- Home

- »

- Animal Health

- »

-

Europe Veterinary Antibiotics Market Size, Share Report 2030GVR Report cover

![Europe Veterinary Antibiotics Market Size, Share & Trends Report]()

Europe Veterinary Antibiotics Market Size, Share & Trends Analysis Report By Animal (Pigs, Cattle), By Drug Class (Tetracyclines, Penicillins), By Dosage Form (Oral Powders, Oral Solutions), By Country (UK, Germany), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-988-4

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Europe Veterinary Antibiotics Market Trends

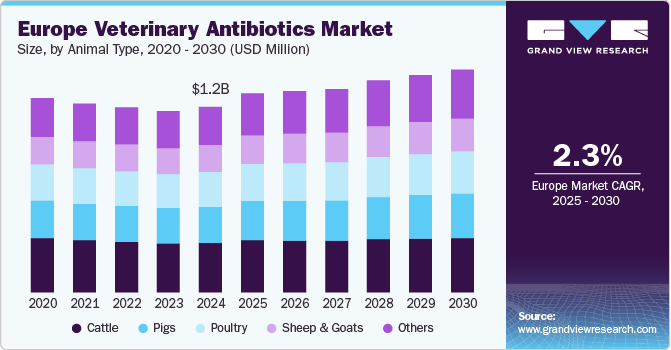

The Europe veterinary antibiotics market size was estimated at USD 1.19 billion in 2024 and is projected to grow at a CAGR of 2.31% from 2025 to 2030. The increasing prevalence of livestock diseases, growing awareness and adoption of pet healthcare, rising focus on animal-only antibiotics & ionophores, and growing product launches or other initiatives are driving the market growth. According to the German livestock data, the country has the largest dairy cattle herd and the second-largest cattle population in the EU. In addition, according to the International Committee for Animal Recording (ICAR), around 50% of German farms specialize in livestock, which is anticipated to create a conducive environment for the market.

One of the primary drivers of the market in Europe is the rising incidence of zoonotic diseases. Zoonotic diseases, which are infectious diseases that can be transmitted from animals to humans, pose a significant public health risk. The increase in livestock farming and pet ownership has amplified the risk of such diseases spreading, necessitating more vigilant and widespread use of antibiotics to control and prevent outbreaks. Veterinary antibiotics are essential in treating bacterial infections in animals, thus preventing the transmission of diseases to humans. As public health agencies and veterinary professionals emphasize the importance of controlling zoonotic diseases, the demand for effective veterinary antibiotics continues to grow.

The market is witnessing a shift toward animal-only antibiotics and ionophores. This trend is largely driven by antibiotic resistance and health & welfare concerns. The awareness about the relationship between the use of antibiotics in livestock and the development of antibiotic-resistant bacteria is growing, which may threaten both animal and human health. As a result, there is a need to develop antibiotics that are exclusively used in animals to minimize the risk of cross-resistance.

Moreover, major players in the market have shifted their focus to animal-only antibiotics as a measure to address antibiotic resistance while protecting animal health. For instance, Elanco introduced an antibiotic stewardship plan, which focuses on reducing shared-class antibiotics and increasing the production of animal-only antibiotics. In 2023, the revenue of animal-only antibiotics increased by 6%, representing 15% of Elanco's total revenue. In 2023, ionophores accounted for over 90% of the revenue generated from antibiotics produced only for animals. Some of the animal-only antibiotics or ionophores available in the market are Maxiban & Monteban (used to prevent coccidiosis in poultry) and Rumensin (used to treat coccidiosis in cattle). Therefore, increasing focus on ionophores is expected to drive market growth over the forecast period.

Furthermore, the new Veterinary Medicines Regulations (VMR) introduced in Great Britain on May 17, 2024, aim to restrict antibiotic use in livestock. These regulations are based on EU measures from January 2022 but fall short in several key areas. Unlike the EU, the UK has not fully banned group prophylactic antibiotic use and does not mandate species-specific antibiotic use data collection. The EU regulations also limit metaphylactic treatments and impose stricter controls on antibiotic use in animal feed. The EU will ban imports of animal products produced with antibiotics for growth promotion by 2026 and requires Member States to report antibiotic use by species. The Alliance to Save Our Antibiotics advocates for stricter UK rules, including a full ban on preventive group treatments, mandatory data collection, and a reduction in antibiotic use by 40% by 2030. The contrast in regulations impacts the European veterinary antibiotic market by enforcing stricter antibiotic controls, data transparency, and reducing the risk of antimicrobial resistance (AMR).

