- Home

- »

- Advanced Interior Materials

- »

-

Film Adhesive Market Size, Share & Growth Report, 2027GVR Report cover

![Film Adhesive Market Size, Share & Trends Report]()

Film Adhesive Market Size, Share & Trends Analysis Report By Application (Electronics & Electrical, Medical, Automotive), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-614-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Advanced Materials

Report Overview

The global film adhesive market size was valued at USD 398.1 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 2.3% from 2020 to 2027. The growth in the electronics and electrical sector, coupled with medical equipment manufacturing, is anticipated to propel market growth.

Film adhesive, as the name implies, is a type of adhesive tape used for large and small substrates in various end-use industries. In the electronics industry, considering the shrinking of assembling with rising power requirements, it becomes vital to have proper thermal management. Application of film adhesive in electronics and electrical provides thermal and mechanical properties and reduces the assembly costs.

U.S. is amongst the leading manufacturers in the electronics and electrical industry. In 2018, the country exports for electronic circuit components stood at USD 37.7 billion with a global share of 5.3%. Rising concerns among electronic manufacturers over-improving product quality, lead times, and low-cost production propelled them to make use of innovative adhesives. Technological advancements in polymer chemistry and delivery mechanisms benefit manufacturers and provide them with a wide variety of options to choose from. Epoxy film adhesives offer advantages in electronic manufacturing over liquid and paste adhesives owing to their solid state that allows them to be cut in desired shape as per customization.

The ability of film adhesive to be applied uniformly to the substrate with least wastage makes it a preferable choice in joining intricate shapes and in applications that require precise bond lines. Hence, they are used for attaching substrates into microelectronic package housing, where sensors and other sensitive electronic components are involved.

However, the market for film adhesive is anticipated to witness sluggish growth across the forecast period owing to the availability of substitutes in the market and the Covid-19 pandemic across the globe. The crisis has significantly impacted the raw material supplies for adhesives and sealants. Apart from resins and binders, several other materials are used in production, which is being directed towards other applications. For example, alcohols are sent for hand sanitizers and photo initiators for UV applications.

Application Insights

Medical application is expected to witness a CAGR of 2.7% from 2020 to 2027 as the Covid-19 pandemic has affected different end-use industries with varying levels of impact. Packaging, DIY, and medical equipment industries are anticipated to be the least impacted sectors in this crisis. Staying at home has boosted the DIY skills amongst people, which is leading towards more demand for products, such as sealants, caulks, and tapes, especially for interior repairs and remodeling. Growing demand for packaged foods is expected to benefit the film adhesive industry growth, especially during the ongoing crisis.

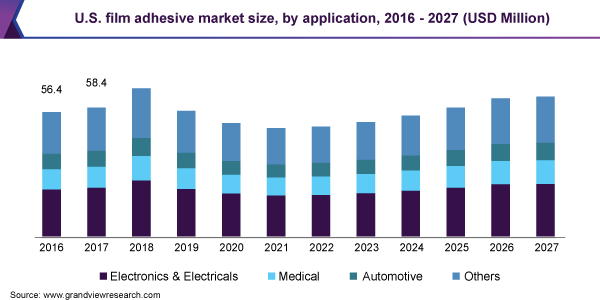

Based on application, the market for film adhesive has been segmented into electronics and electrical, medical, automotive, and others. Electronics and electrical accounted for the largest volume share of 34.7% in 2019 owing to extensive use of film adhesive in electronic and electrical components and white goods, such as bonding internal and external components, decorative trim and logo mounting, electronic corrosion prevention, internal insulation, surface protection, high temperature resistant masking, prevention from dirt and debris, and thermal management.

The medical segment is anticipated to witness the fastest growth across the forecast period. Film adhesive is widely used in the medical industry in ultrasound and mammography equipment, x-ray and blood monitoring equipment, PET/CT and MRI scanners, and bone densitometers. Its use has further propelled amidst the pandemic with an increasing need for medical equipment.

The other application segment includes construction, aerospace and defense, paper/printing, and others. The segment is anticipated to witness sluggish growth, along with automotive and transportation. Decline in industrial and manufacturing activities across the globe, coupled with transport-related delays in supplying raw materials, has impacted the segment growth.

