- Home

- »

- Medical Devices

- »

-

Feminine Hygiene Products Market Size, Share Report, 2030GVR Report cover

![Feminine Hygiene Products Market Size, Share & Trends Report]()

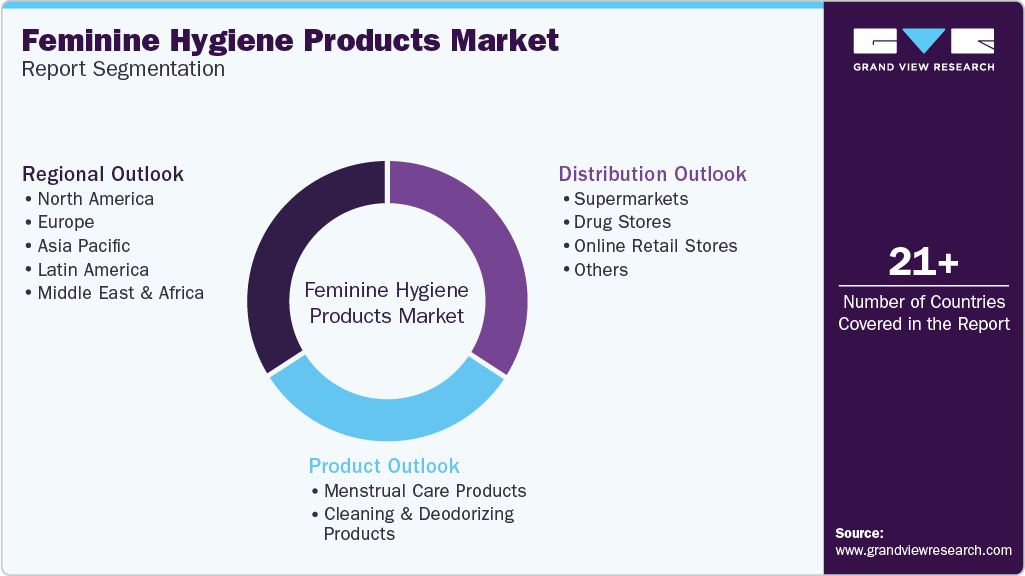

Feminine Hygiene Products Market Size, Share & Trends Analysis Report By Product (Menstrual Care Products Cleaning & Deodorizing Products), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-662-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Feminine Hygiene Products Market Trends

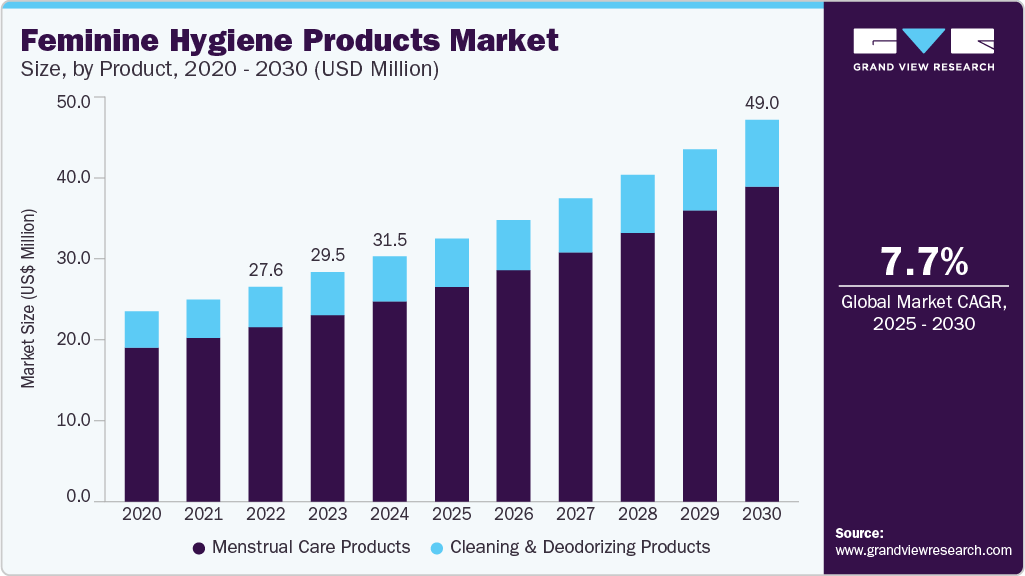

The global feminine hygiene products market size was valued at USD 29.5 billion in 2023 and is projected to grow at a CAGR of 7.6% from 2024 to 2030. The driving factors of the growth are attributed to rising consumer awareness, increasing menstrual and personal hygiene literacy, government initiatives, and new product innovations.

