- Home

- »

- Medical Devices

- »

-

Extracorporeal CO2 Removal Devices Market Report, 2030GVR Report cover

![Extracorporeal CO2 Removal Devices Market Size, Share & Trends Report]()

Extracorporeal CO2 Removal Devices Market Size, Share & Trends Analysis Report By Product (Extracorporeal CO2 Machines, Disposables, Others), By Application, By Access, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-636-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2020 - 2030

- Industry: Healthcare

Report Overview

The global extracorporeal CO2 removal devices market size was estimated at USD 78.9 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. The rise in the prevalence of acute respiratory distress syndrome (ARDS) and chronic obstructive pulmonary disease (COPD) disorders has led to the introduction of novel products for vitalizing blood flow and efficient gas exchange. Increasing product approvals by regulatory bodies for several extracorporeal removal devices during the COVID-19 pandemic helped various market players to increase their product sales. For instance, in April 2020, Alung Technologies received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration for Hemolung Respiratory Assist System (RAS) used in the treatment of COVID-19.

The COVID-19 pandemic resulted in many fatalities. Respiratory manifestation was one of the main clinical characteristics of this disease, and approximately 15%-20% of confirmed and suspected patients required mechanical ventilation and developed severe hypoxemia. The usage of extracorporeal CO2 removal devices has increased since the emergence of COVID-19. However, the number of extracorporeal membrane oxygenation (ECMO) machines and specific extracorporeal carbon dioxide removal (ECCO2R) devices were in a state of serious shortage for quite a long time during the peak period of the pandemic. With such increasing demand for extracorporeal CO2 removal devices throughout the world, the market witnessed a significant increase in demand.

In recent years, technological improvements and strategies have made it possible to reduce the complexity and size of extracorporeal CO2 removal devices. Such a gradual rise in technological advancements has facilitated the growth in the safety and adoption of these systems. Various technical advancements have permitted extracorporeal CO2 removal devices to become feasible and simple and represent further options for support of patients with severe respiratory ailments and high mortality. Thus, such technological advancements are anticipated to boost the market growth.

Technological advancements in extracorporeal respiratory assist systems have led to improved interest in extracorporeal carbon dioxide removal (ECCOR) devices. For instance, in November 2021, Alung Technologies received a De Novo Clearance for the Hemolung respiratory system. This system is the first ECCO2R device approved by the FDA. Furthermore, in November 2020, X-COR Therapeutics closed an approximately 2.6 million funding round. This company anticipates using these funds to continue developing its products including ECCO2R devices.

Extracorporeal CO2 removal devices are used for treating patients with severe COPD exacerbation and ARDS. Extracorporeal CO2 removal devices eliminate blood CO2 and fight against the adverse effects of hypercapnia and related acidosis. According to the WHO, COPD has been considered the third leading cause of death globally and caused about 3.2 million deaths in 2022. In addition, according to the American Lung Association, more than 11 million people get diagnosed with COPD in the U.S. each year. Thus, rising cases of COPD are estimated to boost the adoption of extracorporeal CO2 removal devices, boosting the market growth.

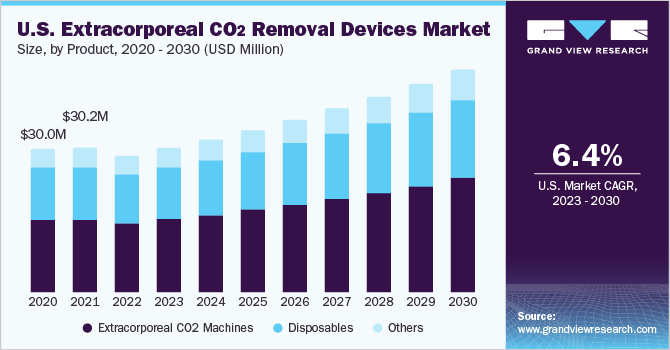

Product Insights

Based on product type, the extracorporeal CO2 removal devices market is segmented into extracorporeal CO2 machines, disposables, and others. The extracorporeal CO2 removal machines segment accounted for the largest revenue share of 52.4% in 2022 and is also expected to grow at the fastest CAGR of 7.4% over the forecast period. Technical simplification has caused the development and potential applications of extracorporeal CO2 extraction devices to progress rapidly, avoiding nearly some of the initial problems associated with ECMO. The devices are theoretically simpler and have fewer personnel as well as logistic requirements, leading to an increased preference among patients. Thus, increasing benefits associated with ECCO2R are anticipated to boost segment growth.

