- Home

- »

- Medical Devices

- »

-

Global Film Dressing Market Size & Share Report, 2022-2030GVR Report cover

![Film Dressing Market Size, Share & Trends Report]()

Film Dressing Market (2022 - 2030) Size, Share & Trends Analysis By Application (Acute Wounds, Chronic Wounds), By End-use (Hospitals, Specialty Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-983-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

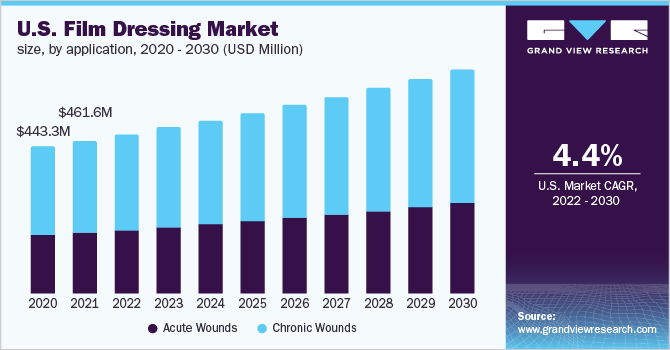

The global film dressing market size was valued at USD 1,454.34 million in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 4.54% from 2022 to 2030. The increasing prevalence of chronic and acute wounds is the key factor driving the film dressing market. For instance, Healogics, LLC in 2022 stated that around 7.0 million Americans are living with a chronic wound. Similarly, according to the article published in the African Journal of Health Sciences Volume, 2020, the prevalence of diabetic foot ulcers is highest is Belgium at 16.6% followed by Canada at 14.6%, USA and North America at 13.0% while Asia, Europe, and Africa had a prevalence of only 5.5%, 5.1%, and 7.2% respectively.

Moreover, it is anticipated that rising rates of burns, trauma, and accidents is likely to boost the expansion of the film dressing market. For instance, according to Undersea and Hyperbaric Medical Society, in the U.S., there are more than 2.0 million burn injuries reported each year, and 14,000 people pass away, whereas, about 20,000 have injuries that necessitate admission to a burn unit.

Moreover, each year, around 75,000 individuals need to be hospitalized, and 25,000 of them stay there for more than two months. These incidents frequently cause serious bleeding and other injuries, demanding immediate medical attention and surgical procedures to provide patients with immediate relief.

Thus, rising prevalence of chronic and acute wounds is likely to boost demand for the film dressings, as they are effective for the wounds of varying thicknesses. Thereby aforementioned factors are driving the film dressing market growth.

Film wound dressings have been invented technologically to better wound diagnosis and therapies in response to the increasing financial burden of wounds on worldwide healthcare systems. Film dressings are an easy and efficient alternative to keep a moist wound environment and speed up the healing of superficial wounds.

They are advised for the treatment of minor burns and simple wounds, and their versatility allows them to be employed to conceal sutures following surgery. There are certain advantages of utilizing film dressing over other types of dressings.

Some of the benefits are as follows:

-

It requires less maintenance than traditional dressing (gauze)

-

It is flexible and water resistant.

-

Wound visualization without dressing removal

-

Prevents secondary infection

-

There is no additional dressing required (no tape or wrap)

The market is in its early phases, with constant research being carried out to develop film dressings. Here are a few examples of recent research studies:

- In August 2021, researchers from the Indian Institute of Technology (IIT) Guwahati developed a new, low-cost, transparent material for wound healing that also minimizes scarring. The novel material outperforms existing wound-dressing treatments because it is based on the "integration of a synthetic polymer" and produces a film that creates a "moist environment" around the wound

- Since, the new film dressing is transparent; it is possible to monitor the healing of a wound without removing the dressing. Additionally, it has "sufficient mechanical qualities" and is "highly absorbent," which enable it to "adjust to the contour of the wound" and reduce scarring

- Technology innovator Lubrizol Life Sciences, one of the largest manufacturers of engineered polymers, uses its expertise in specialty TPUs to create state-of-the-art wound care products. Additionally, Tegaderm wound dressing from 3M, another global leader in wound care, has long set the bar for transparent film used in cutting-edge wound care applications

- An Indian scientist developed a revolutionary film wound dressing based on agarose, a natural polymer created from seaweed agar, in order to treat patients with chronic wounds and infected diabetic wounds. It is in keeping with the "Make in India" strategy and was supported by the DST's Advanced Manufacturing Technologies Program.Currently, these dressings are in third stage of development, and have been tested on rats

Therefore, increased R&D spending and the launch of improved film dressings by key companies and the organizations are among the factors, anticipated to fuel the market expansion, during the years to come.

