- Home

- »

- Advanced Interior Materials

- »

-

Fire Resistant Protective Wear Knitted Fabric Market, 2030GVR Report cover

![Fire Resistant Protective Wear Knitted Fabric Market Size, Share & Trends Report]()

Fire Resistant Protective Wear Knitted Fabric Market Size, Share & Trends Analysis Report By Fiber Type (Aramid Blends, Cotton FR Blends), By Application (Firefighting, Military), By Region, And By Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-052-4

- Number of Report Pages: 109

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

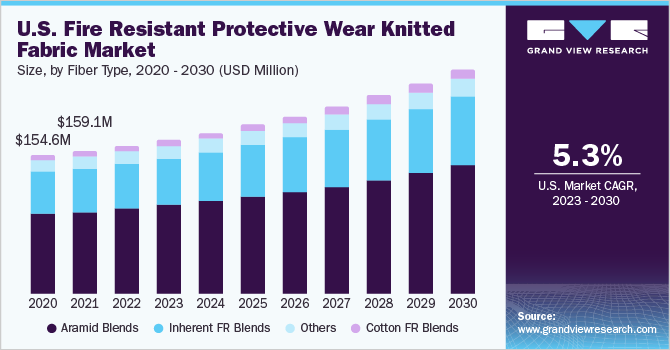

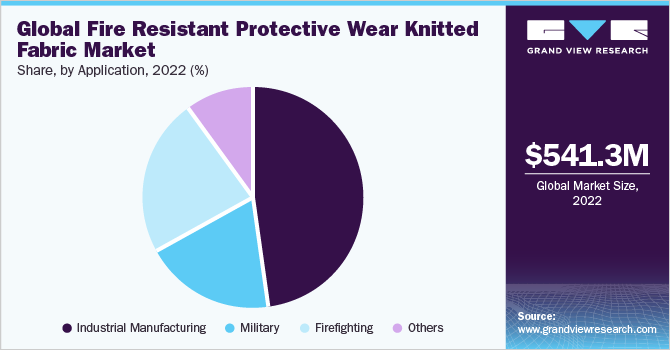

The global fire resistant protective wear knitted fabric market size was valued at USD 541.3 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2030 to 2030. The growth is driven by the rising concerns regarding the health and safety of workers in workplaces along with stringent regulations established by governmentbodies with respect to workplace hazards.The growth of the manufacturing, healthcare, transportation, and construction sectors in regions, such as Asia Pacific and North America, is expected to increase the blue-collar workforce.

This, in turn, is expected to generate demand for knitted protective wear fabrics for workers and boost the requirement for knitted personal protective wear and further boost the demand over the forecast period.There has been a rise in the importance of employee safety at workplaces due to the increasing number of injuries and fatalities across various end-use industries. Moreover, governments of various countries have implemented stringent regulations to ensure the safety of employees working in industries, such as oil & gas, chemical, military, utility, and firefighting, wherein the possible risk of exposure to hazardous materials and fire incidents is high.

The lack of awareness regarding health and safety risks in the workplace is a serious problem that is affecting workers. Several governmentshave set standards for protective wear andmade it mandatory for people working near electric arcs and flames to wear flame/thermal-resistant protective wear that has an arc rating greater than or equal to the heat energy in that workspace. These laws have a significant impact on workplace safety and thus are expected to increase the product demand. The market in the U.S. is further anticipated to grow on account of the stringent flammability standards that need to be followed extensively.

This has also escalated the demand for knitted fire-resistant or knitted flame-resistant fabrics for seating, cargo nets, and interior finishes in aeronautical, automotive, and marine applications. These fabrics are also used in drapes, sheets, and mattress covers in hospitals and industrial & construction worker uniforms. In addition, the rise in spending by the U.S. military on smart fabrics that have inherent fire-resistant properties would also support the market growth over the forecast period.

