- Home

- »

- Plastics, Polymers & Resins

- »

-

Expanded Polystyrene Market Size, Industry Report, 2033GVR Report cover

![Expanded Polystyrene Market Size, Share & Trends Report]()

Expanded Polystyrene Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (White, Grey), By Application (Construction, Packaging, Automotive), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-1-68038-603-5

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Expanded Polystyrene Market Summary

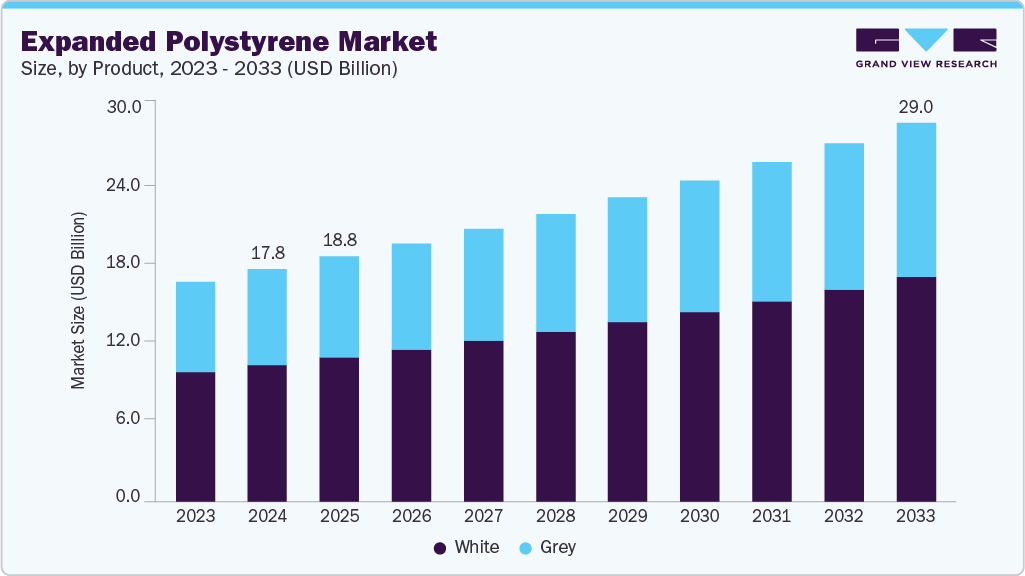

The global expanded polystyrene market size was estimated at USD 17.82 billion in 2024 and is projected to reach USD 29.04 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The growth is attributed to the increasing influence of social factors such as improving occupant health and well-being, encouraging sustainable business practices, and creating a sense of community.

Key Market Trends & Insights

- Asia Pacific dominated the Expanded Polystyrene Market with the largest revenue share of 41.06% in 2024.

- China’s expanded polystyrene market is expected to witness rapid growth.

- By product, the white product dominated the global expanded polystyrene market and accounted for a revenue share of 58.77% in 2024.

