- Home

- »

- Advanced Interior Materials

- »

-

Fire Safety Equipment Market Size, Industry Report, 2033GVR Report cover

![Fire Safety Equipment Market Size, Share & Trends Report]()

Fire Safety Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution (Detection, Suppression), By Application (Commercial, Industrial, Residential), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-789-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fire Safety Equipment Market Summary

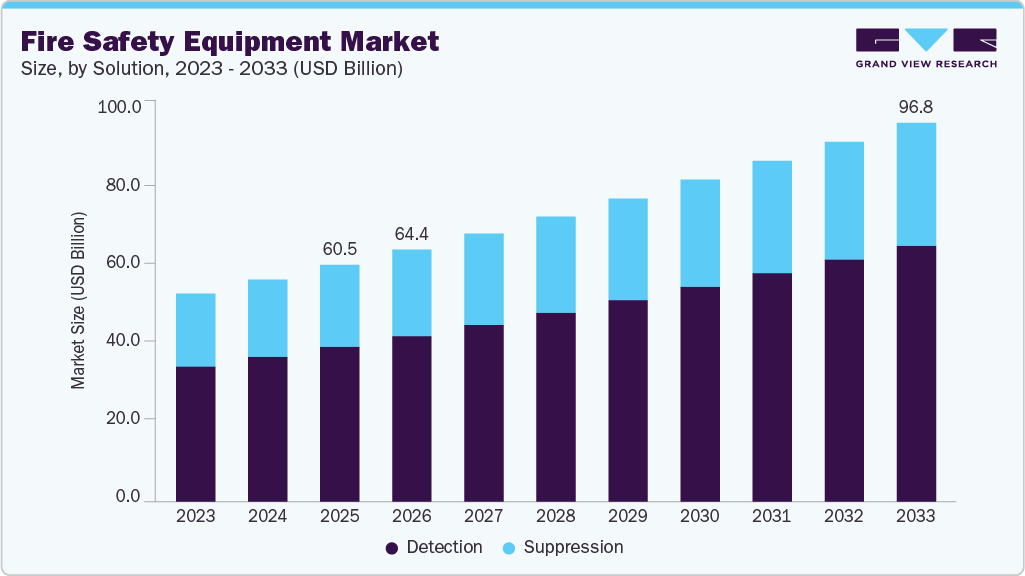

The global fire safety equipment market size was estimated at USD 60.48 billion in 2025, and is projected to reach USD 96.82 billion by 2033, growing at a CAGR of 6.0% from 2026 to 2033. The market is likely to benefit from advancements in wireless sensor networks and the increased adoption of wireless fire sensing devices.

Key Market Trends & Insights

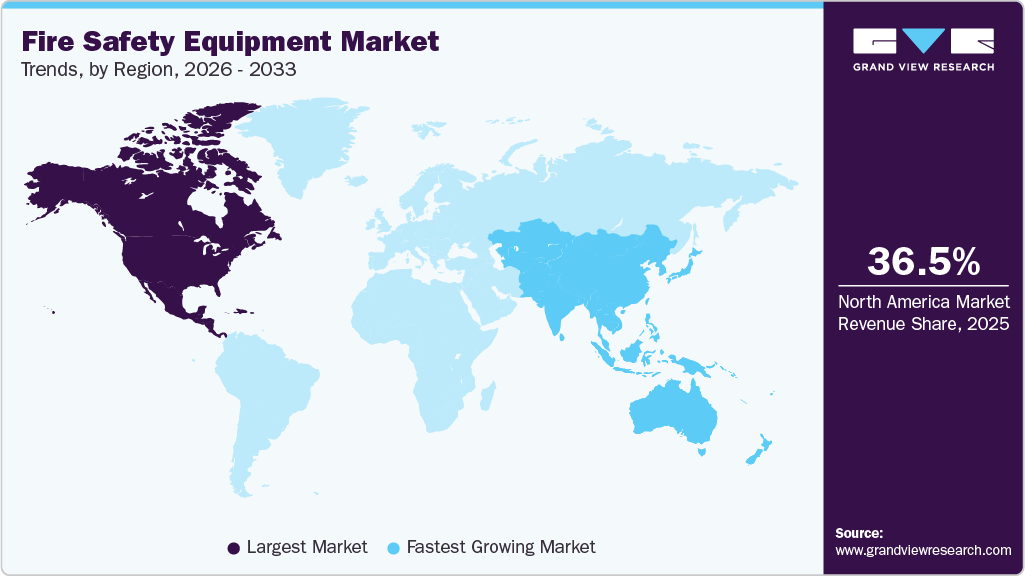

- North America fire safety equipment market accounted for a 36.5% share of the overall market in 2025.

- The fire safety equipment industry in the U.S. held a dominant position in 2025.

- By solution, the detection segment accounted for the largest share of 65.5% in 2025.

