- Home

- »

- Electronic & Electrical

- »

-

Television Market Size And Share, Industry Report, 2033GVR Report cover

![Television Market Size, Share & Trends Report]()

Television Market (2026 - 2033) Size, Share & Trends Analysis Report By Display Technology (QLED, OLED, LCD, LED), By Screen Size, By Features (Smart, Non-Smart TV), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Television Market Summary

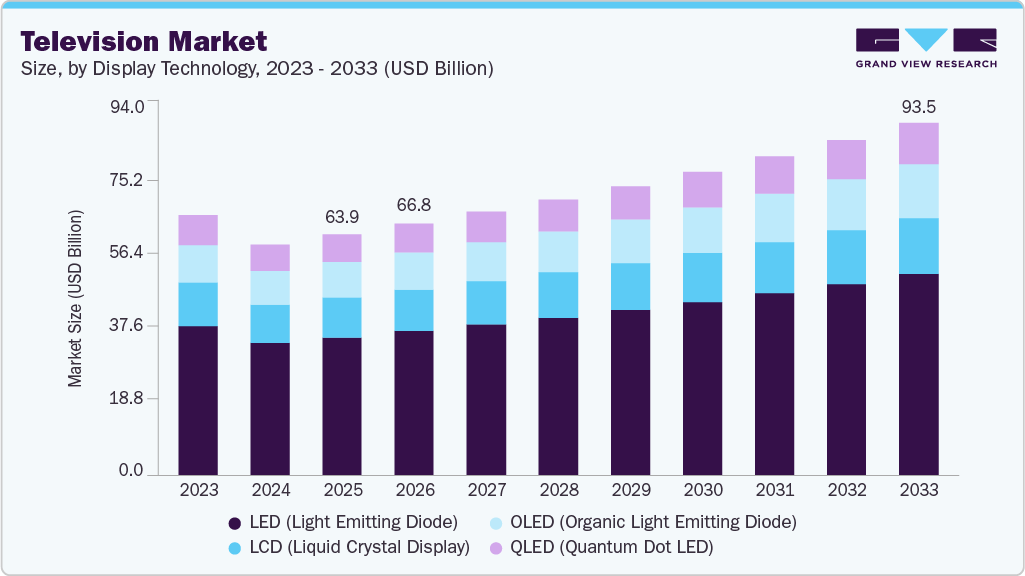

The global television market size was estimated at USD 63.89 billion in 2025 and is projected to reach USD 93.46 billion by 2033, growing at a CAGR of 4.9% from 2026 to 2033. This can be attributed to the increase in consumer spending on home entertainment and the rising demand for smart TVs with advanced display and connectivity features.

