- Home

- »

- Homecare & Decor

- »

-

Europe & U.K. Nonstick Cookware Market Size Report, 2030GVR Report cover

![Europe & U.K. Nonstick Cookware Market Size, Share & Trends Report]()

Europe & U.K. Nonstick Cookware Market Size, Share & Trends Analysis Report By Product, By Raw Material (Stainless Steel, Carbon Steel), By Coating (Teflon Coated, Ceramic Coated), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-165-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

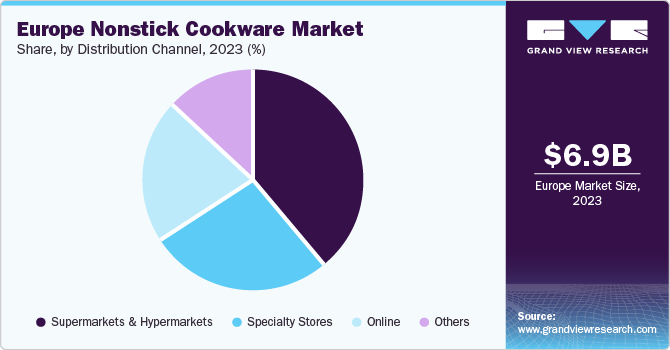

The Europe & U.K. nonstick cookware market size was estimated at USD 6.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030.The trend of people enjoying cooking at home has increased due to wellness and hygiene concerns, leading to a surge in the demand for nonstick cookware in these regions. The growing popularity of modular kitchens and rising living standards are driving the need for nonstick cookware items in both the residential and commercial markets.

Companies in the market are focused on launching new products, collaborations, mergers and acquisitions, and expansions in developing markets. For instance, in September 2023, Stanley Tucci, a renowned American celebrity, launched a cookware collection in collaboration with GreenPan, a ceramic-coated cookware brand. This collection is exclusively sold at Williams Sonoma, a consumer retail company offering premium kitchenware. The collection consisting of a variety of pans and pots is manufactured and designed in Italy.

Innovation in material sciences has led to a range of materials being used in the manufacturing of nonstick cookware, including aluminum, ceramics, and cast iron. Moreover, with increased investments in technology and automation in the nonstick cookware market, players have been adaptive to a wide range of scientific improvements in their products. For instance, Flonal Spa, an Italian cookware brand offers aluminum cookware with nonstick coating. The company offers reinforced nonstick coating cookware such as Magma-Tech and Magma-Tech Plus. The Magma-Tech reinforced nonstick coating on cookware consists of 5 layers of hard mineral particles.

The growing consumer preference for healthy recipes without added fats or oils and preserving food flavors have driven the demand for nonstick cookware in Europe. In addition, the harmful effects of Teflon coatings have led to innovation in products driving the market growth. In June 2023, Tefal, a cookware brand of one of the key European players Groupe SEB, launched RENEW, a new range of pots and pans made from 100% recycled aluminum, featuring the exclusive Inoceramic nonstick ceramic coating.

An increasing number of manufacturers prefer using advanced coatings and alloys that enhance the cookware's durability and nonstick properties. For instance, FBS Balke International GmbH & Co. KG, a German company offering anti-bacterial nonstick coating, employs epoxy-free coating systems with growth-inhibiting properties to ensure hygiene standards, nonstick effect, optimal cooking performance, and longevity of the cookware. The growing demand for sustainable options such as recycled metals or biodegradable coatings from consumers is driving the adoption of innovative nonstick coating solutions and materials.

With people spending more time at home due to the lockdown and in the post-COVID-19 period, there has been a noticeable increase in cooking at home. More individuals are experimenting with new recipes and techniques, leading to a higher demand for cookware products. According to an International Housewares Association (IHA) representative Pascal Glorieux, nearly 37% of the French population tried new recipes during the lockdown. The trend is also expected to continue in countries such as Germany and the U.K., owing to the growing preference for culinary experiences at home.

Product Insights

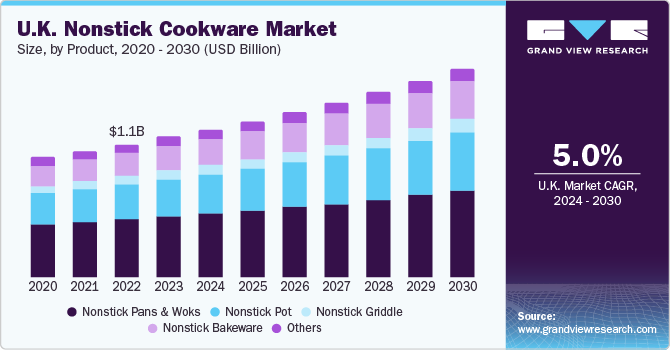

Nonstick pans and woks dominated the market with a share of 42.51% in 2023. This segment is estimated to grow steadily over the forecast period, owing to the rising demand for multi-purpose and colorful pans. People purchase pans and pots based on their requirements and prefer variety in terms of features, designs, and colors. The rising interest in colorful nonstick cookware, particularly in residential settings where people seek products that complement their kitchen decor and cookware, is expected to drive the growth of this product category over the forecast period.