The rise in menstrual literacy is a primary factor driving the demand for feminine hygiene products. The schools and government initiatives are helping to increase menstrual health literacy. For instance, according to the National Library of Medicine data published in July 2022, menstrual health knowledge is imparted in Ethiopia’s rural areas through life-skills programs such as Act-With-Her-Ethiopia (AWH-E) targeting adolescents. Such programs educating young women and developing hygiene literacy are driving the market growth.

According to the Plastic Odyssey Organization’s published data in December 2023, a woman produces over 30 tonnes of non-recyclable menstrual waste in her reproductive lifespan. The IKHAPP data published in October 2023 stated nearly 12 billion disposable menstrual products are utilized annually. The growing environmental hazards due to improper waste disposal and the use of non-recyclable, non-biodegradable products have also created the opportunity for the innovation and development of eco-friendly feminine hygiene products in the market. For instance, in August 2023, Sparkle, a plant-based period brand, was launched in the U.S.

Product Insights

Menstrual care products dominated the market and accounted for a share of 81.4% in 2023. The rising female population has boosted the demand for menstrual products. The World Bank Group recorded a 3.99 billion female population in 2023. According to the UNICEF organization, nearly 1.8 billion women menstruate every month, driving the growth of the segment. This has driven the demand and innovation in the menstrual care segment. In addition, the government is taking initiatives to promote menstrual hygiene. For instance, according to the data published in July 2022, the Ministry of Health and Family Welfare in India implemented a scheme to promote adolescent menstrual hygiene. The scheme also offers sanitary napkins at a subsidized price to promote its application.

The tampons sub-segment is the fastest-growing product in menstrual care as they are discreet, comfortable, and less bulky than sanitary napkins. They offer freedom of movement during physical activities such as swimming, playing sports, or exercising. These advantages include the easy availability of products that drive the segment growth.

The cleaning and deodorizing products segment is expected to grow significantly during the forecast period. The driving factors are attributed to consumer awareness, rising disposable income, and the need to maintain hygiene and avoid odor-causing bacteria growth. In addition, government initiatives are creating awareness regarding feminine hygiene and health literacy. For instance, Changlang District in India, in support of the Northeastern Council under the Ministry of DoNER, conducted an awareness campaign on female hygiene and care goods in February 2022.

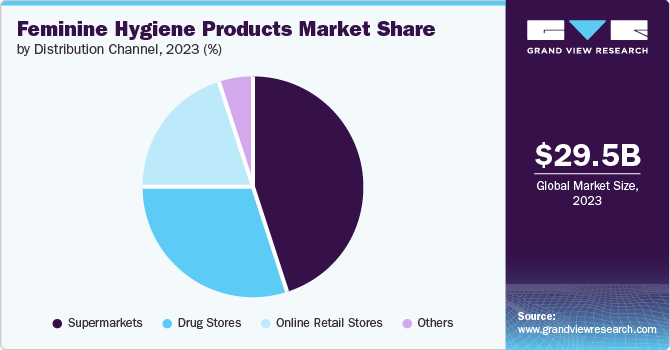

Distribution Channel Insights

The supermarkets accounted for the largest market revenue share of 45.3% in 2023. The factors attributed to the growth of the segment are the possibility of bulk purchases, hefty discounts, and the wide selection of brands to pick from. Supermarkets collaborate with companies to offer convenient solutions for customers and drive segment growth. For instance, Pinkie Pads launched a female hygiene product, tween line at Walmart in April 2024.