Key Market Trends & Insights

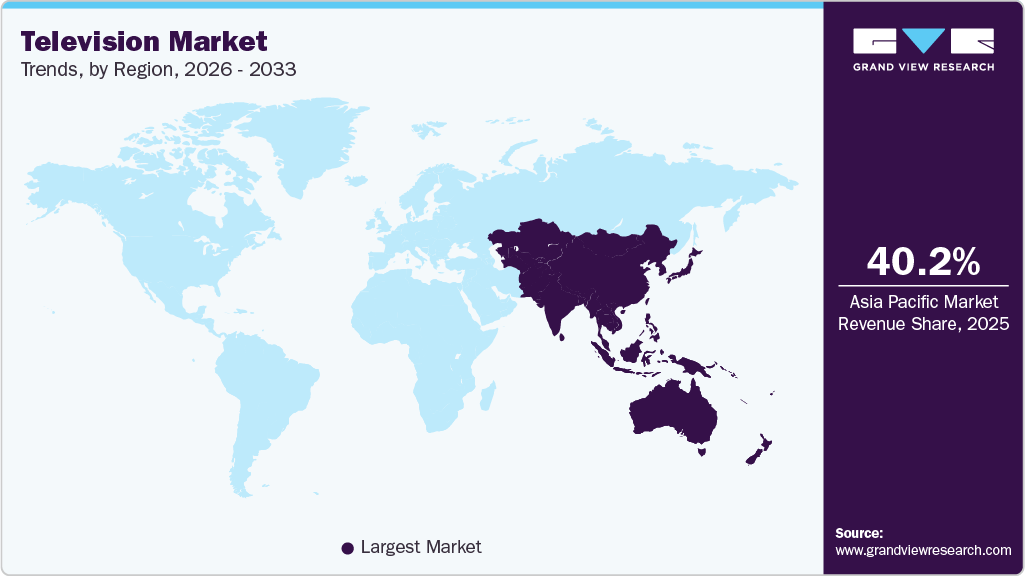

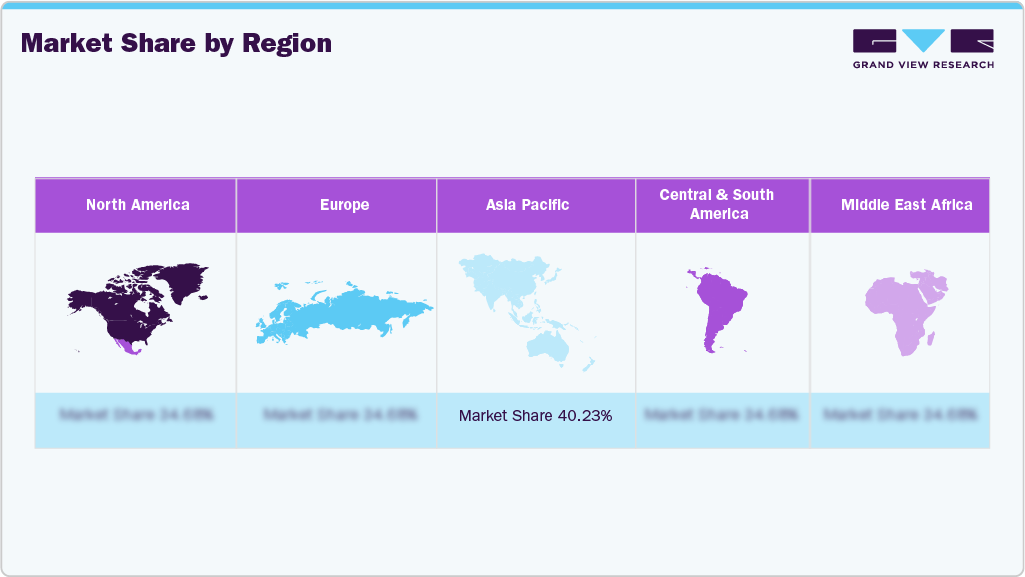

- Asia Pacific television industry held the largest global market share of 40.23% in 2025.

- The India television industry is expected to register a CAGR of 5.7% from 2026 to 2033.

- By display technology, LED (Light Emitting Diode) TV segment held a market share of 57.35%% in 2025.

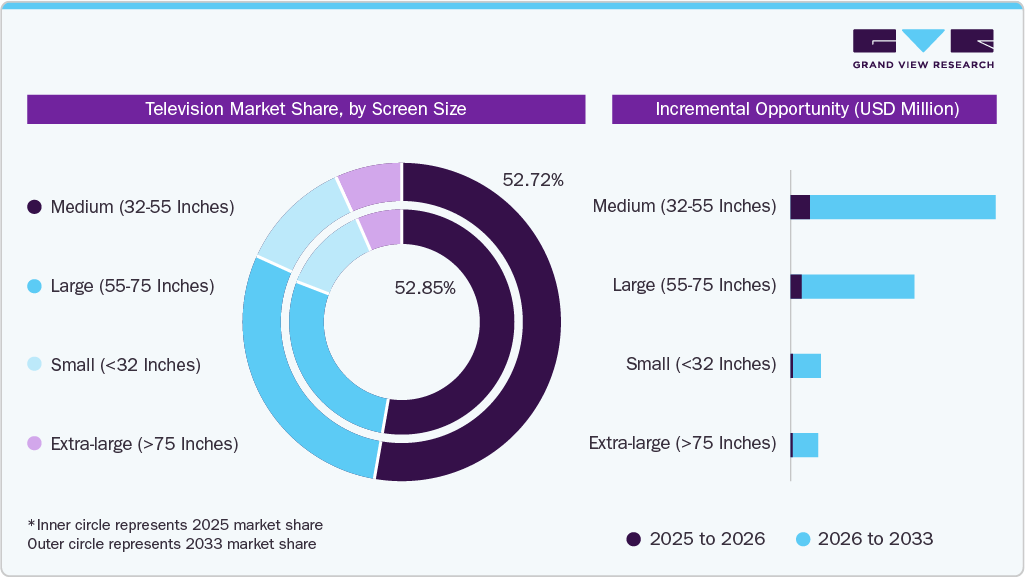

- By screen size, the medium (32-55 inches) segment held a market share of 52.85% in 2025.