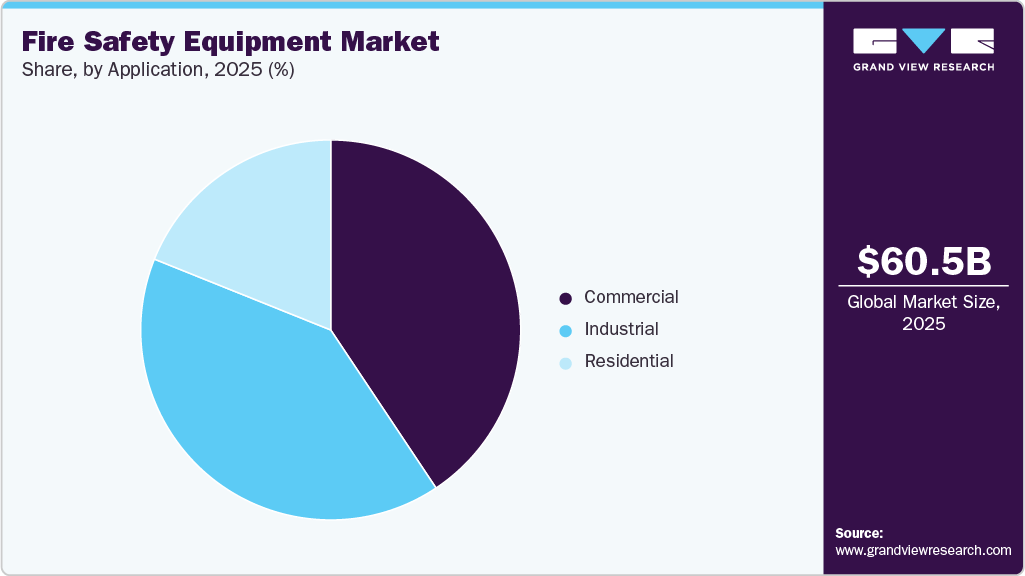

- By application, the commercial segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 60.48 Billion

- 2033 Projected Market Size: USD 96.82 Billion

- CAGR (2026-2033): 6.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Growing awareness about combating fire hazards, along with a substantial rise in building infrastructure development activities, are also expected to be high-impact drivers for the market. Organizations across the globe are increasingly spending on the safety and security of infrastructure to reduce human losses. Implementation of fire safety codes for building and renovation activities is further expected to stimulate the demand for fire safety equipment across the globe.The installation of safety rules for fire protection and reconstruction projects will have a favorable effect on market expansion. The increase will be further boosted by technological developments such as wireless alarm systems, smoke detectors, and water mist technology. The increased knowledge of fire safety gear and the potentially disastrous results is anticipated to fuel market expansion. However, the market's expansion will be hampered by the high replacement costs of conventional fire apparatus.

The relatively mature market is likely to be driven by the rising number of laws and regulations mandating the installation of fire safety equipment across several industries and sectors over the forecast period. Factors such as the easy availability of technologically advanced equipment and advanced networking capabilities that allow efficient communication between fire detection solutions and fire suppression systems or solutions are also expected to drive the market.

The market is also likely to benefit from advancements in wireless sensor networks and the increased adoption of wireless fire-sensing devices. Growing awareness about combating fire hazards, along with a substantial rise in building infrastructure development activities, are also expected to be high-impact drivers for the market. Organizations across the globe are increasingly spending on the safety and security of infrastructure to reduce human losses. Implementation of fire safety codes for building and renovation activities is further expected to stimulate the demand for fire safety equipment across the globe.

With the development of sensor technologies and the consecutive introduction of smart wireless systems, the use of electronic components in fire safety devices has significantly increased. These improved devices have heightened sensitivity and respond quickly to emergencies. As they are manufactured with high precision and enhanced materials, the cost of these components and systems is high. For instance, a high-end photoelectric smoke detector can cost as high as USD 2,400 each. Similarly, high-end photoelectric heat detectors would cost approximately USD 2,000 to USD 2,400, and flame detectors would range from USD 2,800 to USD 3,000 per unit.

The high costs may discourage the uptake of these products across a number of cost-conscious industries, organizations, and countries. Thus, making advanced systems affordable is crucial for steady growth for manufacturers over the forecast period. The easy availability of affordable systems and components is likely to lead to their widespread adoption among small & medium enterprises, which will ensure optimum growth prospects for the fire safety equipment industry.

Solution Insights

Based on the solution, the fire detection dominated the market and accounted for more than 65.5% share of the global revenue in 2025. This growth can be attributed to increasing policies, regulations, and government mandates, along with the use of advanced technology in detection devices. Furthermore, the growing number of fire accidents globally has prompted the need to install fire safety equipment.

The fire detection segment is anticipated to expand at the highest CAGR over the forecast period. The rapid development in commercial construction and growing smart city projects will boost the demand for fire detection equipment during the forecast period. Furthermore, increased consumer spending on construction activities owing to the availability of disposable income and growing awareness about fire detectors is expected to drive the growth of the market in the near future.

