- Home

- »

- Advanced Interior Materials

- »

-

Ferrochrome Market Size, Share, & Growth Report, 2030GVR Report cover

![Ferrochrome Market Size, Share, & Trends Report]()

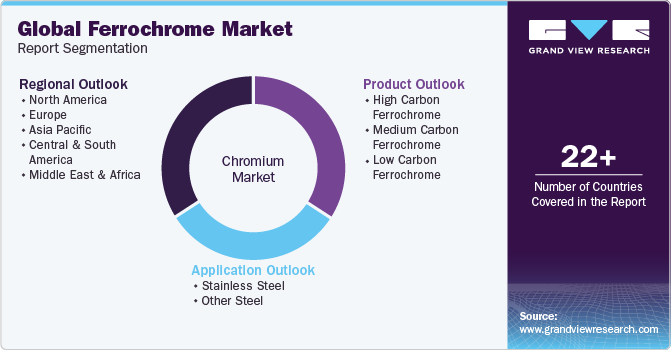

Ferrochrome Market Size, Share, & Trends Analysis Report By Product (High Carbon Ferrochrome, Medium Carbon Ferrochrome, Low Carbon Ferrochrome), By Application (Stainless Steel, Other Steel), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-027-9

- Number of Report Pages: 117

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Ferrochrome Market Size & Trends

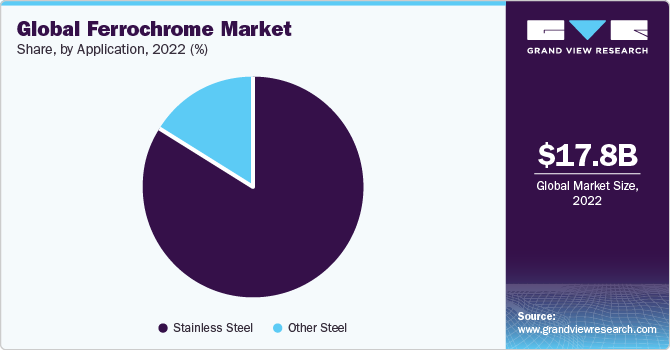

The global ferrochrome market size was valued at USD 17.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. Increasing stainless steel production around the globe is a significant factor driving the market growth. Ferrochrome (FeCr) is added to stainless steel to enhance its appearance and impart corrosion resistance. The minimum FeCr content in stainless steel is 10%, while the average content is 18%. The dynamics of the stainless steel industry play a crucial role in influencing FeCr supply and demand, as it accounts for the majority of ferrochrome consumption.

The Asia Pacific is mainly driven by the increasing production of stainless steel in China and India. Ferrochrome is widely used to manufacture stainless steel as it is resistant to corrosion and has an aesthetic appearance. As per the International Stainless Steel Forum, melt shop production of stainless steel in Asia reached 39,386 thousand metric tons in 2022.

Growing manufacturing activities and increasing foreign investments are some of the major factors driving the stainless steel market in the region. Foreign investments help to boost the growth of manufacturing sectors such as construction, heavy machinery, consumer goods, and automotive. As per the United Nations Conference on Trade and Development, the inward foreign direct investment (FDI) rate for Asia was 9.1% in 2017, the highest of all regions.

ASEAN-5, which comprises Indonesia, Malaysia, the Philippines, Vietnam, and Thailand, is also likely to contribute to the demand for ferrochrome over the coming years. Amid the global slowdown stated by the International Monetary Fund (IMF) in 2019, ASEAN-5 countries are likely to maintain a steady growth of 5.1% in 2019 as per IMF. In addition, these countries are attracting significant foreign investments in various end-use industries such as automotive and construction, where the demand for stainless steel is significantly high.

The FeCr production is a highly electrical energy intensive process. Estimated power consumption of 4,500 kWh and 2.5 tons of chromite ore is required to manufacture one ton of the product. The current method of production, which is used globally, involves carbothermic smelting reduction of chromite in submerged electric arc furnaces (SAF).

Application Insights

The stainless steel segment held the largest revenue share of 83.8% in 2022. FeCr is mainly added to reduce oxidation and improve its aesthetic appearance. As of 2022, there was no substitute for ferrochrome for the aforementioned purposes in stainless steel application. As a result, the demand for products is expected to remain strong over the coming years.

The other steel segment is anticipated to register a CAGR of 5.0% over the forecast period. Ferrochrome is also added to carbon & low alloy, engineering, tool, and high-strength steels. The product is added to impart additional hardness, wear resistance, and toughness. Alloy steels are mainly used in the building & construction industry.

Product Insights

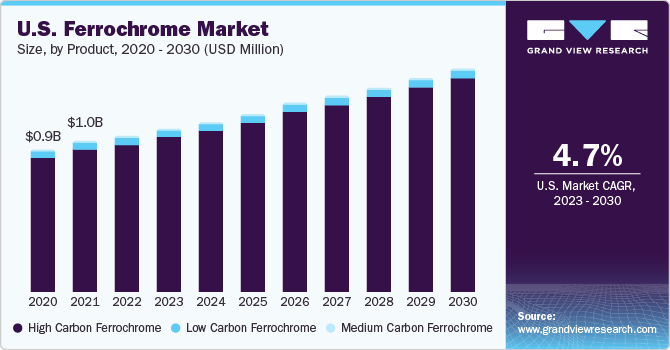

The high carbon ferrochrome (HC FeCr) segment held the largest revenue share of 92.6% in 2022. The significant factor contributing to the dominance of HC FeCr is its lower cost and availability of larger reserves as compared to other products. As a result, this product is largely consumed by stainless steel manufacturers.

