- Home

- »

- Medical Devices

- »

-

Fertility Test Market Size And Trends, Industry Report, 2033GVR Report cover

![Fertility Test Market Size, Share & Trends Report]()

Fertility Test Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (Ovulation Prediction Tests, Female Fertility Hormone Tests, Male Fertility Tests), By Application (Female, Male), By Sample Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-755-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fertility Test Market Summary

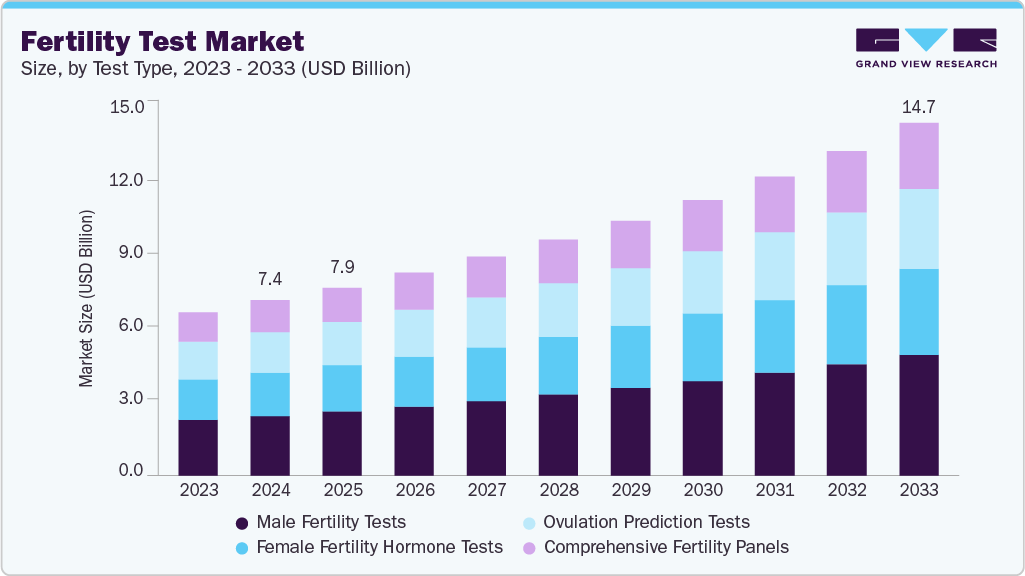

The global fertility test market size was estimated at USD 7.38 billion in 2024 and is projected to reach USD 14.74 billion in 2033, growing at a CAGR of 8.08% from 2025 to 2033. This growth is attributed to lifestyle changes, higher stress levels, delayed pregnancies, and exposure to environmental pollutants.

Key Market Trends & Insights

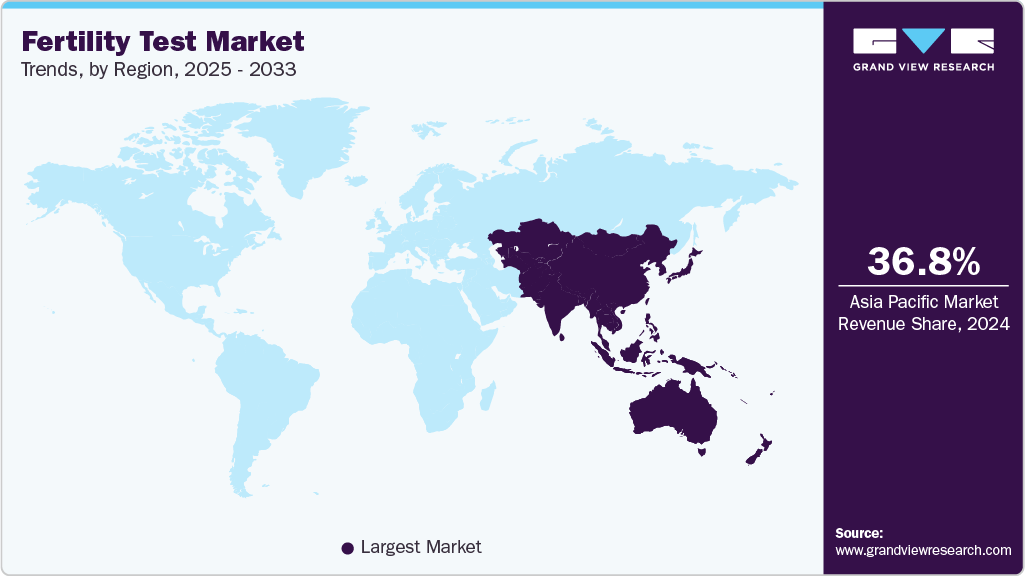

- Asia Pacific dominated the global fertility test market in 2024 with the largest revenue share of 36.76%.

- The India fertility test industry is anticipated to register the fastest CAGR from 2025 to 2033.

- By test type, the male fertility tests segment held the largest revenue share in 2024.

