- Home

- »

- Digital Media

- »

-

Europe Theme Park Market Size & Trends Report, 2020-2027GVR Report cover

![Europe Theme Park Market Size, Share & Trends Report]()

Europe Theme Park Market Size, Share & Trends Analysis Report By Revenue Source (Tickets, Food & Beverages, Merchandize, Hotels & Resorts), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-270-4

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Technology

Report Overview

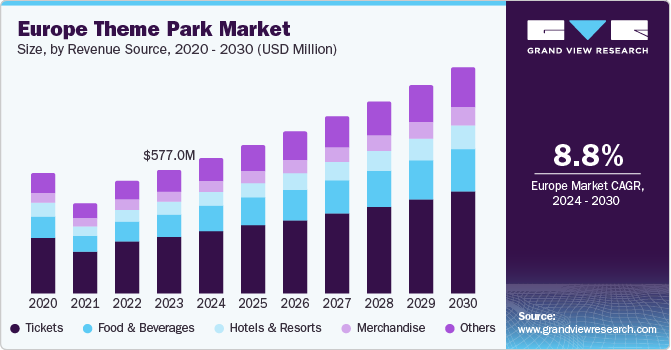

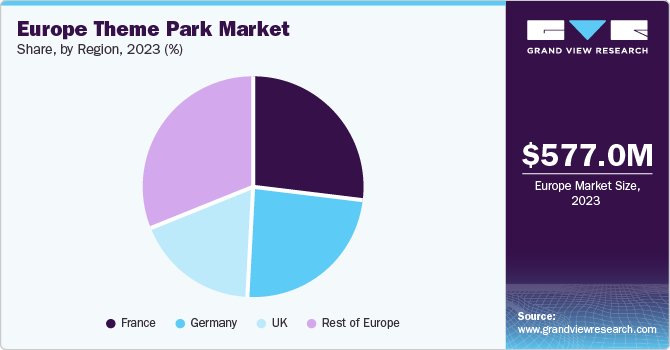

The Europe theme park market size was valued at USD 992.0 million in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 2.0% from 2020 to 2027. In general, theme parks are categorized into mega parks, Tier 1, Tier 2, and Tier 3 parks. The majority of the people visiting mega parks are those who prefer fancy rides. The theme parks majorly influencing the regional market growth fall under the small park or Tier 3 category. Such parks offer various options for entertainment, including historic playgrounds, classic city-park charmers, and lively adventures. Rising tourism expenditure and increasing middle-class and urban population are some of the key factors driving the market growth.

The theme park market in Europe witnessed a significant decline in its revenue due to the COVID-19 pandemic that led to a temporary lockdown across the region. Nevertheless, during the second quarter of 2020, most of the theme parks were reopened with limited capacity. But, with the surge in COVID-19 cases, the region had to face a temporary lockdown. As a result, most of the entertainment shows were either postponed to 2021 or canceled. Amidst the pandemic outbreak, subsequent restrictions and capacity limitations, and the resultant decline in tourism, all the theme parks would be putting a renewed emphasis on revenue generation, which would be complicated by the economic recession. A more cautious approach to the visitors also does not bode well for the theme park market. As such, some of the theme parks would continue confronting hardships in the long term, or at least a year or two, as the market limps back gradually to the pre-COVID-19 visitor numbers.

Theme park companies running small parks put a strong emphasis on reinvesting in new attractions, special events, and celebrations backed by strong marketing so that guests keep visiting again and again. Small parks exhibit their growth, particularly in the number of visits. However, mega theme parks and regional theme parks represent the overall state and the trends evident in the market. Theme parks offering different rides tend to be the most attractive and the most visited by the visitors, and the most followed by the media.

On the other hand, the high initial setup costs with frequent maintenance of resorts increase theme parks' operational costs. Also, the limited number of trained workforce is one of the factors that hinder the growth of the regional market. Moreover, given the spread of coronavirus in the region, the re-opening dates of theme parks are likely to be delayed. The latest wave of COVID-19 spreading across Europe has forced almost all of the region’s top theme parks to remain closed. Italy, which has been particularly hit hard by the pandemic, has enforced stringent regulations. Varying levels of social distancing are also in force in other European countries, thereby directly impacting the market.