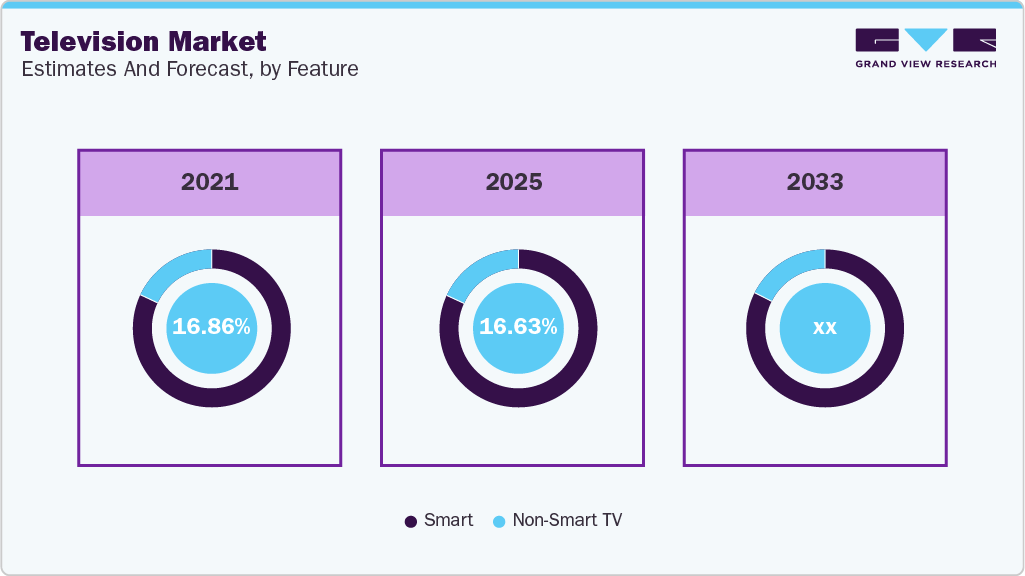

- By features, the smart TV segment accounted for a revenue share of 83.37% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 63.89 Billion

- 2033 Projected Market Size: USD 93.46 Billion

- CAGR (2026-2033): 4.9%

- Asia Pacific: Largest market in 2025

The television industry is experiencing a significant shift toward smart, internet protocol television (IPTV) and connected TVs that feature ultra-high-definition displays (4K/8K) and incorporate built-in streaming apps, voice controls, and AI-powered personalization. Consumers are increasingly treating TVs as multifunctional entertainment hubs for gaming, on-demand content, and interactive experiences, rather than just for traditional broadcasting.

One of the strongest drivers of the global television industry is the TV becoming the default access device for streaming ecosystems, not just a screen. In many households across the US, Europe, India, and Southeast Asia, TVs are the primary access point for streaming services such as Netflix, YouTube, Disney Plus, regional OTT apps, and FAST channels. This transition is expanding the pay television market, digital terrestrial television market, and television broadcasting service market, as households replace legacy devices incapable of supporting contemporary interfaces and applications.

Screen size expansion at stable price points is also contributing to market growth. Sets between 55 and 65 inches are increasingly affordable, reinforcing demand in the curved television market and for associated television TV mount market solutions. Consumer purchasing decisions are now primarily influenced by immersive experience factors such as gaming, sports, and shared viewing rather than solely by feature updates.

Another key driver is lifestyle-led usage expansion beyond linear viewing. TVs are increasingly used for cloud gaming, fitness apps, video calling, and smart-home control, and educational content, supporting growth in the educational television market. Features like high refresh rates, voice control, and ambient modes influence purchase decisions. This evolution also supports the closed circuit television CCTV camera market, as TVs become central to entertainment, security, and smart home ecosystems.

