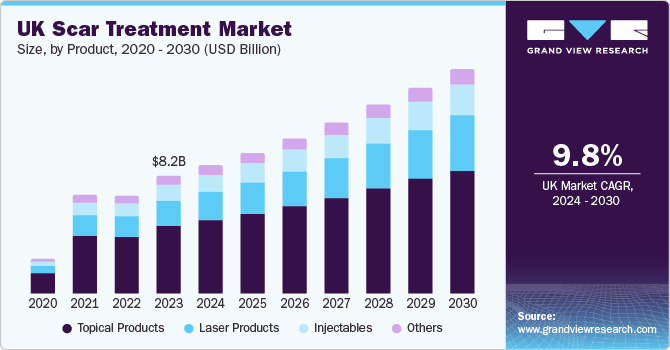

UK Scar Treatment Market Trends

Scar treatment market in the UK is witnessing growth because of the increasing number of NHS plastic surgery units and centers in the country. Moreover, plastic surgery for reconstructive purposes is free under the National Health Services (NHS). According to a study conducted by the government of Great Britain, 29,795 KSI casualties and 136,002 severe casualties were reported in 2022. The population in the country is developing a high level of esthetic awareness, which might boost the demand for scar revision procedures.

Germany Scar Treatment Market Trends

Scar treatment market in Germany is expected to show steady growth over the forecast period owing to health reforms implemented in 2007, which do not provide reimbursement for aesthetic plastic surgery. The German Association for Aesthetic-Plastic Surgeons has made a list of conditions that require esthetic intervention, which includes congenital abnormalities, cancer disfigurements, accidents, or burns, which are generally reimbursed.

France Scar Treatment Market Trends

Scar treatment market in France accounts for 2.2% of all procedures performed worldwide. France is among the top 10 countries responsible for many cosmetic procedures This can be attributed to the high esthetic & fashion consciousness in the country. Rising esthetic awareness and high adoption of plastic surgery are expected to propel market growth.

Italy Scar Treatment Market Trends

Scar treatment market in Italy accounted for approximately 4.1% of all cosmetic procedures performed worldwide, highlighting a high market demand. Increasing esthetic consciousness is boosting the demand for & popularity of cosmetic procedures in the country. According to The Local, Italy is among the most advanced countries in terms of surgical prowess, as well as awareness and high adoption country for plastic surgery procedures.

Key Europe Scar Treatment Company Insights

The major players are focusing on strategies such as new product launches, mergers and acquisitions, and geographical expansions to cater to the unmet demand of the target population. For instance, in August 2023, Sofwave Medical Ltd received approval from the FDA for its Precise SUPERB Applicator to treat acne scars. Similarly, in July 2022, Secret Duo of ilooda Co., Ltd. received approval from the FDA for its product, Secret Duo, a 1540 nm laser to treat scars post monkeypox infection.

Key Europe Scar Treatment Companies:

The following are the leading companies in the europe scar treatment market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these europe scar treatment companies are analyzed to map the supply network.

- Smith & Nephew PLC

- Lumenis

- Merz Pharmaceuticals, LLC

- Sonoma Pharmaceuticals, Inc.

- Cynosure

- CCA Industries, Inc.

- Newmedical Technology Inc.

- Mölnlycke Health Care AB

- Suneva Medical

- Scar Heal Inc.

- Pacific World Corporation

- Perrigo Company plc

Recent Developments

-

In May 2022, Perrigo Company plc completed the acquisition of HRA Pharma, which was initiated in September 2021. The acquisition was valued at USD 2.1 billion. This acquisition was anticipated to strengthen Perrigo’s presence in the European market.

-

In January 2021, Smith & Nephew acquired the extremity orthopedics division of Integra LifeSciences. The acquisition was valued at USD 240 million and is expected tostrengthen the company’s product portfolio in the upper & lower extremities segment.

-

In December 2020, Mölnlycke Health Care AB opened a new distribution center in Northamptonshire, UK. This new distribution center was expected to ensure uninterrupted product supply throughout the UK with prevailing supply uncertainty caused due to Brexit and COVID-19.

Europe Scar Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.0 billion

Revenue forecast in 2030

USD 15.7 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Market representation

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Product, scar type, end-use, region

Regional scope

Europe

Country Scope

Germany; UK; Spain; France; Italy; Russia; Denmark; Sweden; Norway

Key companies profiled

Smith & Nephew PLC; Lumenis; Merz Pharmaceuticals, LLC; Sonoma Pharmaceuticals, Inc.; Cynosure; CCA Industries, Inc.; Newmedical Technology Inc.; Mölnlycke Health Care AB; Suneva Medical; Scar Heal Inc.; Pacific World Corporation; Perrigo Company plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Scar Treatment Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe scar treatment market report based on product, scar type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Products

-

Creams

-

Gels

-

Silicon Sheets

-

Others

-

-

Laser Products

-

CO2 Laser

-

Pulse-dyed Laser

-

Others

-

-

Injectables

-

Others

-

-

Scar Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrophic Scars

-

Hypertrophic & Keloid Scars

-

Contracture Scars

-

Stretch Marks

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The market is expected to grow due to several factors, such as the growing concern among people regarding their aesthetic appearance, the increasing number of road accidents and burn injuries, and technological advancements supplementing new device launches.

b. The Europe scar treatment market is estimated at USD 8.2 billion in 2023 and is expected to reach USD 9.0 billion in 2024.

b. The Europe scar treatment market is expected to grow at a CAGR of 9.7% from 2024 to 2030 to reach USD 15.7 billion in 2030.

b. The topical products dominated the market with a revenue share of 58.0% in 2023. The availability of topical creams, gels, and silicone sheets as over-the-counter (OTC) products allows people to use them to treat scars.

b. Some of the prominent players in the Europe scar treatment market include Smith & Nephew PLC, Lumenis, Merz Pharmaceuticals, LLC, Sonoma Pharmaceuticals, Inc., Cynosure, CCA Industries, Inc., Newmedical Technology Inc., Mölnlycke Health Care AB, Suneva Medical, Scar Heal Inc., Pacific World Corporation, Perrigo Company plc.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."