- Home

- »

- Advanced Interior Materials

- »

-

Stainless Steel Market Size & Share, Industry Report, 2033GVR Report cover

![Stainless Steel Market Size, Share & Trends Report]()

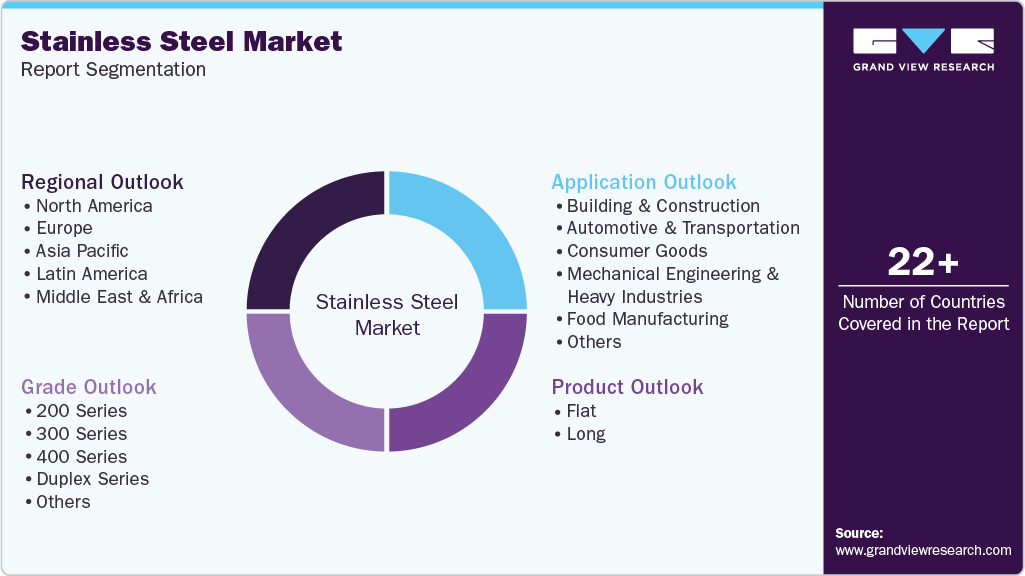

Stainless Steel Market (2026 - 2033) Size, Share & Trends Analysis Report By Grade (200 Series, 300 Series, 400 Series, Duplex Series), By Product (Flat, Long), By Application (Building & Construction, Consumer Goods), By Region, And Segment Forecasts

- Report ID: 978-1-68038-945-6

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Stainless Steel Market Summary

The global stainless steel market size was estimated at USD 135.81 billion in 2025 and is projected to reach USD 247.42 billion by 2033, growing at a CAGR of 7.8% from 2026 to 2033. Market growth is driven by rising demand from construction and infrastructure projects, expanding automotive and transportation manufacturing, and increased usage in industrial processing, the food & beverage industry, and chemical applications.

Key Market Trends & Insights

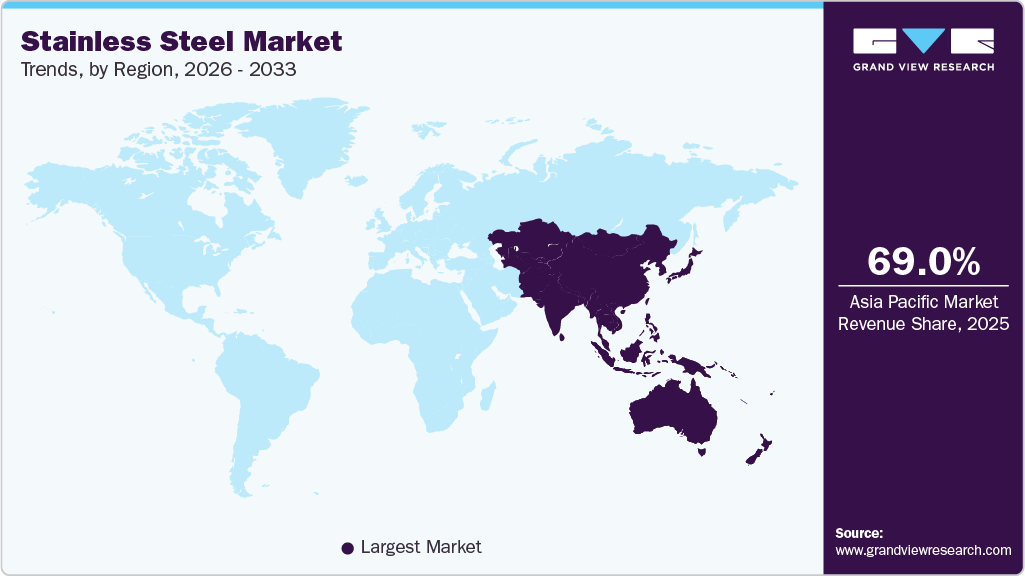

- Asia Pacific dominated the stainless steel market with a revenue share of over 69.0% in 2025.

