- Home

- »

- Network Security

- »

-

File Integrity Monitoring Market Size, Industry Report, 2030GVR Report cover

![File Integrity Monitoring Market Size, Share & Trends Report]()

File Integrity Monitoring Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Installation, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-171-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

File Integrity Monitoring Market Size & Trends

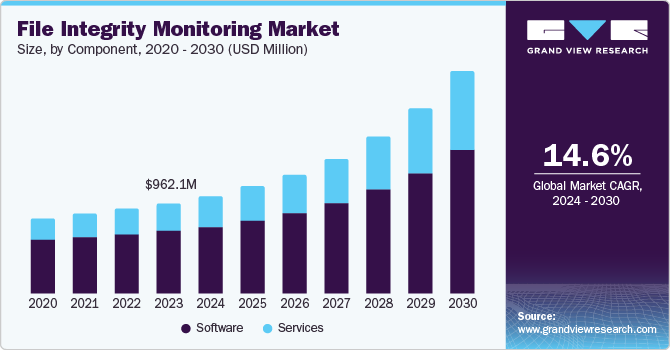

The global file integrity monitoring market size was valued at USD 962.1 million in 2023 and is projected to grow at a CAGR of 14.6% from 2024 to 2030. The rising number of cyberattacks and data breaches in various organizations requires file integrity monitoring (FIM) software to identify unauthorized file modifications. The major factor contributing to the market growth is the escalating occurrence of cyber threats and data breaches. Organizations rely more on digital data and safeguarding sensitive information from unauthorized access, modifications, or deletions. Furthermore, FIM solutions provide a strong mechanism to identify and prevent various sectors from such incidents, protecting essential assets.

The growing intricacy of IT environments, driven by cloud integration, virtualization, and the rise of Internet of Things (IoT) devices, has intensified the difficulties in maintaining data integrity. FIM tools provide a thorough method for supervising and controlling changes to files within various IT systems, guaranteeing the consistency and reliability of data. Moreover, integrating artificial intelligence (AI), machine learning (ML), and multi-factor authentication with file integrity monitoring technology has propelled the market.

The growing number of regulations, such as HIPAA (Health Insurance Portability and Accountability Act), GDPR (General Data Protection Regulation), and PCI DSS (Payment Card Industry Data Security Standard), is focusing more on data security and responsibility. FIM solutions are essential in helping organizations meet stringent requirements by providing data that is protected from unauthorized modifications and ensuring compliance with industry regulations. Furthermore, the strict regulations regarding data security in developing countries such as India, China, and Japan are further propelling the demand to adopt FIM solutions in organizations.

Component Insights

The software segment dominated the market with a revenue share of 69.1% in 2023. Software-based FIM solutions provide excellent scalability, flexibility, and seamless integration with other security tools, allowing customization to various organizational requirements. In addition, the lower cost of ownership of software solutions and simpler maintenance compared to hardware-based alternatives make them a more appealing option for businesses of all sizes. The software sector in the FIM market has experienced substantial growth and dominated the market due to factors such as the rising complexity of IT environments and the increasing demand for strong data protection.

The services segment is expected to grow at the fastest CAGR of 16.8% over the forecast period. Organizations face complex IT environments, increased security threats, and regulatory compliance mandates. As a result, they turn to service providers for guidance, implementation, and continuous management of FIM solutions. These services, including consulting, deployment, integration, and support, equip organizations with the expertise needed to safeguard their crucial data, mitigate risks, and meet industry standards for compliance. The growing complexity of FIM technologies and the need for ongoing updates and maintenance drive the demand for specialized services, leading to substantial growth in the sector.

Installation Insights

The agent-based segment dominated the market with a revenue share of 64.9% in 2023 attributed to its superior performance and flexibility. Agent-based solutions deploy agents on individual systems to monitor and detect real-time file changes. This approach offers detailed insight into file activity, allowing organizations to detect and address security risks promptly. In addition, agent-based solutions are more scalable and adaptable to diverse IT environments, making them suitable for organizations with complex infrastructures. The ability to customize agent behavior and configurations further enhances the effectiveness of agent-based FIM solutions, contributing to their market dominance.

The agentless segment is expected to register the fastest CAGR of 14.6% over the forecast period owing to its ease of deployment and reduced overhead. Agentless solutions do not require the installation of agents on individual systems, simplifying the deployment process and minimizing resource consumption. This feature especially appeals to companies needing more IT resources or dealing with difficulties in agent management. In addition, agentless solutions often provide centralized monitoring and management, offering a more efficient approach to file integrity monitoring. The agentless segment is anticipated to grow further in the FIM market as organizations aim to streamline security operations and reduce expenses.