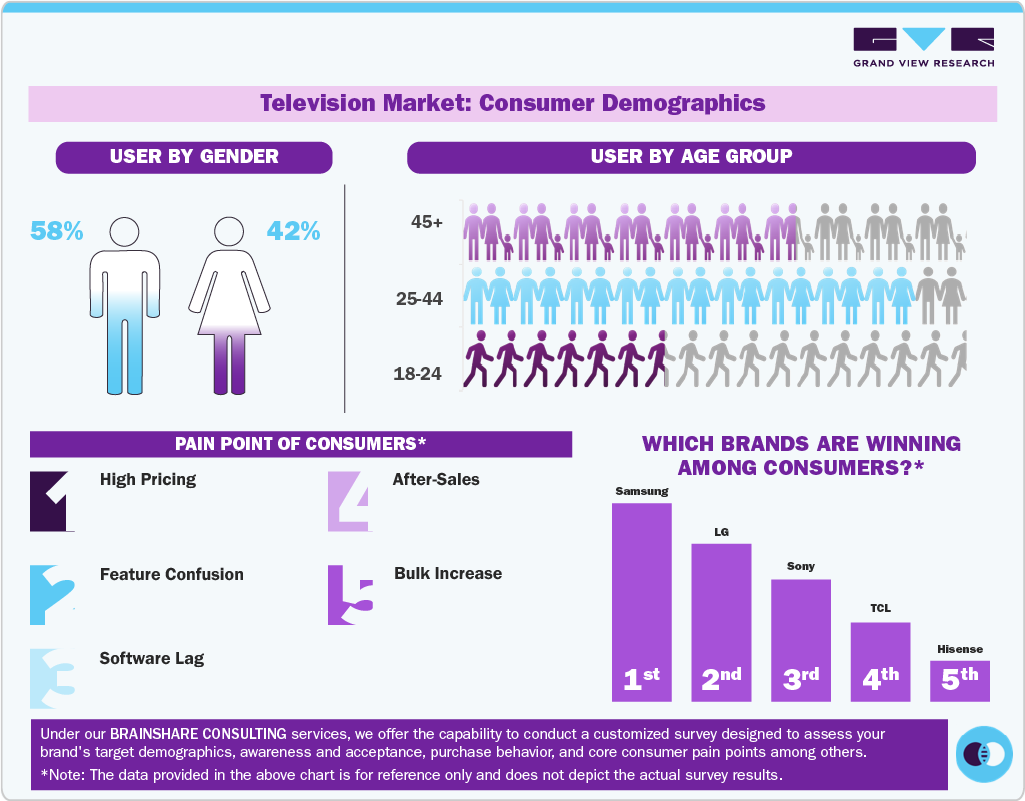

Consumer Insights

Globally, television purchasing is male-skewed, with men accounting for roughly 60% of buyers. This reflects higher male involvement in technical evaluation, specification comparison, and final transaction execution. Female buyers represent about 40%, with stronger influence on design, brand trust, and household fit, even when not the primary purchaser.

From an age perspective, 25-44-year-olds dominate TV purchases, contributing close to half of global demand. This cohort is driven by household formation, upgrades to larger or smarter screens, and higher disposable income. Buyers aged 45+ form a substantial secondary segment, largely replacement-driven and more inclined toward premium brands, while 18-24-year-olds represent a smaller share due to renting behavior, mobile-first media consumption, and budget constraints.

Key consumer pain points in TV purchases center on high pricing, feature confusion, and software-related issues. Many buyers struggle to differentiate between competing technologies, worry about product longevity, and express dissatisfaction with smart TV performance and after-sales support, making purchase decisions more complex and cautious.

In terms of brand performance, Samsung, LG, Sony, TCL, and Hisense are winning globally among consumers. These brands combine scale, technological credibility, broad price coverage, and strong retail presence, allowing them to capture both first-time and replacement buyers across developed and emerging markets.

Display Technology Insights

LED (Light Emitting Diode) TV held a market share of 57.35%% in 2025. LED TVs remain the most purchased globally as they offer good picture quality at accessible prices. In markets like India and Latin America, LED sets from brands such as Samsung, LG, and Hisense are preferred in mid-income households where value matters more than premium features. Retailers also bundle LED TVs with festival or sporting event promotions (e.g., soccer tournaments) and pay television market subscriptions, driving volume sales. LED TVs also serve as primary devices in the Internet Protocol Television market and for accessing television broadcasting services.