- By application, the female fertility testing segment dominated the fertility test market in 2024.

- By sample type, the blood-based segment led the fertility test industry with a share of 39.50% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.38 Billion

- 2033 Projected Market Size: USD 14.74 Billion

- CAGR (2025-2033): 8.08%

- Asia Pacific: Largest market in 2024

In addition, there is a growing awareness of reproductive health and greater acceptance of fertility testing among both men and women, which encourages early diagnosis and intervention. Moreover, the rising prevalence of reproductive disorders, such as polycystic ovary syndrome (PCOS) and endometriosis, is encouraging more individuals to seek evaluations.

The increasing rates of infertility among both men and women are a significant factor driving the growth of the market. As per the report published by the World Health Organization (WHO) in April 2023, infertility affects approximately 1 in 6 adults, or 17.5% of the population. The report indicates that infertility rates are consistent across various regions and income levels, with a lifetime prevalence of 17.8% in high-income countries and 16.5% in low- and middle-income countries. This suggests that infertility is not confined to specific demographics or areas, making it a serious challenge for people worldwide.

Rising Infertility Rates:

Director of Sexual and Reproductive Health and Research at WHO, including the United Nations’ Special Programme of Research, Development and Research Training in Human Reproduction (HRP), said:

"Millions of people face catastrophic healthcare costs after seeking treatment for infertility, making this a major equity issue and all too often, a medical poverty trap for those affected. Better policies and public financing can significantly improve access to treatment and protect poorer households from falling into poverty as a result.”

Several factors contribute to this decline in reproductive health, including unhealthy lifestyle choices, rising obesity levels, chronic stress, and environmental pollution, all of which make it more challenging for couples to conceive naturally. In addition, social trends such as delayed parenthood have worsened the situation, as fertility generally decreases with age. As awareness of these issues grows through healthcare initiatives and public campaigns, more individuals and couples are taking the initiative to seek diagnostic solutions to understand their fertility status. This rising demand for early detection and evaluation has led to a greater adoption of tests, making them an essential tool for family planning and reproductive health management.

Annual Incidence Rates of Female Infertility Diagnoses by Age Group, Active Component Service Women, U.S. Armed Forces, 2019-2023:

Age Group

2019

2020

2021

2022

2023

<20

18.3

18.0

11.1

7.5

6.4

20–24

51.7

42.1

42

35.3

32.6

25–29

99.5

92.2

89.2

75.7

67.3

30–34

166.5

132

149.2

137.6

131.9

35–39

176.1

158.5

166.9

150.8

145.7

40–44

101

84.4

99.7

93.8

97.0

45–49

10.4

5.6

7.4

5.8

4.4

Growing Awareness about Reproductive Health:

As education levels increase and awareness campaigns gain traction, more individuals are becoming informed about factors that affect fertility, such as hormonal imbalances, lifestyle choices, and age-related decline. This heightened understanding encourages people to seek medical advice and diagnostic solutions earlier. Moreover, increased awareness of available fertility tests and their benefits has helped reduce the stigma associated with infertility, making it easier for couples and individuals to access these services. Hence, the acceptance and use of fertility tests have surged, contributing to the overall growth of the market as more people actively monitor and manage their reproductive health.

On World IVF Day, ReadyToBeMom.com launched a comprehensive initiative aimed at raising awareness and educating the public about IVF in November 2024, addressing the increasing concerns surrounding infertility in India. This program was created in collaboration with the Federation of Obstetric and Gynaecological Societies of India (FOGSI), the Indian Society for Assisted Reproduction (ISAR), and its Maharashtra Chapter. The goal was to bridge knowledge gaps and reduce hesitancy surrounding assisted reproduction. The initiative included a specialized webinar for gynecologists, offering updates on the latest advancements in IVF and assisting with reproductive technologies. In addition, a multimedia campaign was launched to further enhance understanding. This included a "Doctor Bytes" series on FM radio channels, where listeners could submit questions related to assisted reproduction. These inquiries were addressed through both video and audio podcasts. Following this, a four-week mobile campaign was conducted on platforms such as YouTube and Instagram to educate prospective parents about their options in assisted reproduction.

Technological Advancements

Advancements in technology have played a pivotal role in transforming the market by making diagnostic methods more accurate, user-friendly, and widely accessible. Modern testing techniques, such as advanced hormone assays, have improved the precision of detecting hormonal imbalances and reproductive health issues. At-home testing kits have empowered individuals by offering privacy and ease of use, eliminating the need for frequent hospital visits. Genetic screening tools now enable the identification of hereditary conditions affecting fertility, helping couples make informed decisions earlier in their reproductive journey. Moreover, digital platforms and mobile tracking applications have made monitoring cycles and health parameters seamless, allowing users to access personalized insights and healthcare guidance conveniently. These innovations have collectively expanded the reach of fertility testing, encouraged early diagnosis, and enhanced the overall experience, driving the market growth.

