- Home

- »

- Medical Devices

- »

-

Facial Fat Transfer Market Size & Share Report, 2030GVR Report cover

![Facial Fat Transfer Market Size, Share & Trends Report]()

Facial Fat Transfer Market (2022 - 2030) Size, Share & Trends Analysis Report By Donor Site (Thigh, Flank, Abdomen), By End-use (Hospitals, Clinics & Surgery Center), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-047-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Facial Fat Transfer Market Summary

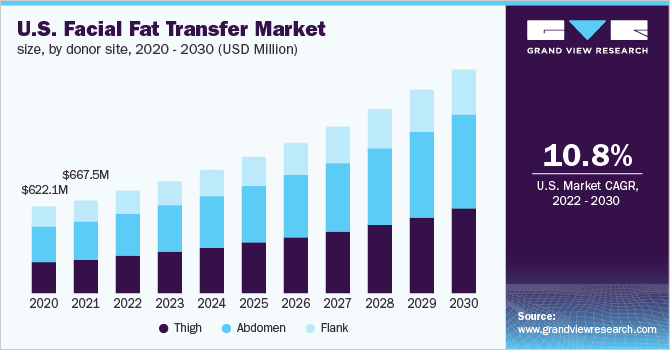

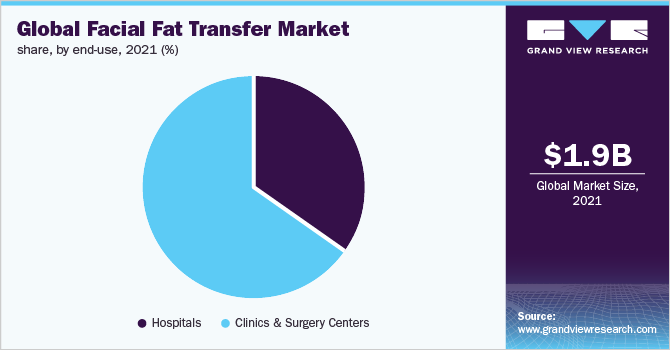

The global facial fat transfer market size was estimated at USD 1.9 billion in 2021 and is projected to reach USD 4.9 billion by 2030, growing at a CAGR of 10.8% from 2022 to 2030. The rising geriatric population and the growing demand for cosmetic procedures are anticipated to fuel the demand for facial fat transfer.

Key Market Trends & Insights

- North America dominated the global market for facial fat transfer in 2021 with a 35.6% share.

- Latin American region is expected to witness high growth during the forecast period.

- By donor site, the abdomen segment accounted for the largest revenue share of 40% in the market in 2021.

- By end-use, clinics and surgery centers segment held the maximum market share of 65% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 1.9 Billion

- 2030 Projected Market Size: USD 4.9 Billion

- CAGR (2022-2030): 10.8%

- North America: Largest market in 2021

The advent of the COVID-19 pandemic has hugely affected the global market. But many aesthetic professionals believe that the pandemic might propel the overall aesthetic industry. Many dermatology clinics have witnessed a boost in the number of future appointments and consultations for skin treatments, implying that facial fat transfer treatments that can assist with treating signs of aging may witness growth. Facial fat transfers have also been used to correct facial scarring and can be injected into areas such as temples, forehead, upper and lower orbit, cheeks, perioral region, nasolabial fold, jawline, and chin. Plastic surgeons are increasingly suggesting fat grafting for facial volume augmentation surgery, owing to its various advantages over traditional dermal fillers.

As compared to conventional dermal fillers, the results of facial fat transfer last longer, have zero/minimal adverse reactions and are cost-effective from a long-term perspective. Fat transfer, also known as autologous fat transfer or fat grafting, is mainly performed to enhance the aesthetic appeal of the face by reducing crow’s feet, smile lines, or frown lines. An increase in the incidences of such conditions due to aging & pollution is propelling the demand for facelifts, thus driving the market for facial fat transfer. In such treatments, fat is harvested generally from the abdomen or thigh, which is then processed and carefully injected into the lines, hollows, and depressions of the face to rejuvenate and recontour the facial features.

For instance, since the fat used for grafting is obtained from the patient’s own body, it has almost zero probability of causing an adverse reaction, whereas the hyaluronic acid-based dermal filler has a potential risk of causing multiple allergic reactions. Such advantages are expected to drive the market for facial fat transfer during the forecast period.

In 2020, nearly 24,529,875 cosmetic procedures (including both minimally invasive & surgical) were performed as per a report by the International Society of Aesthetic Plastic Surgery. Two of the top five surgical procedures were liposuction and tummy tuck. The increasing demand for these procedures is anticipated to drive the market for facial fat transfers. The report also stated that fat transfer procedures on the face witnessed a 10.4% increase from 2018 to 2019, indicating that the treatment adoption is rising. This can be attributed to the cost-effectiveness of the combination of these procedures along with the fat transfer process.

Despite the COVID-19 pandemic negatively impacting several industries, the aesthetic treatment market has witnessed an increase in procedures by the end of 2020. In 2021, the market has witnessed high demand due to the backlog of 2020 and increased interest from people related to dermatological procedures. The market witnessed a decline of 13.0% in 2020 as compared to 2019. This was majorly due to the fact that such treatments are high contact services that increased the chances of virus transmissions. Therefore, many clinics witnessed a drop in patient footfall, as patients were hesitant to undergo such treatments.