The OLED (Organic Light Emitting Diode) TV segment is anticipated to witness a CAGR of 5.5% from 2026 to 2033. OLED’s growth is fueled by rising premium demand and content quality improvements. Buyers in the U.S., Japan, and Western Europe are increasingly choosing OLED for its ability to deliver true blacks and contrast, particularly for cinema-grade viewing of streaming originals on platforms like Netflix and Disney+. Sony and LG’s aggressive OLED line expansions are pushing wider adoption beyond early adopters into luxury living rooms.

Screen Size Insights

Medium (32-55 inches) held a market share of 52.85% in 2025. Medium screens dominate because they fit typical living spaces in global urban and suburban homes — apartments in Seoul, Mumbai, and London alike. For many consumers, a 32” to 55” LED Smart TV strikes the right balance of price, seating distance, and content experience, making this range the workhorse segment for everyday use.

Large (55-75 inches) TV is anticipated to witness a CAGR of 5.5% from 2026 to 2033. Large TVs are growing fast as consumers increasingly treat the TV as a home entertainment centerpiece. With sharper 4K content widely available on Netflix, Amazon Prime, and YouTube, and with falling prices on 65-inch panels from TCL and Samsung, even mid-income buyers are upgrading to screens that provide cinema-like immersion in living rooms.

Features Insights

Smart TV held a market share of 83.37% in 2025. Smart TVs dominate because connectivity and app ecosystems now define value. Buyers expect instant access to OTT services, voice assistants, and firmware updates right out of the box. This trend is visible globally, from connected Android TVs in Indonesia to WebOS sets in the U.S., as consumers increasingly cut cords and rely on integrated streaming experiences.

Non-Smart TVs are anticipated to witness a CAGR of 4.6% from 2026 to 2033. Non-Smart TVs are growing in cost-sensitive or secondary room segments. For example, budget buyers purchasing a second set for bedrooms or guest rooms in Mexico or Egypt still favor basic TVs without smart features. Retail promotions and lower entry prices help sustain this segment, even as connectivity becomes standard elsewhere.

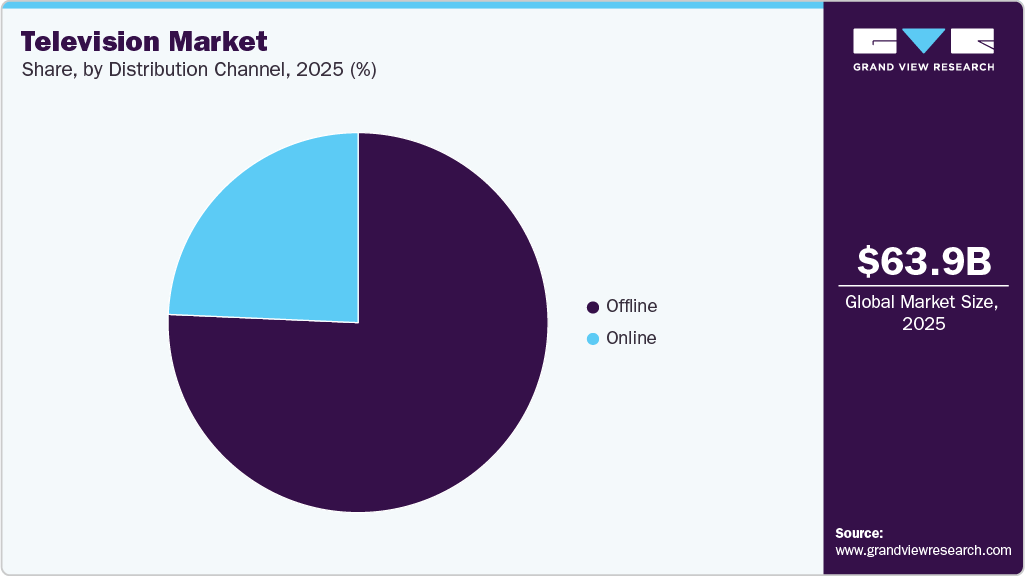

Distribution Channel Insights

The sale of television through offline channels accounted for 75.69% of the market. Offline remains dominant because many consumers still prefer touch-and-feel buying, especially for evaluating size and picture quality. In markets like India, China, and Brazil, large appliance showrooms and neighborhood electronics stores remain fundamental, as customers often want to see brightness, viewing angles, and UI responsiveness before making a purchase.