The disposables segment is expected to grow at a significant CAGR during the forecast period. Disposables are used on procedures per patient basis in extracorporeal CO2 removal therapy. High consumption and demand for consumables in extracorporeal carbon dioxide removal procedures are projected to augment the growth of the market. Hence, the increasing need for disposables for several COPD and ARDS-related procedures is anticipated to foster the demand for extracorporeal CO2 removal devices over the analysis period.

Application Insights

Based on application, the market is segmented into acute respiratory distress syndrome (ARDS), chronic obstructive pulmonary disease (COPD), bridge to lung transplant, and others. The bridge to lung transplant segment held the largest revenue share of 40.0% in 2022. Patients waiting for lung transplantation who develop life-threatening hypercarbia may benefit from extracorporeal CO2 removal devices by using them as a bridge to transplantation. The rising focus of manufacturers such as Alung Technologies, Xenios AG, and others on developing extracorporeal CO2 removal devices for the bridge to lung transplantation is anticipated to spur market growth during the forecast period.

The acute respiratory distress syndrome (ARDS) segment is expected to grow at the fastest CAGR of 8.0% over the forecast period. In patients with ARDS, extracorporeal CO2 removal devices are in much demand owing to their ability to remove CO2 and help enable lung protective ventilation through a reduction in plateau pressures and tidal volumes. Extracorporeal CO2 removal devices aid in the management of ARDS and allow more protective ventilation meanwhile eluding extreme levels of respiratory acidosis. ECCO2R devices are considered essential for the establishment of protective or ultra-protective ventilation in patients suffering from ARDS. It was also observed that venovenous ECCO2R devices allowed significant reductions in pressure among patients with moderate-to-severe ARDS, thereby surging the product demand.

Access Insights

Based on access, the market is bifurcated into venovenous and arteriovenous. The venovenous segment held the largest revenue share of 64.0% in 2022. In venovenous access, the blood is drawn from the central vein through a drainage cannula using a roller or centrifugal pump to produce flow across the gas exchange membrane. In recent years, a new generation of extracorporeal CO2 removal devices has been developed. Efficient venovenous extracorporeal CO2 removal devices are made available and are replacing the arteriovenous method, having the benefit of not requiring arterial puncture. Such a rise in the usage of venovenous extracorporeal CO2 removal devices among patients is predicted to accelerate market growth.

The arteriovenous segment is expected to grow at the fastest CAGR of 7.9% over the forecast period due to the enormous number of drugs in the clinical pipeline and helpful government initiatives which are also anticipated to have a positive impact on the market for intravenous therapy. With arteriovenous extracorporeal CO2 removal devices, the blood flows from the femoral artery with the help of a gas exchanger and returns into the contralateral femoral vein. The arteriovenous system uses a high-technology, and simplified membrane lung characterized by high gas transfer efficiency, enormously low resistance to blood flow, and the absence of a heat exchanger. Thus, the above-mentioned factors are anticipated to accelerate the market growth.

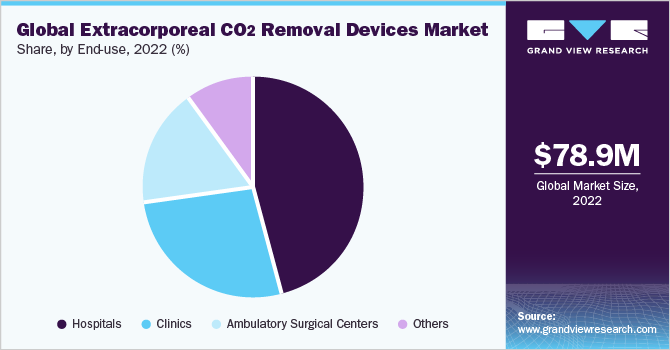

End-use Insights

Based on end-use, the extracorporeal CO2 removal devices market is segmented into hospitals, ambulatory surgical centers, clinics, and others. The hospitals segment held the largest revenue share of 46.3% in 2022 and is also expected to grow at the fastest CAGR of 7.6% over the forecast period. The increasing number of hospital admissions, especially the patients suffering from ARDS due to the recent outbreak of COVID-19 is predicted to boost the segment growth.

