- Home

- »

- HVAC & Construction

- »

-

Excavator Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Excavator Market Size, Share & Trends Report]()

Excavator Market (2024 - 2030) Size, Share & Trends Analysis Report By Vehicle Weight (< 10, 46 >), By Engine Capacity (Up To 250 HP, More Than 500 HP), By Type (Wheel, Crawler), By Drive Type (Electric, ICE), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-537-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Excavator Market Summary

The global excavator market size was estimated at USD 75.85 billion in 2023 and is projected to reach USD 108.37 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. The market has experienced significant growth due to increasing investments in the construction sector, mainly from India, China, and South Korea.

Key Market Trends & Insights

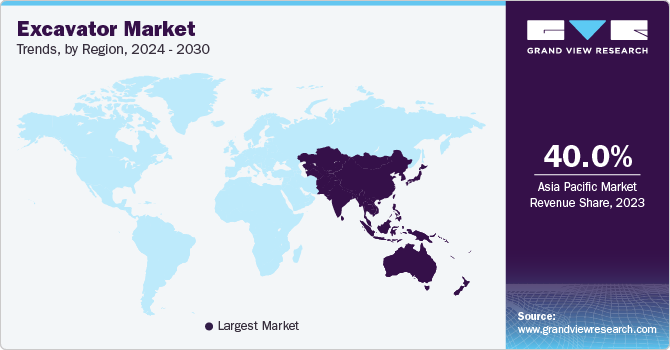

- Asia Pacific dominated the market and accounted for around 40.0% share in 2023.

- China dominated the market owing to the presence of major manufacturers and their increasing efforts to establish new production plants.

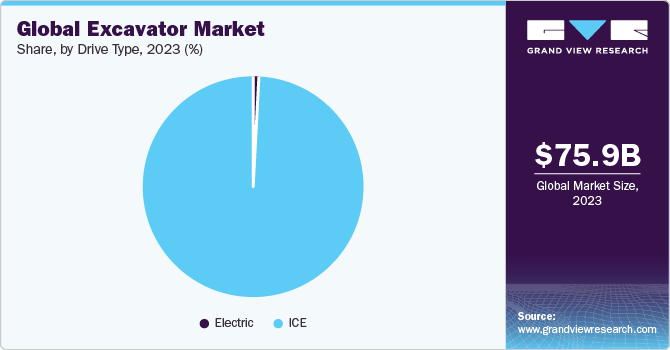

- Based on drive, ICE segment led the market in 2023 in the wake of increasing road projects and initiatives undertaken by governments worldwide.

- In terms of engine capacity, the up to 250 HP segment accounted for the largest market revenue share in 2023.

- On the basis of type, wheel excavators led the market in 2023 as these are projected to increase as a result of the growing requirement for waste management in the industrial industries.

Market Size & Forecast

- 2023 Market Size: USD 75.85 billion

- 2030 Projected Market Size: USD 108.37 billion

- CAGR (2024-2030): 5.0%

- Asia Pacific: Largest market in 2023

Global demand for excavators has increased as a result of an increase in the number of major projects in the road and port construction, mining, and oil and gas construction industries. Moreover, technological advancements in excavator design and functionality, such as improved fuel efficiency and enhanced performance, further contribute to their widespread usage and market growth.

In enclosed spaces such as forestry, agriculture, and small-scale construction projects, excavators are employed. The instrument is practical for accelerating construction activities and is built to offer greater operational skills, thus elevating the market growth. For instance, in May 2023 Hitachi Construction Machinery Co., Ltd. launched ZAXIS-7 compact excavators designed to enhance task efficiency on urban work sites. The company also launched ZX75US-7 model that featured an ultra-short-tail swing radius, which allowed access to small spaces. In addition, the ZX85USB-7 model, with its swing boom and ultra-short-tail swing radius, enabled productive excavation near walls and guardrails.

Mini excavators are anticipated to have new technological characteristics and offer lower emissions due to the integration of cutting-edge hydraulic systems and electrification. A growing number of smart infrastructure projects are being launched in underdeveloped countries with significant government backing. Strong consumer real estate investments and increased disposable income will increase the need for hydraulic excavators in the construction industry. For instance, in September 2023, Hyundai Construction Equipment Co. Ltd. North America unveiled the immediate availability of three additional excavator models, namely HX40A, HX35AZ, and HX48AZ, within its HX-A series of compact hydraulic excavators in the region.