Latest Trends and Technologies Shaping IVF Treatments in 2024:

Technology

Description

Impact on IVF Treatment

AI and Machine Learning

Uses algorithms to interpret embryo images and predict implantation success

Enhances selection of healthiest embryos, improving pregnancy rates

Time-Lapse Imaging

Continuous monitoring of embryos without disturbing incubation

Provides detailed developmental insights, reducing trial-and-error methods

Non-Invasive Genetic Testing

Screening embryos for genetic abnormalities without invasive procedures

Reduces risk of miscarriage, improves birth outcomes

Personalized IVF Protocols

Customizing treatment based on hormonal, lifestyle, and medical factors

Increases success rates by tailoring treatments to patients’ needs

Improved Egg-Freezing Techniques

Advanced vitrification methods for preserving eggs

Higher success rates and more choices for women delaying motherhood

IVF-Friendly Lifestyle Apps

Digital tools for tracking medication, nutrition, and emotional wellbeing

Enhance patient compliance and experience, easing the IVF journey

Microfluidics in Sperm Selection

Mimics the female reproductive environment for selecting the healthiest sperm

Improves chances of fertilization and supports a successful pregnancy

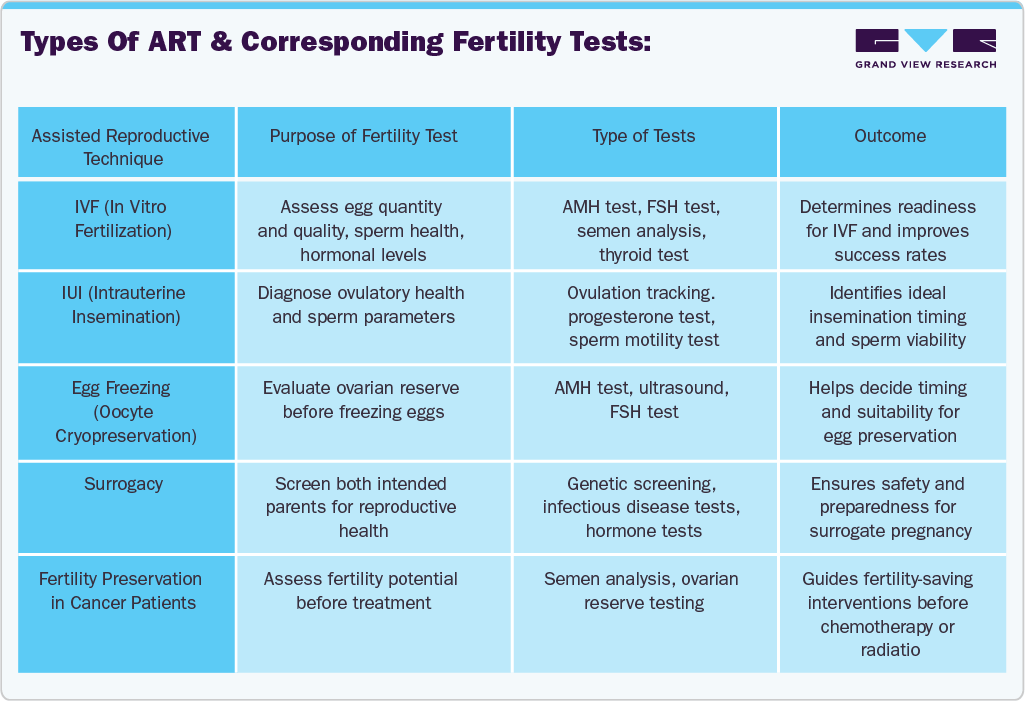

Growing Adoption of Assisted Reproductive Technologies (ART):

The increasing use of ART, such as In Vitro Fertilization (IVF) and Intrauterine Insemination (IUI), is significantly driving industry growth. These advanced procedures necessitate thorough assessments to uncover the underlying causes of infertility, determine the most appropriate treatment methods, and monitor hormonal and reproductive health throughout the process. As more couples pursue ART solutions due to factors such as delayed childbearing, medical conditions, or unexplained infertility, the demand for accurate and accessible testing has surged. Diagnostic tests play a vital role in evaluating ovarian reserve, sperm quality, hormonal balance, and genetic factors, ensuring that treatment plans are personalized and effective. Therefore, the growing use of ART has led to greater reliance on tests, fostering innovation and growth within the market.

Government Initiatives and Support:

Government initiatives and support play a crucial role in the growth of the market. By implementing policies that promote awareness of reproductive health, governments educate individuals and couples about fertility-related issues, which encourages early diagnosis and treatment. In addition, insurance coverage for tests and treatments helps reduce the financial burden, making these services more accessible to a larger population. Public health bodies also provide subsidized testing services, ensuring that individuals from lower-income groups can benefit from fertility assessments. These supportive measures improve access to fertility care and encourage a proactive approach to reproductive health, ultimately expanding the market.