- The stainless steel market in the Asia Pacific is expected to grow at a substantial CAGR of 8.2% from 2026 to 2033.

- By grade, the 300 series dominated the market with a revenue share of over 53.0% in 2025.

- By product, flat products dominated the market with a revenue share of over 73.0% in 2025.

- The consumer goods segment held the largest share of over 38.0% of stainless steel revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 135.81 Billion

- 2033 Projected Market Size: USD 247.42 Billion

- CAGR (2026 - 2033): 7.8%

- Asia Pacific: Largest market in 2025

Its corrosion resistance, durability, and low maintenance requirements make it a preferred material for structural components, processing equipment, pipelines, and consumer appliances. Sustainability has become a core strategic pillar of the market, driven by regulatory pressure, customer preference for low-carbon materials, and the metal’s inherent recyclability. Stainless steel is one of the most recycled materials globally, with recycled scrap accounting for a significant share of raw material input, thereby reducing dependence on virgin resources and lowering lifecycle emissions. Producers are increasingly investing in electric arc furnaces (EAFs), renewable energy integration, and process optimization to reduce carbon footprints, particularly in Europe and North America. In addition, stainless steel's long service life, corrosion resistance, and minimal maintenance requirements support circular economy objectives, making it a preferred material for green buildings, sustainable infrastructure, water treatment systems, and renewable energy projects.

Technological advancements are reshaping stainless steel production and application, with manufacturers focusing on high-performance alloys, process automation, and digitalization. Innovations in alloy design have led to the development of high-strength, lightweight, and corrosion-resistant grades tailored for automotive, energy, chemical processing, and aerospace applications. On the manufacturing side, the adoption of Industry 4.0 technologies such as advanced sensors, AI-based quality control, predictive maintenance, and smart rolling mills has improved yield efficiency, product consistency, and cost control. These technological improvements not only enhance competitiveness but also enable producers to meet stringent performance and sustainability requirements across end-use industries.

Drivers, Opportunities & Restraints

The stainless steel industry remains driven by strong demand from the infrastructure, construction, automotive, and industrial manufacturing sectors. In June 2025, industry discussions highlighted that stainless steel consumption in India is growing at a rate of around 7-8% year-on-year, supported by large-scale investments in metro systems, railways, airports, urban infrastructure, and water management projects. Globally, similar trends are evident, as governments prioritize durable, low-maintenance materials for public infrastructure. Meanwhile, the automotive sector, particularly in the realm of electric vehicles, continues to increase its use of high-performance stainless steel grades for structural, thermal, and exhaust system applications.

The transition toward sustainability and advanced manufacturing presents significant opportunities for the stainless steel industry. In October 2025, industry assessments highlighted the increasing adoption of digital manufacturing technologies, including AI-enabled quality control, smart rolling mills, and process automation, to enhance yield efficiency and develop application-specific stainless steel grades. These advancements are expanding opportunities in renewable energy, EV platforms, chemical processing, and high-end consumer appliances, where demand for corrosion-resistant, lightweight, and precision-engineered materials is increasing.

Market growth is constrained by volatility in raw material prices and tightening environmental regulations. During 2024-2025, fluctuations in nickel and chromium prices created cost uncertainty for stainless steel producers, which directly impacted their margins and long-term pricing contracts. In addition, the impending implementation of carbon-related regulations, such as the European Carbon Border Adjustment Mechanism scheduled for January 2026, is increasing compliance costs and pressure producers to invest in low-emission technologies. These factors collectively limit capacity expansion and pose challenges, particularly for smaller and mid-sized manufacturers.

Product Insights

Flat products account for the largest share of the global stainless steel market, driven by their extensive use across construction, automotive, consumer goods, and industrial manufacturing. Sheets, plates, and coils are widely preferred due to their superior surface finish, ease of fabrication, and suitability for large-scale production. Demand is robust from infrastructure projects, household appliances, and food processing equipment, where consistency, corrosion resistance, and hygiene are critical. In addition, flat products are commonly used in value-added applications, such as cladding, architectural panels, and pressure vessels, which support their dominant market position.