Amid the pandemic, theme park operators are focusing on adhering to a myriad of safety regulations and are employing strategies to encourage practices that can potentially prevent the spread of COVID-19 among staff and guests once the lockdown is lifted and theme parks are back in action. The market size has confronted a decline from USD 992.0 million in 2019 to USD 562.0 million in 2020, particularly due to reduced consumer confidence around the world. Hardships in containing the pandemic have also led to reduced profit expectations. Nevertheless, revamped health, hygiene, and security measures and an expected vaccine are expected to drive the growth of the market over the forecast period

Revenue Source Insights

The tickets segment dominated the European theme park market with a revenue share of 46.5% in 2019 and is expected to register healthy growth during the forecast period. This high share is attributed to the increased marketing and advertisement strategies adopted by theme park operators to entice visitors. The daily admissions fees form the main source of revenue for theme parks as most of the theme parks charge visitors a daily admission. However, considering the current pandemic situation, the ticket prices are likely to cut down significantly to attract visitors across the region. Theme park operators are adopting new pricing strategies that attract local visitors and tourists for repeated visits to the theme park. The small theme park operators witness tough competition from the Mega Parks, Tier 1, and Tier 2 operators in new rides and attractions. As a result, theme park operators must adopt new pricing strategies that attract local visitors and tourists for repeated visits.

Furthermore, the food & beverages segment is expected to expand at a CAGR of over 2.6% over the forecast period. Tourists visiting a theme park tend to spend the most on food and beverages among other amenities. Hence, significant efforts are being made to encourage visitors to spend more time in the theme park as part of the efforts to increase the revenues stemming from the visitors’ in-park expenditure.

Key Companies & Market Share Insights

The market can be described as a niche market owing to the limited number of players present in the market. The major players include Ancient Kiev, Astrid Lindgrens Värld, FunPark Ordnung (Playmobil-Funpark), High Chaparral Theme Park, Moomin Characters, Watermouth Castle, and Puy du Fou among others. The competitive rivalry in this market can be very much evident either between the different theme parks or the parent organizations owning and managing the theme parks. The overall theme park business focuses on effective marketing strategies to ensure profitable operations. Large or mega theme parks can ensure economies of scale and hence possess the capital to offer more popular and trending themes to attract more visitors. On the contrary, small theme parks particularly focus on catering to the local markets and offering unique attractions that cannot be found in rival theme parks. Some of the prominent players in the Europe theme park market are:

-

Ancient Kiev

-

Astrid Lindgrens Värld

-

FunPark Ordnung (Playmobil-Funpark)

-

High Chaparral Theme Park

-

Moomin Characters

-

Watermouth Castle

-

Puy du Fou

Europe Theme Park Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 562.0 million

Revenue forecast in 2027

USD 646.7 million

Growth Rate

CAGR of 2.0% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Revenue source

Regional scope

Europe

Key companies profiled

Ancient Kiev; Astrid Lindgrens Värld; FunPark Ordnung (Playmobil-Funpark); High Chaparral Theme Park; Moomin Characters; Watermouth Castle; Puy du Fou

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the regional levels and provides an analysis of the latest industry trends from 2016 to 2027 in each of the sub-segments. For this study, Grand View Research has segmented the Europe theme park market report based on revenue source:

-

Revenue Source Outlook (Revenue, USD Million, 2016 - 2027)

-

Tickets

-

Food & Beverages

-

Merchandize

-

Clothing

-

Toys

-

Décor

-

Books

-

Others

-

-

Hotels & Resorts

-

Others

-

Events & Activities

-

Parking

-

-

Frequently Asked Questions About This Report

b. The Europe theme park market size was estimated at USD 992.0 million in 2019 and is expected to reach USD 562.0 million in 2020

b. The Europe theme park market is expected to grow at a compound annual growth rate of 2.0% from 2020 to 2027 to reach USD 646.7 million by 2027.

b. The ticket segment dominated the Europe theme park market with a share of 46.5% in 2019. This is attributable to the increased marketing and advertisement strategies adopted by theme park operators to entice visitors. The daily admissions fees form the main source of revenue for theme parks as most of the theme parks charge visitors a daily admission.

b. Some key players operating in the Europe theme park market include Ancient Kiev, Astrid Lindgrens Värld, FunPark Ordnung (Playmobil-Funpark), High Chaparral Theme Park, Moomin Characters, Watermouth Castle, and Puy du Fou among others.

b. Key factors that are driving the Europe theme park market growth include the rising demand for new attractions to interest tourists and engage local visitors for the repeated theme park visits.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."