- Home

- »

- Next Generation Technologies

- »

-

Finance Lease Market Size, Share & Trends Report, 2022-2030GVR Report cover

![Finance Lease Market Size, Share & Trends Report]()

Finance Lease Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (International Business, Domestic Business), By Type (Banks, Non-banks), By Application (IT & Telecom, Medical Devices), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-981-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Finance Lease Market Summary

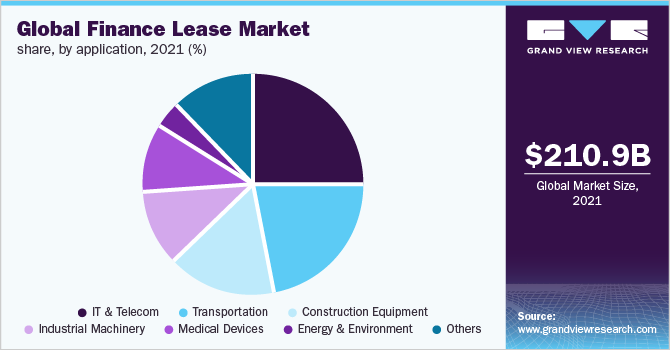

The global finance lease market size was valued at USD 210.99 billion in 2021 and is projected to reach USD 324.40 billion by 2030, growing at a CAGR of 5.1% from 2022 to 2030. The growth can be attributed to the rising demand for heavy machinery, equipment, and other critical assets from players operating in sectors such as healthcare, construction, and IT & telecom.

Key Market Trends & Insights

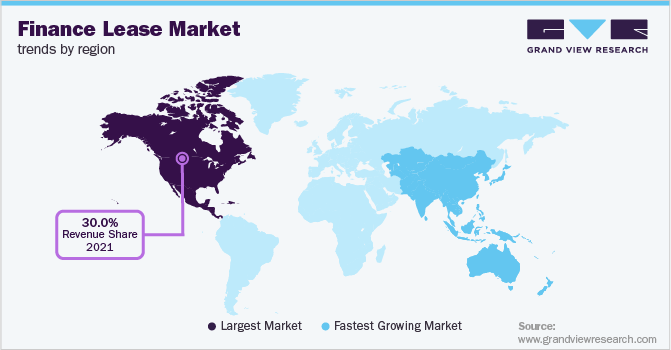

- North America accounted for the largest revenue share of over 30.0% in 2021.

- Asia Pacific is expected to grow at the highest CAGR during the forecast period.

- By application, the IT & telecom segment led the market in 2021 and accounted for a global revenue share of over 25.0%.

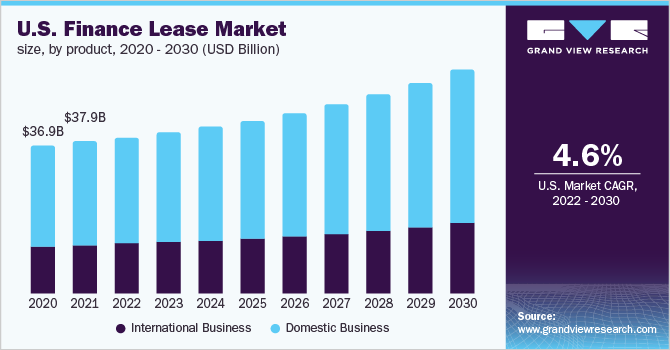

- By product, the domestic business segment accounted for the largest revenue share of more than 67.0%.

- By type, the bank segment accounted for the largest revenue share of more than 65.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 210.99 Billion

- 2030 Projected Market Size: USD 324.40 Billion

- CAGR (2022-2030): 5.1%

- North America: Largest market in 2021

A rapid shift from an agricultural-based economy to a manufacturing-based economy in developing nations is expected to drive the demand for financial leasing. The increased demand for automobiles and other consumer durables worldwide is also anticipated to create a positive outlook for market growth. The market expansion is attributed to increased demand for finance lease accounting among small and medium-sized enterprises (SMEs) and start-ups globally. The SMEs and start-ups owing to the limited capital turn towards finance leasing options to speed up the growth of the company. In addition, these firms look for flexible financing options, which are offered to them through a finance lease.As a result, a growing number of small and medium-sized enterprises and start-ups globally has opened up new opportunities for leasing services because these businesses cannot obtain conventional funding sources like loans or venture funding. As a result, many banks, financial institutions, and lease providers have entered the market with innovative solutions tailored specifically for small and medium enterprises and start-ups.