The low carbon ferrochrome (LC FeCr) segment is anticipated to register a CAGR of 6.8% over the forecast period. Although LC FeCr) is also used in stainless steel, the major applications of the product are carbon & low alloy, and tool steels. Steel producers typically use low carbon ferrochrome in the last stages of production to add the precise quantity of chrome without affecting the carbon levels.

Regional Insights

Asia Pacific dominated the global ferrochrome market and accounted for the largest revenue share of 61.8% in 2022. This dominance can be attributed to significant stainless steel production in the region. China, known as the largest producer and consumer of stainless steel globally, observed a 1.64 percent year-on-year increase in its stainless steel output, surpassing 30.6 million tons in 2021. Additionally, the apparent consumption of stainless steel experienced a modest growth of 1.92 percent year-on-year, reaching approximately 26.1 million tons, According to China Daily. Besides China, India is yet another lucrative market for FeCr as the production of stainless steel in the country has gathered a rapid momentum over the past few years.

Europe is expected to grow at a CAGR of 6.4% during the forecast period. Europe is characterized by the presence of a large number of automakers and auto component manufacturers in Germany and a massive aerospace manufacturing sector in France. As a result, there is considerable domestic production of stainless steel as a variety of auto components are manufactured by stainless steel. Moreover, the recent trend indicates protectionist policies implemented by the government to boost domestic steel production. This is a positive factor for FeCr market as it will likely result in increasing demand for the product.

In North America, the U.S. is a considerably larger market for ferrochrome when compared to Canada and Mexico. Rising prices of stainless steel owing to greater demand from domestic producers may negatively affect its demand and thereby offset its production. This uncertainty is expected to influence the dynamics of the ferrochrome industry in the country.

The Central & South American market is mainly driven by the rising production of specialty and stainless steel in Brazil. Currently, in the Brazilian automotive sector, beneficial policies for domestic vendors are the key factors driving stainless steel production which contributes to the consumption of ferrochrome.

Key Companies & Market Share Insights

The market is largely dictated by China, as China is the largest supplier and consumer of FeCr. The suppliers in China are unorganized independent smelters who procure chromite ore from countries such as India, South Africa, and Turkey to produce ferrochrome.

Suppliers outside China are mainly present in South Africa, Turkey, India, and Kazakhstan. The supply landscape outside China is consolidated in nature. Furthermore, most of the manufacturers outside China are integrated in nature and produce FeCr from their own chromite ore mines.

Key Ferrochrome Companies:

- Samancor Chrome

- Jindal Steel & Power Limited

- Eurasian Resources Group

- Hernic

- Vargön Alloys AB

- Ferbasa

- Yilmaden

- Glencore

- ALBCHROME

- Outokumpu

- IMFA

- Balasore Alloys Limited

- Ferro Alloys Corporation Ltd.

Recent Developments

-

In October 2022, Oman Chrome Company entered into an agreement to acquire a 20 percent stake in a low-carbon ferrochrome plant for a sum of USD 1.3 million (RO 500,000). The plant is presently being constructed in the Sohar Port and Freezone, serving as an expansion to the portfolio of value-added projects related to chrome ore. It is anticipated that this investment will contribute approximately 10 percent to the company's overall profits.

-

In September 2022, SAL STEEL LTD., announced the establishment of a three-year supply agreement with AIA Engineering (AIA) for the provision of ferrochrome. The agreement allows for the supply of ferrochrome to AIA on a non-exclusive basis. SAL STEEL operates in the manufacturing sector, specifically engaged in the production of sponge iron, ferro alloys, and power. The company's products are marketed both domestically and internationally. AIA Engineering, on the other hand, specializes in the manufacturing of high chrome mill internals.

-

Merafe Resources Limited, a leading ferrochrome producer, reported that its attributable production from the Glencore Merafe Chrome Venture for the nine months of 2022 experienced a 3.7% increase, reaching 286 kilotons in comparison to the same period in 2021.

Ferrochrome Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.55 billion

Revenue forecast in 2030

USD 28.83 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; Russia; Turkey; China; Japan; India; Australia; South Korea; Vietnam; Indonesia; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa; Egypt

Key companies profiled

Samancor Chrome; Jindal Steel & Power Limited; Eurasian Resources Group; Hernic; Vargön Alloys AB; Ferbasa; Yilmaden; Glencore; ALBCHROME; Outokumpu; IMFA; Balasore Alloys Limited; Ferro Alloys Corporation Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ferrochrome Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ferrochrome market on the basis of product, application and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; Volume, Kilotons, 2018 - 2030)

-

High Carbon Ferrochrome

-

Medium Carbon Ferrochrome

-

Low Carbon Ferrochrome

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; Volume, Kilotons, 2018 - 2030)

-

Stainless Steel

-

Other Steel

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Turkey

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Vietnam

-

South Korea

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global ferrochrome market size was estimated at USD 17.8 billion in 2022 and is expected to reach USD 18.54 billion in 2023.

b. The global ferrochrome market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 28.82 billion by 2030.

b. High Carbon Ferrochrome dominated the ferrochrome market with a share of 93.1% in 2022. This is attributable to lower cost and availability of larger reserves as compared to other products, thus, being largely consumed by stainless steel manufacturers.

b. Some key players operating in the ferrochrome market include Glencore (South Africa), Samancore Chrome (South Africa), Jindal Steel & Power Ltd. (India), and TNC Kazchrome JSC (Kazakhstan).

b. Key factors that are driving the market growth include increasing stainless steel production around the globe on account of increasing application scope.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."