Feminine Wipes Market Size & Trends

The global feminine wipes market size was valued at USD 1.71 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. Improving female education levels, rising disposable incomes, and rising demand for convenient and discreet intimate care products are some of the prominent factors contributing to product demand worldwide. Feminine wipes refer to cloths/wipes that are intended to clean the vaginal area. While other intimate care products, such as sanitary pads, are typically used during menstruation, feminine wipes are marketed as ideal for daily/everyday use.

The influence of social media and advertising campaigns promoting the benefits of feminine wipes has heightened consumer awareness and acceptance. Furthermore, product formulations advancements, including natural and soothing ingredients, have enhanced the appeal of feminine wipes. The expanding retail network, including online platforms, has also made these products more accessible to a broader audience.

Beneficial properties of feminine wipes, such as ease of use, disposability, portability, and reduced risk of cross-contamination, are expected to favor market growth in the foreseeable future. Consumers worldwide prefer feminine wipes based on various factors, including cost convenience, hygiene, performance, timesaving, ease of use, disposability, and consumer-centered aesthetics.

With the rising global concerns regarding the use of chemicals and preservatives in feminine wipes, key brands are increasingly focusing on using formulas powered by herb-based ingredients (free from parabens and dyes). The global market for feminine wipes is expected to witness significant growth in the natural space throughout the forecast timeframe.

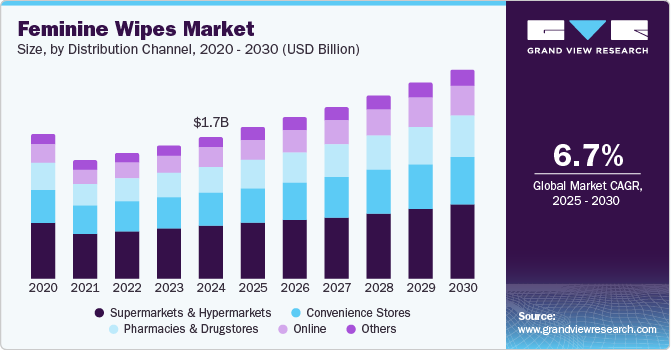

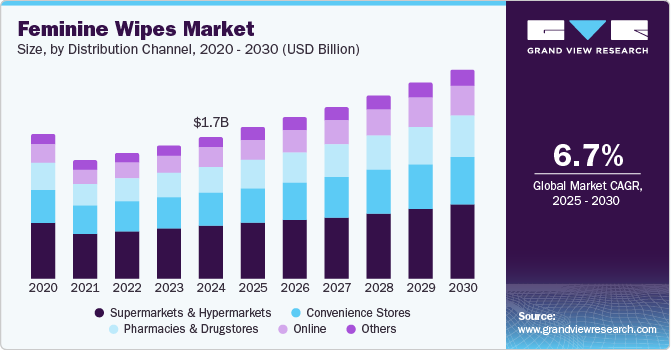

Distribution Channel Insights

Hypermarkets & supermarkets dominated the market with the largest revenue share of 37.3% in 2024. These retail channels offer a convenient one-stop shopping experience, attracting a large number of consumers. Hypermarkets and supermarkets provide an extensive range of feminine hygiene products, including feminine wipes, allowing customers to compare and choose from various brands and product options easily. These retail chains' wide reach and strong distribution networks ensure high product availability and accessibility, which is crucial for everyday essentials like feminine wipes. Additionally, frequent promotions, discounts, and loyalty programs offered by hypermarkets and supermarkets make them an attractive shopping destination for consumers looking to save on personal hygiene products.

The online channel is expected to grow at the fastest CAGR of 7.3% over the forecast period. The convenience and ease of online shopping are significant drivers, as consumers increasingly prefer to purchase personal hygiene products from the comfort of their homes. The online channel offers a vast selection of brands and product options, allowing consumers to easily compare and choose the best products to meet their needs. Additionally, the rise of digital marketing and targeted advertising has heightened the visibility and appeal of feminine wipes sold online. The availability of detailed product descriptions, customer reviews, and subscription services also enhances the online shopping experience, encouraging repeat purchases. Furthermore, frequent online promotions and discounts make buying feminine wipes online an attractive option for cost-conscious consumers.

