- Home

- »

- Advanced Interior Materials

- »

-

Exterior Insulation And Finish System Market Report, 2030GVR Report cover

![Exterior Insulation And Finish System Market Size, Share & Trends Report]()

Exterior Insulation And Finish System Market Size, Share & Trends Analysis Report By Type (Polymer Based, Polymer Modified), By Insulation Material (EPS, Mineral Wool), By End Use (Residential, Non-Residential) By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-373-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The global exterior insulation and finish system market size was estimated at USD 92.7 billion in 2023 and is projected to grow at a CAGR of 8.4% from 2024 to 2030. The key factor driving industry demand is growing investments in green building construction initiatives worldwide. Governments worldwide are implementing stricter energy efficiency regulations for buildings to reduce carbon emissions and energy consumption. EIFS provides excellent thermal insulation, reducing heating and cooling costs significantly. This factor drives demand as building owners seek to comply with regulations and lower operating expenses.

EIFS offers a wide range of design options and aesthetic flexibility compared to traditional exterior cladding materials like brick or concrete. They can mimic various textures and finishes, giving architects and designers more creative freedom in building facades. This aesthetic appeal attracts both commercial and residential property developers looking to differentiate their projects.

EIFS are lightweight compared to traditional masonry systems, which reduces structural load and simplifies construction. Their versatility allows for easier installation around architectural details, curved surfaces, and irregular shapes, making them suitable for complex building designs. Modern EIFS systems are durable and resistant to moisture, cracking, and impact damage when properly installed and maintained. They offer long-term performance and require less maintenance compared to other cladding systems, which appeals to building owners seeking cost-effective solutions over the building's lifecycle.

EIFS are considered environmentally friendly due to their energy-saving properties. They contribute to reducing greenhouse gas emissions associated with building operations by improving thermal performance. Additionally, some EIFS products use recyclable materials or have lower embodied energy compared to traditional materials, aligning with sustainability goals.

Type Insights

Polymer based segment dominated the market with the major revenue share of 65.5% in 2023 and is forecasted to grow at a significant CAGR from 2024 to 2030. Polymer-based EIFS typically incorporate acrylic or polymer-modified cementitious materials, which enhance their durability and weather resistance. These systems are more resilient against moisture infiltration, cracking, and impact damage compared to traditional EIFS that use solely cementitious or organic materials. This durability makes them suitable for various climates and environmental conditions, thereby expanding their market appeal.

Moreover, Polymer-based EIFS offers greater flexibility and elasticity, which allows them to accommodate structural movement and thermal expansion without developing cracks. This flexibility helps maintain the integrity of the building envelope over time, reducing the likelihood of water penetration and associated maintenance issues. As a result, building owners and developers favor polymer-based EIFS for their reliability and long-term performance benefits.

Insulation Material Insights

EPS segment dominated this market with the major revenue share of 19.8% in 2023 and is forecasted to grow at a significant CAGR of 9.1% from 2024 to 2030. EPS is known for its outstanding thermal insulation capabilities. It effectively reduces heat transfer through building walls, enhancing energy efficiency by minimizing heating and cooling costs. As energy efficiency regulations become more stringent globally, EPS-based EIFS are increasingly favored for their ability to help buildings meet these requirements and achieve sustainable design goals.

Moreover, EPS is lightweight compared to other insulation materials like mineral wool or rigid foam boards. This characteristic makes EPS easy to handle and install, reducing labor costs and construction time. Its lightweight nature also minimizes structural loads on buildings, making it suitable for both new construction and retrofit projects. EPS used in EIFS is typically treated to be moisture-resistant and resistant to mold growth. This treatment ensures that the insulation retains its thermal performance over time and does not degrade due to moisture exposure. Additionally, EPS is durable and does not corrode or decay, providing long-term reliability in building envelope applications.

End Use Insights

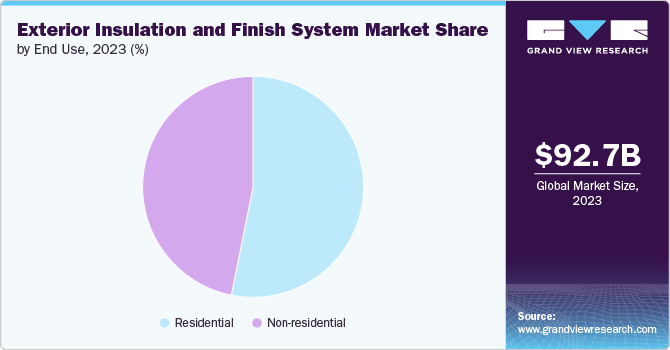

Residential application segment dominated this market in 2023 with a revenue share of 51.2%. This is expected to grow at the highest CAGR of 8.5% from 2024 to 2030. One of the primary drivers for EIFS adoption in residential buildings is their exceptional thermal insulation properties. EIFS provides a continuous insulation layer across the exterior walls, significantly reducing thermal bridging and heat loss. This improved thermal performance helps homeowners reduce heating and cooling costs throughout the year, making EIFS an attractive option for energy-conscious consumers.

EIFS offers homeowners a wide range of design options and aesthetic flexibility. Unlike traditional siding materials such as brick or vinyl, EIFS can mimic various textures, colors, and architectural styles. This versatility allows homeowners to achieve customized and visually appealing facades that enhance the curb appeal and overall value of their homes. Additionally, EIFS can incorporate decorative elements like moldings, reveals, and artistic finishes, further enhancing design possibilities.