The online retail stores segment is expected to register the fastest CAGR over the forecast period. Feminine hygiene remains a taboo talk, to even go for shopping menstrual products. The online retail stores provide anonymity to the user, allowing them to experiment with innovative alternate products such as tampons and menstrual cups, eliminating hesitation. The online retailers contributing to the growth of the segment include Amazon, Flipkart, Blinkit, and Wellness Forever to name a few.

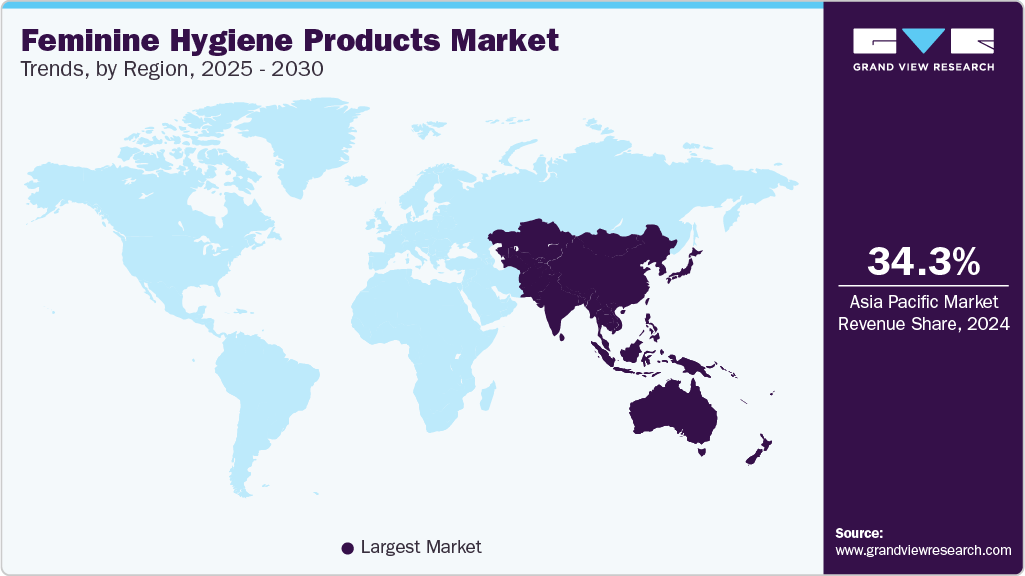

Regional Insights

North America accounted for significant market growth in 2023 in the feminine hygiene products market. The driving factors contributing to the market growth are high awareness, a vast range of products, and government initiatives. For instance, the government of Canada allotted USD 25 million in the 2022 budget to develop a menstrual equity fund program to help make hygiene products available to the low-class income population. In addition, according to the government of Canada data published in September 2023, Food Banks Canada announced to receive USD 17.9 million to address issues of affordability and stigma while accessing menstrual products. Such initiatives are expected to drive market growth.

U.S. Feminine Hygiene Products Market Trends

The U.S. feminine hygiene products market accounted for a 37.9% share of the global market in 2023. The market growth is attributed to a higher rate of self-awareness, a wide range of product availability, and government initiatives. For instance, according to the National Conference of State Legislature report published in February 2023, the U.S. state plans to increase access to feminine hygiene products. In addition, twelve states, including the District of Columbia (D.C), provide menstrual products in schools free of charge. Many states also offer these products in correctional facilities and home shelters free of cost. Such initiatives raise feminine hygiene awareness and help increase market growth.

Europe Feminine Hygiene Products Market Trends

Europe accounted for a significant market share in 2023 in the feminine hygiene products market. The increasing awareness regarding menstrual hygiene and initiatives taken in different countries are expected to drive market growth. For instance, in March 2024, under the initiative of the Spain government, the Catalonia region provided free reusable menstrual cups, cloth pads, and period underwear at pharmacies. Such initiatives are likely to create awareness and boost market growth in the region.

The rise in period poverty in the UK encourages companies and the government to take the initiative and drive market growth. For instance, according to the ActionAid data published in May 2023, in the UK, period poverty increased from 12% to 21% in a year. According to information published by Plan International UK in October 2021, about 2 million girls missed school due to the monthly cycle and lack of awareness. The UK government is incorporating schemes to promote awareness in young women. For instance, the UK government launched the Period Products Scheme in 2020, and since the launch of the scheme, 99% of schools and post-16 organizations have benefitted from the initiative. Such government interventions and the high availability of products are expected to contribute to market growth.