In June 2023, the Tamil Nadu government announced the establishment of fertility centers in Chennai and Madurai, aimed at providing accessible reproductive healthcare services to the public. In Chennai, the Women and Children Hospital in Egmore is set to inaugurate the state's first public treatment unit in October 2023. This facility aims to offer level two care, including in vitro fertilization (IVF) treatments, free of charge to economically disadvantaged patients. Meanwhile, in Madurai, the Government Rajaji Hospital (GRH) announced the launch of a similar IVF facility. These initiatives are part of the government's broader efforts to address the rising infertility rates and the associated financial burden on low-income families.

Moreover, the article "Janani Yatra to educate on fertility," published by the Times of India in May 2025, highlights a significant initiative to address declining fertility rates in Andhra Pradesh. With rates in the state dropping to 1.7, well below the replacement threshold of 2.1, infertility has emerged as a pressing public health concern. In response, Oasis Fertility launched the Oasis Janani Yatra, a 30-day, 30-town journey across Telangana and Andhra Pradesh from Gajuwaka. The primary objective of the initiative is to educate communities about the often-overlooked causes of infertility and the urgent need for proactive lifestyle changes.

Digital Health Platforms and Telemedicine:

The growth of digital health platforms and telemedicine has significantly driven the fertility test industry’s growth. These innovations enhance accessibility, convenience, and patient engagement. Online consultations with fertility specialists and personalized reproductive health advice allow individuals and couples to seek guidance without the constraints of geography or scheduling. In addition, tracking apps that monitor menstrual cycles, hormone levels, and ovulation windows provide users with real-time insights into their reproductive health. This encourages proactive management and earlier intervention. These digital solutions also offer privacy and ease of use, helping to reduce the stigma associated with fertility concerns. In August 2025, Maven Clinic introduced the Cycle Tracker and Male Fertility Tools, which help individuals and couples conceive more effectively. By combining data-driven insights with personalized guidance, these tools enable users to gain a deeper understanding of their menstrual cycles, ovulation patterns, and male fertility factors, all of which are essential for planning a pregnancy. The Cycle Tracker allows women to monitor hormonal fluctuations and identify fertile windows. At the same time, the Male Fertility Tools provide assessments related to sperm health and lifestyle factors that can impact fertility.

The CEO and founder of Maven Clinic said:

"For far too many of us, it takes trying to have a baby to understand how our own body works. With 75% of women believing falsehoods about their fertility, and nearly 40% of men avoiding testing because of the inconvenience, people need better support and they need it earlier on. Together these new features are bringing better consumer health to families while building on Maven's ultimate goal: helping people find their shortest, safest and most affordable path to a healthy baby."

Delayed Marriages and Parenthood:

Many individuals around the world are prioritizing higher education, career development, financial stability, and personal growth before starting a family. Hence, the average age at which couples attempt to conceive has increased. This delay has significant implications for fertility, particularly for women, as fertility naturally declines with age due to decreased egg quality and quantity. Thus, more couples are turning to fertility assessments to understand their reproductive health, plan for pregnancies, and consider assisted reproductive technologies if necessary. Tests provide essential insights into hormonal levels, ovarian reserve, and other factors affecting fertility, making them a valuable resource for couples facing age-related challenges in conception.

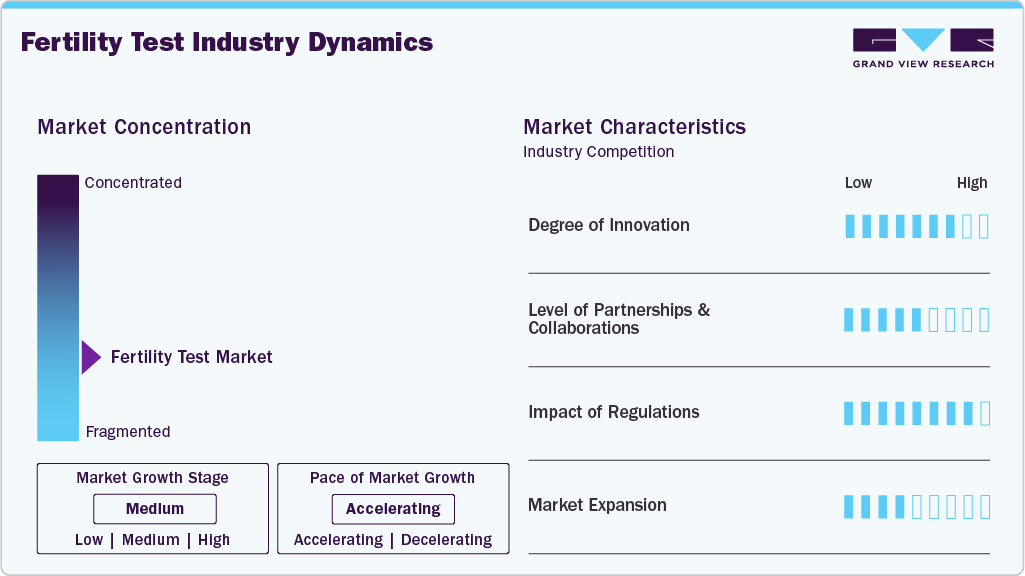

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, characteristics, and participants. There is a high degree of innovation, moderate level of partnership & collaboration activities, high impact of regulations, and a moderate service expansion of industry.