Additionally, strict emission control requirements have mandated the use of eco-friendly machinery, opening up lucrative growth prospects for the world market for Crawler excavators. Diesel is the fuel of choice for most excavators utilized in various industrial sectors. Numerous governing authorities have enacted strict emission requirements that all market participants must follow in order to reduce air pollution brought on by heavy machinery with ignition engines, such as excavators. For manufacturers in the excavator sector, the U.S. Environmental Protection Agency (EPA) has set Tier 4 emission regulations, certification criteria, and other compliance restrictions.

The Regulation (EU) 2016/1628 and the European Commission's non-road mobile machinery emission standards force firms to alter their manufacturing processes, which could raise the overall cost of production. Manufacturers of excavators continue to be impacted by the strict legislation and quality standards that are being imposed. However, a few of the factors that are anticipated to impede the market's growth include costly installation and maintenance costs, as well as the requirement for ongoing technical assistance.

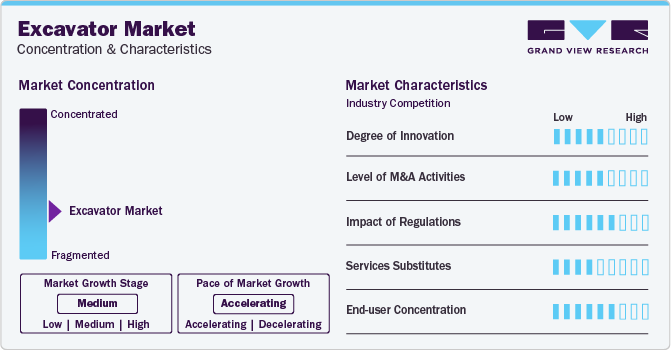

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in sensors, cameras, and AI-driven algorithms which enable them to detect and navigate through obstacles, enhancing precision and reducing the risk of accidents.

The market is also characterized by a high level of merger & acquisition (M&A) activity by the market players. This is due to several factors, including the desire to gain access to new regions, need to consolidate the growing market demand for excavators, and establishing strong brand position in the market.

The market is also subject to increasing regulatory scrutiny. Increasing environmental regulations and a growing emphasis on eco-friendly construction practices are driving the shift toward electric excavators. As a result, construction and mining industry is witnessing a broader trend of electrifying heavy equipment, including excavators, to reduce emissions and enhance sustainability.

At present, there are hardly any direct or external substitutes for excavators. However, there are considerable opportunities for internal substitutions, such as the electrification of construction equipment, over the next few years. Moreover, excavators are continuously getting smarter and energy-efficient in line with the advances in technology and continuous research & development efforts undertaken by the OEMs.

End-user concentration is a significant factor in the market. The concentration of demand for electrification creates opportunities for companies that focus on developing electric excavators for end-use industries. Ongoing development in battery technology, including higher energy density and faster charging capabilities, are influencing the design and performance of electric excavators.

Drive Type Insights

ICE segment led the market in 2023. Increasing road projects and initiatives undertaken by governments worldwide are poised to stir up the demand for excavators. Increasing urbanization and industrialization are leading to a rise in construction activities and subsequently, upsurge in demand for excavators. Over the course of the forecast period, the market expansion for excavators is anticipated to be driven by ongoing residential construction and infrastructure development. Additionally, the widespread use of excavators in the construction, upkeep, and restoration of electric transmission networks and gas pipelines is anticipated to hasten the growth of the market.

The electric drive type segment is projected to witness the highest growth over the forecast period. A significant driver for the electric excavator segment is the growing awareness and commitment to reducing carbon emissions and combating climate change. Governments and industries worldwide are increasingly emphasizing sustainability and environmental protection, leading to a surge in the adoption of electric construction equipment, including excavators. Electric excavators are seen as a crucial component in the broader shift toward cleaner, greener construction practices.

