- Home

- »

- Medical Devices

- »

-

Exoskeleton Market Size & Share, Industry Report, 2030GVR Report cover

![Exoskeleton Market Size, Share & Trends Report]()

Exoskeleton Market (2025 - 2030) Size, Share & Trends Analysis Report By Mobility (Mobile, Fixed/Stationary), By Technology (Powered, Non-powered), By Extremity, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-071-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Exoskeleton Market Summary

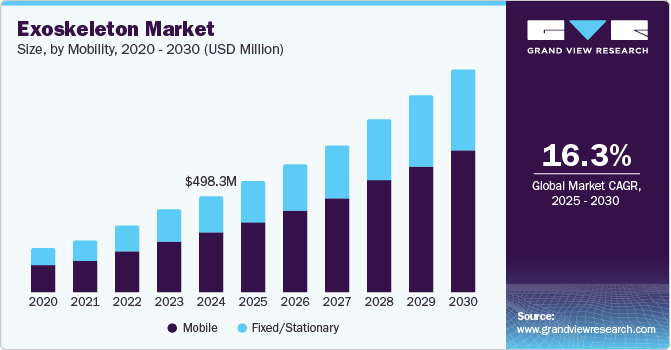

The global exoskeleton market size was estimated at USD 498.33 million in 2024 and is projected to reach USD 1.25 billion by 2030, growing at a CAGR of 16.27% from 2025 to 2030. Rapidly growing global geriatric population, rising adoption rates of medical devices in different industries such as automobile, military, defense, and construction, and rising incidence of stroke are some of the key driving forces responsible for the exoskeleton market growth.

Key Market Trends & Insights

- North America led the market in 2024, capturing 45.13% of the revenue and 26.32% of the volume share.

- The U.S. dominated the North America exoskeleton market.

- On the basis of mobility, the mobile segment led the market in 2024 with the largest revenue share of 62.39%.

- By extremity, lower body segment dominated the market in terms of revenue share.

Market Size & Forecast

- 2024 Market Size: USD 498.33 Million

- 2030 Projected Market Size: USD 1.25 Billion

- CAGR (2025-2030): 16.27%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the growing incidence rate of spinal cord injuries (SCI) is expected to drive the demand across global markets. For instance, as per the National Spinal Cord Injury Statistical Center (NSCISC), in the U.S., 17,730 new SCIs are diagnosed annually, and approximately 291,000 live with SCIs . Exoskeleton solutions are widely adopted across industries to support employee health and boost productivity. Growing demand has led to emergence of several startups expertizing in exoskeleton technology and providing solutions for rehabilitation. Furthermore, constantly evolving exoskeleton industry is driving market players to devise innovative product development strategies to boost adoption over the forecast period. For instance, in June 2022, Ekso Bionics received 510(k) FDA clearance for marketing the EksoNR robotic exoskeleton. It is the latest generation of devices that can be used for rehabilitation of multiple sclerosis patients.Increasing prevalence of spinal cord injury is boosting the growth of exoskeleton market as the patients suffering from spinal cord injury are recommended to use exoskeleton to improve their condition. This has become major driver for adoption of exoskeleton by patients as well as healthcare providers. According to world Health Organization, every year in world around 250000 - 500000 people suffer from spinal cord surgery and this increasing number of patients is resulting in increasing use of exoskeleton.

Some of the most common musculoskeletal injuries and disorders affecting the construction industry are occupational overuse syndrome (OOS), cumulative trauma disorders (CTD), and repetitive strain injury (RSI). For instance, as per WHO data estimates published in July 2022, approximately 1.71 billion individuals across the globe have musculoskeletal disorders that include neck pain, lower back pain, fractures, amputation, rheumatoid arthritis, and osteoarthrit is. Similarly, in 2022, according to the U.S. Bureau of Labor Statistics, approximately 502,380 workers have occupation-related musculoskeletal disorders across several industries. These are some of the driving factors boosting adoption of exoskeleton solutions owing to benefits associated with exoskeleton technology, such as augmenting or assisting users’ physical activity or capability, improving users’ health & productivity, and reducing fatigue experienced by industrial workers.