The industry is experiencing a high degree of innovation. At-home testing has become more common, with innovations such as highly sensitive hormone assays, self-collected blood microsampling, and rapid tests for follicle-stimulating hormone (FSH) and anti-Müllerian hormone (AMH). For instance, in December 2023, Arva Health launched an at-home test designed for women, especially those with conditions such as PCOS and thyroid disorders. The test analyzes up to 12 hormone levels, including AMH, FSH, E2, and TSH, offering important insights into reproductive, thyroid, and metabolic health. In addition, innovations such as digital health platforms, telemedicine, and remote monitoring have improved accessibility and convenience in fertility care. These technologies enable personalized treatment plans and optimized embryo selection using AI and data analytics.

Several key players in the fertility test market are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in October 2024, ARC Fertility announced a partnership with Sapyen to introduce a transformative approach to male fertility testing, aiming to enhance reproductive health benefits for employees. This collaboration allows employers to offer their male employees and health plan members a seamless fertility testing experience from the comfort and privacy of their homes.

MD, founder and CEO, ARC Fertility, said:

“Our partnership with Sapyen aligns perfectly with our mission to deliver high-quality, cost-effective and flexible family-forming and fertility benefits that enhance employee satisfaction and loyalty while contributing to improved health outcomes and cost savings. By offering the Sapyen at-home fertility test, we are providing a unique, accessible and discreet option for male fertility testing that will significantly benefit our clients and their employees. The Sapyen solution is crucial in addressing reproductive challenges early on to minimize costs and provide more opportunities to explore options on the path to parenthood.”

The market is regulated by a variety of guidelines designed to ensure patient safety, quality of care, and ethical business practices. The market operates under various regulatory frameworks aimed at ensuring product safety, accuracy, and consumer protection. Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national health authorities oversee the approval and monitoring of testing kits and devices. In many regions, advertising claims are regulated to prevent misleading consumers. As the demand for at-home testing solutions grows, regulators are increasingly focusing on data privacy, proper usage instructions, and consumer education to minimize the risk of misuse and misinterpretation of results.

In September 2024, MGM Healthcare inaugurated Varam IVF, a state-of-the-art fertility center located in Chennai. This dedicated center aims to provide comprehensive reproductive healthcare services, combining advanced medical technology with compassionate, personalized care. The center is staffed by a team of experienced specialists, such as a Senior Consultant in Obstetrics and Gynaecology, who bring expertise in reproductive medicine to the facility. With a focus on high success rates and a patient-centered approach, Varam IVF is committed to supporting individuals and couples on their journey to parenthood.

Test Type Insights

The ovulation prediction tests segment held a significant market share of 30.40% in 2024. This growth is attributed to the rising prevalence of infertility and the growing awareness among women regarding reproductive health. Increasing delays in childbearing due to lifestyle choices, career priorities, and late marriages are fueling the demand for reliable home-based solutions. Technological advancements, such as digital and smartphone-connected ovulation kits, have made testing more convenient, accurate, and user-friendly, further boosting adoption.

The male fertility tests segment is expected to grow at the significant CAGR during the forecast period. This is driven by the rising prevalence of male infertility, which accounts for nearly half of infertility cases globally. Factors such as increasing stress, sedentary lifestyles, obesity, smoking, alcohol consumption, and exposure to environmental toxins have contributed to declining sperm quality and count, thereby fueling demand for fertility assessments. In addition, growing awareness of fertility health among men, delayed parenthood trends, and the increasing number of couples seeking assisted reproductive technologies (ART) further support the demand for male fertility tests as a crucial first step in identifying underlying issues and guiding treatment pathways.

Application Insights

The female fertility testing segment dominated the fertility test market in 2024, driven by the increased availability and affordability of advanced diagnostic technologies. Innovations such as high-sensitivity hormone assays, self-collected blood microsampling, and rapid follicle-stimulating hormone (FSH) and anti-Müllerian hormone (AMH) tests enable women to evaluate ovarian reserve and reproductive health with clinical precision from home. Moreover, integration with digital health platforms allows for automated result interpretation, trend tracking, and teleconsultations, further boosting adoption. Moreover, rising infertility rates among women are fueling segment growth. For instance, a 2023 study published in the International Journal of Reproduction, Contraception, Obstetrics, and Gynecology found that among infertile women, 57.33% experienced primary infertility, while 42.66% had secondary infertility, with the 26-30 age group being most affected, emphasizing the need for early and accurate assessment.