Fiber Type Insights

On the basis of fiber type, the aramid blend segment accounted for the largest revenue share of 55.5% in 2022. Aramid fibers are synthetic fibers that exhibit superior strength and heat-resistant properties. Thus, these fabrics neither ignite nor melt in a normal level of oxygen. In addition, the evolution of advanced knitted para-aramid and meta-aramid brands, such as Kevlar, & Nomex, which have strong heat resistance have provided comfortable protective wear for workers in the utility, chemical, and metallurgy sectors. Aramid fiber demand in protective wear knitted fabric is anticipated to witness growth on account of the rising need for security and protective measures in various end-use industries, such as mining, oil & gas, chemicals manufacturing, and military.

Moreover, the growing concerns pertaining to military personnel safety and the rising defense budget are anticipated to augment the demand for aramid fibers in FR protective wear over the forecast period. The cotton FR blend segment accounted for a significant volume share in 2022 and the segment is estimated to grow at the fastest CAGR from 2023 to 2030. Fire-resistant protective wear made up of 100% cotton has a chance of flammability in high temperatures owing to its loose, fluffy pile, or brushed nap. Thus, the cotton FR protective wear is knitted with other synthetic materials like polyester and is chemically treated. The adoption of chemically treated cotton FR protective wear knitted fabric is high in developing countries owing to its affordable price in comparison to other materials.

Application Insights

On the basis of application, the industrial manufacturing segment accounted for the highest revenue share of 47.5% in 2022. The product finds application in the oil & gas, chemical, metallurgy, and utility industries as well. Product adoption is high in these industries as the workers are exposed to extremely high temperatures. Other manufacturing industries like automotive, shipbuilding, etc., also have a high product demand due to stringent regulations by various governments making it mandatory to provide suitable safety equipment at the workplace. The rapid industrialization in developing economies, especially in China and India, due to cheap labor would increase the workforce in the manufacturing sector, which would result in increased demand for protective wear knitted fabric over the coming years.

The firefighting application segment is expected to grow at the highest CAGR from 2023 to 2030. Firefighters are the frontline workers who are directly exposed to fire and smoke in cases of serious hazards; they primarily require protective wear to avoid flame and burn injuries. The majority of the fire departments use chemically-treated cotton FR protective gears, which can easily break down when exposed to certain temperatures. This has generated the need for comfortable and high-quality materials in protective wear, which are more advanced, chemically treated, or inherently possess fire-resistant properties.

Regional Insights

North America dominated the market with the highest revenue share of 40.5% in 2022. The government bodies in North America are focused on the fire safety of workers, and are making it mandatory for industries to follow fire protection guidelines provided by the NFPA and OSHA. Conventional knitted fabrics do not offer adequate safety during fire accidents in household, industrial, or defense settings; these require advanced knitted fabric materials. Due to the rising health hazards in operational settings within various industries, all the countries in North America have started following the National Fire Protection Association (NFPA) standards and have developed fire safety regulations that mandate compliance by FR fabric manufacturers.

In addition, industries are becoming more concerned about the safety of their employees as per the guidelines of the International Labor Organization (ILO), which has congruently augmented the product demand in the industrial segment. In addition, regulatory agencies are promoting the use of necessary safety equipment to avoid any mishapsduring industrial operations.The Asia Pacific region is expected to register the fastest CAGRfrom 2023 to 2030.

This is due to the growth of various manufacturing industries, such as oil & gas, chemical, mining, metallurgy, and construction, especially in countries, such as China, India, and South Korea. The availability of cheap and low production costs is driving multinational companies to set up their production facilities in developing countries, including China and India. However, these economies have experienced a significant increase in injuries and fatalities across industries due to the lack of superior-quality knitted fabric protective wearables. This leads to high compensation costs for employers in the long term, which is anticipated to accelerate the expansion of the market in the region.