Asia Pacific Feminine Hygiene Products Market Trends

The Asia Pacific region dominated the market and accounted for a revenue share of 34.05% and is expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. The rising young population in the region is the primary factor for the market growth. The government is involved in incorporating schemes and initiatives to eliminate the taboo, raise awareness among women, and encourage the adoption of feminine hygiene products. For instance, according to the State Government of Victoria report published in November 2023, initiated to provide free hygiene products through installing 700 vending machines across the state. Such initiatives are raising awareness in women and helping the market growth.

The rising disposable income, awareness regarding feminine hygiene, and government initiatives drive market growth in India. For instance, according to the National Health Mission (MHS) data in July 2024, the Ministry of Health and Family Welfare introduced a promotion scheme for feminine hygiene among adolescent girls in rural areas. Various foundations and NGOs, such as the Pinkishe Foundation are working to eliminate period taboos, promote safe practices, and provide free period products in schools to raise awareness in remote parts of the country. The Indian government is promoting hygiene products; for instance, the Ministry of Health and Family Welfare implemented Pradhan Mantri Bharatiya Janausadhi Pariyojna (PMBJP) scheme and provided oxy-biodegradable pad at a very cheap price. Various companies and organizations are working in the domain, providing eco-friendly and reusable products such as Anandi, Eco Femme, Saathi, and Avni Wellness.

Key Feminine Hygiene Products Company Insights

Some key companies in the Feminine Hygiene Products market include Proctor & Gamble, KCWW, Prestige Consumer Healthcare Inc., GLENMARK PHARMACEUTICALS LTD, and Unicharm Corporation. Key companies are involved in strategic initiatives such as innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Proctor & Gamble is a multinational consumer goods company that manufactures and markets products. The company serves customers globally through a wide range of products, in various areas such as feminine hygiene products, haircare, skincare, laundry, self-grooming and cleaning products, home care, and personal health care products.

-

Unilever is a fast-moving consumer goods (FMCG) company that manufactures and markets a vast range of consumer goods in various segments, including but limited to feminine hygiene products, skincare, personal care, food, home care, hair care, and laundry goods, serving in 190 countries globally.

Key Feminine Hygiene Products Companies:

The following are the leading companies in the feminine hygiene products market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- GLENMARK PHARMACEUTICALS LTD

- Unicharm Corporation

- Unilever

- Maxim Hygiene

- KCWW

- Edgewell Personal Care

- Premier FMCG (Pty) Ltd.

- Essity Aktiebolag

- Ontex BV

- Bodywise (UK) Limited

- Kao Corporation

- Prestige Consumer Healthcare Inc.

Recent Developments

-

Qvin received FDA approval for its menstrual pad blood test in January 2024.

-

KCWW (Kimberly-Clark Corporation) acquired a majority stake in Thinx, Inc. in February 2022.

Feminine Hygiene Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.5 billion

Revenue forecast in 2030

USD 49.0 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

Procter & Gamble, GLENMARK PHARMACEUTICALS LTD, Unicharm Corporation, Unilever, Maxim Hygiene, KCWW, Edgewell Personal Care, Premier FMCG (Pty) Ltd., Essity Aktiebolag, Ontex BV, Bodywise (UK) Limited, Kao Corporation, Prestige Consumer Healthcare Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Feminine Hygiene Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global feminine hygiene products market report based on product, distribution channel, and region:

-

Product Outlook: (Revenue, USD billion, 2018 - 2030)

-

Menstrual Care Products

-

Sanitary Napkins

-

Tampons

-

Menstrual Cups

-

Others

-

-

Cleaning & Deodorizing Products

-

Feminine Powders, Soaps and Washes

-

Others

-

-

-

Distribution Channel Outlook: (Revenue, USD billion, 2018 - 2030)

-

Supermarkets

-

Drug Stores

-

Online Retail Stores

-

Others

-

-

Regional Outlook (Revenue, USD billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."