EIFS are lightweight and easy to install, which can reduce construction time and labor costs compared to heavier materials like brick or stone. This ease of installation makes EIFS suitable for both new construction and retrofit projects, allowing homeowners to upgrade the exterior appearance and energy efficiency of their homes with minimal disruption.

Regional Insights

Exterior insulation and finish system market in North America experiences diverse climate conditions, from harsh winters in the northern regions to hot summers in the southern states. EIFS systems can be tailored with insulation and moisture management components to enhance building envelope performance across these varied climates. This adaptability makes EIFS a practical choice for residential, commercial, and institutional buildings throughout the region.

U.S. Exterior Insulation And Finish System Market Trends

In the U.S., stringent energy efficiency regulations at federal, state, and local levels are driving the adoption of EIFS. These regulations aim to reduce carbon emissions and promote sustainable building practices. EIFS provides excellent thermal insulation, helping buildings meet or exceed energy codes and achieve high-performance building certifications like LEED (Leadership in Energy and Environmental Design).

Europe Exterior Insulation And Finish System Market Trends

Several countries in Europe have some of the strictest energy efficiency standards in Europe, driven by EU directives and national regulations. EIFS plays a crucial role in meeting these standards by enhancing thermal insulation and reducing building energy consumption. The regions focus on sustainable building practices and energy-efficient renovations supports the growing demand for EIFS in both residential and commercial sectors.

Asia Pacific Exterior Insulation And Finish System Market Trends

The Asia-Pacific region, including countries like China, Japan, South Korea, and Australia, is experiencing rapid urbanization and a construction boom. EIFS offers a lightweight, cost-effective solution for enhancing building energy efficiency and aesthetics in high-density urban environments. Many countries in the Asia-Pacific region have adopted green building initiatives and sustainable construction practices to mitigate environmental impact. EIFS contribute to these initiatives by improving building energy efficiency and reducing greenhouse gas emissions, aligning with regional sustainability goals.

Key Exterior Insulation And Finish System Company Insights

Some of the key players operating in the market include Saint-Gobain and BASF

-

Saint-Gobain is engaged in designing, manufacturing, and distribution of high-performance materials and building materials. In addition, the company provides solutions for energy efficiency, growth challenges, and protection of the environment. The company operates in three business segments, namely, innovative materials, construction products, and building distribution.

-

BASF is engaged in the manufacturing and distribution of chemicals and related products throughout the world. This company operates its business through six segments including industrial solution, chemicals, agricultural solutions, materials, surface technologies, and nutrition & care. Industrial segment offers products and ingredients for applications such as admixtures, pigments, polymer dispersions, and resins. Chemicals segment offers petrochemicals and its intermediates while the materials business segment provides advanced materials such as polyamides and antioxidants, among others.

Some of the emerging market participants in the market are:

-

Sto Corp is involved in the production of energy efficient and easy-to-apply insulation and finishing system with manufacturing plants located in the U.S. This company caters to the construction demand throughout the U.S., Canada, and the Caribbean, providing smart building solutions to customers.

Key Exterior Insulation And Finish System Companies:

The following are the leading companies in the exterior insulation and finish system market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Saint-Gobain

- Wacker Chemie

- Sto Corp

- Owens Corning

- Dryvit Systems Inc

- Master Wall Inc

- Parex Usa, Inc

- SFS Group

- Rmax

Recent Developments

-

In June 2022, Owens Corning, an American company specializing in insulation, roofing, and fiberglass composites, has acquired WearDeck. WearDeck is a renowned premium composite decking and structural lumber manufacturer in Ocala, Florida. This strategic acquisition is expected to play a vital role in Owens Corning’s growth strategy by enabling the company to shift its focus within the Composites business toward high-value material solutions in the building and construction industry. By incorporating WearDeck’s innovative solutions, Owens Corning aims to enhance its offerings and strengthen its position in the market.

Exterior Insulation And Finish System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 101.23 billion

Revenue forecast in 2030

USD 178.35 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, insulation materials, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan. India; South Korea; Brazil; Saudi Arabia

Key companies profiled

BASF; Saint-Gobain; Wacker Chemie; Sto Corp; Owens Corning; Dryvit Systems Inc; Master Wall Inc; Parex Usa, Inc; SFS Group; Rmax

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Exterior Insulation And Finish System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global exterior insulation and finish system market report based on type, insulation materials, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymer based

-

Polymer Modified

-

-

Insulation Material Outlook (Revenue, USD Million, 2018 - 2030)

-

EPS

-

Mineral Wool

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global exterior insulation and finish system market size was estimated at USD 92.70 billion in 2023 and is expected to reach USD 101.23 billion in 2024.

b. The Exterior insulation and finish system market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 178.35 billion by 2030.

b. Among product, polymer based exterior insulation and finish system accounted for the largest market in 2023 with a revenue share of 65.5% as Polymer-based EIFS typically incorporate acrylic or polymer-modified cementitious materials, which enhance their durability and weather resistance

b. Some of the key players operating in the exterior insulation and finish system market include BASF, Saint-Gobain, Wacker Chemie, Sto Corp, Owens Corning, Dryvit Systems Inc, Master Wall Inc, Parex Usa, Inc, SFS Group, Rmax

b. The key factor that is driving the exterior insulation and finish system includes the rising building & construction activities in the developing countries around the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."