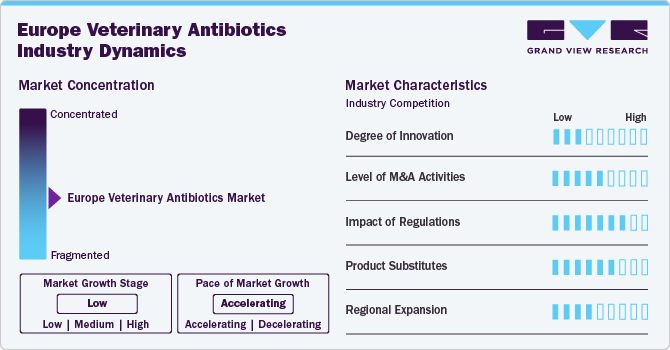

Market Concentration & Characteristics

The market is expected to grow significantly due to favorable government regulations like the European Union (EU) Veterinary Medicines Regulation. According to an article published by the European Public Health Alliance, stringent regulations limiting the use of veterinary antibiotics came into effect across the EU in January 2022. These new regulations limit the use of antibiotics to prevent treatments for specific animals and their routine administration. Moreover, antimicrobials cannot substitute inadequate hygiene and animal husbandry practices. Furthermore, trade organizations, such as the European Free Trade Association (EFTA) between Liechtenstein, Iceland, Norway, and Switzerland, have encouraged trade between these countries and increased growth opportunities across Europe.

Europe Veterinary Antibiotics Industry Characteristics

The innovation in the European veterinary antibiotics market is characterized by significant advancements in drug formulation, delivery mechanisms, and diagnostic technologies. Pharmaceutical companies continuously invest in research and development to create antibiotics with enhanced efficacy, broader spectra of activity, and improved safety profiles. Innovations such as long-acting injectables, sustained-release formulations, and novel combination therapies are revolutionizing how bacterial infections are treated in animals.

The level of mergers and acquisitions (M&A) activities in the market has been robust, reflecting the strategic efforts of companies to expand their product portfolios, enhance market presence, and gain competitive advantages. Leading pharmaceutical companies actively acquire smaller firms and innovative startups to integrate advanced technologies and novel antibiotics into their offerings. These acquisitions often aim to address gaps in product lines, diversify revenue streams, and strengthen research and development capabilities. Moreover, collaborations and strategic partnerships between established players and biotech firms are common, focusing on co-developing new antibiotics and tackling antimicrobial resistance.

Regulations have a profound impact on the market, shaping the development, approval, and use of these medications. The European Union (EU) enforces stringent regulations to ensure the safety, efficacy, and responsible use of veterinary antibiotics, primarily aimed at mitigating antimicrobial resistance. The Veterinary Medicinal Products Regulation (Regulation (EU) 2019/6) and the Medicated Feed Regulation (Regulation (EU) 2019/4) are pivotal in governing the market. These regulations mandate rigorous testing and approval processes for new antibiotics, emphasizing the need for evidence of safety and efficacy.

The availability of product substitutes, such as vaccines, probiotics, and improved biosecurity measures, reduces the demand for antibiotics in the European veterinary market. These alternatives, which promote animal health without contributing to antimicrobial resistance (AMR), are driving a shift toward more sustainable and preventive healthcare solutions, impacting overall antibiotic usage.

Regional expansion in the market is driven by the diverse agricultural practices and varying levels of economic development across the continent. Companies are strategically expanding their presence in emerging markets within Eastern Europe and Southern Europe, where there is a growing demand for advanced veterinary care and antibiotics due to increasing livestock farming and pet ownership.

Animal Insights

The cattle segment held the largest market share of 26.51% in 2024. This dominance is attributed to the increased consumption of beef and dairy products and the high incidence of bacterial infections. According to the Agriculture and Horticulture Development Board, In the first half of 2024, EU beef production rose by 3% due to increased slaughtering and export demand but is projected to decline by 0.5% by year-end due to a shortage of cattle. Europe is renowned for its high-quality beef and dairy products, which enjoy strong domestic and international demand. This economic importance necessitates rigorous health management practices to ensure the productivity and quality of cattle herds.

Veterinary antibiotics play a crucial role in this context, essential for treating and preventing bacterial infections that can compromise animal health and productivity. Common conditions like mastitis, respiratory infections, and gastrointestinal diseases are prevalent in cattle and require effective antibiotic treatments to manage. The high prevalence of these infections drives the demand for veterinary antibiotics. Mastitis, for instance, is a widespread issue in dairy cattle and can lead to significant economic losses due to decreased milk production and quality.

Other segment is expected to grow rapidly during the forecast period due to increasing pet ownership, rising awareness of pet health, and the prevalence of antibiotic-resistant infections. Additionally, expanding veterinary services and advancements in pet healthcare technologies are driving higher antibiotic prescriptions.