Rapid technological advancements in the exoskeleton market are expected to boost the demand for exoskeletons. Increasing popularity and growing adoption of exoskeletons by companies are expected to contribute to market growth. In addition, increasing adoption of exoskeletons in manufacturing sector, logistics, automotive, and construction is leading to a rise in penetration of exoskeletons, thereby fueling the market growth. For instance, in December 2021, IKEA and BMW are using Bionic’s fifth generation Cray X, an AI-enabled, powered exoskeleton capable of lifting an additional 70 pounds, reducing the risk of repetitive stress injuries and back injuries. Such advancements are expected to boost market growth over the forecast period.

The trend of including exoskeletons in health insurance coverage is rising, making them more accessible to patients. This is particularly evident in countries such as Germany, where specific exoskeleton systems are recognized for insurance procurement. For instance, in November 2023, ReWalk Robotics Ltd. appreciated the Centers for Medicare & Medicaid Services (CMS) for officially publishing the Calendar Year 2024 Home Health Prospective Payment System Rule. This regulation, which was issued on November 1, 2023, and is set to be implemented starting from January 1, 2024, confirms the classification of exoskeletons under the Medicare brace benefit category.

Case Studies & Insights

Case Study Title: “Exoskeletons for Medical Rehabilitation - A Review of Recent Advances”

Source: Journal of Assistive Technology, Tandfonline, 2023

Overview

This case study examines the advancements in medical exoskeletons, specifically for patients with spinal cord injuries, stroke recovery, and other neurological conditions. It highlights the key challenges and recent technological improvements in the development of exoskeletons that aim to restore mobility and improve rehabilitation outcomes.

Key Findings

-

Technological Integration: The study emphasizes the integration of AI, robotics, and biomechanics to enhance the adaptive capabilities of exoskeletons. These technologies help to personalize therapy, allowing for a more tailored and effective rehabilitation process.

-

Patient Mobility: Significant progress has been made in creating lightweight exoskeletons that are easier to wear and provide natural, intuitive movement. This improves patient comfort and encourages longer usage, which is vital for rehabilitation.

-

Market Adoption: Despite technological advances, the study highlights that cost, regulatory hurdles, and the need for medical supervision limit wider adoption in rehabilitation centers.

-

Example: Ekso Bionics' EksoGT is a key example of an exoskeleton used for walking assistance in stroke and spinal injury patients. The device has shown positive results in improving patient mobility and rehabilitation.

Conclusion

Exoskeletons are promising tools for rehabilitation, but cost-efficiency, user comfort, and long-term effectiveness need continued refinement for broader market integration

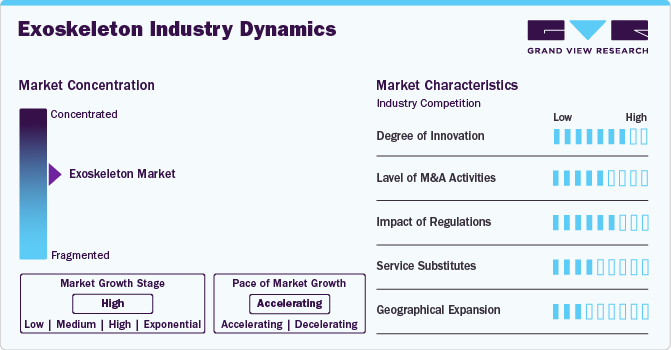

Market Concentration & Characteristics

The exoskeleton market is characterized by a high degree of innovation due to the rapid technological advancements driven by factors such as advancements in robotics and artificial intelligence technology. Novel and innovative applications of exoskeletons are constantly emerging, leading to the creation of new opportunities for market players.

Level of M&A Activities: The exoskeleton market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to access new robotic technologies needed to consolidate in a rapidly growing market and the increasing adoption of these newly developed exoskeletons.

Well-developed regulatory framework and rising approval for the exoskeleton products from these regulatory bodies positively impact market growth. The certifications and standards provided by government authorities for exoskeletons in their manufacture, deployment, and use would enhance their adoption at workplace.

Traditional rehabilitation methods remain prevalent, and exoskeletons are emerging as valuable alternatives. They offer advantages such as enhanced mobility and independence for patients with spinal cord injuries or neurological disorders. The high cost and need for specialized training may limit their widespread adoption, positioning them as complementary rather than direct substitutes to conventional therapies.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising research and development activities create more opportunities for market players to enter new regions.