Deployment Insights

The cloud segment dominated the market with a revenue share of 57.0% in 2023. The increasing adoption of cloud-based computing and its advantages are the factors driving the dominance of the cloud segment in the file integrity monitoring (FIM) market. Cloud-based FIM solutions are easy to install and require minimal maintenance, making them a popular option for organizations of all sizes. In addition, cloud providers often offer pre-configured FIM solutions with built-in best practices, simplifying deployment and reducing the risk of human error. The growing adoption of cloud services has fueled the demand for cloud-based FIM solutions, contributing to their market growth.

The on-premise sector is projected to grow with a significant CAGR over the forecast period due to the growing need for data sovereignty and control. Organizations in industries with strict compliance requirements, such as healthcare and finance, often opt for premise deployment to maintain their data and ensure compliance with local regulations and data privacy laws. Moreover, certain organizations might also have reservations regarding data security and privacy while storing sensitive data in cloud storage. As organizations emphasize data sovereignty and control, the on-premise segment is expected to experience significant expansion.

Enterprise Insights

The large enterprise segment dominated the market in 2023. The factors contributing to the segment dominance are the intricate IT setups, strict regulatory compliance, and the significant amount of sensitive data managed by these companies. It can be challenging for big companies to oversee and secure data across multiple systems and sites due to their extensive IT infrastructures. Furthermore, the increased requirement to adhere to regulations specific to certain industries has intensified the demand for strong FIM solutions to protect confidential data and reduce risks. In addition, large enterprises' significant amount of data processing increases their susceptibility to cyber-attacks, further driving the need for effective FIM solutions in large enterprises.

The SMEs segment is expected to register the fastest CAGR of 15.5% during the forecast period. The expected growth in cybersecurity is due to the increasing awareness of cybersecurity threats and the expanded use of digital technologies. Small and medium-sized enterprises recognize the importance of protecting sensitive information from cyber-attacks as they increasingly utilize digital tools and services. The rising costs of data breaches and an increasingly stringent regulatory environment, make it essential for SMEs to implement robust cybersecurity strategies, such as file integrity monitoring (FIM), to drive this recognition. The growth in this segment is also fueled by the affordability of FIM solutions and the availability of cloud-based options, which make it more convenient for SMEs to adopt these crucial security measures.

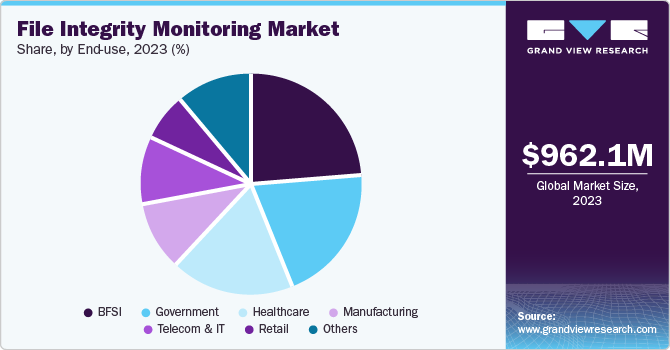

End-use Insights

The BFSI segment accounted for the largest revenue share of 24.4% in 2023. The importance of safeguarding customer data, detecting financial scams, and meeting regulatory requirements such as GDPR, HIPAA, and PCI DSS has turned FIM into a crucial asset for BFSI companies. The vast amount of data these organizations manage and the rising complexity of cyber threats have increased the need for strong FIM solutions to protect sensitive data and reduce risks, driving the BFSI segment in the FIM market.

The healthcare sector is projected to grow at the fastest CAGR over the forecast period due to the growing dependency on electronic health records (EHRs) and the increased importance of protecting patient information. The increasing use of EHRs has led to a large quantity of sensitive patient data that needs to be protected from unauthorized access, alteration, or disclosure. Furthermore, the healthcare industry is subject to strict regulations such as HIPAA that mandate organizations to have strong data security measures to protect patient confidentiality. These factors have led to a notable rise in the healthcare industry's demand for file integrity monitoring (FIM) solutions.

Regional Insights

North America file integrity monitoring market dominated the global industry in 2023 with a revenue share of 36.6% due to its strong cybersecurity awareness. Strict regulations regarding the use of FIM solutions further drove market growth. North America, a pioneer in adopting technologies, has a strong presence of companies providing FIM solutions. Furthermore, the region's well-developed IT infrastructure facilitates easier integration and implementation of FIM solutions.