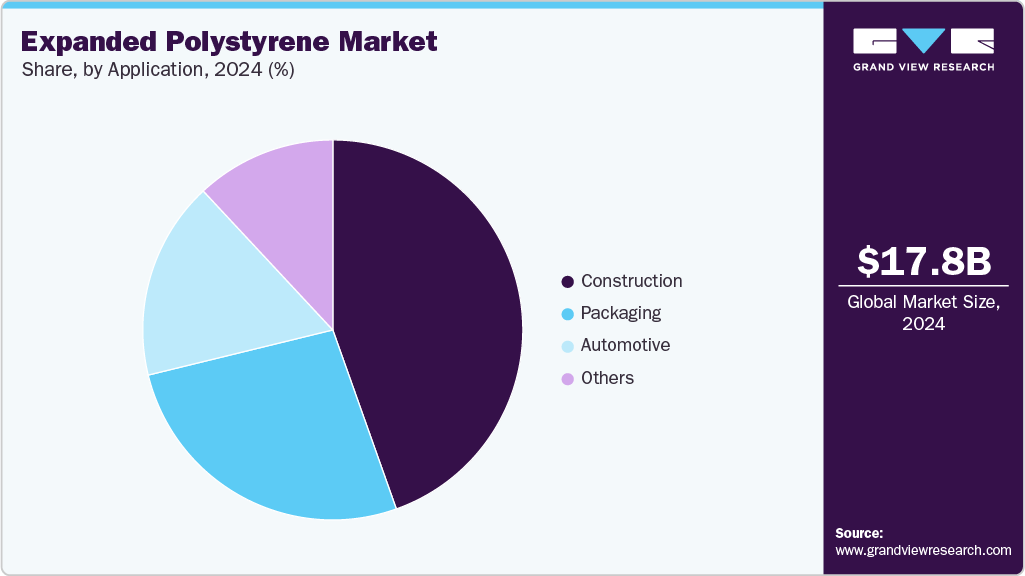

- By application, the construction segment dominated the application segment in the global expanded polystyrene market and accounted for a total revenue share of 44.84% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 17.82 billion

- 2033 Projected Market Size: USD 29.04 billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

The Expanded Polystyrene (EPS) market is expected to experience steady growth, driven by rising demand in sectors such as construction, packaging, automotive, and consumer goods. Its lightweight nature, excellent thermal insulation, impact resistance, and moisture resistance make it a preferred material for energy-efficient buildings, protective packaging, and durable components. In construction, EPS contributes to enhanced energy conservation and cost savings, while in packaging, it ensures product safety during transportation. The market is further influenced by advancements in recycling technologies, increasing emphasis on sustainable building materials, and stricter energy efficiency regulations across developed and emerging economies.

In addition, rising infrastructure investments, rapid urbanization, and growth in e-commerce and retail sectors are contributing to a broader adoption of expanded polystyrene. With industries focusing on performance, cost efficiency, and compliance with environmental regulations, steady growth in the EPS market is anticipated in the coming years.

Drivers, Opportunities & Restraints

The expanded polystyrene market is expected to keep growing, fueled by increasing demand from sectors such as construction, packaging, automotive, and consumer goods. Its lightweight properties, superior thermal insulation, and impact resistance make it essential for energy-efficient buildings, protective packaging, and durable product applications. The increasing use of EPS in insulation panels, molded protective packaging, and automotive components further supports market expansion, particularly with ongoing infrastructure development and industrial growth in emerging regions.

Emerging prospects are anticipated in the expanded polystyrene market, driven by a growing focus on sustainability and circular economy initiatives. The development of recyclable and energy-efficient EPS solutions is gaining traction, particularly in Europe and North America. Additionally, the expansion of green building projects, the growth of e-commerce requiring protective packaging, and the rising adoption of lightweight automotive components are creating new opportunities for EPS in safe, compliant, and cost-effective applications.

The expanded polystyrene industry is anticipated to face challenges due to growing environmental concerns over plastic waste and the limited biodegradability of EPS products. Stricter regulations on waste management, recycling rates, and material usage could increase compliance and processing costs. Additionally, fluctuations in raw material prices and potential disruptions in global supply chains may impact production stability, while competition from alternative insulation and packaging materials, such as mineral wool, cellulose, and molded pulp, could limit EPS adoption in certain applications.

Market Concentration & Characteristics

The Expanded Polystyrene (EPS) market is presently experiencing a moderate growth phase, with an accelerating trend driven by rising applications across construction, packaging, automotive, and consumer goods. While the market is fragmented, leading companies maintain significant influence over the competitive landscape through their strong technical expertise, diverse product portfolios, and extensive global distribution networks. Key players such as BASF SE, Alpek S.A.B. de C.V., LG Chem, KANEKA CORPORATION, SIBUR, SUNPOR, Synthos, Total Energies, Supreme Petrochem Ltd, NOVA Chemicals, Epsilyte LLC, Ravago, Knauf Industries, Versalis S.p.A., SABIC, Taita Chemical Co., Ltd., and NexKemia Petrochemicals Inc. are instrumental in shaping market dynamics. These companies drive innovation by developing advanced EPS grades with enhanced insulation performance, improved recyclability, and cost-efficient solutions tailored to meet stringent regulatory requirements and the evolving sustainability and performance demands of global industries.