The emergence of 360-degree capital leasehold and rental services for mobile and fixed assets is another factor driving the industry’s growth. For instance, in May 2021, Skootr Offices launched a financial service model Skootr FinSave. This provides a 360-degree leasing solution for large and mid-sized businesses. These innovative platforms integrate effective stock management, fleet operations, warranty, license, and equipment compliance solutions.

The global finance lease market is expanding due to increased credit availability, making it much easier for customers to buy expensive items such as cars and homes on credit. Moreover, the finance lease provides consumers with specific benefits such as low monthly installments, long-term considerations, maximum tax benefits, and trouble-free maintenance, among others. The installments paid for the items leased include insurance charges which provide consumers with cost-effective leasing options. Thus, based on these aspects, the industry is anticipated to have a positive outlook.

Furthermore, to lower the risk and the losses, businesses, and organizations are increasingly opting to acquire equipment on lease. Thus, creating growth opportunities for the market during the forecast period. However, the growing concerns over the fluctuating interest rates offered by finance lease service providers are expected to restrain the growth during the forecast period. Furthermore, the increasing inflation rate negatively affects bank profitability and real return on a financial asset, which can lead to the financial lease becoming an unprofitable venture.

COVID-19 Impact Analysis

The COVID-19 pandemic played a significant role and positively impacted the growth of the finance lease market. The COVID-19 pandemic adversely affected the profitability of companies operating in the sectors, including IT & telecom, automotive, transportation, and real estate, among others. The low demand for various products such as electronic items, vehicles, real estate, and others resulted in a decline in the cash flow of the companies, which eventually increased the demand for finance leasing by the impacted industries worldwide. The global epidemic and the curfew accelerated digitalization trends, with many leasing and credit finance companies moving their operations online in a short time, thus creating a positive outlook for the industry.

Product Insights

The domestic business segment accounted for the largest revenue share of more than 67.0%. The growth is attributed to the growing number of startups and small businesses in developing countries like India, China, and others. Furthermore, due to their low profits, MSMEs created a demand for a finance lease to maintain the proper cash flow and meet business expenses. Moreover, the high availability of the lessor across almost all of the developed and developing countries encourages finance lease companies to enhance their offerings.

The international business segment is anticipated to witness significant growth during the forecast period. Factors such as rising inflation and taxation are compelling businesses globally to opt for leasing services, thereby driving the segment’s growth. International leasing gives the lessee more flexibility in utilizing resources, better plan budgets, financial convenience, and taxation advantages, among others. Furthermore, start-up companies worldwide tend to employ low initial capital and hence avoid ownership of the assets which eventually results in the growth of the segment.

Type Insights

The bank segment accounted for the largest revenue share of more than 65.0% in 2021. The growth is attributed to its vast customer base globally. In addition, the growing demand for finance leasing from several industries such as automotive, construction machinery, Technology, Media, and Telecommunications (TMT), medical devices, and ECI (Energy, Chemicals, and Infrastructure) is anticipated to drive the segment growth over the forecast period. These industries lease equipment to gain a competitive edge over their competitors.

The non-banks segment registered significant growth during the forecast period. The increasing number of non-bank institutes, such as credit unions, that offer finance lease services is one of the major factors expected to accentuate the growth. The banking firms are entering into a partnership with non-banking technology platform providers, thereby driving the growth of the non-bank segment. For instance, in January 2021, OTO Capital announced its partnership cKers Finance, an NBFC firm. The partnership was aimed at deploying electric two-wheeler to the customers of OTO on flexible leasing models.

Application Insights

The IT & telecom segment led the market in 2021 and accounted for a global revenue share of over 25.0%. IT & telecom companies, to satisfy the ever-changing market demands, are constantly trying to expand their infrastructure. In this effort, these companies lease their IT-related equipment, which is expected to drive segment growth. Furthermore, the finance lease companies are entering into partnerships to offer various leasing services to IT & telecom companies.

For instance, in May 2022, SatLease Capital, a LeaseTech company, announced the enhancement of its existing partnerships with Blue C Mobile, a satellite service provider. This partnership is aimed at expanding access to SatCom by including a wide range of leasing options for all of BCM’s hardware solutions.