The sale of television through the online channel is expected to grow at a CAGR of 5.3% from 2025 to 2033. Online TV sales are growing rapidly due to improved e-commerce pricing, doorstep delivery, and seasonal sales. Platforms like Amazon, Flipkart, and JD.com frequently offer deep discounts and flexible returns, which attract tech-savvy buyers in urban centers across the U.S., Germany, and Southeast Asia, making online an increasingly important growth channel.

Regional Insights

The Asia Pacific television industry held a global revenue share of 40.23% in 2025. The region leads because it combines sheer volume with rapid value upgrading. Countries such as China, India, Indonesia, and Vietnam are seeing households move from basic or aging TVs to affordable smart and large-screen models, driven by aggressive pricing from TCL, Hisense, Xiaomi, and Samsung. Festival-led purchases (Diwali, Lunar New Year, Singles’ Day) and expanding broadband access mean TVs are bought not just for entertainment, but as central digital devices for streaming, gaming, and family viewing, sustaining high revenue contribution and supporting growth in the internet protocol television (IPTV) market.

India Television Market Trends

The India television market is expected to register a CAGR of 5.7% from 2026 to 2033. India’s market growth is driven by price-led upgrades and first-time smart TV adoption. Consumers are moving from 32” non-smart or HD sets to 43–55” smart 4K TVs, largely due to falling prices and local assembly reducing costs. Brands such as Xiaomi, Samsung, and TCL push feature-rich TVs below traditional price thresholds, while OTT platforms (Hotstar, YouTube, Netflix) make smart functionality a necessity rather than a luxury, accelerating replacement cycles and driving adoption of pay television market subscriptions in combination with streaming services.

North America Television Market Trends

The North America television market is anticipated to witness a CAGR of 4.8% from 2026 to 2033. North America’s growth is replacement-driven and premium-skewed, not volume-led. Consumers already own TVs, but are upgrading for larger screens, OLED/Mini-LED displays, and gaming-ready features such as high refresh rates and low latency. For example, households upgrade specifically for PlayStation/Xbox gaming or sports streaming in 4K, supporting steady growth despite market maturity.

The U.S. television market is expected to see a CAGR of 4.8% from 2026 to 2033. The U.S. market is driven by screen size inflation and ecosystem lock-in. Buyers increasingly replace functional TVs to move from 55” to 65” or 75” screens, supported by falling prices and strong retail financing. In addition, tight integration with streaming platforms, voice assistants, and smart-home ecosystems (Amazon Alexa, Google TV, Apple AirPlay) makes TVs a core connected-home hub, sustaining consistent upgrade demand even in a saturated market.

