- Home

- »

- Next Generation Technologies

- »

-

Field Device Management Market Size, Industry Report 2030GVR Report cover

![Field Device Management Market Size, Share & Trends Report]()

Field Device Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software), By Deployment (On-premise, Cloud), By Industry, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-913-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Field Device Management Market Trends

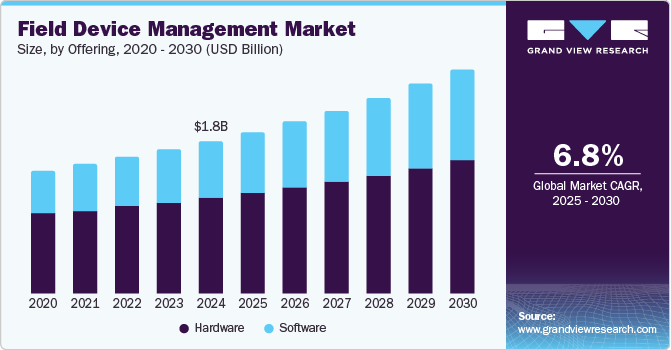

The global field device management market size was valued at USD 1.83 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. The rapid shift from conventional technologies to automated and smart technologies is a primary factor influencing market expansion. Growing proliferation of smart factories across developed and emerging economies, coupled with the popularity and adoption of Industry 4.0 in several verticals, is expected to drive significant demand for field device management (FDM) solutions. The steadily growing automotive and manufacturing industries require FDM systems due to mass production that necessitates their usage to lower operational and maintenance costs. By collecting data from field devices in real time, such as temperature, pressure, vibration, and flow measurements, these solutions analyze trends and predict when a device is likely to fail. This reduces unplanned downtime, extends the lifespan of equipment, and allows for maintenance to be scheduled only when needed, minimizing unnecessary repairs.

The FDM solutions are being highly adopted for the development of smart factories and another industrial internet of things (IIoT) based applications, which is providing a huge scope for the growth of this market. IIoT assists manufacturers with efficient and high-speed systems at reduced prices, which influences the demand for these solutions/ services positively as it requires the integration of such advanced systems for enhanced automation. Automation companies are focusing on investments in IIoT applications development to implement industry 4.0 and support full automation in their industries. Thus, the surge in IIoT applications creates a huge demand for field device management solutions.

There has been a rise in the investment among various industries in smart devices, which is influencing the need for FDM systems. To deal with bulk productions, smarter machines have been introduced to increase work flexibility and reduce manual tasks and complexities in the processes. Thus, FDM systems help with the minimization of manual tasks and configuration of smart devices and tools remotely, which complements the growing digitalization and usage of smart devices in manufacturing and other automation processes. These factors have fueled the growth of the field device management market across the globe with a healthy CAGR in the Asia-Pacific region.

Since connectivity among devices is an essential part of the manufacturing process, field/ site device management plays a vital role in industrial automation and smart factories. Growth in smart factories directly drives the growth of the FDM market, such as cyber-physical production systems are implemented in smart factories for providing management in real-time. Major companies working on automation are using FDM-based software for better software management and central management with reduced operational and maintenance costs. Companies get better business mobility and compliance with secure enterprise mobility and field device management.

Offering Insights

The hardware segment accounted for a leading revenue share of 62.7% in 2024 and is expected to maintain its position in the coming years. These components are designed to support the integration, monitoring, control, and optimization of field devices in a wide range of industrial environments. Additionally, they help ensure real-time data collection, predictive maintenance, safety, and operational efficiency. By leveraging advanced sensors, controllers, communication systems, and data analytics platforms, FDM solutions provide companies with a powerful resource to reduce costs, enhance productivity, and extend the lifespan of their critical assets. Sensors are notable field devices that measure various physical parameters, such as temperature, pressure, flow, level, vibration, and chemical composition, and convert them into electronic signals. Meanwhile, actuators physically alter a process or system based on signals from controllers and can control valves, motors, pumps, or switches. Apart from these, other components such as communication hardware, data acquisition systems, and power supply and backup are included in this segment.

The software segment is expected to witness fastest CAGR during the forecast period. The demand for FDM software has been growing significantly across major industries, aided by technological advancements, operational challenges, and the need for increased efficiency in managing a wide range of field devices. This demand is especially high in sectors that rely heavily on industrial automation, process control, and asset management, such as oil & gas, energy, manufacturing, utilities, and chemical processing. Businesses are increasingly focusing on Asset Performance Management (APM) to get the most value from their assets. FDM software plays a crucial role in managing the entire lifecycle of assets, from installation and commissioning to ongoing operation and decommissioning. By using FDM software for asset tracking, performance analysis, and failure prediction, businesses can optimize asset utilization, improve decision-making, and extend the useful life of field devices.