Drug Class Insights

The penicillins segment held the largest market share of more than 24.30% in 2024 due to its broad-spectrum efficacy, established safety profile, cost-effectiveness, and regulatory support for its responsible use. Penicillin is one of the most commonly sold antibiotic classes for veterinary applications. On the basis of chemical structure, penicillins are divided into monobactams and carbapenems. Based on the spectrum, it is classified as narrow, extended, and broad. Similarly, on the basis of source, it is divided into synthetic, semisynthetic, and natural. Penicillin veterinary antibiotics are widely manipulated to improve their spectrum, pharmacological characteristics, efficacy, and resistance to β-lactamase destruction. Penicillin is widely available in various formulations, including injectable, oral, and topical formulations, making them convenient for different animal species and infections. According to the Republic of Estonia Agency of Medicines, the percentage of sales of penicillin was 29.5% in 2023.

The sulfonamides segment is expected to grow at a significant CAGR during the forecast period. Sulfonamides are among the oldest and most widely used antibiotic classes in veterinary medicine, chiefly due to their lower cost and greater efficacy in most common bacterial infections. This versatility makes them invaluable in treating various bacterial infections in livestock, companion animals, and poultry. Their ability to inhibit the synthesis of folic acid in bacteria, thereby preventing bacterial growth and replication, underscores their efficacy and utility in veterinary medicine. The synergistic action of sulfonamides with specific diaminopyrimidines further improves the drug efficacy. They commonly prevent or treat local infections or acute systemic conditions. Some bacterial conditions treated using sulfonamides are actinobacillosis, mastitis, colibacillosis, polyarthritis, toxoplasmosis, metritis, coccidiosis, respiratory infections, and pododermatitis.

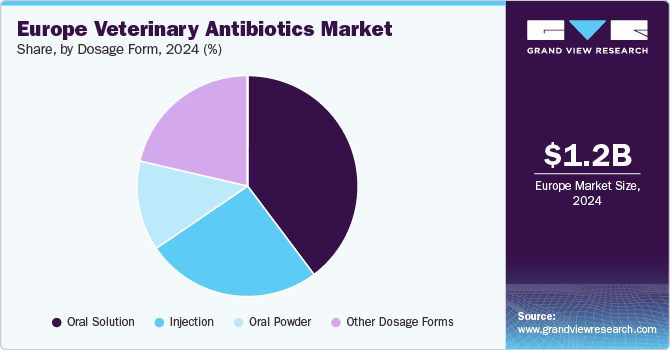

Dosage Form Insights

The oral solutions segment held the largest market share of more than 39.68% in 2024, and it is also expected to grow at a significant CAGR during the forecast period. This dominance is driven by a combination of factors, including ease of administration, higher compliance rates, cost-effectiveness, versatility across different animal species, and advancements in formulation technologies. Oral antibiotics can be conveniently administered to animals through their drinking water or feed, reducing the stress and discomfort associated with other routes of administration, such as injections. This method is particularly advantageous for large-scale livestock operations, where administering injections to hundreds or thousands of animals would be labor-intensive and logistically challenging.

Oral solutions streamline the treatment process, making it more efficient and manageable for farmers and veterinarians. Some large animal farms use automatic metering devices or medication proportions to treat a large number of animals at the same time. According to EMA, oral antimicrobial solutions sales in over 31 EU countries were estimated to be 63.4% in 2022, which exhibits their wide suitability for veterinary treatments in European animal farms. Moreover, oral solutions are generally less expensive to produce and administer than other dosage forms, such as injectables or topical applications. This cost-efficiency is crucial for the livestock industry, where profit margins can be tight, and cost control is essential. By reducing the overall cost of treatment, oral solutions help farmers maintain the health of their herds economically, supporting their widespread use.

Country Insights

Germany Veterinary Antibiotics Market Trends

The veterinary antibiotics market in Germany is expected to grow over the forecast period due to the rising animal adoption, such as pets and growing animal husbandry. According to the International Committee for Animal Recording (ICAR), around 50% of German farms specialize in livestock, which is anticipated to create a conducive environment for the market. The growing awareness about the significance of farm & companion animal health and the rising partnerships & collaborations among key players are major factors expected to fuel market growth.

UK Veterinary Antibiotics Market Trends

The veterinary antibiotics market in UK is expected to grow at a CAGR of 2.87% over the forecast period. Various factors contributing to this growth include increased pet ownership and insurance. As the insurance policies cover the cost of veterinary care, pet owners are more inclined to take their animals to veterinary hospitals & clinics for diagnosis and treatment, which is expected to improve the need for animal antibiotics or animal drugs. The People’s Dispensary for Sick Animals (PDSA), a leading veterinary charity in the UK, provides low-cost and free treatments to animals in need. As the prevalence of injury and illnesses is growing among companion animals, the need for proper treatment is expected to grow. According to PDSA’s statistics, around 800 cases a month require emergency surgery and are treated at PDSA charity animal hospital.

