- Home

- »

- Medical Devices

- »

-

Fill-finish Pharmaceutical Contract Manufacturing Market Report, 2030GVR Report cover

![Fill-finish Pharmaceutical Contract Manufacturing Market Size, Share & Trends Report]()

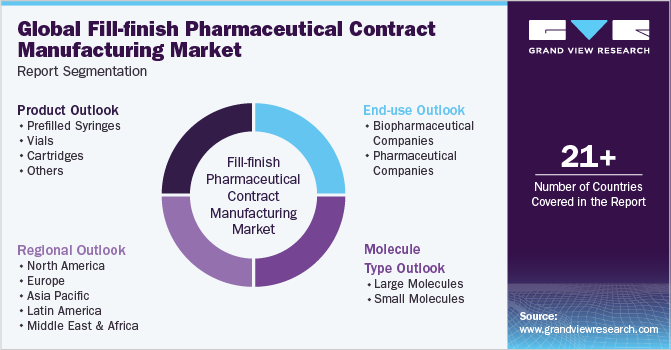

Fill-finish Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis Report By Product (Prefilled Syringes, Vials, Cartridges), By Molecule (Large, Small), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-949-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

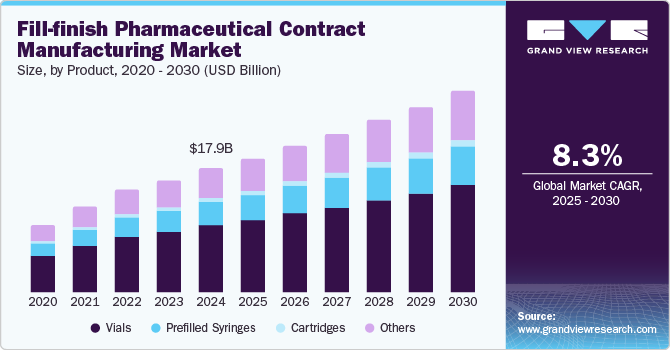

The global fill-finish pharmaceutical contract manufacturing market size was estimated at USD 17.95 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. A prominent trend driving market growth is the increasing outsourcing of fill-finish operations by pharmaceutical companies. By contracting these specialized services to contract manufacturers (CMOs), companies can concentrate on their core competencies, including drug discovery and development. This outsourcing strategy mitigates operational risks and helps in reducing overall investment costs, allowing firms to remain competitive in a rapidly evolving market environment.

The escalating demand for injectable drugs, driven by the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions affecting millions worldwide, is significantly increasing the need for efficient fill-finish services. In Mexico, approximately 70.9% of the 128 million population is covered by health services, signifying a growing pharmaceutical market. Concurrently, in Asia Pacific, India, and China’s healthcare expenditures have surged, with China reaching 6.6% of GDP, highlighting the urgency for reliable fill-finish service providers post-COVID-19.

Technological advancements in fill-finish manufacturing processes are significantly enhancing efficiency and quality, positively impacting the market. Continuous improvements allow for handling complex biologics while ensuring compliance with rigorous regulatory standards. For instance, in June 2024, Lonza introduced the Capsugel Enprotect size 9 capsule, streamlining pre-clinical testing of acid-sensitive APIs in rodents and expediting drug development timelines. Furthermore, regulatory bodies, including the NMPA in China and ANMAT in Argentina, are accelerating approval processes, thereby improving overall market dynamics.

Moreover, the burgeoning market growth of biologics, particularly monoclonal antibodies and vaccines, necessitates specialized fill-finish services that can support large volume production of high-potency products. Collaborative efforts between local pharmaceutical companies and international CMOs are essential in addressing the escalating demand within emerging markets, particularly notable in regions such as Saudi Arabia and India, where public investments in healthcare infrastructure are on the rise. For instance, in June 2023, Saudi Arabia’s Public Investment Fund launched Lifera, a CDMO focused on local biopharmaceutical manufacturing, aiming to enhance domestic capacity and secure the supply of essential medicines in alignment with the country’s Vision 2030. Strategic alliances formed amid these regulatory reforms will ultimately foster innovation and efficiency, positioning the fill-finish pharmaceutical contract manufacturing sector for sustained growth in the coming years.