Deployment Insights

The on-premise segment accounted for a larger revenue share in the global market in 2024. This deployment mode provides a range of advantages for businesses, including robust data security, better control over data management, and improved regulatory compliance. Additionally, the presence of legal and regulatory requirements that mandate the restricted availability of data related to critical infrastructure or sensitive operations within a specific geographic region also drives segment demand. On-premise solutions also ensure that the data generated by field devices is processed locally, reducing the time required to gather this data and take the required actions. This is particularly important in environments that require real-time decision-making, such as in manufacturing plants, chemical processing, or energy grids. Furthermore, on-premise FDM solutions can continue to function even without a constant internet connection, ensuring that operations are not interrupted by connectivity issues in remote locations such as offshore oil rigs and mining operations.

The cloud segment is anticipated to advance at a faster CAGR from 2025 to 2030. This deployment model involves software platforms that manage, monitor, and optimize field devices such as sensors, actuators, and controllers via cloud infrastructure. These solutions allow for centralized data storage, remote monitoring, real-time analytics, and system management, all of which are accessible through the Internet, typically using a web interface or mobile application. Cloud-based FDM solutions are especially appealing for industries that prioritize flexibility, scalability, and real-time access to device performance data. In utilities and energy distribution, they are used to manage smart grids by collecting data from sensors and meters distributed across the grid and analyze performance to optimize energy distribution, detect faults, and predict equipment failures.

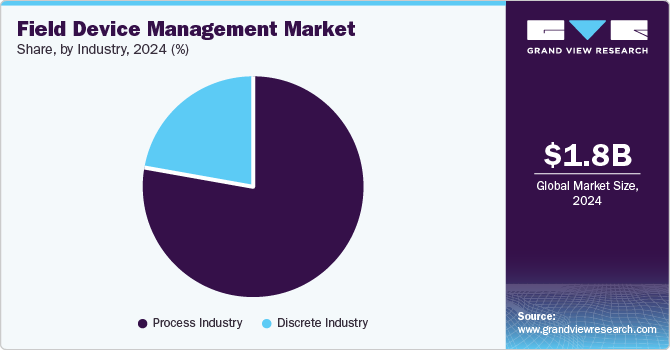

Industry Insights

The process industry segment accounted for the largest revenue share in 2024 and is further expected to advance at the fastest CAGR during the forecast period. Process industry includes verticals such as pharmaceuticals, chemicals, food & beverages, oil & gas, and energy & utilities, among others. As these industries require the deployment of critical monitoring and control systems, a number of smart field devices and sensors are being introduced for data analysis. The energy & utilities industry accounted for a leading revenue share among process industries, as FDM solutions play a critical role in ensuring the effective management, monitoring, and optimization of various devices and assets across infrastructure. Predictive maintenance is another major use case for FDM in this sector, as the software can collect data from field devices, analyze performance trends, and predict when maintenance or replacement will be required before an asset fails.

Meanwhile, the discrete industry segment is anticipated to witness moderate growth during the forecast period. Discrete industries, including sectors such as automotive, manufacturing, and aerospace & defense, are characterized by high precision, complexity in manufacturing processes, and the need for equipment that operates reliably and efficiently. Field devices such as sensors, actuators, controllers, measurement devices, and other connected assets are integral to these processes, and effective management of these devices can lead to significant improvements in productivity and cost control. Discrete manufacturing often involves managing a vast array of components, subassemblies, and finished products. Effective asset management and traceability are critical in ensuring quality control, especially when managing multiple devices across global supply chains. FDM solutions help provide visibility into the operational status of field devices, both on-site and across the supply chain. By ensuring devices are properly maintained and that performance data is logged, FDM systems can support track-and-trace capabilities for key components and assemblies, ensuring regulatory compliance and aiding in quality assurance processes.

Regional Insights

North America accounted for a notable revenue share of the global market in 2024. The regional market is expanding at a steady CAGR, aided by the transition to smart manufacturing that has necessitated the use of automation and digital management systems in industries. The U.S. and Canada have been early adopters of advanced industrial technologies. FDM solutions are crucial to maintain and optimize the performance of field components such as sensors, controllers, and other IoT-enabled devices that are vital in industries such as manufacturing, energy, and utilities. Utilities in the region are investing heavily in modernizing their electrical grids by incorporating smart meters, sensors, and other smart devices. FDM solutions are critical in managing these field devices, ensuring real-time monitoring, data collection, and efficient operation of the grid.

U.S. Field Device Management Market Trends

The U.S. accounted for a leading revenue share in 2024, aided by the extensive industrialization in the economy, presence of major market competitors, and technical knowledge regarding these systems. Industrial sectors in the country, particularly manufacturing, energy, and oil & gas, are increasingly adopting predictive maintenance strategies to reduce downtime and prevent costly unplanned maintenance.