U.S. File Integrity Monitoring Market Trends

The U.S. file integrity monitoring market dominated North America in 2023 due to its strong presence of cybersecurity professionals. This results in a higher adoption rate of FIM solutions. In addition, the U.S. is quick to embrace new technologies, providing numerous growth opportunities to local FIM solution providers.

Europe File Integrity Monitoring Market Trends

The European file integrity monitoring market was identified as a lucrative region in 2023. Organizations are becoming more aware of the importance of data privacy and cyber security threats. The region has strict regulations regarding cyber security. Europe is a developed economy with various businesses. These organizations require advanced cyber security solutions such as FIM.

The UK file integrity monitoring market is expected to grow rapidly in the coming years, as the region has a well-developed financial services sector and requires strong data security solutions. The UK has data protection laws, such as GDPR (General Data Protection Regulation), and involves file integrity monitoring solutions, driving the country's market growth.

Asia Pacific File Integrity Monitoring Market Trends

Asia Pacific file integrity monitoring market is expected to grow with the fastest CAGR over the forecast period. The region has witnessed a rise in cyberattacks in the last few years, which has created a strong demand for FIM solutions. Major Asian countries mandatorily implement data security regulations; therefore, file integrity monitoring solutions are highly adopted. There is a rise in awareness of cyber security threats, which leads to a higher demand for security measures.

China held a substantial market share in 2023 due to its growing economy and significant advancements in information technology, finance, and manufacturing. The country needs strong cyber security solutions for its industries. The increasing cyberattacks, data security breaches, and online threats drive the demand for file integrity monitoring solutions.

Key File Integrity Monitoring Company Insights

Some key companies in the file integrity monitoring market include McAfee, LLC, Trend Micro Incorporated, AlienVault, Inc., TrustWave Holdings, Inc., Cimcor, Inc., Ionx Solutions LLP, and others. Companies focus on increasing their customer base to gain a competitive advantage in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

McAfee, LLC, is a computer security firm that provides anti-virus and anti-malware protection software, network, cloud defense, database security solutions, endpoint security, risk and compliance, and security information management services. McAfee's consumer base includes small and large enterprises, government agencies, and others.

-

Qualys, Inc. provides solutions for managing security risks and ensuring compliance in information technology. The Company offers products for identifying vulnerabilities, policy compliance, scanning web applications, detecting malware, and other related security products.

Key File Integrity Monitoring Companies:

The following are the leading companies in the file integrity monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- McAfee, LLC

- Trend Micro Incorporated

- AlienVault, Inc.

- TrustWave Holdings, Inc.

- Cimcor, Inc.

- Ionx Solutions LLP

- Qualys, Inc.

- Securonix

- AT&T Intellectual Property

- Software Diversified Services

- SolarWinds Worldwide, LLC.

- Splunk Inc.

- LogRhythm, Inc.

- IBM Corporation

- NewNet

Recent Developments

-

In August 2023, LogRhythm integrated its Security Information and Event Management (SIEM) platform with Cimcor's CimTrak file integrity monitoring solution. This collaboration enables users to comprehensively monitor the integrity of a diverse range of assets, including physical, virtual, hybrid, air-gapped, and cloud-based systems, as LogRhythm highlights.

-

In May 2023, LogRhythm announced partnerships with Mimecast to incorporate its email security capabilities into LogRhythm's Smart Response security orchestration, automation, and response (SOAR) solution. This integration empowers security teams to identify threats, gain better insight into their email system, and identify email-related risks faster and more efficiently.

-

In February 2023, Trend Micro Corporation collaborated with LogRhythm to help the security team speed up threat detection and response. The incorporation enables security teams to utilize the LogRhythm SIEM platform to collect and analyze logs from the Trend Micro Vision One solution.

File Integrity Monitoring Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.04 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, installation, deployment, enterprise, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

McAfee, LLC; Trend Micro Incorporated; AlienVault, Inc.; TrustWave Holdings, Inc.; Cimcor, Inc.; Ionx Solutions LLP; Qualys, Inc.; Securonix; AT&T Intellectual Property; Software Diversified Services; SolarWinds Worldwide, LLC.; Splunk Inc.; LogRhythm, Inc.; IBM Corporation; NewNet

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global File Integrity Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global file integrity monitoring market report based on component, installation, deployment, enterprise, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

Agent-based

-

Agentless

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

BFSI

-

Government

-

Retail

-

Telecom and IT

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.