Product Insights

Vials dominated the market and accounted for a share of 53.4% in 2024, fueled by the rising production of biologics, primarily packaged in vials for enhanced safety and efficacy. Advancements in vial filling technologies and the heightened demand for injectable drugs, especially during the COVID-19 pandemic, have led pharmaceutical companies to outsource fill-finish operations, increasing demand for vial packaging solutions.

Prefilled syringes are expected to grow at the fastest CAGR of 9.3% over the forecast period. Prefilled syringes improve patient safety by reducing dosing errors and contamination risks while enhancing convenience for healthcare providers and patients. The increasing incidence of chronic illnesses demands precise medication administration, and the trend toward self-administration of injectable therapies further elevates the appeal of prefilled syringes in contemporary pharmaceutical practices. For instance, in October 2024, MabPlex launched a pre-fillable syringe production line, enhancing service flexibility and competitiveness in the CDMO market, with plans for additional options by Q2 2025.

Molecule Insights

Large molecules led the market with a revenue share of 67.3% in 2024, attributed to the expanding development of biologics and monoclonal antibodies commonly delivered through injectables. This growth addresses unmet medical needs and complex diseases while increased approvals for large molecule therapeutics and the outsourcing of fill-finish operations to specialized manufacturers enhance efficient production and timely market entry.

Small molecules are projected to grow rapidly over the forecast period. The development of small molecule drugs has significantly increased, driven by their cost-effectiveness and efficacy in treating diseases such as cancer and diabetes. This segment benefits from a strong pipeline of late-stage clinical products, while pharmaceutical companies increasingly outsource fill-finish operations to specialized manufacturers for enhanced production efficiency.

End Use Insights

Biopharmaceutical companies held the largest revenue share of 55.3% in 2024, fueled by the swift development of drugs and vaccines addressing emerging health challenges. The demand for efficient, scalable manufacturing solutions for biologics and injectables drives biopharmaceutical companies to outsource fill-finish operations to specialized manufacturers, ensuring high-quality production while maintaining focus on drug discovery.

Pharmaceutical companies are anticipated to grow lucratively over the forecast period. Pharmaceutical companies are progressively outsourcing fill-finish operations to specialized contract manufacturers to concentrate on core competencies such as drug discovery and development. This trend, driven by the need for efficient, scalable manufacturing of injectable drugs and biologics, also reduces investment costs and accelerates time-to-market for new therapies.

Regional Insights

North America fill-finish pharmaceutical contract manufacturing market dominated the global market with a revenue share of 34.9% in 2024. The region’s emphasis on biologics and advanced drug development, alongside the growing trend of outsourcing manufacturing operations, has improved efficiency and reduced costs. Furthermore, the escalating demand for vaccines and monoclonal antibodies has driven growth, supported by stringent regulatory standards that uphold high-quality manufacturing in North America.

U.S. Fill-finish Pharmaceutical Contract Manufacturing Market Trends

The fill-finish pharmaceutical contract manufacturing market in the U.S. dominated the North America market with a revenue share of 88.3% in 2024. The country accommodates numerous leading pharmaceutical companies that outsource fill-finish processes to specialized contract manufacturers, enabling a focus on core activities such as drug discovery. The U.S. market advantages from advanced technologies and a skilled workforce, supporting compliance with rigorous regulatory standards and increasing demand for injectable drugs and biologics.

Europe Fill-finish Pharmaceutical Contract Manufacturing Market Trends

Europe fill-finish pharmaceutical contract manufacturing market held a substantial market share in 2024, aided by heightened demand for biologics and the expiration of major biologic product patents, prompting increased production by generic firms. Enhanced research and development efforts, particularly following health crises, have accelerated fill-finish manufacturing,

The fill-finish pharmaceutical contract manufacturing market in the UK is expected to grow in the forecast period. The UK government’s commitment to innovation and research creates a favorable environment for pharmaceutical development. Numerous leading CMOs offering specialized fill-finish services, coupled with a growing emphasis on biologics and personalized medicine, drive demand for efficient, high-quality production solutions that meet regulatory standards.

Asia Pacific Fill-finish Pharmaceutical Contract Manufacturing Market Trends

The Asia Pacific fill-finish pharmaceutical contract manufacturing market is expected to register the fastest growth over the forecast period. The region capitalizes on lower labor costs and a growing number of CMOs serving both domestic and international markets. The increasing prevalence of chronic diseases drives demand for efficient drug delivery systems, with India and China emerging as key players in pharmaceutical manufacturing, meeting global standards.