The segment is also projected to increase due to rising COPD and ARDS occurrences. Increasing patient hospitalization rates and an increase in the number of hospitals around the world are anticipated to fuel market expansion over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 40.7% in 2022 owing to the increasing demand for extracorporeal CO2 removal devices among healthcare professionals. Improved healthcare infrastructure and high adoption of extracorporeal CO2 removal devices especially during the COVID-19 pandemic across the U.S. and Canada is projected to contribute to North America’s market share. Early adoption of novel technologies, a large patient pool of ARDS and COPD, and increasing occurrence of chronic respiratory diseases is anticipated to accelerate the regional market growth. Rising preference for safe and rapid minimally invasive ventilation devices has accelerated the market growth.

Asia Pacific is anticipated to grow at the fastest CAGR of 8.9% during the forecast period. The presence of a large patient pool, rising awareness regarding acute respiratory failure, and increasing government healthcare expenditure in developing countries such as India and Japan are the factors predicted to accelerate the regional market growth. Favorable government initiatives, as well as the high rate of success for extracorporeal CO2 removal devices during respiratory surgeries, are expected to drive market growth. A huge population base with low per capita income in the Asia Pacific led to a high demand for affordable treatment options. Multinational companies are looking forward to investing in developing countries such as China, anticipating the regional market growth.

The Europe market is expected to grow at a significant CAGR during the forecast period. Increasing demand for healthcare devices coupled with the rising prevalence of chronic diseases such as respiratory failure in the region are some key drivers for the growing market share of this region. Favorable reimbursement policies, increasing government investment in long-term healthcare, and growing healthcare research infrastructural framework are also boosting the usage rates of extracorporeal CO2 removal devices.

Key Companies & Market Share Insights

The market is highly competitive and product launches, approvals, acquisitions, and innovations are some of the strategies being undertaken by market participants to expand their global reach. In May 2020, ALung Technologies, Inc. announced the commercial development of the next-generation artificial lung. Hemolung Respiratory Assist System (RAS) extracorporeal CO2 removal devices are manufactured specially for this therapy and are widely used as well as simple to use. Some prominent players in the global extracorporeal CO2 removal devices market include:

-

Medtronic

-

Getinge AB

-

Xenios AG

-

Medica S.P.A.

-

Aferetica srl

-

ALung Technologies, Inc.

-

ESTOR S.P.A.

Extracorporeal CO2 Removal Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 84.1 million

Revenue Forecast in 2030

USD 137.2 million

Growth rate

CAGR of 7.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, application, access, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic; Getinge AB; Xenios AG; ALung Technologies, Inc.; ESTOR S.P.A.; Medica S.P.A.; Aferetica srl

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Extracorporeal CO2 Removal Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global extracorporeal CO2 removal devices market report based on product, application, access, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Extracorporeal CO2 Machines

-

Disposables

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Respiratory Distress Syndrome (ARDS)

-

Chronic Obstructive Pulmonary Disease (COPD)

-

Bridge to Lung Transplant

-

Others

-

-

Access Outlook (Revenue, USD Million, 2018 - 2030)

-

Venovenous

-

Arteriovenous

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Clinics

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global extracorporeal CO2 removal devices market size was estimated at USD 78.9 million in 2022 and is expected to reach USD 84.10 million in 2023.

b. The global extracorporeal CO2 removal devices market is expected to grow at a compound annual growth rate of 7.24% from 2023 to 2030 to reach USD 137.2 million by 2030.

b. The extracorporeal CO2 machines segment dominated the global extracorporeal CO2 removal devices market and accounted for the largest revenue share of 52.4% in 2022.

b. Some key players operating in the extracorporeal CO2 removal devices market include Medtronic, Xenos AG, Alung Technologies, Getinge AB, ESTOR S.P.A, Medica Spa, and Aferectica Srl.

b. Key factors that are driving the extracorporeal CO2 removal devices market growth include increasing prevalence of COPD and asthma, technological advancements, rising number of product launches,es and product approval.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."