- Home

- »

- Renewable Chemicals

- »

-

Fatty Methyl Ester Sulfonate Market Size, Share Report, 2033GVR Report cover

![Fatty Methyl Ester Sulfonate Market Size, Share & Trends Report]()

Fatty Methyl Ester Sulfonate Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Personal Care, Detergents), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-1-68038-401-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fatty Methyl Ester Sulfonate Market Summary

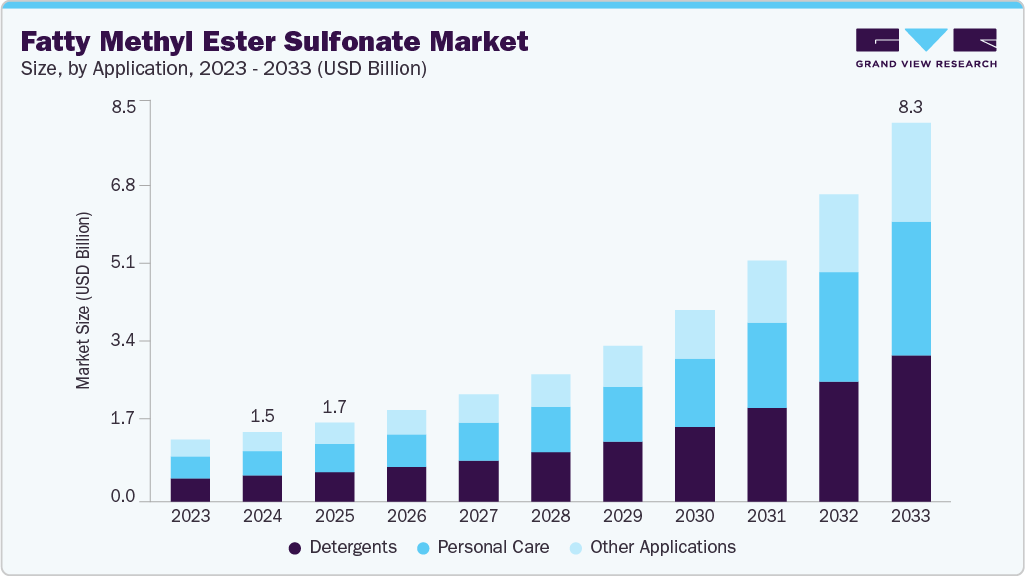

The global fatty methyl ester sulfonate market size was estimated at USD 1,463.5 million in 2024 and is projected to reach USD 8,309.8 million by 2033 growing at a CAGR of 22.3% from 2025 to 2033. Fatty Methyl Ester Sulfonates (FMES) are extensively utilized as surfactants, which find applications across various application industries, including personal care, cosmetics, laundry detergents, and lubricants.

Key Market Trends & Insights

- Europe dominated the fatty methyl ester sulfonate market with the largest revenue share of 32.3% in 2024.

- The fatty methyl ester sulfonate market in Germany held a substantial share of the Europe market.

- By application, personal care fatty methyl ester sulfonate market is expected to witness the fastest growth of 21.4% from 2025 to 2033.

- By application, detergents fatty methyl ester sulfonate market, dominated the market with a revenue share of 37.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,463.5 Million

- 2033 Projected Market Size: USD 8,309.8 Million

- CAGR (2025-2033): 22.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Among these, the individual care and cosmetics segment represents a significant share of the surfactants market, given their widespread use in hair care, skincare, creams, gels, and ointment formulations. The rapid growth of the personal care industry, combined with increased consumer spending on premium applications, is expected to drive market expansion. Additionally, the growing organization of the retail sector in emerging economies such as Brazil, India, and China is likely to speed up the growth of the personal care and cosmetics market, thereby increasing the demand for FMES-based surfactants.The increasing availability of plant-based chemicals as effective alternatives to petrochemical-derived compounds is expected to boost demand for laundry detergent chemicals. These chemicals can be produced from both petrochemical sources and oleochemicals derived from plant oils like palm kernel oil, palm stearin, and coconut oil. Growing consumer awareness about the sustainability of ingredients used in household products is driving this shift, especially in developed regions such as the U.S. and the UK. In North America, market growth is mainly supported by plant-based oleochemicals like FMES in laundry detergent formulations.