The fill-finish pharmaceutical contract manufacturing market in China is expected to grow at the fastest rate of 9.8% over the forecast period in the Asia Pacific market. The swift growth of local pharmaceutical companies embracing international quality standards bolsters production capabilities. Furthermore, China’s escalating healthcare demands and rising interest in biologics propel market expansion. Both domestic firms and multinational corporations are establishing state-of-the-art manufacturing facilities to meet these evolving needs.

Key Fill-finish Pharmaceutical Contract Manufacturing Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc., Sartorius AG, Boehringer Ingelheim International GmbH, and Catalent, Inc. (acquired by Novo Holdings A/S). Strategic initiatives focus on capacity expansion and technological advancements to address the growing demand for injectable drugs and biologics, while key players collaborate to enhance service offerings and operational efficiency. For instance, in November 2024, Lonza’s Synaffix licensed its ADC technology to BigHat Biosciences, combining it with BigHat’s ML platform to develop a new pipeline of innovative antibody-drug conjugates.

-

Boehringer Ingelheim delivers end-to-end solutions, encompassing aseptic filling, lyophilization, and packaging for vials and prefilled syringes. Its global network optimizes capacity and flexibility, addressing diverse client requirements within the biopharmaceutical industry.

-

Eurofins Scientific offers varied services in the industry, prioritizing quality control and regulatory compliance. The firm’s specialization in analytical testing and biopharmaceutical development ensures that drug products adhere to rigorous safety and efficacy standards.

Key Fill-finish Pharmaceutical Contract Manufacturing Companies:

The following are the leading companies in the fill-finish pharmaceutical contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Boehringer Ingelheim International GmbH

- Catalent, Inc (acquired by Novo Holdings A/S)

- Societal CDMO (Recro Pharma, Inc)

- Baxter

- Eurofins Scientific

- Symbiosis Pharmaceutical Services Ltd

- MabPlex International Co. Ltd.

- Recipharm AB

- Fresenius Kabi, USA LLC

- Lonza

View a comprehensive list of companies in the Fill-finish Pharmaceutical Contract Manufacturing Market

Recent Developments

-

In November 2024, Lonza announced the completion of its first GMP batch at the Portsmouth facility, advancing its capacity for small- to mid-scale mammalian biologics and enhancing support for various molecule types.

-

In May 2024, Eurofins CDMO Alphora Inc. announced a three-fold expansion of its Drug Product Analytical Services Laboratory in Mississauga, Canada, enhancing capabilities.

-

In February 2024, Societal CDMO announced its acquisition by CoreRx for approximately USD 30 million, forming an enhanced CDMO with expanded capabilities in formulation development, production, and packaging services.

Fill-finish Pharmaceutical Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.51 billion

Revenue forecast in 2030

USD 29.06 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, molecule, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Sartorius AG; Boehringer Ingelheim International GmbH; Catalent, Inc (acquired by Novo Holdings A/S); Societal CDMO (Recro Pharma, Inc); Baxter; Eurofins Scientific; Symbiosis Pharmaceutical Services Ltd; MabPlex International Co. Ltd.; Recipharm AB; Fresenius Kabi, USA LLC; Lonza

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fill-finish Pharmaceutical Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fill-finish pharmaceutical contract manufacturing market report based on product, molecule, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prefilled Syringes

-

Vials

-

Cartridges

-

Others

-

-

Molecule Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Molecules

-

Small Molecules

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Pharmaceutical Companies

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fill-finish pharmaceutical contract manufacturing market size was estimated at USD 17.95 billion in 2024 and is expected to reach USD 19.51 billion in 2025.

b. The global fill-finish pharmaceutical contract manufacturing market witnessed a moderate growth rate of 8.29% from 2025 to 2030 to reach USD 29.06 billion by 2030.

b. The by product type, the vials segment dominated the market with a share of 53.4% in 2024. This is attributable to the increasing production of biologics, that are majorly commercialized in the vials form.

b. Some key players operating in the fill-finish pharmaceutical contract manufacturing market include AbbVie Inc., Boehringer Ingelheim, Pfizer, Catalent Inc, Recro Pharma, Inc., Baxter’s BioPharma Solutions, Eurofins Scientific, and a few others.

b. Growing technological advancements across the fill finish lines to enhance its efficacy and turn around time coupled with increasing number of CMOs focusing on the expansion of fill finish manufacturing plants are the major growth driving factors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."