The COVID-19 had a negative effect on the film dressing industry since elective procedures were postponed or cancelled. The market has again recovered from the epidemic, due to the increased telemedicine and virtual consultation penetration. For instance,

-

In February 2021, the Digital Technology Supercluster contributed USD 2.5 million to Tele wound Care, Canada, a new USD 3.1 million project that aims to improve wounded patients' access to care online

-

In January 2021, Delta Care Rx introduced a virtual service for the wound care consulting that connects nurses, who work in palliative and hospice nursing with a doctor and nurse specialist in the field

-

Independent medical practices using telemedicine increased from 22.0% before the pandemic to 41.0% after it, according to a study paper published in Medline Industries LP. The willingness of consumers to use telehealth has also increased during the pandemic, from 49.0% to 60.0%

A number of studies also demonstrate that telemedicine alternatives are a cost-effective strategy to increase patient compliance and satisfaction while enhancing wound care outcomes. In addition, insurance companies also cover telemedicine costs. In the post-pandemic period, the aforementioned factors will probably cause the film dressing industry to expand rapidly.

Application Insights

Acute wounds segment is expected to develop at the fastest CAGR of 4.66% during the forecast period. The surgical & traumatic wounds segment held the largest share in 2021. One of the primary factors fueling the segment's growth is the rise in surgical site infections. SSIs are the main cause of surgical wounds. For instance, 2% to 4% of patients undergoing inpatient surgical procedures get SSI, according to the Agency for Healthcare Research and Quality. In addition, research by Wounds International indicated that 11.7% of patients, who underwent general surgery, developed surgical site infections (SSI), which led to 19.2% of patients needing to be readmitted during the study period.

Due to the increasing frequency of burn injuries, the burns segment is estimated to experience the considerable growth rate during the forecast period. According to the Joye Law Firm, following are the statistics about burn injuries in the U.S.:

-

On average, there are around 450,000 burn injuries throughout the U.S.

-

Each year, about 3,500 people are fatally injured in a fire or burn accident

-

Approximately 45,000 people are hospitalized each year for the burn injuries. Of those who are hospitalized, 25,000 are admitted to specialized burn centers

Therefore, rising prevalence of traumatic wounds, SSI and burn injuries are among the factors anticipated to propel segment growth throughout the forecast period.

Chronic wounds segment held the largest share of 59.93% in 2021 and is foreseen to witness substantial growth rate during the forecast period. Rising incidence of diabetes and diabetic foot ulcers is a major factor driving the segment growth. For instance, according to Science Direct, more than 25.0% of diabetics may develop diabetic foot ulcers, and 20.0% of the patients may require foot amputation. Moreover, as per the National Diabetes Statistics Report by CDC, 37.3 million i.e., 11.2% of the U.S. population had diabetes.

Similar to this, the CDC predicted that almost 96.0 million Americans, aged over 18 or older, would have prediabetes. Additionally, 26.4 million adults, aged over 65 and above, were expected to have prediabetes, according to a similar source. Since the usage of film wound dressings aids in the healing of these ulcers, the segment is anticipated to grow during the forecast period.

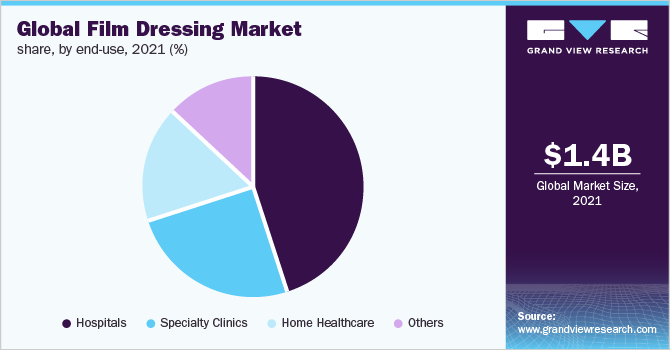

End-use Insights

The hospital segment held the largest share of 45.28% in 2021.The dominance of this segment is mainly due to the rise in the number of hospitals and patients, worldwide. For instance, according to Smith & Nephew, in a typical hospital setting, patients with wounds occupy between 25 and 40% of beds. Additionally, an increase in surgical procedures is further fueling the segment growth.

For instance, according to the most recent figures reported in a study article, published in NCBI, 31, 02,674 surgical procedures were performed in England & Wales, overall in 2020. Since film dressings are frequently used for the surgical incisions, their use is likely to grow as more procedures are performed.Hence, owing to aforementioned factors, the segment is predicted to impel during the forecast period.

Home healthcare segment is anticipated to expand at the fastest CAGR of 5.21% during the forecast period due to the patients' growing inclination from hospital to home care settings for the personalized wound care. Most procedures have a prolonged healing phase, which necessitates regular dressing changes. Additionally, elderly people with wounds prefer home care over hospitalization.