Long products are expected to register the highest CAGR over the forecast period, supported by increasing investments in infrastructure, transportation networks, and heavy engineering projects. Bars, rods, and wires are widely used in structural frameworks, fasteners, reinforcement components, and industrial machinery, where strength and durability are essential. Growth in railways, metro projects, bridges, and renewable energy installations, particularly in emerging economies, is accelerating demand for long-form materials, positioning this segment for faster growth compared to flat products.

Grade Insights

The 300 series holds the highest market share, largely due to its excellent corrosion resistance, formability, and versatility across a wide range of applications. Grades such as 304 and 316 are extensively used in food processing, chemical equipment, medical devices, and consumer products, where hygiene and durability are essential. Consistent demand from industrial, residential, and commercial end uses continues to reinforce the leadership of this grade segment.

The duplex series is expected to register the highest CAGR during the forecast period, driven by growing demand for high-strength and corrosion-resistant materials in challenging environments. Combining the benefits of austenitic and ferritic structures, duplex grades offer superior mechanical strength and resistance to stress corrosion cracking. These properties make them increasingly attractive for oil & gas, marine, chemical processing, and infrastructure applications, supporting rapid adoption and long-term growth.

Application Insights

The consumer goods segment holds the largest share of the market, driven by widespread usage of kitchenware, cookware, cutlery, home appliances, and sanitary products. Rising urbanization, improving living standards, and growing awareness of hygiene and product longevity have increased demand for durable and easy-to-clean materials in household applications. In addition, the material’s aesthetic appeal, recyclability, and corrosion resistance make it a preferred choice for premium consumer products, sustaining strong and consistent demand globally.

The building and construction segment is projected to witness the highest CAGR during the forecast period, supported by rapid urban development, innovative city initiatives, and large-scale infrastructure investments. Applications include structural components, fades, roofing, handrails, bridges, and water management systems, where long service life and low maintenance are critical. The increasing adoption of green buildings and public infrastructure, combined with a growing preference for sustainable and corrosion-resistant materials, is expected to significantly accelerate growth in this segment.

Regional Insights

The North America stainless steel market is characterized by steady demand from construction, automotive, energy, and industrial manufacturing sectors, supported by the refurbishment of aging infrastructure and a strong emphasis on sustainable materials. The region is increasingly focused on low-carbon production routes, with producers investing in electric arc furnaces, utilizing recycled scrap, and implementing energy-efficient processing to comply with tightening environmental regulations. Demand is also supported by growth in EV manufacturing, food processing, and chemical industries, where corrosion resistance and durability are critical performance requirements.

U.S. Stainless Steel Market Trends

The stainless steel market in the U.S. is primarily driven by infrastructure modernization, transportation projects, and advanced manufacturing. Federal spending on bridges, water systems, and public transit continues to support long-term material demand, while reshoring manufacturing and investing in automotive and aerospace production add further momentum. In addition, trade protection measures and import duties have strengthened domestic supply chains, encouraging capacity utilization and new investments by local producers, particularly in value-added and specialty grades.

Asia Pacific Stainless Steel Market Trends

The stainless steel market in the Asia Pacific region dominates global consumption, driven by rapid urbanization, large-scale infrastructure development, and expanding industrial output in countries such as China, India, Japan, and those in Southeast Asia. Strong growth in construction, transportation, consumer appliances, and manufacturing drives high-volume demand, while rising investments in metro rail, airports, and smart cities further strengthen market fundamentals. The region also benefits from cost-competitive production and capacity expansions, although volatility in exports and pricing pressures remain key considerations for regional producers.

Europe Stainless Steel Market Trends

The stainless steel market in Europe represents a mature yet technology-driven market, with demand primarily influenced by sustainability mandates and high-performance industrial applications. Producers are aligning operations with strict carbon reduction targets, accelerating the adoption of green steel initiatives, renewable energy usage, and digitalized production systems. Consumption is supported by automotive manufacturing, renewable energy infrastructure, and chemical processing industries; however, high energy costs and regulatory compliance requirements continue to pressure margins and production volumes across several countries.

Key Stainless Steel Company Insights

Some of the key players operating in the market include Acerinox S.A., Jindal Stainless Limited, and POSCO, among others.