Fatty methyl ester sulfonates, a type of anionic surfactant, are extensively utilized in laundry detergent formulations for both household and institutional use. Their broad adoption is due to advantageous properties like strong foaming performance and low sensitivity to water hardness. These characteristics make them particularly suitable for use in light-duty liquid dishwashing products and laundry detergents.

Methyl Ester Sulfonates (MES), derived from renewable sources such as palm and coconut oils, are increasingly gaining attention as a sustainable and cost-effective alternative to petrochemical-based surfactants, particularly considering rising crude oil prices. MES is seen as a favorable substitute for alkyl benzene sulfonates (LABS), the dominant surfactant in the detergent industry, due to its renewable origin, excellent biodegradability, superior calcium hardness tolerance, and strong detergency performance.

Compared to LABS, MES offers significant advantages, including lower application costs and a smaller environmental footprint, especially regarding CO₂ emissions. Palm oil, particularly palm stearin, is a common feedstock for MES, and the increasing global palm oil trade has helped reduce the cost per ton of methyl esters. Additionally, MES needs less quantity to provide the same cleaning performance as LAB, boosting its value. Its stability in hard water, high detergency, low toxicity, and environmental friendliness highlight MES's potential as a more sustainable, eco-friendly surfactant for modern detergent formulations.

However, the growth of the fatty methyl ester sulfonates (FMES) market faces notable restraints due to the environmental challenges associated with palm oil Applicationion, a key raw material in FMES manufacturing. In major palm oil-producing countries such as Indonesia and Malaysia, large-scale plantations have raised serious concerns over deforestation, biodiversity loss, and greenhouse gas emissions, particularly when cultivated on peatlands. These environmental issues have prompted calls for stricter regulations and sustainable practices, which could limit the availability or increase the cost of sustainably sourced palm oil.

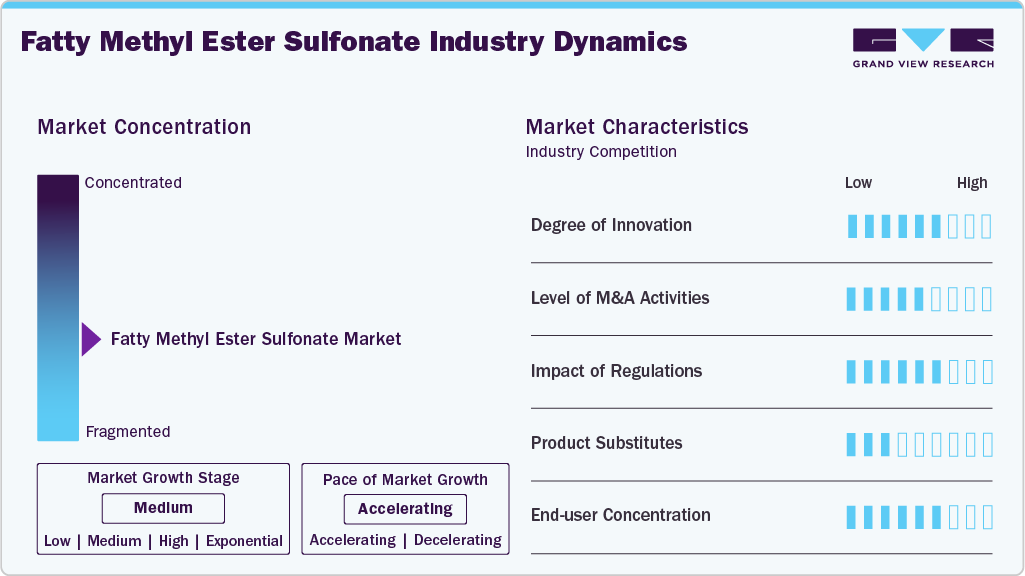

Market Concentration & Characteristics

The fatty methyl ester sulfonate market is somewhat fragmented, with a few major vertically integrated players holding a dominant position. These key companies benefit from economies of scale, internal sourcing of raw materials such as natural oils and fatty acids, and well-established global distribution channels. Their integration across the oleochemical value chain, from feedstock processing to sulfonation, allows them to achieve cost efficiencies, maintain consistent application quality, and ensure steady supply. This strategic advantage enables them to reliably serve core application industries including detergents, personal care, agriculture, textiles, and industrial cleaning.