Mergers and acquisitions are influencing the expanded polystyrene (EPS) market, as leading companies acquire specialized firms to strengthen their global footprint, diversify product portfolios, and enhance supply chain capabilities. These strategic moves are fostering innovation in recyclable, low-emission, and high-performance EPS solutions in response to increasingly stringent environmental regulations. Regulatory frameworks, particularly in Europe and North America, are guiding material choices toward sustainable, non-toxic, and energy-efficient insulation and packaging materials. Rising compliance costs and evolving industry standards are prompting investments in advanced recycling technologies, cleaner production processes, and next-generation EPS formulations designed to meet both performance and sustainability goals.

The expanded polystyrene market experiences moderate competition from alternative materials such as mineral wool, polyurethane foam, and molded pulp. However, EPS retains a strong market position due to its lightweight nature, excellent thermal insulation, impact resistance, and cost-effectiveness. There is notable concentration among end users, particularly within the construction, packaging, and automotive sectors, where large builders, retail chains, e-commerce companies, and OEMs significantly influence procurement decisions. This concentration shapes product development priorities and demand patterns, making the market sensitive to changes in building energy codes, sustainability regulations, innovation in insulation and packaging technologies, and evolving customer requirements.

Product Insights

White product segment dominated the global expanded polystyrene market and accounted for a revenue share of 58.77% in 2024. White EPS is the most commonly used and widely available form of expanded polystyrene. Made from standard polystyrene beads without additives, it exhibits a bright white color and offers excellent insulation, cushioning, and lightweight properties. This material is primarily used in packaging applications for electronics, consumer goods, and perishable items due to its shock-absorbing and thermal insulation qualities. For example, white EPS is frequently used in molded packaging for TVs, refrigerators, and other home appliances, as well as in fish boxes for cold chain logistics.

Grey EPS is an advanced version of standard EPS, typically enhanced with graphite or infrared (IR) reflective particles that significantly boost its thermal insulation properties. The addition of these particles reduces thermal conductivity by reflecting and absorbing radiant heat, making grey EPS an ideal choice for high-performance building insulation applications. For example, BASF's Neopor is a well-known grey EPS product that offers up to 20% better insulation than traditional white EPS at the same thickness, supporting energy-efficient building design in compliance with modern green building codes.

Application Insights

Construction dominated the application segment in the global expanded polystyrene market and accounted for a total revenue share of 44.84% in 2024. Expanded Polystyrene (EPS) plays a vital role in the construction industry due to its lightweight nature, thermal insulation properties, moisture resistance, and ease of installation. EPS is extensively used in wall and roof insulation, underfloor insulation, structural insulated panels (SIPs), and foundation systems. It provides excellent thermal efficiency, significantly contributing to building energy conservation efforts in residential and commercial constructions. The global push towards green buildings and energy-efficient structures is accelerating the use of EPS-based insulation materials.

The packaging industry is another significant application area for EPS, particularly in protective and thermal packaging. EPS is widely used to package electronic items, medical devices, appliances, and temperature-sensitive goods such as seafood and pharmaceuticals. Its shock absorption properties, low weight, and cost-effectiveness make it a preferred choice for ensuring the safety and freshness of products during transportation and storage. The rise in e-commerce and online food delivery has further amplified the demand for protective EPS packaging.

In the automotive sector, EPS is primarily used in safety and light weighting applications. Due to its energy-absorbing and impact-resistance properties, EPS foam is found in car bumpers, headrests, side impact protection, and child car seats. With automotive manufacturers focusing on vehicle weight reduction to meet stringent fuel efficiency and emission standards, EPS offers a cost-effective and lightweight solution for non-structural components.

Region Insights

The Asia Pacific expanded polystyrene market dominated the global EPS market in 2024 and accounted for a revenue share of 41.06%. Asia Pacific is expected to be one of the largest and fastest-growing markets over the forecast period, primarily fueled by the ascending demand for the product from key applications, including automotive, packaging, and construction, in emerging economies such as China and India. The Asia Pacific construction industry is the fastest-growing market across all regions.

China Expanded Polystyrene Market Trends

China’s expanded polystyrene market is expected to witness rapid growth, driven by fast-paced urbanization, large-scale infrastructure projects, and strong government support for energy-efficient construction. The expanding real estate sector, rising demand for thermal insulation in buildings, and growth in e-commerce and cold-chain logistics are fueling EPS usage in insulation panels, protective packaging, and temperature-controlled containers. Additionally, advancements in domestic manufacturing capabilities and an increasing focus on recyclable, cost-effective materials are further boosting market adoption.