-

Acerinox S.A., established in 1970, is a leading global producer of flat and long products, with operations across Europe, North America, Africa, and Asia. Headquartered in Spain, the company integrates melting, casting, rolling, and finishing processes, supported by a strong focus on operational efficiency and sustainability. Acerinox serves diverse end-use industries, including construction, automotive, energy, and consumer goods, and is recognized for its cost-competitive production model and high recycling rates across its manufacturing facilities.

-

Jindal Stainless Limited, founded in 1970, is India’s largest producer and one of the leading global manufacturers in its segment. The company operates an integrated business model that encompasses melting, casting, hot and cold rolling, and the production of downstream, value-added products. Jindal Stainless caters to infrastructure, railways, automotive, consumer durables, and process industries, with a growing export footprint. Its strategic emphasis includes capacity expansion, import substitution, and development of specialized grades aligned with infrastructure and sustainability-driven demand.

-

POSCO, established in 1968, is a South Korea-based global steel major with a strong presence across Asia, the Americas, and Europe. Operating under POSCO Holdings, the company focuses on advanced materials, high-strength alloys, and technology-driven manufacturing. POSCO supplies a wide range of industries, including automotive, construction, shipbuilding, and energy, and is known for its investments in smart factories, low-carbon production technologies, and next-generation materials to support electrification and sustainable industrial growth.

Key Stainless Steel Companies:

The following are the leading companies in the stainless steel market. These companies collectively hold the largest market share and dictate industry trends.

- Acerinox S.A.

- Aperam Stainless

- ArcelorMittal

- Baosteel Group

- Jindal Stainless

- Nippon Steel Corporation

- Outokumpu

- POSCO

- ThyssenKrupp Stainless GmbH

- Yieh United Steel Corp.

Recent Developments

-

In March 2025, Jindal Stainless announced the commissioning of additional downstream processing capacity at its Odisha facility to expand the production of value-added flat products. The expansion is aimed at catering to rising demand from infrastructure, railways, and consumer durables, while improving delivery timelines and reducing reliance on imports for specialized grades.

-

During its Q2 results announcement in July 2025, Acerinox highlighted progress on efficiency and sustainability upgrades at its North American operations, including higher scrap utilization and energy optimization initiatives. These measures aim to lower production costs, reduce carbon intensity, and enhance competitiveness in the automotive and construction end-use segments.

-

In May 2025, POSCO disclosed advancements in the development of high-strength and corrosion-resistant grades targeted at electric vehicles and hydrogen-related infrastructure. The company indicated that these new materials are undergoing commercial-scale trials and are expected to support lightweighting, durability, and performance requirements in next-generation mobility and clean energy applications.

Stainless Steel Market Report Scope

Report Attribute

Details

Market definition

The apparent demand in the applications is considered for market estimates & forecasts.

Market size value in 2026

USD 146.06 billion

Revenue forecast in 2033

USD 247.42 billion

Growth rate

CAGR of 7.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Italy; Spain; Turkey; China; India; Japan; South Korea; Indonesia; Brazil; GCC

Key companies profiled

Acerinox S.A.; Aperam Stainless; ArcelorMittal; Baosteel Group; Jindal Stainless; Nippon Steel Corp.; Outokumpu; POSCO; ThyssenKrupp Stainless GmbH; Yieh United Steel Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Stainless Steel Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global stainless steel market report by grade, product, application, and region:

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

200 Series

-

300 Series

-

400 Series

-

Duplex Series

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Flat

-

Long

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Automotive & Transportation

-

Consumer Goods

-

Mechanical Engineering & Heavy Industries

-

Food Manufacturing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million,2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Russia

-

Spain

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

-

Frequently Asked Questions About This Report

b. The global zeolite market size was estimated at USD 135.81 billion in 2025 and is projected to reach USD 146.06 billion by 2026.

b. The global stainless steel market is expected to grow at a compound annual growth rate of 7.8% from 2026 to 2033 to reach USD 247.42 billion by 2033.

b. By product, flat products dominated the market with a revenue share of over 73.0% in 2025.

b. Some of the key vendors of the global stainless steel market are Acerinox S.A., Aperam Stainless, ArcelorMittal, Baosteel Group, Jindal Stainless, Nippon Steel Corp., Outokumpu, POSCO, ThyssenKrupp Stainless GmbH, Yieh United Steel Corp., and others.

b. The key factor driving the growth of the global stainless steel market is rising demand from infrastructure, construction, and industrial manufacturing, supported by rapid urbanization, transportation expansion, and the need for durable, corrosion-resistant, and low-maintenance materials across both developed and emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.