At the same time, new players in the Asia-Pacific and Middle East regions are steadily increasing their presence in the Fatty Methyl Ester Sulfonate market by utilizing abundant local feedstocks, low energy costs, and growing domestic demand. These regional manufacturers are making strategic investments in oleochemical infrastructure and sulfonation facilities within integrated industrial zones. They continue to focus on providing cost-effective solutions for high-volume applications like laundry detergents, agrochemicals, fabric softeners, and industrial cleaners. This changing landscape, characterized by consolidation among established global companies and regional growth driven by application efficiencies, is further transforming the competitive dynamics of the FMES market.

However, the Fatty Methyl Ester Sulfonate Market faces several challenges, like stiff competition from well-established petrochemical-based detergent manufacturers that benefit from highly efficient operations and robust global supply chains. The competition is particularly intense between smaller-scale bio-refineries and large, technologically mature petrochemical plants, which can produce at lower costs due to economies of scale.

Application Insights

Detergent-based segments by application dominated the fatty methyl ester sulfonate market with a 37.9% share in 2024, mainly due to increasing regulatory pressure on synthetic, petrochemical-based surfactants in laundry products because of their harmful environmental impact, especially wastewater contamination. These regulations have encouraged detergent manufacturers to adopt more sustainable, biodegradable alternatives. FMES, especially the α-sulfo fatty methyl ester sulfonate (α-MES) variant, has gained popularity in the cleaning industry as a sulfate-free, bio-based anionic surfactant. Palm oil-based α-MES is a key raw material for FMES, offering high detergency, excellent compatibility, and environmental safety. Its use in both powder and liquid laundry detergents reflects the broader market shift toward eco-friendly cleaning solutions.

The personal care segment by application of fatty methyl ester sulfonate is expected to grow the fastest, with a CAGR of 21.4% from 2025 to 2033 during the forecast period. This growth is driven by its excellent compatibility with a wide range of surfactants, including anionic, cationic, nonionic, and amphoteric types. Its stability across a broad pH range, along with low irritation to skin and eyes, makes it particularly suitable for formulating mild and skin-friendly personal care products. FMES is commonly used in shampoos, facial cleansers, and bubble bath formulations, where it enhances foam formation, provides conditioning benefits, and improves application viscosity. In shampoo applications, FMES works synergistically with other active agents to deliver noticeable thickening and softening effects, offering a luxurious feel and ease of application. Additionally, due to its gentle nature, it is considered ideal for baby care applications and sensitive-skin formulations, aligning well with the growing consumer demand for mild, biodegradable, and naturally derived personal care ingredients. The trend toward sulfate-free and eco-friendly formulations further propels the use of FMES in next-generation personal care innovations.

Regional Insights

The fatty methyl ester sulfonate market in Europe dominated with a 32.3% share in 2024 owing to the largest market globally for detergents, comprising nearly one-fifth of the worldwide demand. The substance is highly utilized in the formulation of powdered detergents as well as detergent cakes. Countries in Europe, including Italy and the UK registered high demand for detergent powder over the past decade. Detergent pods are increasingly gaining traction in the region due to their ease of preservation and storage. For instance, according to a press release, in August 2024, Henkel Adhesives Technologies India Private Limited's laundry and home care segment witnessed robust growth, reflecting positively on the Fatty Methyl Ester Sulfonate (MES) market, given its widespread use as a sustainable surfactant in detergent formulations. Organic sales in the segment grew by 3.1% overall, with Q2 registering a 1.5% increase. The Laundry Care division saw solid gains, particularly driven by a double-digit rise in the Fabric Care category and notable growth in Fabric Cleaning.

Germany Fatty Methyl Ester Sulfonate Market Trends

The fatty methyl ester sulfonate market in Germany held a substantial share of the Europe market in 2024, driven by the country’s strong industrial base, growing demand for eco-friendly surfactants, and emphasis on sustainable product development. MES consumption in Germany is primarily fueled by its use in laundry detergents, household cleaners, and personal care products. The nation’s robust focus on green chemistry and regulatory support for biodegradable and non-toxic ingredients has accelerated the adoption of plant-based surfactants like MES. Companies such as KLK OLEO are catering to this demand with offerings like Sympare Methyl Ester Sulphonates, which meet the EPA’s Safer Choice Standard and are listed in the CleanGredients database. With its low-irritation profile, sulfate-free composition, and more than 50% natural origin content as per ISO 16128, MES is finding increased usage in Germany's fast-growing personal care sectors, including baby care, skincare, and natural cosmetics, reinforcing the country’s leadership in sustainable and mild formulation innovation.

