- Home

- »

- Communications Infrastructure

- »

-

Fiber Optic Connector Market Size And Share Report, 2030GVR Report cover

![Fiber Optic Connector Market Size, Share & Trends Report]()

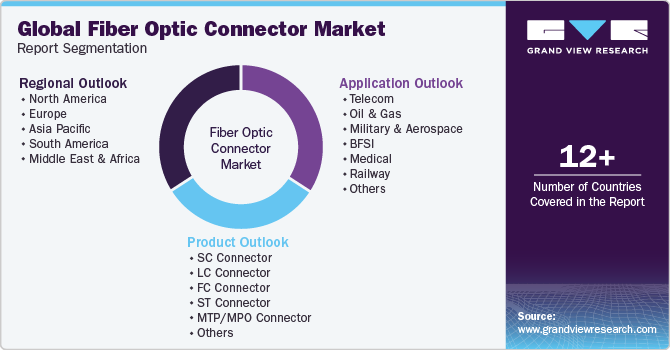

Fiber Optic Connector Market Size, Share & Trends Analysis Report By Product (SC Connector, LC Connector, FC Connector, ST Connector, MTP/MPO Connector), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-846-6

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Fiber Optic Connector Market Size & Trends

The global fiber optic connector market size was valued at USD 4.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The growing adoption of fiber optic technology majorly drives the global marketplace. The increasing preference toward high bandwidth communication and emerging opportunities in the healthcare sector are anticipated to fuel the technology market alongside the connectors market.

The industry is anticipated to pose promising growth prospects (over the forecast period), which stem from numerous factors such as growing government funding for telecommunication infrastructure development and investments & research embarked upon by leading players for upgrading and enlarging the solicitation frontiers. In addition, the growing awareness of the benefits of technology is further driving market growth.

Fabricators produce fiber optic connectors, in bulk, for long-distance cabling purposes. They are made of ultra-pure quartz. The global market is anticipated to witness substantial growth over the forecast period. The high demand from sensing applications and the communication segment for diverse purposes deliver dynamic opportunities for industry growth.

The market is witnessing considerable mergers and acquisitions undertaken by the benefactors of the telecommunication and network service providers in their endeavors to achieve enhanced service portfolios by gaining access to numerous patents of the client application domain. The growing demand for power-efficient, cost-effective, and high-level network infrastructure integration in the IT sector is expected to fuel the market demand in the next few years.

Continuous advancements have led to the evolution of the fifth-generation fiber optics technology based on the Dense Wave Division Multiplexing (DWDM) optical solutions concept. Furthermore, fiber optic connectors have become the preferred transmission integrating medium, owing to their ability to provide reliable network connections, low back reflection, compact size, and wide temperature range of epoxies. The telecom industry has become one of the biggest beneficiary sectors globally, attributed to the technological aspects of fiber optic connectors. In addition, medical & healthcare is one of the prominent application sectors where the technology is extensively adopted.

The evolving fiber optic connector industry has experienced tremendous growth in the past decade. There is an increasing need for more intelligent network architectures, simplified network installations, and advanced switching techniques that can change dynamically and respond well to traffic patterns while offering cost efficiency. The fiber optic connector market has witnessed considerable global growth and is expected to grow at a significant CAGR over the forecast period.

A substantial increase has been observed in the fiber optic cable and component market as it offers increased reliability, greater bandwidth, enhanced security, and many other factors. One of the leading factors driving the market is the growing demand for high bandwidth. Researchers are attempting to achieve even higher bandwidth with 100Gb/s. It is paramount for applications such as file downloading, video calling, online gaming, etc. Dense Wave Division Multiplexing (DWDM) leads the path for multi-terabit transmission. There is a global need for increased bandwidth, which has resulted in the interest to develop multi-terabit optical networks and fiber connectors for efficient termination with fiber optic cables.

Fiber optic connectors help join optical fibers to transmit information efficiently without losses. They are implemented across various applications, including security and defense, telecommunication, data centers, community antenna televisions, inter/intra building applications, and high-density interconnection. The Asian telecom market has been witnessing growing adoption of 4G and Long Term Evolution (LTE) services for improved distribution of high-speed data, television, telephony, and video services.

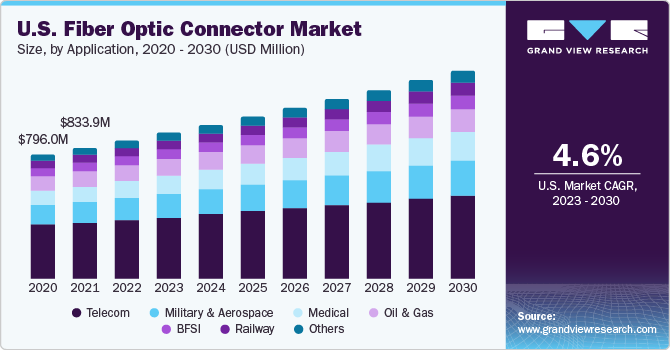

Application Insights

Based on applications, the market has been segmented into telecom, oil & gas, military & aerospace, BFSI, medical, railway, and other applications. The telecom segment accounted for the largest revenue share of 42.5% in 2022. The growing penetration of telecommunication infrastructure in developing economies, such as China and India, is attributable to the significant growth of technology in the region. Data transmission and communication services account for the major shares of the telecommunication application arena. Additionally, the increasing number of cloud-based applications, audio-video services, and Video-on-Demand (VoD) services are anticipated to stimulate the demand for growing installations.