Mobility Insights

The mobile segment led the market in 2024 with the largest revenue share of 62.39% and is anticipated to witness fastest CAGR over the forecast period. Factors such as a rise in research and development activities and a surge in demand for motor-equipped robots aiding human body mechanics are attributed to market growth. For instance, in October 2022, a research team at Stanford University funded by NIH developed an exoskeleton that can assist with walking .

Moreover, availability of favorable reimbursement policies promoting adoption of exoskeleton technologies in emerging economies & developing nations directly contributes to the segment's development and growth.

The fixed/stationary segment is expected to grow significantly, driven by increasing demand for rehabilitation and assisted living solutions. These devices, designed to aid patients with limited mobility, provide vital support for standing, posture correction, and walking stationary. For instance , the NX A3-M is a fixed-frame exoskeleton designed for gait rehabilitation, offering improvements over the earlier NX-A3 model.

Technology Insights

The powered segment held the largest revenue share in 2024 owing to rising implementation of powered exoskeleton solutions in several industries to enhance personal safety and boost productivity. In addition, the rise in innovative product launches and benefits associated with powered technology products are smoother lifting motion, reduced strain on worker’s body, increased strength, force multiplier, and enhanced productivity. For instance , in August 2024, Arc’teryx and Skip teamed up to introduce the world’s first powered pants, a wearable exoskeleton designed to improve human mobility by providing powered support.

Non-powered technology segment is anticipated to register the fastest growth rate over the forecast period, driven by demand for cost-effective, lightweight solutions that assist with lifting and mobility without relying on external power sources. These devices use mechanical systems, like elastics or springs, to enhance movement and reduce fatigue, making them ideal for industrial and rehabilitation applications. Key drivers include the rising need for manual labor assistance in logistics, construction, and healthcare sectors, where workers handle heavy loads. For instance, the UPLIFT exoskeleton utilizes elastic mechanisms to support lifting tasks, highlighting the growing adoption of affordable, non-powered solutions in the workforce.

Extremity Insights

By extremity, market is segmented into lower body,upper body and full body. Lower body segment dominated the market in terms of revenue share owing to rising investments, growing incidence of lower body disabilities, and increasing adoption rates of exoskeleton products by geriatric populations and paralyzed patients for weight-bearing capabilities and mobility. Initiatives such as, in April 2024, the ABLE Exoskeleton, a lightweight and affordable hip-knee-powered device by ABLE Human Motion, has received CE Mark approval under the new Medical Device Regulation, enabling its commercial sale for spinal cord injury rehabilitation in the EU.

The upper body segment is anticipated to register the fastest growth rate over the forecast period due to benefits provided by exoskeleton products in the upper extremities, such as supporting disabled communities and rehabilitation aid in post-stroke, neurological, or musculoskeletal impairments. Furthermore, growing prevalence of neurological disorders led to a rise in market growth. For instance, in May 2022, according to data published by the European Academy of Neurology, globally, a neurological disease affects 1 in 3 people at some point in their life.

End Use Insights

Healthcare segment dominated the market in terms of revenue share in 2024, owing to the rising incidence rate of spinal cord injuries (SCIs), widespread adoption of these products & solutions in rehabilitation centers, and significant surge in treatment numbers are some of the key driving factors. Moreover, a growing number of regulatory approvals and rising awareness of technologically advanced systems are driving the demand & adoption rate of exoskeleton products in the healthcare industry. For instance, in October 2023, Wandercraft SAS launched in the U.S. commercial operations of its exoskeleton, Atalante X. The solution is used for individuals with mobility impairments.

Industry segment is anticipated to register the fastest growth over the forecast period owing to rising awareness levels towards the benefits of exoskeleton technologies in several industry applications and the rapidly growing incidence rate of occupation-related injuries. Furthermore, the surge in demand for novel technologies and growing adoption of the exoskeleton in multiple sectors such as construction, manufacturing, and distribution is expected to accelerate growth of the industry segment.

Regional Insights

North America led the market in 2024, capturing 45.13% of the revenue and 26.32% of the volume share, driven by increasing investment in research, a growing disabled population, and expanding partnerships among key players, availability of advanced technologies, and strong public and private sector support. For instance, in March 2021, Ekso Bionics, an exoskeleton technology company, partnered with U.S. Physiatry (USP) to educate clinicians or physicians on the clinical benefits of an EksoNR exoskeleton. Moreover, rising disposable income, a rapidly growing geriatric population, widespread presence of key market players, growing human augmentation in industry and military verticals, and availability of public & private investors are driving the growth.