Rising number of geriatric population, globally, is projected to fuel the film dressing market. For instance, as per Economic and Social Commission for Asia and the Pacific, there will be 1.3 billion older people worldwide in 2050, up from 630.0 million in 2020. Correspondingly, 13.6% of the Asia-Pacific region is predicted to have a quarter of the world's elderly population by 2050.

Extended hospital stays are frequently required for the conditions like venous leg ulcers, diabetic foot ulcers, and surgical wounds, which can be challenging for elderly individuals. Thereby, boosting the film dressing market.

Additionally, a rising number of individuals with chronic diseases opt to receive treatment at home due to the escalating healthcare costs. As film dressings are used to treat, diagnose, and monitor a variety of chronic and acute wounds, this trend is anticipated to increase demand for them. Therefore, it is projected that these factors will spur segment expansion during the forecast period.

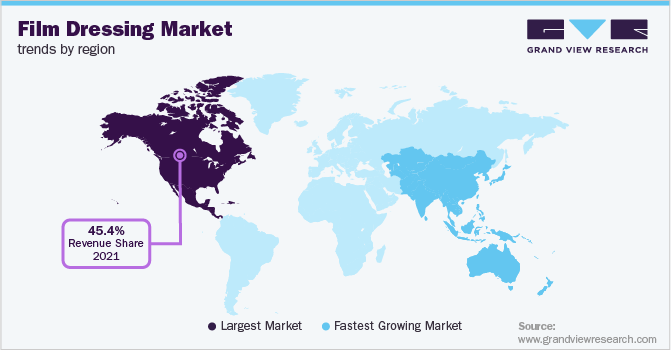

Regional Insights

North America dominated the film dressing market with the share of 45.43% in 2021 and is expected to witness the considerable growth rate throughout the forecast period. The region’s dominance can be accredited to rising prevalence of the chronic wounds, higher treatment costs, and the accessibility of supportive reimbursement programs in the U.S. and Canada.

According to the research article published in NCBI, 2021 in the U.S. around 2.0% of the total population are estimated to be affected by the chronic wounds. Similarly, according to the data reported by the Wound Source, it is estimated 500,000-600,000 people have venous leg ulcers in the U.S. As a result of the large patient population suffering from chronic wounds, there is an increasing need for the advanced wound care products such as film dressings, thereby helping region dominate the market.

Asia Pacific region is estimated to witness the highest growth of CAGR 5.19% in the global market for film dressing during the forecast period. Numerous prospects exist for the introduction of new products on the market, which is continually expanding. Additionally, this region is experiencing an increase in medical tourism, which is leading to an increase in surgical procedures.

For instance, according to a study by the Indian Institute of Public Administration, 697,453 foreign tourists visited India for the medical treatment in 2019. A combination of increased government support and a focus by the major players on the developing Asian countries has led to an expansion of the film dressing business in this region.

Key Companies & Market Share Insights

The film dressing market is consolidated and is dominated by the few large manufacturers. Degree of competition and competitive rivalry in the market is anticipated to intensify during the forecast period. Major companies are focusing on merger acquisitions, product launches and approvals, geographic expansion to have competitive edge over others. Some of the prominent players in the global film dressing market include:

-

Cardinal Health

-

Smith & Nephew

-

3M

-

Paul Hartmann AG

-

McKesson Corporation

-

Molnlycke Health Care AB.

-

Medline Industries, Inc.

-

DermaRite

-

Lohmann & Rauscher

Film Dressing Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1,517.53 million

Revenue forecast in 2030

USD 2,165.41 million

Growth rate

CAGR of 4.54% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Cardinal Health; Smith & Nephew; 3M; Paul Hartmann AG; McKesson Corporation; Molnlycke Health Care AB.; Medline Industries, Inc.; DermaRite; Lohmann & Rauscher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Film Dressing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global film dressing market report based on the application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Home Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global film dressing market size was estimated at USD 1,454.34 million in 2021 and is expected to reach USD 1,517.53 million in 2022

b. The global film dressing market is expected to grow at a compound annual growth rate of 4.54% from 2022 to 2030 to reach USD 2,165.41 million by 2030

b. North America dominated the film dressing market in 2021 during the forecast period and is expected to witness a growth rate of 4.58% over the forecast period. This can be attributed to the rising patient population and the presence of major market players

b. Prominent key players operating in the film dressing market include Cardinal Health, Smith & Nephew, 3M, Paul Hartmann AG, McKesson Corporation, Molnlycke Health Care AB., Medline Industries, Inc., DermaRite Industries LLC, Lohmann & Rauscher

b. Key factors that are driving the market growth include an increasing number of traumatic accidents, the surge in the global geriatric population, rising technological advancements, rise in the number of people suffering from different chronic and acute disorders, and a rising incidence of burn cases worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.