The medical applications segment is expected to witness the fastest CAGR of 7.4% over the forecast period. The expanding prevalence of telemedicine amplifies the demand for uninterrupted, high-quality video streaming and data sharing, amplifying the need for superior fiber optic connectors. This surge is further catalyzed by the imperative of enhancing patient care through precision and the minimization of procedural complexities, driving manufacturers to develop advanced medical devices.

The railway segments are anticipated to witness significant growth rates, attributable to their growing adoption in dynamic healthcare treatment, lighting applications, deployment in railway line inspection, and load calculation applications. The technology has created copious new applications across the medical industry, mainly used for light conduction and illumination, flexible bundling, and laser delivery systems.

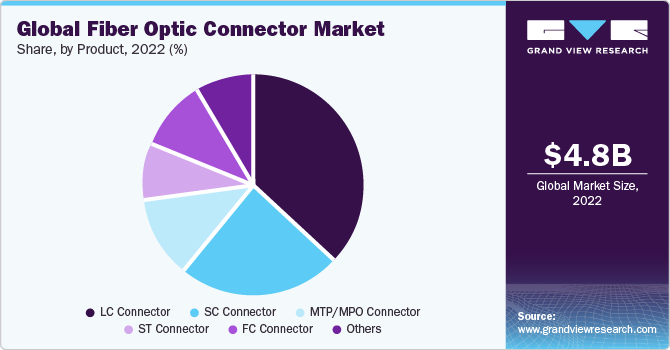

Product Insights

The market has been segmented based on product types into SC, LC, FC, ST, MTP/MPO connectors, and others. The LC segment accounted for the largest revenue share of 36.7% in 2022. The military & aerospace and railway application segments are poised to witness significant growth rates, owing to the increasing adoption of Plastic Optical Fiber (POF) across these application segments. The military utilizes optical connector technology for various ground, sea, air, and space solicitations, such as in avionics testing equipment modules and ground support systems in fighter planes.

The FC connector segment is expected to grow considerably at a CAGR of 7.5% over the forecast period. The increasing adoption of cloud-based services, video streaming, and IoT applications further amplifies the need for efficient data transfer, thus elevating the significance of these connectors. Additionally, the transition towards 5G technology necessitates the utilization of fiber optics to manage the escalating data volumes, stimulating the demand for FC connectors in supporting this infrastructure.

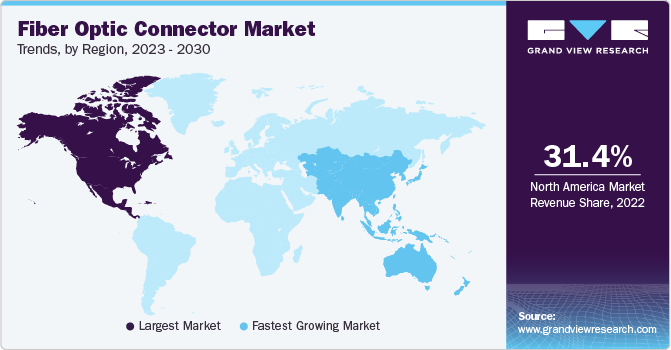

Regional Insights

North America dominated the market and accounted for the largest revenue share of 31.4% in 2022. The expanding deployment of 5G networks fuels the demand for fiber optic connectors in North America. 5G networks require high-speed, low-latency connections to handle the massive amounts of data generated by connected devices and applications. Fiber optic connectors provide the bandwidth and performance to support the requirements of 5G networks, making them essential components in the infrastructure development for telecommunications companies and network operators.

Asia Pacific is expected to grow at the fastest CAGR of 7.0% during the forecast period. The high penetration rate of the manufacturing sector and the expanding IT & telecommunication sector are strengthening the Asia Pacific regional market. The Asia Pacific region is expected to surface as a leading region over the forecast period. The regional market growth can be attributed to the growing adoption of fiber optic technology in numerous industry verticals, specifically the telecommunications sector.

The APAC region has witnessed a rising demand due to increased broadband network infrastructures. Moreover, the growing demand for high-speed wired internet drives the demand for fiber optic components. Niche applications such as gaming, media, and video consume more data, requiring a considerably high-speed internet connection. Data centers comprise storage and networked computers that organizations or other businesses use to store, disseminate, organize, and process large amounts of data.