Regional Insights

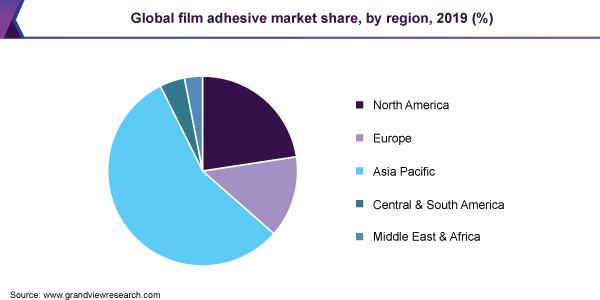

Asia Pacific dominated the market for film adhesive in 2019 with a revenue share of 56.4% and is expected to witness the fastest growth in the forecast period. China emerged as the largest market in the region in 2019 and countries like India and South Korea are anticipated to witness significant growth during the forecast period owing to the rising emphasis on industrial production in these developing economies.

The electronics and electrical segment are anticipated to witness considerable growth in the long term in Asia Pacific owing to increasing investments in the sector. The production in the electronics sector including consumer electronics, computer hardware, mobile phones, components, and LEDs witnessed significant growth in past years in India. For example, industrial electronics production registered a CAGR of 15.0% from 2014 to 2019.

Significant growth is anticipated in coming years, considering the investments and favorable government policies in the country. For example, the National Policy on Electronics 2019 targets a turnover of USD 400 billion by 2025 in the country. Moreover, in 2019, Chinese white goods company, Midea announced an investment of ₹1,350 crores in a manufacturing plant in Pune, Maharashtra, India, which will be engaged in producing home appliances, HVAC products, and compressors.

Central and South America is the second fastest growing regional market. The growth can be attributed to medical and automotive segments. The market in Brazil has huge potential and ample opportunities for manufacturers to invest. Country’s medical equipment revenues reached USD 10.5 billion in 2018 and the public and private health expenses accounted for a share of 9.1% of the GDP.

Brazil is amongst the few countries to witness positive growth of 2.3% in automotive production in 2019. According to the National Association of Motor Vehicle Manufacturers, the country is expected to witness positive growth in 2020 as well, which is expected to positively influence the film adhesive demand in the country.

North America and Europe are expected to witness sluggish growth across the forecast period owing to the Covid-19 pandemic that has largely impacted the global economy, especially in countries like U.S., Spain, Italy, U.K., Germany, France, Russia, and Turkey. It is difficult for the countries to resume their operations soon, which is expected to impact film adhesive industry growth in the long term.

Key Companies & Market Share Insights

The global market for film adhesive has been characterized by intense competition owing to the presence of major manufacturers. Manufacturers are investing in capacity expansion in order to cater to the growing demand from the end-use industries. For instance, in June 2019, Henkel opened a new adhesive plant, especially for aerospace applications, in Montornès del Vallès, Spain. The plant aims at supporting the global demand for aircraft engines and components. Some of the prominent players in the global film adhesive market include:

-

3M

-

Henkel

-

Bostik

-

Toray Industries

-

Avery Dennison Corporation

-

H.B Fuller

Recent Developments

-

In December 2022, Toray Industries, Inc. launched an eco-friendly polyethylene terephthalate (PET) film. This product eliminates solvents derived from carbon dioxide emissions and has good applicability for water-based paints.

-

In November 2022, Bostik launched the Bostik HM2060 and Bostik HM2070. The launch accelerated the company’s market growth and helped to meet the customer demand in the FMCG, pharmaceuticals, and logistics industries.

-

In April 2021, 3M launched 2484 3MTM Hi-Tack Silicone Adhesive. This tape is gentle on delicate skin and minimizes skin cell removal, making it suitable for patients who have fragile skin.

Film Adhesive Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 385.6 million

Revenue forecast in 2027

USD 477.4 million

Growth Rate

CAGR of 2.3% from 2020 to 2027

Market demand in 2020

97.8 kilotons

Volume forecast in 2027

115.9 kilotons

Growth Rate

CAGR of 1.9% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Volume in kilotons, revenue in USD million, CAGR from 2020 to 2027

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; China; India; South Korea; Brazil

Key companies profiled

3M; Henkel; Bostik; Toray Industries; Avery Dennison Corporation; H.B Fuller

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global film adhesive market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

Electronics & Electrical

-

Medical

-

Automotive

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."