Key Companies & Market Share Insights

Themarket is characterized by intense competition due to the presence of several players. Prominent players are involved in vertical integration to reduce their operational costs. They are manufacturingproducts with low differentiating factors, which, in turn, is likely to intensify the competition. Companies are also investing in research and development to enhance the fire-resistant and multifunctional properties of knitted fabrics, which is associated with high costs. This is likely to keep the threat of new market entrants to a minimum. Some prominent players in the global fire resistant protective wear knitted fabric market include:

-

DuPont

-

Nam Liong Global Corp.

-

Hai Huei International Corp.

-

Henan Zhuoer Protective Technology

-

Shanghai Tanchain New Material Technology Co., Ltd.

-

XM Textiles

-

Baltex

-

ARGAR Srl

-

Sintex Inc.

-

Hornwood Inc.

-

Refinery Work Wear

-

Beverly Knits, Inc.

-

Gehring-Tricot Corp.

-

4F France

-

Toledo Fabrics

-

Marback Tricot AB

-

Orneule OY

-

CP Aluart, SL

-

Trikaby AB

-

Sampaio & Filhos Texteis

-

Sontex DK

-

Arıteks A.Ş.

-

Antex Knitting Mills

Fire Resistant Protective Wear Knitted Fabric Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 563.9 million

Revenue forecast in 2030

USD 823.6 million

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2023 to 2030

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Fiber type, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; France; Spain; Italy; U.K.; Belgium; The Netherlands; Poland; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia

Key companies profiled

DuPont; Nam Liong Global Corp.; Hai Huei International Corp.; Henan Zhuoer Protective Technology; Shanghai Tanchain New Material; Technology Co., Ltd.; XM Textiles; Baltex; ARGAR Srl;Sintex Inc.; Hornwood Inc.; Refinery Work Wear;Beverly Knits, Inc.; Gehring-Tricot Corp.; 4F France; Toledo Fabrics;Marback Tricot AB; Orneule OY; CP Aluart, SL; Trikaby AB; Sampaio & Filhos Texteis; Sontex DK; Arıteks A.Ş.; Antex Knitting Mills

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Resistant Protective Wear Knitted Fabric Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global fire resistant protective wear knitted fabric market report on the basis of fiber type, application, and region:

-

Fiber Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Aramid Blends

-

Inherent FR Blends

-

Cotton FR Blends

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Industrial Manufacturing

-

Oil & Gas

-

Chemical Industries

-

Metallurgy Industries

-

Utility Industries

-

Others

-

-

Military

-

Firefighting

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

U.K.

-

Belgium

-

The Netherlands

-

Poland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Central & South America

-

Brazil

-

-

Frequently Asked Questions About This Report

b. The global fire resistant protective wear knitted fabric market size was estimated at USD 541.3 million in 2022 and is expected to reach USD 563.9 million in 2023.

b. The global fire resistant protective wear knitted fabric market is expected to grow at a compound annual growth rate a CAGR of 5.4% from 2023 to 2030 to reach USD 823.6 million by 2030.

b. The U.S fire resistant protective wear knitted fabric market accounted for the largest revenue share in 2022 and this is due to the increasing stringent regulations with respect workplace safety in the country.

b. Some key players operating in the fire resistant protective wear knitted fabric market include DuPont, Nam Liong Global Corporation, Hai Huei International Corp., Henan Zhuoer Protective Technology, Shanghai Tanchain New Material, Technology Co., Ltd., XM Textiles, Baltex, ARGAR Srl, SINTEX Inc., Hornwood Inc., Refinery Work Wear, BEVERLY KNITS, INC, Gehring-Tricot Corp, 4F FRANCE, Toledo Fabrics, MARBACK TRICOT AB, ORNEULE OY, CP Aluart, SL, Trikaby AB, Sampaio & Filhos Texteis, Sontex DK, Arıteks A.Ş., Antex Knitting Mills

b. The growing demand due to rising importance of employee safety at workplace due to increasing number of injuries and fatalities across various end-use industries is driving the demand for fire resistant protective wear knitted fabric in the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."