Lucrative investments made by the government in the Asia Pacific region to enhance fiber optic networks and the growing adoption of mobile devices provide significant growth opportunities in the market. Increased penetration of fiber optic connectors has been witnessed in Japan, China, and South Korea. The adoption of fiber optic connectors has increased significantly in China and Japan, owing to the requirements for connectivity improvement and widespread usage of 3G/4G services. The growing demand for high-speed data connection primarily drives the market in this region. The advantage of assured security of transmitted data has led to increased adoption of fiber optic connectors among consumers.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in October 2022, Hexatronic Group, a technology group in fiber communications products, entered into a purchase agreement with TE Connectivity (TE) to acquire all the business activities of Rochester Cable. Rochester Cable is known for its expertise in designing and manufacturing electro-optical cables suitable for harsh environments. This strategic agreement strengthens Hexatronic's fiber optic submarine communication cable portfolio, expanding it to include working cables capable of transmitting electrical signals and power alongside optical signals.

Key Fiber Optic Connector Companies:

- 3M

- Optical Cable Corporation

- STL Tech

- OFS Fitel, LLC

- Corning Incorporated

- ALE International, ALE USA Inc.

- Arris Group of Companies

- TE Connectivity

- FURUKAWA ELECTRIC CO., LTD

Recent Developments

-

In May 2023, SABIC, a chemical manufacturing company based in Saudi Arabia, expanded its ULTEM portfolio by introducing new colorable, high-flow, and reinforced grades designed specifically for connectors and other thin-wall components. Adding low-viscosity ULTEM 2120, 2220, and 2320 resins brings remarkable flow characteristics, enabling designers to develop miniaturized and high-precision components with intricate and complex geometries. This enhancement to the ULTEM product range provides customers with advanced materials that offer both improved performance and greater design flexibility, catering to the evolving needs of the industry for high-quality, specialized components.

-

In March 2023, Sumitomo Electric Industries, Ltd, an electric wire and optical fiber cable manufacturer, partnered with US Conec Ltd. The collaboration aims to jointly manufacture MMC connectors and TMT ferrule components, catering to the growing demand for next-generation, multi-fiber, high-density cabling solutions. This strategic alliance enables the organizations to sustain cabling programs for hyper-scale data centers and establish a reliable supply chain for arising and prospective optical link architectures. Initial deployments will focus on low-loss, 24F single-mode MMC connectors, providing enhanced connectivity solutions for advanced optical networks.

-

In May 2022, Optical Cable Corporation, a fiber optic cable manufacturer, established a long-term agreement with CommScope, a provider of network infrastructure solutions. The agreement entails a cross-licensing arrangement that allows both companies to access and utilize certain portions of each other's patent portfolios. This collaboration enables them to leverage the licensed patents and technologies of the other company, fostering innovation and facilitating the development of advanced solutions in network infrastructure.

-

In December 2021, Samtec, a manufacturer of interconnect systems, acquired Ultra Communications, a provider of RF fiber optic and high-speed digital components. This strategic acquisition allows Samtec to enhance and broaden its range of fiber optic products, particularly for military/aerospace and harsh environment applications. By integrating Ultra Communications' proficiency in high-speed mixed-signal circuit design, packaging solutions for superior electrical and optical coupling, and comprehensive testing at the wafer and component level, with Samtec's expertise in advanced interconnect design, the company to deliver cutting-edge product and technology solutions to its valued customers.

-

In December 2021, Amphenol Corporation, an electronic and fiber optic connectors, cable, and interconnect systems producer, acquired Halo Technology, a passive and active fiber optic interconnect components provider, for approximately USD 715 million. This acquisition strengthens the Amphenol offering to IT and data communications, broadband customers, and mobile networks, upgrading their systems and networks to handle increased data traffic.

Fiber Optic Connector Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.18 billion

Revenue forecast in 2030

USD 8.21 billion

Growth Rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; Optical Cable Corporation; STL Tec; OFS Fitel, LLC; Corning Incorporated; ALE International; ALE USA Inc.; Arris Group of Companies; TE Connectivity; FURUKAWA ELECTRIC CO.; LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Optic Connector Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global fiber optic connector market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

SC Connector

-

LC Connector

-

FC Connector

-

ST Connector

-

MTP/ MPO Connector

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global fiber optic connector market size was estimated at USD 4.83 billion in 2022 and is expected to reach USD 5.18 billion in 2023.

b. The global fiber optic connector market is expected to grow at a compound annual growth rate of 5.9% from 2023 to 2030 to reach USD 8.21 billion by 2030.

b. North America dominated the fiber optic connector market with a share of 31.4% in 2022. This is attributable to the fact that fiber optics serve as a medium to cope with the increasing bandwidth requirements associated with broadband services, network operators, and broadband connection providers.

b. Some key players operating in the fiber optic connector market include Corning, Inc., Optical Cable Corporation, Sterlite Technologies Limited, 3M, and OFS Fitel, LLC.

b. Key factors that are driving the market growth include growing penetration of data centers in the APAC region, growth opportunities in the telecommunication sector, and growing government funding in network infrastructure.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."