The male fertility testing segment is expected to grow at the fastest CAGR over the forecast period. Factors such as declining sperm counts, hormonal imbalances, and increasing prevalence of lifestyle-related infertility have prompted men to seek early and convenient diagnostic solutions. As per the 2022 NIH report, human sperm counts have decreased by over 50% worldwide in the last five decades, highlighting the need for timely testing. Furthermore, technological innovations, including home-based semen analysis kits and microfluidic sperm testing devices, allow men to assess motility, concentration, and morphology without visiting clinics, reducing social stigma and encouraging proactive health monitoring, thereby driving industry growth.

Sample Type Insights

The blood-based segment led the fertility test industry with a significant share of 39.50% in 2024. This growth is primarily due to their high accuracy, reliability, and ability to provide comprehensive hormonal insights compared to urine or at-home methods. These tests help measure critical fertility-related hormones such as FSH, LH, AMH, estradiol, and progesterone, which are essential in assessing ovarian reserve, ovulation cycles, and overall reproductive health. Rising infertility rates worldwide, fueled by lifestyle changes, delayed pregnancies, and increasing cases of hormonal imbalances and polycystic ovary syndrome (PCOS), are creating higher demand for precise diagnostic solutions, including blood-based testing.

The urine-based segment is expected to grow at the fastest CAGR during the forecast period. This is driven by its convenience, affordability, and non-invasive nature compared to blood-based tests. These tests are widely preferred for at-home use as they allow individuals and couples to monitor ovulation cycles and fertility status privately without frequent clinical visits. Increasing awareness about family planning, delayed pregnancies due to lifestyle changes, and the growing prevalence of infertility are further boosting demand. Technological advancements, such as digital ovulation kits with higher accuracy and smartphone app integration, are also enhancing consumer adoption. In addition, the availability of these tests through both retail and online channels makes them highly accessible, fueling their growth within the overall market.

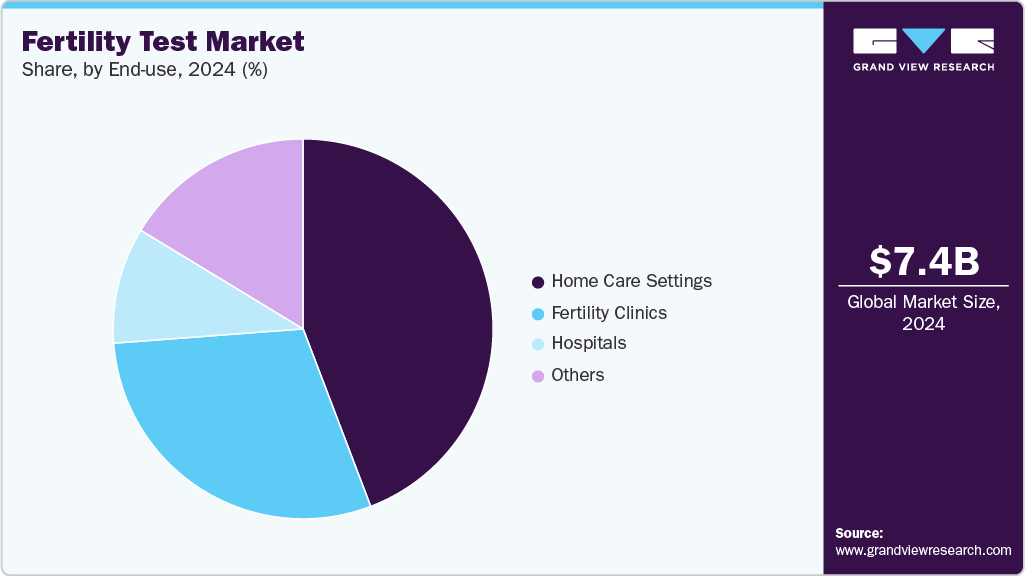

End-use Insights

The home care settings segment accounted for the largest share of 44.21% in 2024 due to rising preference for convenient, non-invasive, and private fertility monitoring solutions. Increasing awareness about reproductive health, coupled with the desire to track ovulation, hormone levels, and sperm quality in the comfort of one’s home, is driving adoption of at-home testing devices. In addition, advancements in device accuracy, ease of use, and integration with digital health platforms have enhanced user confidence and engagement. Moreover, rising internet penetration and e-commerce availability have expanded access to these devices, making home-based fertility care an increasingly viable and preferred option.

The fertility clinics are expected to grow at the fastest CAGR over the forecast period, owing to increasing demand for specialized reproductive healthcare and advanced assisted reproductive technologies (ART). Fertility clinics offer comprehensive services, including ovulation induction, in vitro fertilization (IVF), intrauterine insemination (IUI), and hormone monitoring, attracting patients seeking personalized care. The expansion of insurance coverage and reimbursement policies in certain regions has further increased accessibility to clinic-based treatments. Moreover, increased female workforce participation and delayed parenthood trends have also contributed to higher patient volumes, thus supplementing industry growth.