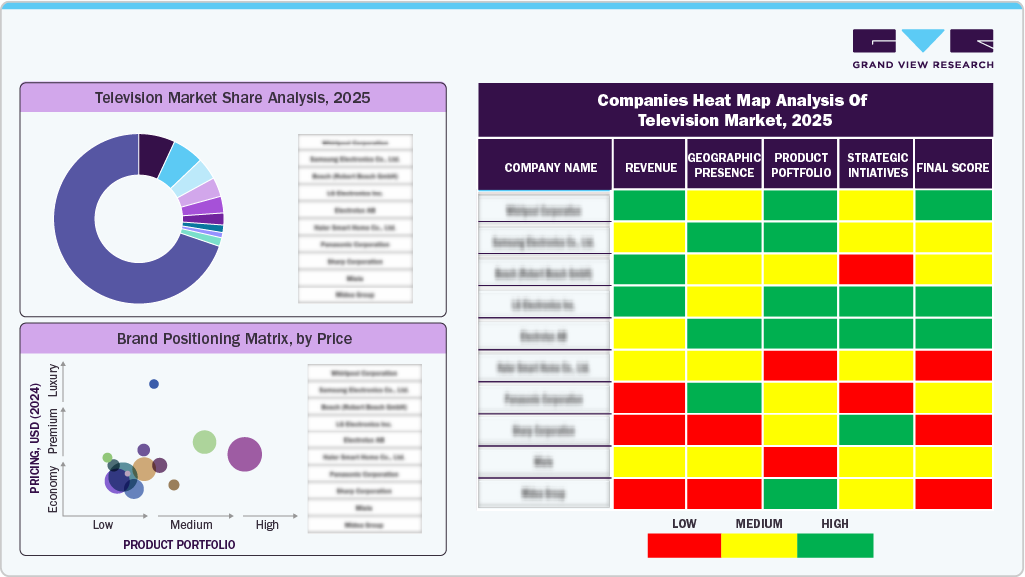

Key Television Company Insights

The global television industry includes a mix of long established technology leaders with value focused mass brands and fast growing regional players serving different price segments and usage needs. Market share is concentrated among a small group of global brands that combine scale display innovation and wide distribution.

Established companies such as Samsung LG and Sony lead the mid to premium segments through strengths in display technology brand trust and strong presence across offline retail and online platforms. Their growth is supported by replacement demand larger screen upgrades and premium feature adoption in developed markets.

Value oriented brands including TCL, Hisense, Xiaomi, and Vizio are gaining share quickly especially in Asia Pacific, Latin America, and parts of North America by offering competitively priced large screen smart TVs. This clear tiering between premium innovation mainstream reliability and value driven scale continues to shape competition in the global television industry.

Key Television Companies:

The following are the leading companies in the television market. These companies collectively hold the largest Market share and dictate industry trends.

- Samsung Electronics

- LG Electronics

- Sony Corporation

- TCL Electronics

- Hisense Group

- Xiaomi Corporation

- Panasonic Corporation

- Vizio Holding Corp

- Skyworth Group

- Sharp Corporation

Recent Developments

-

In December 2025, Samsung announced plans to launch a premium 115-inch Micro RGB TV, featuring micro-scale red, green, and blue LEDs that enable more precise color control, higher contrast, and superior picture accuracy compared to conventional LED TVs.

-

In August 2025, Panasonic launched the ShinobiPro MiniLED 4K TV series in India, featuring MiniLED backlighting, Google TV, Dolby Vision and Dolby Atmos, and gaming-ready performance. The launch highlights Panasonic’s push into the value-premium large-screen segment, targeting consumers seeking high contrast visuals and immersive home entertainment at competitive prices.

Television Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 66.79 Billion

Revenue forecast in 2033

USD 93.46 Billion

Growth Rate (Revenue)

CAGR of 4.9% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Display technology, screen size, features, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia & New Zealand ; South Korea; Brazil; South Africa

Key companies profiled

Samsung Electronics; LG Electronics; Sony Corporation; TCL Electronics; Hisense Group; Xiaomi Corporation; Panasonic Corporation; Vizio Holding Corp; Skyworth Group; Sharp Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Television Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global television market report based on display technology, screen size, features, distribution channel, and region:

-

Display Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

LED (Light Emitting Diode)

-

OLED (Organic Light Emitting Diode)

-

QLED (Quantum Dot LED)

-

LCD (Liquid Crystal Display)

-

-

Screen Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small (<32 inches)

-

Medium (32-55 inches)

-

Large (55-75 inches)

-

Extra-large (>75 inches)

-

-

Features Outlook (Revenue, USD Million, 2021 - 2033)

-

Smart

-

Non-Smart TV

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Electronics stores

-

Hypermarkets

-

Specialty stores

-

Others

-

Online

-

E-commerce

-

Brand websites

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global television market size was estimated at USD 259.16 billion in 2021 and is expected to reach USD 283.64 billion in 2022.

b. The global television market is expected to grow at a compound annual growth rate of 10.0% from 2022 to 2028 to reach USD 504.52 billion by 2028.

b. Asia Pacific dominated the television market with a share of 39.8% in 2021. This is attributable to the rising demand for smart TVs from developing countries coupled with the increasing middle-class population and rising disposable income.

b. Some key players operating in the television market include Samsung Electronics Co. Ltd.; Sony Corp.; LG Electronics, Inc.; Toshiba Corp.; Haier Electronics Group Co., Ltd.; VIZIO, Inc.; Videocon Industries Ltd.; and Sansui Electric Co. Ltd.

b. Key factors that are driving the television market growth include rising demand for smart TVs in developing regions, such as the Asia Pacific, growing working population, increasing urbanization, and a rise in disposable incomes along with changing lifestyles across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.