Asia Pacific Fatty Methyl Ester Sulfonate Market Trends

The fatty methyl ester sulfonate market in Asia Pacific accounted for 29.5% of the global revenue in 2024, mainly driven by increasing demand for detergents and personal care applications across quickly developing economies like India and China. These countries have become major manufacturing centers, supporting a rise in laundry detergent use, one of the main applications for FMES. The growing personal care industry in countries like Japan, South Korea, India, and China, fueled by increasing consumer demand for hair care, skincare, cosmetics, and hygiene products, is expected to boost the adoption of FMES as a sustainable and biodegradable surfactant in regional formulations in the coming years.

North America Fatty Methyl Ester Sulfonate Market Trends

The North America fatty methyl ester sulfonate market secured 21.3% of the market share in 2024, driven by its increasing adoption across applications such as personal care and industrial cleaners. As a key surfactant, FMES benefits from the region’s strong position in global soap and detergent Applicationion, as highlighted by the Journal of the American Oil Chemists’ Society. Rising consumer awareness around the environmental and health risks associated with synthetic and ionic surfactants in household and personal care formulations is further accelerating the shift toward bio-based alternatives like FMES. Moreover, stringent regulatory frameworks across developed countries in the region-aimed at limiting synthetic chemical usage due to ecological concerns-are expected to reinforce the uptake of sustainable and biodegradable surfactants such as FMES throughout the forecast period.

Middle East & Africa Fatty Methyl Ester Sulfonate Market Trends

The Middle East & African fatty methyl ester sulfonate market is experiencing strong growth, primarily driven by its key role in the personal care and beauty sector, with sustainable surfactants like FMES in application formulations. Cultural preferences for clean and well-maintained clothing across the region are boosting the consumption of laundry detergents, further increasing the need for FMES as a vital ingredient. Saudi Arabia stands out as a major market for cleaning applications, with companies such as SIDCO, Knooz Al-Ardh Detergent Factory, and Surfactant Detergent Company Ltd. (SDC) leading the way through widespread market presence and innovation-focused application development. The rising emphasis on hygiene and cleanliness is expected to create strong demand for FMES in both detergent and personal care products across the region in the coming years.

Latin America Fatty Methyl Ester Sulfonate Market Trends

The Latin American fatty methyl ester sulfonate market is experiencing steady growth, mainly driven by the importance of MES in applications such as liquid fabric softeners, spot and stain removers, and carpet cleaners, which have gained popularity in the region. Additionally, the demand for key consumer applications like hand wash and fabric cleaners in both residential and commercial sectors is expected to boost application demand over the forecast period. The market's growth is also fueled by rising demand for detergents, supported by consumers' preference for maintaining personal hygiene through clothing and apparel, along with increased purchasing power. For example, the key detergent formulators in the country, Unilever, reformulated its OMO detergent range with sustainable surfactants in February 2023, while Quimica Amparo introduced a new FMES-based detergent in July 2022. Asa Industria expanded its FMES sourcing contracts in late 2023 to meet the rising demand.

Key Fatty Methyl Ester Sulfonate Company Insights

Some of the key players operating in the fatty methyl ester Sulfonate Market include KLK OLEO and Wilmar International Ltd.

-

KLK OLEO, headquartered in Malaysia, is a dominant and vertically integrated player in the Fatty Methyl Ester Sulfonate (MES) market, leveraging its strong palm-based oleochemical foundation. The company offers high-purity MES Applications widely used in detergents, personal care, and industrial cleaning applications, known for their excellent biodegradability and foaming properties. KLK OLEO ensures supply security and consistent quality through global Applicationion facilities and a robust feedstock base. Its R&D initiatives emphasize sustainable surfactant technologies and tailored performance formulations for eco-conscious markets.

Chemithon Corporation and FENCHEM are an emerging market participant in the Fatty Methyl Ester Sulfonate Market.