Spain Veterinary Antibiotics Market Trends

The veterinary antibiotics market in Spain is expected to grow rapidly over the forecast period in the livestock sector and the increasing meat production & consumption. According to the Food & Wines from Spain's data, the country has approximately 6.4 million heads of cattle (almost half are cows). In addition, the Autonomous Communities of Spain have the largest beef cattle, including Castile-La Mancha, Castile-Leon, Extremadura, and Aragon. Moreover, the rising pet adoption, the growing number of veterinarian clinics, and the increasing owner awareness, leading to a surge in annual veterinary treatment spending, are expected to fuel market growth over the forecast period. For instance, according to Protectapet, there are 6,000+ veterinarian clinics in the country catering to nearly 17 million pets. In addition, the country's veterinarian clinics offer various services and collective treatment for the pet patient population.

Key Europe Veterinary Antibiotics Company Insights

The market is fragmented due to the existence of numerous small to major market participants. Due to the existence of multiple small and large companies, the market is highly fragmented. Thus, small players face intense competition to maintain their market position. Moreover, companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansion, and the launch of products to grow in the market.

Key Europe Veterinary Antibiotics Companies:

- Merck & Co., Inc.

- Ceva

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Vetoquinol S.A.

- Virbac

- Calier

- Bimeda, Inc.

- Prodivet Pharmaceuticals SA/NV

View a comprehensive list of companies in the Europe Veterinary Antibiotics Market

Recent Developments

-

In August 2024, The Responsible Use of Medicines Alliance - Companion Animal and Equine (RUMA CA&E) is launching its third annual Antibiotic Amnesty Month this November to raise awareness of antimicrobial resistance (AMR) in European veterinary practices. The campaign encourages practices to set up pharmaceutical bins for the safe return of unused or outdated antibiotics, helping to combat the rising threat of drug-resistant infections and environmental pollution from improper medication disposal.

-

In February 2024, Blacksmith Medicines, Inc. and Zoetis entered into a collaboration to develop novel antibiotics specifically for animal health to address the growing concern of antibiotic resistance that can affect both animals and humans. By using Blacksmith's innovative metalloenzyme platform, the partnership aims to create targeted treatments for life-threatening infections in livestock while reducing reliance on antibiotics shared with human medicine.

Europe Veterinary Antibiotics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.27 billion

Revenue forecast in 2030

USD 1.43 billion

Growth rate

CAGR of 2.31% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal type, drug class, dosage form, country

Country scope

Germany; UK; Netherlands; Belgium; Denmark; France; Italy; Spain; Hungary; Poland; Portugal; Romania

Key companies profiled

Merck & Co., Inc.; Ceva; Zoetis; Boehringer Ingelheim GmbH; Elanco; Vetoquinol S.A.; Virbac; Calier; Bimeda, Inc.; Prodivet pharmaceuticals sa/nv

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Veterinary Antibiotics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe veterinary antibiotics market report based on animal type, drug class, dosage form, and country.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2033)

-

Pigs

-

Cattle

-

Sheep & Goats

-

Poultry

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2033)

-

Tetracyclines

-

Penicillins

-

Sulfonamides

-

Macrolides

-

Trimethoprim

-

Lincosamides

-

Polymyxins

-

Aminoglycosides

-

Fluoroquinolones

-

Pleuromutilins

-

Other Drug Class

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2033)

-

Oral Powder

-

Oral Solution

-

Injection

-

Other Dosage Forms

-

-

Country Outlook (Revenue, USD Million, 2018 - 2033)

-

Germany

-

UK

-

The Netherlands

-

Belgium

-

Denmark

-

France

-

Italy

-

Spain

-

Hungary

-

Poland

-

Portugal

-

Romania

-

Frequently Asked Questions About This Report

b. The Europe veterinary antibiotics market size was estimated at USD 1.19 billion in 2024 and is expected to reach USD 1.27 billion in 2025.

b. The Europe veterinary antibiotics market is expected to grow at a compound annual growth rate of 2.31% from 2025 to 2030 to reach USD 1.43 billion by 2030.

b. The UK dominated the Europe veterinary antibiotics market in 2024. This is attributable to the presence of key players, the deployment of strategic initiatives by leading companies, and the rising prevalence of diseases in animals.

b. Some key players operating in the Europe veterinary antibiotics market include Merck & Co., Inc.; Ceva; Zoetis; Boehringer Ingelheim GmbH; Elanco; Vetoquinol S.A.; Virbac; Calier; Bimeda, Inc.; Prodivet pharmaceuticals sa/nv

b. Key factors that are driving the market growth include increasing animal health concerns, focus on animal-only antibiotics, strategies implemented by key companies, and initiatives to promote the prudent use of antibiotics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."