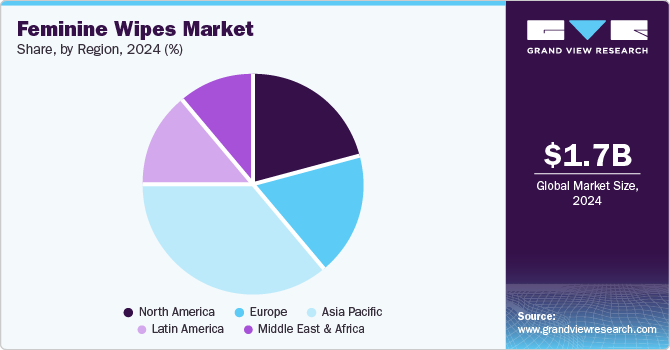

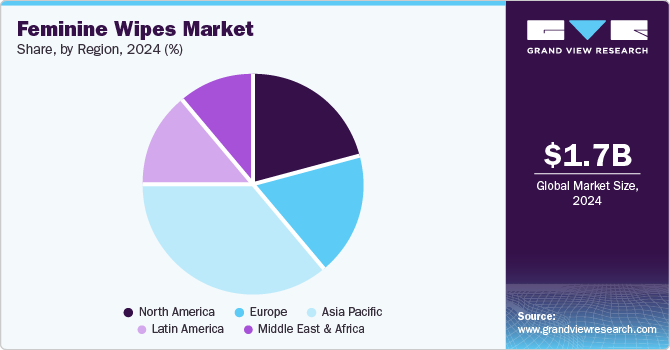

Regional Insights

Asia Pacific feminine wipes industry dominated the global market with the largest revenue share of 36.5% in 2024. The increasing awareness of personal hygiene and the growing adoption of feminine hygiene products in countries such as China, Japan, and India have significantly contributed to market growth. The rising disposable incomes and urbanization in these regions have led to higher spending on personal care products. Additionally, the expanding retail sector and the widespread availability of feminine wipes across both urban and rural areas have boosted accessibility and convenience for consumers. The influence of social media and marketing campaigns promoting the benefits of feminine hygiene products has also played a crucial role in increasing consumer awareness and acceptance. Furthermore, the introduction of innovative and eco-friendly products by key players in the market has attracted a larger consumer base, contributing to the robust growth of the feminine wipes industry in the Asia Pacific region.

North America Feminine Wipes Market Trends

The North American feminine wipes industry was identified as a lucrative region in 2024 owing to high disposable incomes, increased urbanization, and a growing focus on health and personal hygiene. The region's preference for premium and eco-friendly personal care products and strong consumer awareness about feminine health boosts market demand.

U.S. Feminine Wipes Market Trends

The U.S. feminine wipes industry is expected to grow significantly over the forecast period owing to the rising health consciousness among women and the demand for convenient hygiene solutions that cater to their busy lifestyles. The growth of e-commerce has significantly contributed to this market, making it easier for consumers to purchase feminine wipes online. Additionally, innovative products featuring natural and organic ingredients, pH-balanced formulas, and eco-friendly packaging are driving consumer interest.

Europe Feminine Wipes Market Trends

Europe feminine wipes industry is expected to grow significantly at a CAGR of 4.7% over the forecast period. Educational campaigns and a cultural shift towards accepting and promoting feminine hygiene have significantly increased market uptake. Government support in the form of policies classifying sanitary products as essential items further boosts market growth. Moreover, a strong consumer preference for sustainable and natural products pushes manufacturers to innovate with environmentally friendly formulations and packaging.

Key Feminine Wipes Company Insights

Some key companies in the feminine wipes market include Procter & Gamble, Johnson & Johnson Services, Inc., Edgewell Personal Care, and others.

-

Procter & Gamble is a major player in the feminine wipes industry, known for its well-established brands such as Tampax and Always. P&G continuously innovates its product offerings, focusing on natural and organic ingredients, pH-balanced formulas, and eco-friendly packaging to meet consumer preferences.

-

Johnson & Johnson Services, Inc. is another key player in the feminine wipes industry. The company is recognized for its commitment to providing high-quality and innovative hygiene products. Johnson & Johnson offers a range of feminine hygiene products, including intimate wipes designed to maintain the pH balance of the intimate area and provide a quick and discreet way to stay fresh and clean.

Key Feminine Wipes Companies:

The following are the leading companies in the feminine wipes market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble

- Johnson & Johnson Services, Inc.

- Edgewell Personal Care

- KCWW

- Unicharm Corporation

- Albaad

- Guy & O'Neill, Inc.

- Bodywise (UK) Limited

- Corman SpA

- Laclede, Inc.

Recent Developments

-

In November 2024, The Honey Pot Company launched its inaugural Witch Hazel Intimate Wash & Wipes, designed for postpartum recovery, particularly for new and expectant mothers. These products provide relief from irritation and support a balanced vaginal pH.

-

In January 2024, Marico launched KeepSafe, a premium range of hygiene products designed for personal and out-of-home use. The collection includes multi-purpose disinfectant spray, feminine hygiene wipes, toilet seat disinfectant, hand sanitizer, hygiene hand wipes, and an upcoming intimate wash.

Feminine Wipes Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1.82 billion

|

|

Revenue forecast in 2030

|

USD 2.52 billion

|

|

Growth rate

|

CAGR of 6.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Distribution channel, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; South Africa; UAE

|

|

Key companies profiled

|

Procter & Gamble; Johnson & Johnson Services, Inc.; Edgewell Personal Care; KCWW; Unicharm Corporation; Albaad ; Guy & O'Neill, Inc. ; Bodywise (UK) Limited; Corman SpA; Laclede, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Feminine Wipes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global feminine wipes market report based on distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)