Demand for nonstick bakeware is set to rise at the highest CAGR of about 5.7% in the forecast period. There is a strong demand for baking tins and trays in European countries, primarily owing to the cultural aspects deeply rooted in the region’s baking traditions. Traditional European bread and pastry dishes like strudel (a layered pastry with filling), stollen (a fruit bread), and kugelhopf (a yeast-based cake) are often baked in trays and tins. Bread tins are essential for producing the iconic rectangular loaves, while specialized trays are needed for pretzels and other pastries.

Raw Material Insights

Among the key materials used in the market, stainless steel dominated with a revenue share of 41.10% in 2023. Cookware made of coated stainless steel combines the nonstick properties of the coating with the heat conductivity and durability of stainless steel. Customers with various culinary preferences value its versatility as the material is suitable for different cooking techniques and recipes.Several manufacturers provide premium, professional-grade stainless steel cookware, attracting culinary enthusiasts and home cooks who value performance at a high level. For instance, the Circulon SteelShield stainless steel cookware series is available in sizes ranging from 16cm to 32cm.

Demand for carbon steel nonstick cookware is set to rise at the highest CAGR of about 5.8% from 2024 to 2030. Carbon steel cookware has become increasingly popular among professional chefs, home cooks, and food enthusiasts in European countries. Its exceptional heat conductivity is one of the key factors driving the material’s demand.Those who value both function and aesthetics in their kitchen utensils opt for carbon steel cookware.

Coating Insights

Teflon coated nonstick cookware dominated the market in 2023 with a revenue share of around 37%. Teflon coatings are designed to be non-reactive, ensuring they do not release harmful chemicals or interact with food during cooking. This feature is valued by health-conscious consumers who want to prepare meals with minimal added oils or fats. Teflon-coated cookware is widely available in the global market and is marketed by both international and domestic brands in Europe and the U.K..

Demand for ceramic-coated nonstick cookware is projected to grow at a CAGR of about 5.5% from 2024 to 2030. Nonstick cookware with ceramic coating may not be entirely made of ceramic material itself; it typically features a metal base. The defining characteristic of ceramic cookware is its sol-gel coating, firmly bonded to the cookware's surface. This sol-gel coating is activated upon each use and replicates nonstick qualities, often termed ceramic nonstick coating. The nonstick surface of ceramic cookware is known for its ease of cleaning, with hand washing being the recommended method.

Application Insights

The residential segment accounted for a majority revenue share of about 63% in 2023. According to YPulse's 2022 WE Cooking and Diets behavioral report, 29% of young Europeans (between the age group 13 to 39) use social media to explore new recipes, while 32% watch internet videos.This trend has sparked consumer interest in diverse cuisines, fostering a preference for specialized cookware such as nonstick utensils, positively impacting the European cookware market.

Demand for nonstick cookware in commercial application is anticipated to grow at a CAGR of about 5.2% from 2024 to 2030. The surging demand for high-end commercial cookware in Europe is propelled by the flourishing hospitality sector, marked by a rising number of hotels, restaurants, and resorts and a thriving travel and tourism market. In the U.K., with 101,498 eateries boasting active food hygiene ratings as of November 2023 and a nationwide addition of 13,078 new establishments in the past year, the demand for premium cookware is poised to gain traction among hotel chains and restaurants.

Distribution Channel Insights

Sales through supermarkets & hypermarkets dominated in 2023 with a share of about 38%. Several consumers prefer to purchase nonstick cookware while shopping for other grocery items in supermarkets and hypermarkets. According to a July 2023 article by The Guardian, about two-thirds of people in France purchase food items from hypermarkets or supermarkets. These are preferred channels for cookware shopping due to their accessibility, diverse product options, and often competitive pricing.

Online sales of nonstick cookware in the region are projected to grow at a CAGR of 5.9% during the forecast period. This can be attributed to technological advancements and the rising preference for online platforms to purchase nonstick cookware products as they offer convenience, right from product selection to delivery. A blog post from CYBERCREW.U.K. from March 2023 states that, in January 2022, e-commerce sales made up 27.1% of all retail sales in the U.K. Furthermore, the percentage of U.K. users who purchase online reached an astounding 87% in 2020.

Regional Insights

In Europe, the demand for nonstick cookware is set to grow at a CAGR of about 4.7% from 2024 to 2030. Shifting trends in eating culture, such as the rising prominence of social and casual dining, have resulted in an increased demand for innovative cookware products in Europe. Consumers in Europe are prioritizing convenience, simplicity of cleaning, and healthier cooking options, which is driving the demand for nonstick cookware due to the growing trend of home-cooked meals, particularly since the pandemic. According to a June 2021 analysis published by the Rome Business School Research Centre, 43% of Italians cooked at home more frequently than they did before to the lockdown, which was prompted by the COVID-19 health emergency.