-

FENCHEM, headquartered in China, is an emerging player in the global Fatty Methyl Ester Sulfonate (MES) market, expanding its footprint across Asia and selected international markets. Known for its focus on specialty ingredients and green chemistry, FENCHEM is increasingly exploring MES as a sustainable surfactant for applications in personal care, household cleaning, and industrial formulations. The company leverages bio-based raw materials and modern Applicationion techniques to offer environmentally friendly and performance-oriented solutions. With a growing emphasis on R&D, quality assurance, and regulatory compliance, FENCHEM is positioning itself as a reliable partner for MES-based innovations.

Key Fatty Methyl Ester Sulfonate Companies:

The following are the leading companies in the fatty methyl ester sulfonate market. These companies collectively hold the largest market share and dictate industry trends.

- KLK OLEO

- Zanyu Technology Group Co., Ltd.

- Lion Corporation

- Chemithon Corporation

- FENCHEM

- Emery Oleochemicals

- Wilmar International Ltd

- KPL International Limited

- Procter & Gamble

- Stepan Company

- Henan Jiahe Biotechnology Co.,Ltd.

- Shaoxing Zhenggang Chemical Co.,Ltd

- Surface Chemical Industry Co. Ltd.

Recent Developments

-

In February 2025, KLK OLEO has expanded its global presence by opening a new representative office in Mumbai, India, under KLK OLEO India (KLKOI). This strategic move strengthens its position in the growing Indian market, particularly for Applications like Methyl Ester Sulphonates (MES), widely used in detergents and personal care formulations. With local operations, KLK aims to deepen customer relationships, enhance distribution, and capitalize on rising demand for sustainable, bio-based surfactants such as MES in the home care and industrial cleaning sectors.

-

In June 2025, Wilmar International Limited is set to acquire PZ Cussons plc’s 50% stake in their Nigerian joint venture, PZ Wilmar, making Wilmar the sole owner. PZ Wilmar operates one of Nigeria’s largest sustainable palm oil businesses, producing popular edible oils under the Mamador and Devon King’s brands. This acquisition underscores Wilmar’s long-term commitment to expanding its palm oil operations in Nigeria, a key feedstock for oleochemicals like Fatty Methyl Ester Sulfonates (MES), commonly used in detergents and personal care Applications. The move is expected to strengthen Wilmar’s upstream and downstream value chain, potentially enhancing its MES Applicationion capacity and supply reliability in West Africa.

Fatty Methyl Ester Sulfonate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,661.1 million

Revenue forecast in 2033

USD 8,309.8 million

Growth rate

CAGR of 22.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; Egypt

Key companies profiled

KLK OLEO; Zanyu Technology Group Co., Ltd.; Lion Corporation; Chemithon Corporation; FENCHEM; Emery Oleochemicals; Wilmar International Ltd; KPL International Limited; Procter & Gamble; Stepan Company; Henan Jiahe Biotechnology Co.,Ltd.; Shaoxing Zhenggang Chemical Co.,Ltd; Surface Chemical Industry Co. Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fatty Methyl Ester Sulfonate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global fatty methyl ester sulfonate market report based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

Personal Care

-

Detergents

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global fatty methyl ester sulfonate market size was estimated at USD 1,463.5 million in 2024 and is expected to reach USD 1,661.1 million in 2025.

b. The global fatty methyl ester sulfonate market is expected to grow at a compound annual growth rate of 22.3% from 2025 to 2033 to reach USD 8,309.8 million by 2033.

b. The detergents segment led the market and accounted for the largest revenue share of 37.9% in 2024, due to increasing regulations have encouraged detergent manufacturers to adopt more sustainable, biodegradable alternatives.

b. Some of the key players operating in the Fatty Methyl Ester Sulfonate Market include KLK OLEO, Zanyu Technology Group Co., Ltd., Lion Corporation, Chemithon Corporation, FENCHEM, Emery Oleochemicals, Wilmar International Ltd, KPL International Limited, Procter & Gamble, Stepan Company, Henan Jiahe Biotechnology Co.,Ltd., Shaoxing Zhenggang Chemical Co.,Ltd and Surface Chemical Industry Co. Ltd.

b. The growth is attributed to fatty methyl ester sulfonate ’s is extensively use as surfactants, which find applications across various application industries, including personal care, cosmetics, laundry detergents, and lubricants

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.