U.S. Exoskeleton Market Trends

The U.S. dominated the North America exoskeleton market due to its strong focus on technological innovation, high investment in healthcare and military sectors, and the widespread presence of leading exoskeleton manufacturers. For instance, in April 2025, Lifeward Ltd. announced the nationwide U.S. launch of the ReWalk 7 Personal Exoskeleton, representing the latest advancement in its technology.

“The ReWalk 7 was developed over several years, integrating advanced technological innovations with feedback from clinicians and patients to build upon the ReWalk’s world-class reputation for industry leadership. The result is a device that is optimized for real-world use, with an unmatched user experience and freedom of movement. We are thrilled to be able to provide paralyzed individuals across the country with a new option for integrating walking to everyday life.”

- Larry Jasinski, CEO of Lifeward

Asia Pacific Exoskeleton Market Trends

Asia Pacific is anticipated to register the fastest growth rate during the forecast period owing to a growing patient pool requiring rehabilitation support. Availability of government support & funding and developing & advancing healthcare infrastructure are driving the development & growth of the exoskeleton market in Asia Pacific. Constant economic development in economies such as China, Japan, and India, coupled with favorable public & private support, is expected to bolster the development & growth.

The exoskeleton market in China is rapidly advancing in technologies, focusing on enhancing mobility and strength. Chinese engineers are actively working on creating exoskeleton suits to assist astronauts, demonstrating the country's commitment to innovation in this field. In addition, in January 2025, the Chinese military showcased exoskeletons for logistics operations.

Europe Exoskeleton Market Trends

Strong regulatory frameworks and a focus on medical and industrial applications drive the exoskeleton market in Europe. The European Medicines Agency (EMA) ensures that medical exoskeletons meet stringent safety and efficacy standards, facilitating their integration into healthcare systems. Countries such as Germany, France, and the UK are leading in adopting these technologies for rehabilitation and industrial use.

The Germany exoskeleton market is growing in terms of technologies, and the country benefits from a well-established regulatory framework that supports the development and deployment of exoskeletons. The European Medicines Agency (EMA) is vital in ensuring the safety and effectiveness of medical exoskeletons, helping them integrate into healthcare systems.

Latin America Exoskeleton Market Trends

The exoskeleton market in Latin America is growing significantly. In November 2024, Einstein Hospital in São Paulo is conducting clinical trials to assess the effectiveness of exoskeletons in rehabilitation. It will be the first hospital in Latin America to use an exoskeleton that senses the patient’s movement intentions, amplifies the neurological micro-signals, and aids in executing the movement. This innovation enables patients to play a more active role in their rehabilitation.

Brazil exoskeleton market held largest share in Latin America in 2024. is facilitating innovation in exoskeleton technology through local initiatives. Startups, including Exy Innovation, are developing wearable exoskeletons tailored to the Brazilian workforce to enhance productivity and reduce workplace injuries. In addition, research institutions are collaborating to create cost-effective and adaptable solutions suitable for tropical environments, addressing the region's unique needs.

Middle East & Africa Exoskeleton Market Trends

The exoskeleton market in the Middle East and Africa (MEA) region is experiencing rapid growth. Countries such as Saudi Arabia, the UAE, and South Africa are investing in healthcare infrastructure, including rehabilitation centers equipped with exoskeleton technologies. Public and private sector investments support this expansion to enhance mobility solutions for individuals with disabilities.

The exoskeleton market in South Africa is witnessing advancements, focusing on enhancing mobility and strength. Local initiatives are developing wearable exoskeletons tailored to the South African workforce to improve productivity and reduce workplace injuries. In addition, research institutions collaborate to create cost-effective and adaptable solutions suitable for the region's unique needs.

Key Exoskeleton Company Insights

Key players who focus on innovation, product development, and strategic partnerships to maintain their market positions dominate the exoskeleton market. For instance, in March 2023, Svaya Robotics developed quadruped robot and a wearable exoskeleton. The exoskeleton is specially designed to match the body structure of Indian soldiers, enhancing their physical strength to help them walk long distances without fatigue and carry heavy loads with reduced effort. The market share is concentrated among established players with extensive resources for research and development, while emerging players focus on cost-effective solutions and technological advancements.