North America Expanded Polystyrene Market Trends

The North American Expanded Polystyrene (EPS) Market is projected to grow at a CAGR of 5.7%, driven by strong demand in construction, packaging, and automotive applications. The region’s well-developed industrial base, coupled with increasing investments in energy-efficient building materials and sustainable packaging solutions, is supporting the adoption of high-performance, regulatory-compliant EPS products.

The U.S. Expanded Polystyrene (EPS) Market is expected to grow due to rising demand in construction, infrastructure, and packaging applications. Strict energy-efficiency regulations, coupled with the push for sustainable building materials, are driving the adoption of EPS in insulation systems. Additionally, growth in e-commerce and food service packaging, along with an increasing focus on lightweight, protective, and cost-effective materials, is further contributing to market expansion.

Europe Expanded Polystyrene Market Trends

Strict building energy codes, the growing emphasis on sustainable construction practices, and strong commitments to the circular economy are expected to positively impact the European Expanded Polystyrene (EPS) Market. There is a rising demand for recyclable, low-emission, and high-performance EPS materials, particularly in applications such as thermal insulation for buildings, protective packaging, and lightweight automotive components.

Key Expanded Polystyrene Market Company Insights

The Expanded Polystyrene (EPS) market is currently in a medium growth stage, with an accelerating trajectory driven by increasing applications in construction, packaging, automotive, and consumer goods. While the market remains moderately fragmented, leading players hold substantial influence over the competitive landscape. Key companies such as BASF SE, Alpek S.A.B. de C.V., LG Chem, KANEKA CORPORATION, SIBUR, SUNPOR, Synthos, Total Energies, Supreme Petrochem Ltd, NOVA Chemicals, Epsilyte LLC, Ravago, Knauf Industries, Versalis S.p.A., SABIC, Taita Chemical Co., Ltd., and NexKemia Petrochemicals Inc. are instrumental in shaping market dynamics. These firms drive innovation by developing high-performance, recyclable, and regulatory-compliant EPS grades that address evolving requirements in energy efficiency, sustainability, and product protection across global markets.

Key Expanded Polystyrene Market Companies:

The following are the leading companies in the expanded polystyrene market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Alpek S.A.B. de C.V.

- LG Chem

- KANEKA CORPORATION

- SIBUR

- SUNPOR

- Synthos

- TotalEnergies

- Supreme Petrochem Ltd

- NOVA Chemicals

- Epsilyte LLC

- Ravago

- Knauf Industries

- Versalis S.p.A.

- SABIC

- Taita Chemical Co., Ltd.

- NexKemia Petrochemicals Inc.

Recent Developments

-

In June 2025, Epsilyte, a major North American producer of Expandable Polystyrene (EPS), announced to increase the price of all grades of EPS by USD 0.06 per pound effective June 1, 2025, or as contracts permit. The price hike is attributed to constrained availability and rising costs of delivered styrene feedstock, driven by recent force majeure announcements in the styrene supply chain.

-

In March 2025, Versalis S.p.A. opened a new recycling plant in Porto Marghera, Italy, dedicated to producing plastics made wholly or partially from mechanically recycled raw materials, specifically crystal polystyrene (r-GPPS) and expandable polystyrene (r-EPS) from EPS waste. The plant can produce up to 20,000 tonnes annually and the recycled materials, marketed under the Versalis Revive brand, contain between 35% and 100% post-consumer recycled content.

Expanded Polystyrene Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.78 billion

Revenue forecast in 2033

USD 29.04 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; China; India; Japan; South Korea; Australia; Malaysia; Singapore; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa;

Key companies profiled

BASF SE; Alpek S.A.B. de C.V.; LG Chem; KANEKA CORPORATION; SIBUR; SUNPOR; Synthos; TotalEnergies; Supreme Petrochem Ltd; NOVA Chemicals; Epsilyte LLC; Ravago; Knauf Industries; Versalis S.p.A.; SABIC; Taita Chemical Co. Ltd.; NexKemia Petrochemicals Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Expanded Polystyrene Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2033. For this study, Grand View Research has segmented the global expanded polystyrene market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

White

-

Grey

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Construction

-

Packaging

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Malaysia

-

Singapore

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.