Regional Insights

The North America fertility test market held a significant revenue share in 2024, owing to the high awareness of reproductive health and the widespread availability of advanced assisted reproductive technologies (ART). Moreover, supportive insurance coverage in certain states and growing telehealth adoption for reproductive health consultations have further enhanced accessibility to fertility testing devices.

U.S. Fertility Test Market Trends

The U.S. fertility test industry is experiencing significant growth over the forecast period, driven by the increasing use of personalized fertility care and demand for early detection tools. Fertility testing devices that provide rapid hormone or sperm analysis at home are becoming popular, especially among millennials seeking convenience and privacy. Moreover, partnerships between device manufacturers and telehealth platforms are facilitating remote consultations and continuous monitoring, further driving adoption. For instance, in August 2023, Reproductive Medicine Associates of New York (RMA NY) announced a partnership with US Fertility. This strategic move expanded US Fertility's network to over 100 clinic locations and 32 IVF laboratories across the U.S., enhancing its capacity to provide advanced reproductive care. This partnership reflects a broader trend in the fertility industry towards consolidation, aiming to enhance service delivery and patient outcomes through expanded networks and shared resources.

Asia Pacific Fertility Test Market Trends

The Asia Pacific fertility test market accounted for the largest revenue share of 36.76% in 2024, due to rising awareness, cultural shifts, and increasing adoption of fertility care services. Furthermore, growing urbanization, delayed marriage, and lifestyle changes such as smoking and poor diet are driving demand for both male and female fertility testing devices.

The Japan fertility test marketheld a significant revenue share in 2024. Fertility startups in Japan are emerging as key players in addressing the nation's escalating infertility challenges, driven by a combination of demographic shifts and systemic healthcare inefficiencies. With Japan experiencing one of the world's lowest birth rates, the demand for assisted reproductive technologies (ART) such as in vitro fertilization (IVF) has surged. However, patients often face prolonged waiting times and limited access to treatments, exacerbating the emotional and financial burdens associated with infertility. Entrepreneurs such as Yukiko Nakai are responding to these challenges by leveraging technology to streamline fertility care.

The fertility test market in Indiais driven by the growing funding and other strategic initiatives. For instance, in November 2023, an India-based startup has recently secured USD 6 million in funding to advance its testing solutions. This investment underscores the growing interest and demand for innovative approaches in women's health diagnostics. The startup is developing a novel diagnostic test aimed at determining female fertility by measuring estrogen levels and related metabolites. The funding is likely to support the startup in refining its technology, conducting clinical trials, and navigating regulatory pathways to bring its product to market.

Europe Fertility Test Market Trends

The fertility test industry in Europe is expected to witness high growth over the forecast period, owing to the rising investments in reproductive healthcare infrastructure and public awareness campaigns about fertility preservation. Furthermore, growing government support, coupled with increasing lifestyle-related issues, is driving the market growth.

The Germany fertility test market held a significant share of the Europe industry in 2024, owing to the widespread health insurance coverage for fertility testing and advanced clinical infrastructure. For instance, in August 2023, Berlin-based healthtech startup Fertilly launched Europe's first at-home fertility test kit that employs dried blood microsampling technology. This innovative approach utilizes Mitra devices, developed by Trajan Scientific and Medical, which enable individuals to collect small blood samples via a finger stick at home. These samples are then mailed to a laboratory for analysis as dried blood, providing a convenient and non-invasive method for fertility assessment. Moreover, the increasing infertile population in the region is driving market growth. For instance, as per an article published in Deutsche Welle in 2024, infertility affects 1 in 6 women in Germany.

The fertility test market in Spainis influenced due to the increasing number of patients from other European countries, rapid developments in fertility tourism, and the rising number of international fertility clinics. In recent years, Spain has emerged as a leader in the field of ART, particularly IVF. According to the Instituto Bernabeu, Spain performs 15% of all IVF treatments conducted in Europe, outpacing both France and Germany in this regard. Moreover, in Spain, there are over 165,000 IVF cycles performed annually, and babies conceived through reproductive medicine techniques now make up 12% of all births nationwide. This prominence can be attributed to several factors, including advanced medical technologies, a high level of expertise among fertility specialists, and favorable legal frameworks that support reproductive health.

Latin America Fertility Test Market Trends

The industry in Latin America is expected to register considerable growth over the forecast period owing to the increasing investment in reproductive health, expanding private healthcare facilities, and rising awareness about infertility. In countries such as Brazil and Mexico, cultural stigma around fertility is gradually declining, prompting more individuals to seek testing and treatment.