Asia Pacific Field Device Management Market Trends

Asia Pacific led the market with 37.6% of the global revenue share in 2024. The demand for Field Device Management (FDM) solutions in this region is growing rapidly, driven by a combination of technological advancements, industrial growth, and the increasing need for operational efficiency and safety across a variety of industries. Regional markets such as India and China have emerged as global manufacturing hubs in recent years, owing to favorable government initiatives and presence of a skilled workforce. As industries scale up and become more automated, there has been a growing need to monitor and manage a large number of field devices efficiently. FDM solutions enable companies to control and troubleshoot their devices remotely, improving efficiency and reducing downtime. Additionally, with the region’s increasing focus on sustainable energy and carbon reduction, industries such as energy production, oil & gas, and utilities are increasingly adopting FDM solutions to improve energy efficiency.

China accounted for a leading revenue share in 2024 and is expected to maintain its position in the coming years. The fast pace of industrial development in the economy, technological advancements, and growing focus on operational efficiency have necessitated the deployment of field device management solutions to ensure smooth operations and minimize downtime. As China remains a global leader in terms of manufacturing, there is an increasing need for advanced field device management tools to handle various industrial devices used in manufacturing processes. These include sensors, actuators, temperature controllers, flow meters, and pressure transmitters. FDM solutions help manufacturers ensure that these devices are monitored, maintained, and optimized for maximum efficiency.

Middle East & Africa Field Device Management Market Trends

The MEA region is anticipated to emerge as the second-fastest-growing market during the forecast period. The well-developed oil & gas sector is a major driver of field device management solutions, as regional economies have some of the largest oil and gas reserves in the world. Field devices such as pressure sensors, flow meters, and safety valves are integral to operations in upstream (exploration and production), midstream (transportation), and downstream (refining) processes.

Key Field Device Management Company Insights

Vendors in the market are focusing on increasing the customer base to gain a competitive edge in the market. Therefore, vendors are collaborating with various associations to increase the consumer base. For instance, in October 2018, Emerson Electric Co. acquired General Electric’s intelligent platform business, to expand its consumer base in industrial automation across process industries. Both Intelligent Platforms and Emerson have been focused on leverage automation technologies to drive digital transformation. In July 2018, ABB completed the acquisition of General Electric industrial solutions, to expand its access to the North American market.

-

Schneider Electric is a multinational organization specializing in energy management and digital automation solutions. The company offers a suite of Field Device Management (FDM) solutions as part of its Industrial Automation and Control portfolio. These solutions are designed to improve the reliability, efficiency, and performance of field devices such as sensors, actuators, controllers, and other instruments. Schneider Electric’s EcoStruxure Asset Advisor is a cloud-based monitoring platform that provides real-time visibility and advanced analytics for field devices and assets. It enables industries to improve their asset performance, reduce unplanned downtime, and streamline maintenance operations. Through these solutions, the company caters to sectors such as oil & gas, water treatment, manufacturing, and power distribution.

-

Emerson Electric is a U.S.-based multinational company that develops industrial automation solutions, precision measurement instruments, and climate control systems. The company also provides engineering services and software engineering solutions for consumer, industrial, and commercial markets. The company’s field device management offerings come under the automation solutions division and include asset management software and field communicators. The Emerson AMS Device Manager simplifies the management of all devices across multiple sites, providing a unified approach to configuration, diagnostics, calibration, and lifecycle management of field instruments. These solutions cater to multiple verticals, including manufacturing, oil & gas, and energy & utilities, among others.

Key Field Device Management Companies:

The following are the leading companies in the field device management market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Emerson Electric Co.

- Siemens

- Honeywell International Inc.

- Rockwell Automation

- Yokogawa Electric Corporation

- OMRON Corporation

- Mitsubishi Electric Corporation

- FANUC CORPORATION

- Metso

- Valmet

- Schneider Electric

- Azbil Corporation

- Hamilton Company

- Phoenix Contact

Recent Developments

-

In October 2024, Siemens announced the launch of the SIRIUS 3RC7 intelligent link module that has been developed to boost data transparency in industrial automation. The expansion module combines operational technology (OT) and information technology (IT) that would enable efficient utilization of data available at load feeders.

-

In August 2024, Emerson introduced the Rosemount 802 Wireless Multi-Discrete Input or Output Transmitter that allows remote control of field assets to reduce costs, increase productivity, and improve safety.

Field Device Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.95 billion

Revenue Forecast in 2030

USD 2.70 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Offering, deployment, industry, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

ABB; Emerson Electric Co.; Siemens; Honeywell International Inc.; Rockwell Automation; Yokogawa Electric Corporation; OMRON Corporation; Mitsubishi Electric Corporation. FANUC CORPORATION; Metso; Valmet; Schneider Electric; Azbil Corporation; Hamilton Company; Phoenix Contact

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Field Device Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global field device management market report based on offering, deployment, industry, and region.

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Discrete Industry

-

Manufacturing

-

Automotive

-

Aerospace & Defense

-

-

Process Industry

-

Energy & Utilities

-

Metals & Mining

-

Oil & Gas

-

Food & Beverages

-

Chemicals

-

Pharmaceuticals

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.