However, the International Society of Plastic Surgery stated that the demand for invasive as well as non-invasive aesthetic treatments has increased significantly in the latter months of 2020 and the beginning of 2021, indicating that treatments like facial fat transfer might witness a significant recovery post-pandemic.

Donor Site Insights

The abdomen segment accounted for the largest revenue share of 40% in the market in 2021 and is expected to be the fastest-growing segment during the forecast period. This is owing to its high popularity as compared to the other donor sites. The abdomen is also the most preferred donor site for fat grafting due to ease of access and availability of fat stores. The complications in grafting fat from the abdomen are rare and easily managed in the office. The U.S. abdomen donor site segment is expected to witness a high CAGR of 10.8% over the forecast period. By donor site, the facial fat transfer market is divided into thighs, abdomen, and flanks.

Donor site selection generally depends on the body areas that have uniform, excess, or abundant fat. Thus, sites such as buttocks, flanks, thighs, and abdomen are popularly used for fat harvesting. Furthermore, the cell viability of fat harvested from the abdomen is relatively higher than the other donor sites, thus driving the segment growth. Moreover, the fat grafts taken from the thigh demonstrated greater structural integrity, less cyst formation, less necrosis, and reduced fibrosis; this can lead to a significant increase in the thigh donor site segment growth.

End-use Insights

Clinics and surgery centers held the maximum market share of 65% in 2021 and are anticipated to lead the market for facial fat transfer in the future. This is owing to an increase in the number of clinics and skilled cosmetic and plastic surgeons, and the rising preference of consumers for fat transfer by skilled experts. Moreover, increasing claims of beneficial effects of the fat transfer techniques by some physicians and aesthetic device companies are increasing the adoption of this technique by clinic surgeons, thus propelling the segment growth.

By end-use, the global market for facial fat transfer has been categorized into hospitals, clinics, and surgery centers. Aesthetic clinics like Med spas provide a comprehensive range of treatments and are also increasingly adopting novel treatment systems to cater to the wider esthetic need of patients, which in turn is fueling segment growth. Furthermore, the presence of skilled professionals is also expected to positively influence the market.

Regional Insights

North America dominated the global market for facial fat transfer in 2021 with a 35.6% share, and this trend is expected to continue through the forecast period. According to the International Society of Aesthetic Plastic Surgery, the U.S. is the country with the most non-surgical procedures, and around 28,376 facial fat transfer treatments were carried out in 2020.

This can be attributed to the rising obese population, increasing R&D in the region, the highest per capita disposable income, rising adoption of new technology, and frequent awareness campaigns. The increasing need for perfect appearance and confidence through physical characteristics in major fields of work is driving the regional market growth. The development of convenient procedures and easy access to healthcare facilities is proving to fuel the non-invasive fat reduction market in the country.

However, the Latin American region is expected to witness high growth during the forecast period. This is due to the fact that countries like Brazil and Mexico have become an epicenter for quality aesthetic services at a much more affordable price. The International Society of Aesthetic Plastic Surgery reports that Brazil holds the second position after the U.S., in terms of total aesthetic treatments carried out globally. The rise in aesthetic awareness, availability of advanced cosmetic treatments, etc. are expected to boost the market growth in the region.

Key Companies & Market Share Insights

The industry players are focusing on increasing their credibility to provide enhanced services and products to the growing number of facial fat transfer patients. The presence of board-certified surgeons at clinics and hospitals that are specifically trained and hold strong experience in cosmetic procedures increases the credibility of aesthetic centers, whereas regulatory approvals improve the credibility of the devices.

For instance, in June 2021, Sihuan Pharmaceutical Holdings Group Ltd. obtained the exclusive distribution right for its LipiVage fat collection system, manufactured by the U.S-based Genesis Biosystems, in Greater China and South Korea, which will expand the pipeline for medical aesthetic products for the company. In September 2016, Alma Lasers announced the launch of LipoLife 3G, a liposuction device used for various applications such as fat grafting, liposuction, and skin tightening. This device is a third-generation product in the company’s already existing brand called LipoLife.

Some of the key players in the facial fat transfer market include:

-

Ranfac Corp

-

Alma Lasers.

-

Allergan Plc.

-

Medikan International Inc

-

Genesis Biosystems

-

Emory Healthcare

-

Stanford Health Care

Facial Fat Transfer Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.1 billion

Revenue forecast in 2030

USD 4.9 billion

Growth rate

CAGR of 10.8% from 2022 to 2030

Base year for estimation

2021

Actual estimates/Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

By donor site, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, & MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key Companies Profiled

Ranfac Corp; Cytori Therapeutics, Inc.; Allergan Plc.; Medikan International Inc; Stanford Health Care

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global facial fat transfer market report based on donor site, end-use, and region:

-

Donor Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Thigh

-

Abdomen

-

Flank

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Clinics & surgery centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global facial fat transfer market size was estimated at USD 1.9 billion in 2021 and is expected to reach USD 2.1 billion in 2022.

b. The global facial fat transfer market is expected to grow at a compound annual growth rate of 10.8% from 2022 to 2030 to reach USD 4.2 billion by 2030.

b. North America dominated the global market for facial fat transfer in 2021 with a 35.6% share, and this trend is expected to continue through the forecast period.

b. Some key players operating in the facial fat transfer market include Ranfac Corp; Alma Lasers, Inc.; Allergan Plc.; Medikan International Inc.; and Stanford Health Care.

b. Key factors that are driving the market growth include rising geriatric population and growing demand for cosmetic procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.