The medical devices segment is expected to grow at the highest CAGR during the forecast period. The segment's growth can be attributed to the growing demand for financial lease services among hospitals to purchase expensive medical devices. The players in the medical industry mainly prefer leasing medical devices such as MRI machines owing to their enormous purchasing and maintenance costs. Furthermore, the hospitals are involved in alternative financing and procurement options for delivering public facilities and/ or infrastructure using private finance.

Regional Insights

North America accounted for the largest revenue share of over 30.0% in 2021. The regional market's growth is attributed to the presence of many market participants, such as Wells Fargo Leasing, M&I Equipment Finance, and others. In addition, these market players are adopting various business strategies such as mergers and acquisitions, partnerships, and others, thereby fueling regional growth.

For instance, in June 2022, XCMG America Financial LLC announced its partnership with QuickFi, a U.S.-based end-to-end loan and lease servicing platform. The partnership was aimed at financing Xuzhou Construction Machinery Group Co., Ltd. (XCMG) equipment, including excavators, compactors, graders, MEWP, and wheel loaders across the U.S.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth of the regional industry can be attributed to the increasing development in the construction industry, especially in India and China. Furthermore, the market players in the Asia Pacific region are making efforts to support SMEs and are involved in various strategic initiatives.

For instance, in November 2021, the Asian Development Bank, a multilateral development finance institution, along with the wholly owned subsidiary of Guangzhou Rural Commercial Bank, Zhujiang Financial Leasing Company Limited, signed a loan of USD 40 million to expand company’s long-term lease funding for SMEs across People’s Republic of China.

Key Companies & Market Share Insights

Many leasing finance companies identify the finance lease industry as a competitive marketplace. As part of their efforts to improve their offerings, market participants opt for various strategies, including particular product launches and regional expansion. For instance, in March 2020, BNP Paribas Leasing Solutions declared the launch of commercial operations in Denmark and Sweden. This aims as part of its ongoing strategic expansion in the Nordic region.

Market participants are investing in R&D activities and entering into joint partnerships and collaborations to accelerate the company's growth and expansion. For instance, in June 2022, Marathon Capital, LLC, and Sumitomo Mitsui Banking Corporation (SMBC) entered a joint partnership to accelerate the company's growth and expansion. This collaboration focuses on the origination and implementation of new business mandate activity for both firms' global clients in strategic advisory, capital markets, and credit solutions. Some prominent players in the global finance lease market include:

-

Sumitomo Mitsui Finance and Leasing Co., Ltd.

-

BNP Paribas Leasing Solutions

-

HSBC Group

-

Wells Fargo Bank N.A.

-

Texas Capital Bancshares, Inc.

-

Commerce Bancshares, Inc.

-

Fifth Third Bank

-

Bank of America Corporation

-

Crest Capital

-

North Star Leasing

Finance Lease Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 218.12 billion

Revenue forecast in 2030

USD 324.40 billion

Growth rate

CAGR of 5.1% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; Australia; South Korea; India; Brazil; Mexico

Key companies profiled

Sumitomo Mitsui Finance and Leasing Co., Ltd.; BNP Paribas Leasing Solutions; HSBC Group; Wells Fargo Bank N.A.; Texas Capital Bancshares, Inc.; Commerce Bancshares, Inc.; Fifth Third Bank; Bank of America Corporation; Crest Capital; North Star Leasing

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Finance Lease Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global finance lease market report based on product, type, application, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

International Business

-

Domestic Business

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banks

-

Non-banks

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation

-

Medical Devices

-

Energy & Environment

-

Construction Equipment

-

Industrial Machinery

-

IT & Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

South Korea

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global finance lease market size was estimated at USD 210.99 billion in 2021 and is expected to reach USD 218.12 billion in 2022.

b. The global finance lease market is expected to grow at a compound annual growth rate of 5.1% from 2022 to 2030 to reach USD 324.40 billion by 2030.

b. North America dominated the finance lease market with a share of 30.39% in 2021. The regional market's growth is attributed to the presence of many market participants, such as Wells Fargo Leasing, M&I Equipment Finance, and others.

b. Some key players operating in the finance lease market include Sumitomo Mitsui Finance and Leasing Co., Ltd; BNP Paribas Leasing Solutions; HSBC Group; Wells Fargo Bank N.A.; Texas Capital Bancshares, Inc.; Commerce Bancshares, Inc.; Fifth Third Bank; Bank of America Corporation; Crest Capital; North Star Leasing.

b. Key factors that are driving the market growth include increasing industrialization across the globe and rising demand for finance leasing by MSMEs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.