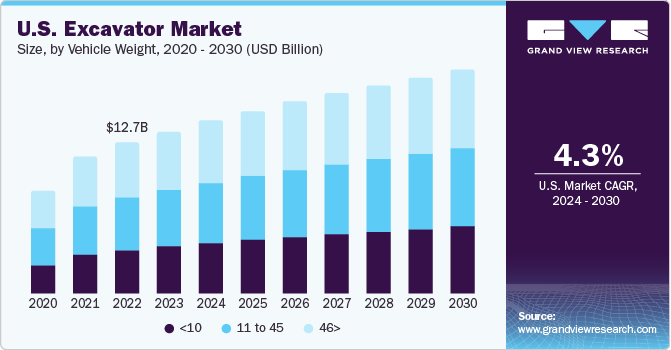

Vehicle Weight Insights

The above 46 weight segment led the market and accounted for 34.2% of the global revenue in 2023. The segment growth is driven by factors such as the escalating infrastructure development in both developed and developing countries. The construction of massive infrastructural projects such as highways, bridges, and urban development initiatives has created a need for robust and efficient excavation equipment. Moreover, with an increasing focus on modernizing transportation networks and expanding urban landscapes, the demand for powerful excavators has become paramount.

Similarly, excavator weighing less than 10 are expected to register the highest growth rate over the forecast period. Excavators with vehicle weight of <10 tons have gained significant traction across the globe due to the increasing demand for compact and versatile machinery in urban construction projects. Their maneuverability and ability to navigate confined spaces make them indispensable for projects in densely populated areas, where space constraints pose a significant challenge. The integration of advanced telematics systems, ergonomic design, and improved hydraulic capabilities have significantly increased the preference for lightweight excavators, making them an attractive option for construction firms seeking optimal performance without compromising on agility and precision.

Regional Insights

Asia Pacific dominated the market and accounted for around 40.0% share in 2023. The construction industry is being supported by improving economic conditions and quick infrastructure development in economies such as China, India, and South Korea. China dominated the market owing to the presence of major manufacturers and their increasing efforts to establish new production plants. Ongoing major projects in China such as the Shanghai Metro Line 23: Phase I, Foshan Metro Line 4: Phase I, Liuzhou-Wuzhou Railway Line, Zhongwei Ji'an Natural Gas Pipeline project, Shanghai Chip Manufacturing Plant, and Belt and Road Initiative among others, projects have helped increase the demand for market in China. Furthermore, growing mining activities in counties such as India, Thailand, China, and Vietnam are also supporting the market growth.

Europe is anticipated to witness considerable growth in the market. The growth of the European market is attributed to the growing emphasis on urban development and redevelopment. European countries have made significant investments toward enhancing their cities and public utilities, with a particular focus on expanding transportation networks and constructing new residential areas. Urbanization and infrastructure development have led to a consistent demand for excavators in the construction industry. These versatile machines are essential for various tasks, such as digging foundations and trenching, which are integral to these projects.

Engine Capacity Insights

The up to 250 HP segment accounted for the largest market revenue share in 2023. One of the main elements fostering a positive perspective for the market is the commercial and residential construction projects. Worldwide, large-scale construction of ports, highways, and mining operations all make extensive use of excavators with engine capacity of up to 250 HP. The segment expansion is being fueled by the increased use of automated excavators. These excavators enable remote operation tracking and help to reduce labor costs. Other growth-promoting aspects include a variety of product improvements, like the use of excavator power from electric motors powered by fuel cells. Fuel cells are compact and more productive than diesel engines, which expands the operator's cabin area and raises the machine's overall output.

The robust growth of the global construction and infrastructure development sector has driven the demand for excavators with 250-500 HP engine capacity. As countries worldwide are emphasizing the expansion and modernization of their transportation networks, the need for powerful excavators has intensified. These machines, with their higher horsepower capacity, are essential for handling heavy-duty tasks such as large-scale excavation, demolition, and earthmoving, thereby expediting the pace of construction projects.

Type Insights

Wheel excavators led the market in 2023 as these are projected to increase as a result of the growing requirement for waste management in the industrial industries. The rising trend of urbanization and the subsequent demand for improved and modernized urban infrastructure have spurred the need for versatile construction machinery. Wheel excavators offer a compact design and enhanced maneuverability, which makes them crucial for urban construction projects, especially in densely populated areas where space constraints are a significant challenge. Their ability to operate in tight spaces and their agility in navigating congested urban environments make them an ideal choice for various construction activities, such as trenching, digging, and material handling.

Demand for crawler excavators is anticipated to rise during the forecast period. Easy mobility of crawler excavators from one place to another and stability due to the weight of their undercarriage help them to work more efficiently. This factor is, therefore, likely to supplement the growth of the market. The market for crawler excavators is predicted to rise as a result of technological developments like air-to-water intercooler engines that produce more power. The market is growing due to features like a special riding control, a dedicated swing pump, load-sensing hydraulics, work-toll adaptability, and a hydraulically powered cooling fan. Some of the factors that hinder the growth of the worldwide crawler market include the fact that crawler excavators are not appropriate for hilly places because of the ground's poor traction and the high maintenance costs.