The industry in Brazil isexpected to register significant growth over the forecast period in the Latin America market. The growth of private fertility clinics offering complementary diagnostic services has stimulated interest in pre-clinic at-home testing to prepare patients for consultations. In addition, in March 2025, the Chief Operating Officer of FertGroup discussed the significant growth of egg freezing in Brazil and the company's pioneering role in transforming the fertility care landscape. Prior to the COVID-19 pandemic, egg freezing accounted for 15–17% of fertility cycles in Brazil. By 2025, this figure had doubled to 30%, with some clinics in the southeast region reaching up to 40%. FertGroup's approach combines technological innovation with private equity support to expand access to fertility services across Brazil, aiming to meet the growing demand for egg freezing and other reproductive treatments.

Middle East and Africa Fertility Test Market Trends

The growth of the fertility test industry in the Middle East & Africa (MEA) is driven by the rising awareness of fertility health, the adoption of advanced reproductive technologies, and high-income urban populations seeking personalized healthcare solutions. In countries such as the UAE and Saudi Arabia, government initiatives to improve maternal and reproductive health, alongside rising investment in private fertility clinics, have driven device adoption.

The UAE fertility test marketis witnessing an increasing investment, leading to its significant expansion. For instance, in July 2025, Abu Dhabi-based FemTech startup Ovasave secured USD 1.2 million in pre-seed funding to expand its digital health platform, which focuses on fertility and hormonal care for women across the MENA region. The capital will be utilized to scale operations across the GCC, enhance corporate partnerships, and develop the next phase of Ovasave's mobile app, which will include features such as menstrual cycle tracking, symptom monitoring, and AI-driven treatment protocols.

Co-founder and CEO of Ovasave said, "There is a critical need for timely intervention in women’s health, particularly around fertility and hormonal health. This funding marks a crucial step in our mission to disrupt women’s health and expand access to fertility and hormonal care across the region. We are grateful for the confidence shown by our investors, which allows us to scale a platform designed to deliver timely, personalised, and accessible fertility and hormonal care. By bringing together medical expertise, digital convenience, and emotional support, we are helping women take control of their health earlier and more effectively across different life stages.”

Key Fertility Test Company Insights

The market is fragmented, with the presence of many country-level fertility test providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Fertility Test Companies:

The following are the leading companies in the fertility test market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics

- Mayo Clinic Laboratories

- Ovation Fertility

- Illume Fertility

- Proov

- BioMérieux

- Labcorp

- CCRM Fertility

- Hertility Health

- Maven Clinic Co.

Recent Developments

- In July 2025, IVI RMA Global expanded its presence in the Gulf Cooperation Council (GCC) region through the acquisition of ART Fertility Clinics' operations in the UAE and Saudi Arabia. This strategic move, valued between USD 400 million and USD 450 million, was finalized with Gulf Capital, the majority shareholder in ART Fertility Clinics. The acquisition encompasses three state-of-the-art clinics located in the UAE and Saudi Arabia, enhancing IVI RMA Global's footprint in the Middle East.

CEO of IVI RMA Global said,“We’re thrilled to welcome ART Fertility Clinics into our network. From the very beginning, our ambition has been the expansion of our network whilst maintaining our quality standards. We are confident in the GCC region's potential to become a hub for international patients and a driver in the development of the fertility sector. In this context, ART Fertility is the ideal platform to drive that growth in the region.”

- In July 2025, Nova IVF Fertility reached a significant milestone by launching its 100th center in Jammu, reinforcing its position as one of India’s leading fertility service providers. This expansion reflects the company’s commitment to increasing accessibility to advanced fertility treatments across the country, catering to the rising demand for assisted reproductive technologies.

CEO, Nova IVF Fertility said:“Our 100th centre is more than a number-it represents 100 access points to new possibilities for aspiring parents. This milestone aligns with our vision to bring quality fertility care closer to communities and address the evolving reproductive health needs of India.”

- In November 2024, Qassay introduced a fertility testing solution for IVF clinics, representing a strategic advancement in reproductive healthcare diagnostics. The solution is designed to provide accurate, rapid, and reliable assessments of key fertility parameters, enabling clinicians to make more informed decisions during the in vitro fertilization (IVF) process. In addition, the integration of such testing solutions into clinical workflows enhances efficiency, minimizes errors, and supports personalized treatment approaches, which are increasingly in demand in fertility care.

Fertility Test Market Report Scope

Report Attribute

Details

Market size in 2025

USD 7.92 billion

Revenue forecast in 2033

USD 14.74 billion

Growth rate

CAGR of 8.08% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Test type, application, sample type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Quest Diagnostics; Mayo Clinic Laboratories; Ovation Fertility; Illume Fertility; Proov; BioMérieux; Labcorp; CCRM Fertility; Hertility Health; Maven Clinic Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fertility Test Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fertility test market report based on test type, application, sample type, end-use, and region:

-

Test Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Ovulation Prediction Tests

-

Female Fertility Hormone Tests

-

Male Fertility Tests

-

Comprehensive Fertility Panels

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Female Fertility Testing

-

Male Fertility Testing

-

-

Sample Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Urine-based

-

Saliva-based

-

Blood-based

-

Semen-based

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Home Care Settings

-

Hospitals

-

Fertility Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.