In 2023, U.K. contributed to a revenue share of about 16% in the Europe nonstick cookware market. The surge in busy lifestyles has led to the popular trend of meal prepping, creating a growing demand for efficient and time-saving kitchen solutions in the U.K.. In the region according to CPD Online College Limited’s blog published in September 2022, 73% of people preferred meal prep to save time and 60% of people opted for meal prep to eat more healthily. This trend, in turn, positively impacts the market, as consumers prioritize easy cleaning, convenience, and versatility in their cooking routines.

Key Companies & Market Share Insights

The market is characterized by the presence of prominent established and emerging players. Major players emphasize product innovation & differentiation and unique designs aligned with the changing consumer trends. These players have extensive distribution networks worldwide, which enable them to reach a wide customer base and expand into emerging markets. The emerging companies, on the other hand, are focused on niche markets, specialized product portfolios, and fresh designs to improve their visibility in the market.

Groupe SEB, a French consortium renowned for manufacturing and distributing small appliances, oversees a portfolio of 31 brands, including All-Clad, Krups, Moulinex, Rowenta, SUPOR, Tefal, WMF, and Maharaja. Since 2012, Groupe SEB has been actively promoting cookware recycling initiatives, particularly with the Tefal brand in Europe. In Europe, notable cookware brands offered by Groupe SEB include Tefal, WMF, All-Clad, and Lagostina.

Key Europe & U.K. Nonstick Cookware Companies:

- Groupe SEB

- Werhahn Group (ZWILLING J.A. Henckels AG)

- Meyer Corporation

- Fissler GmbH

- Tramontina

- Newell Brands Inc. (Calphalon)

- SCANPAN

- Horwood Homewares Ltd. (Judge)

- The Vollrath Co., L.L.C.

- Culinaris Kitchen Accessories (RIESS)

Recent Developments

-

In May 2023, Groupe SEB acquired Pacojet, a Swiss family-owned company that specializes in developing and marketing a unique culinary appliance that has been popular with chefs for three decades. The acquisition was part of Groupe SEB's strategy to expand its presence in the professional market

-

In March 2023, Farberware, a brand under Meyer Corporation, launched its latest cookware line called Eco Advantage. Made up of 100% recycled aluminum, the collection was available in two colors: Gray and Aqua. The products showcase a resilient ceramic nonstick coating that is both long-lasting and scratch-resistant, without the presence of harmful chemicals like PFAS, PFOA, PTFE, lead, or cadmium

-

In March 2021, Werhahn Group completed the acquisition of FiberLean Technologies, a leading producer of patented composite material combining microfibrillated cellulose (MFC) and minerals. This strategic move into the microfibrillated cellulose market reflected Werhahn's commitment to sustainable growth through the establishment or acquisition of forward-looking ventures

Europe & U.K. Nonstick Cookware Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.31 billion

Revenue forecast in 2030

USD 10.09 billion

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, raw material, coating, application, distribution channel, region

Regional scope

Europe

Country scope

U.K.

Key companies profiled

Groupe SEB;Werhahn Group (ZWILLING J.A. Henckels AG); Meyer Corporation; Fissler GmbH; Tramontina; Newell Brands Inc. (Calphalon); SCANPAN; Horwood Homewares Ltd. ( Judge); The Vollrath Co., L.L.C.; Culinaris Kitchen Accessories (RIESS)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe & U.K. Nonstick Cookware Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Europe & U.K. nonstick cookware market based on product, raw material, coating, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nonstick Pans & Woks

-

Nonstick Pot

-

Nonstick Griddle

-

Nonstick Bakeware

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Cast Iron

-

Carbon Steel

-

Aluminum

-

-

Coating Outlook (Revenue, USD Million, 2018 - 2030)

-

Teflon Coated

-

Enameled

-

Ceramic Coated

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Europe

-

U.K.

-

-

Frequently Asked Questions About This Report

b. The Europe & U.K. nonstick cookware market was estimated at USD 6.97 billion in 2023 and is expected to reach USD 7.31 billion in 2024.

b. The Europe & U.K. nonstick cookware market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 10.09 billion by 2030.

b. Nonstick pans & woks dominated the Europe & U.K. nonstick cookware market with a share of over 42% in 2023. This segment is estimated to grow steadily over the forecast period, owing to the rising demand for multi-purpose and colorful pans.

b. Some of the key players operating in the Europe & U.K. nonstick cookware market include SEB; Werhahn Group (ZWILLING J.A. Henckels AG); Meyer Corporation; Fissler GmbH; Tramontina; Newell Brands Inc. (Calphalon); SCANPAN; Horwood Homewares Ltd. ( Judge); The Vollrath Co., L.L.C.; Culinaris Kitchen Accessories (RIESS).

b. Key factors that are driving the Europe & U.K. nonstick cookware market growth include the trend of home cooking, the rise in the demand for private chefs in the region, the growing popularity of modular kitchens, innovation in the industry, and preference towards healthy cooking processes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."