Key Companies & Market Share Insights

Some of the key players operating in the market include Caterpillar Inc., Deere & Company, Sany Heavy Industry Co., Ltd., Komatsu Ltd., and Volvo Construction Equipment AB.

-

Caterpillar Inc. continuously invests in research and development, leading to the incorporation of cutting-edge technologies in its excavators. This includes advanced hydraulic systems, telematics, and operator-assist features that enhance performance and efficiency.

-

Deere & Company offers a diverse range of excavator models, catering to various applications and project requirements. Their product lineup includes compact excavators, mid-size excavators, and larger excavators, providing options for a wide range of construction needs.

Doosan Corporation, Escorts Kubota Limited, and HİDROMEK are some of the emerging market participants in the excavator market.

-

Doosan Corporation has a strong global presence with a well-established distribution network. This enables the company to reach and serve customers across different regions efficiently.

-

Escorts Kubota Limited offer efficient after-sales service, customer support, and the availability of spare parts can enhance the overall customer experience, contributing to market leadership.

Key Excavator Companies:

- Atlas Copco

- Caterpillar Inc.

- CNH Global NV

- Doosan

- Escorts Group

- Hitachi Construction Machinery

- Hyundai Heavy Industries Ltd

- JC Bamford Excavators Ltd.

- John Deere

- Kobelco

- Komatsu Ltd.

- Liebherr-International AG

- Manitou Group

- Mitsubishi

- Sany Heavy Industries Co Ltd.

- Sumitomo Heavy Industries Ltd.

- Terex Corporation

- Volvo Construction Equipment AB

Recent Development

-

In May 2023, Hyundai Construction Equipment Co. Ltd. Europe launched the HX65A crawler excavator and the HW65A wheeled excavator to strengthen the company’s presence in the compact machinery market. The HW65A and HX65A featured TPowerful 48.5kW with 248Nm of torque, Hyundai Stage V compliant diesel engine, increased swing speed and swing torque, and proportional joysticks with ram-lock on joystick.

-

In March 2023, Hitachi Construction Machinery Co., Ltd. launched the next-generation ZX130-7 and ZX160LC-7 excavators. These products are full-sized excavators designed to effectively complete an extensive range of tasks on work sites. They feature hydraulic system refinements and fatigue-fighting comfort enhancements for fuel savings and increased performance.

-

In February 2023, Volvo Construction Equipment AB launched a 33-foot straight boom demolition excavator with the name EC300E. The company also introduced an industry-first feature known as Lifting Mode for Multi Demolition Boom. This feature enables a high-reach demolition excavator to function as a secure carrier for lifting machine components from a trailer to the ground, enhancing the versatility of these specialized machines.

Excavator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 81.04 billion

Revenue forecast in 2030

USD 108.37 billion

Growth rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Vehicle weight, engine capacity, type , drive type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Atlas Copco; Caterpillar Inc.; CNH Global NV; Doosan; Escorts Group; Hitachi Construction Machinery; Hyundai Heavy Industries Ltd; JC Bamford Excavators Ltd.; John Deere; Kobelco; Komatsu Ltd.; Liebherr-International AG; Manitou Group; Mitsubishi; Sany Heavy Industries Co Ltd.;Sumitomo Heavy Industries Ltd; Terex Corporation; Volvo Construction Equipment AB

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Excavator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global excavator market report based on vehicle weight, engine capacity, type, drive type, and region:

-

Vehicle Weight Outlook (Revenue, USD Million, 2018 - 2030)

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wheel

-

Crawler

-

-

Drive Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

ICE

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising infrastructure development and technological upgradation and innovation.

b. The global excavator market size was estimated at USD 75.85 billion in 2023 and is expected to reach USD 81.04 million in 2024.

b. The global excavator market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 108.37 billion by 2030.

b. Asia Pacific dominated the excavators market with a share of 40.5% in 2023. This is attributable to the improving economic conditions and rapid infrastructure development in emerging economies such as China, India, and South Korea.

b. Some key players operating in the excavator market include Caterpillar, Komatsu, Liebherr, Hitachi, John Deere, and Kobelco.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.