Key Exoskeleton Companies:

The following are the leading companies in the exoskeleton market. These companies collectively hold the largest market share and dictate industry trends.

- Ekso Bionics

- ARMASTEC PTE. LTD

- Hocoma

- Lockheed Martin Corporation

- Suit X

- Rex Bionics Plc.

- RB3D

- ReWalk Robotics

- Cyberdyne, Inc.

- ActiveLink (Panasonic Corporation)

- DIH Medical

Recent Developments

-

In February 2025 , Chulalongkorn University has introduced the “Exoskeleton Wheelchair,” a robotic suit designed to assist people with disabilities in sitting, standing, and walking.

-

In February 2025, Wandercraft launched a landmark clinical trial for the Personal Exoskeleton, the world’s first self-balancing device aimed at restoring natural standing, walking, bending, and reaching abilities for individuals with severe mobility impairments.

-

In January 2025, German Bionic unveiled the Apogee ULTRA, which offers 80 lbs (36 kg) of lifting support. It is designed to enhance worker safety and productivity in industries such as logistics, manufacturing, and healthcare.

-

In December 2024, RoboCT's UGO Series Rehab Exoskeleton received CE certification, officially recognizing it as a medical device.

-

In November 2024, Hippos Exoskeleton will release a knee brace featuring airbags designed to help prevent ACL injuries.

-

In December 2022, Ekso Bionics announced the acquisition of Parker Hannifin Corporation’s Human Motion and Control business unit. This acquisition includes Parker’s Indego lower limb exoskeleton product line and the strategic development of robot-assisted prosthetic and orthotic devices.

-

In June 2022, CYBERDYNE Inc. formed a business and capital alliance with LIFESCAPES Inc. This collaboration highlighted the combined effort to further leverage the exoskeleton technology arena and improve rehabilitation options for patients with severe paralysis.

-

In June 2022, CYBERDYNE Inc. announced its collaboration with the Social Security Organization (SOCSO) in Malaysia. This initiative led to the expansion of Cybernics Treatment using hybrid assistive limb (HAL) for SOCSO-insured patients.

Exoskeleton Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 590.02 million

Revenue forecast in 2030

USD 1.25 billion

Growth rate

CAGR of 16.27% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mobility, technology, extremity, end use , region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Denmark; Norway; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ekso Bionics; ARMASTEC PTE. LTD; Hocoma; Lockheed Martin Corporation; Suit X; Rex Bionics Plc.; RB3D; ReWalk Robotics; Cyberdyne, Inc.; ActiveLink (Panasonic Corporation); DIH Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exoskeleton Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global exoskeleton market report on the basis of mobility, technology, extremity, end use, and region:

-

Mobility Outlook (Revenue, USD Million, 000' Units, 2018 - 2030)

-

Mobile

-

Fixed/Stationary

-

-

Technology Outlook (Revenue USD Million, 000’ Units, 2018 - 2030)

-

Powered

-

Non-powered

-

-

Extremity Outlook (Revenue USD Million, 000’ Units, 2018 - 2030)

-

Upper Body

-

Lower Body

-

Full Body

-

-

End Use Outlook (Revenue USD Million, 000’ Units, 2018 - 2030)

-

Healthcare

-

Military

-

Industry

-

-

Regional Outlook Revenue USD Million, 000’ Units, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global exoskeleton market size was valued at USD 498.33 million in 2024 and is expected to reach USD 590.02 million in 2025.

b. The global exoskeleton market is expected to grow at a compound annual growth rate of 16.27% from 2025 to 2030 to reach USD 1.25 billion by 2030.

b. Mobile segment dominated the exoskeleton market with a revenue share of 62.39% in 2024. This is attributable to the introduction of innovative mobile exoskeletons by manufacturers for the aging and disabled population.

b. Some key players operating in the exoskeleton market include Rex Bionics Plc.; Hocoma; Lockheed Martin Corporation; Suit X; ReWalk Robotics; RB3D; ReWalk Robotics Ltd; Cyberdyne, Inc.; and ActiveLink (Panasonic Corporation).

b. Key factors that are driving the exoskeleton market growth include the growing adoption of exoskeletons in healthcare and non-healthcare settings, technological advancements, and the increasing prevalence of spinal cord injuries (SCIs).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.