Application Insights

The commercial application segment dominated the market with a revenue share of over 40% in 2025, supported by rapid infrastructure expansion and the rising stringency of building safety norms across retail, hospitality, corporate offices, healthcare facilities, and educational institutions. These establishments prioritize comprehensive fire protection systems to safeguard high footfall environments, valuable assets, and uninterrupted business operations. Increasing incidences of electrical short circuits, high-density occupancy, and the extensive use of electronic equipment further elevate fire-related vulnerabilities in commercial buildings.

The residential segment is expected to register the highest CAGR over the forecast period. In the past couple of years, the demand for fire safety equipment has increased significantly across this sector, owing to the rising awareness about fire safety equipment and its benefits. The growing infrastructure development in developed and developing countries is also anticipated to fuel the growth.

Regional Insights

The North America fire safety equipment market held the largest market share of 36.5% in 2025. A shift toward continuous, analytics-enabled building upgrades is propelling the market growth across North America, where rising wildfire incidence and aging electrical infrastructure are driving organizations to replace legacy systems with smart, diagnostics-capable fire detection and suppression technologies. This modernization cycle, reinforced by strong regional R&D and early pilot deployments, is boosting the market for advanced fire-safety equipment.

U.S. Fire Safety Equipment Market Trends

In the U.S., constant updates to NFPA codes and Life Safety standards are boosting the market by pushing commercial and residential builders to adopt higher-performance detection and suppression systems. Simultaneously, wildfire-prone regions are witnessing a surge in private investments in roof sprinklers, high-capacity pumps, and on-site water systems, which is propelling the market growth through a new premium consumer sub-segment.

Asia Pacific Fire Safety Equipment Industry Trends

The fire safety equipment market in Asia Pacific is expected to grow at the fastest CAGR during the forecasted period. APAC’s rapid urbanization and preference for IoT-connected, remotely managed fire detection systems are propelling the market growth as commercial complexes, residential towers, and infrastructure projects adopt next-generation solutions from day one. The region’s leapfrog transition to smart fire safety is boosting sustained market adoption and recurring revenue from remote maintenance services.

China’s large-scale urban development has boosted the market through massive deployments of basic fire-safety infrastructure, and the ongoing upgrade cycle toward intelligent, zoned, and building-integrated systems is propelling further market growth. Domestic manufacturers’ ability to scale quickly and add analytics features is strengthening demand.

Japan’s emphasis on compact, redundant, and ultra-reliable fire detection systems suited for dense urban spaces is boosting the market for miniaturized detectors and precision-engineered suppression devices. The country’s demand for non-invasive yet fail-safe retrofits is propelling sustained adoption across transit hubs, apartments, and commercial districts.

India’s accelerating enforcement of fire-safety codes across major metros is propelling the market growth as a vast installed base of older buildings undergoes upgrades, inspections, and certification. This compliance-driven shift is boosting market demand for alarms, sprinkler retrofits, hydrant systems, and bundled survey-plus-service offerings.

Europe Fire Safety Equipment Industry Trends

The fire safety equipment market in Europe was identified as a lucrative region in 2025. Europe’s shift from basic compliance to performance-validated fire systems-evaluated on parameters such as detection-to-response time and verifiable test logs is accelerating adoption of intelligent, analytics-driven protection equipment. This focus on measurable outcomes across hospitals, transport hubs, and retail chains is boosting the regional market for integrated hardware-software fire-safety solutions.

Germany’s preference for engineered, precision-tested fire protection systems-featuring calibrated detectors, system-level warranties, and documented reliability metrics is propelling demand in industrial zones, automotive plants, and chemical parks. This engineering-led procurement approach is boosting market growth for high-specification fire-safety equipment and long-term service contracts.

In the U.K., regulator-led inquiries and heightened public scrutiny following high-profile incidents are spurring market expansion as institutions implement phased system upgrades backed by independent audits. This accountability-driven procurement climate is boosting the market for modern detection, compartmentalization, and suppression technologies.

Key Fire Safety Equipment Companies Insights

Some of the key companies in the fire safety equipment market include Eaton, Gentex Corporation, Halma plc, Hochiki Corporation, Honeywell International Inc., Johnson Controls, Napco Security Technologies Inc., Nittan Company Ltd., Robert Bosch GmbH, Siemens Building Technologies, Space Age Electronics, and United Technologies Corporation, among others. Leading players in the fire safety equipment market continue expanding their technology portfolios and global service footprint to gain a competitive advantage. As a result, major companies are investing in advanced sensing technologies, integrated fire detection-suppression platforms, cloud-enabled monitoring, regional service partnerships, and targeted acquisitions. These strategic moves aim to improve system reliability, reduce false alarms, accelerate building compliance, and align with evolving safety standards across industrial, commercial, and residential applications.

-

Eaton is a prominent global player in emergency lighting, fire alarm control systems, and intelligent notification solutions used across commercial and critical-infrastructure facilities. The company’s fire safety portfolio focuses on addressable control panels, mass notification systems, and energy-efficient emergency luminaires, supported by Eaton’s strong electrical engineering expertise. With a presence in more than 175 countries, Eaton continues investing in smart evacuation technologies and IoT-enabled safety management platforms, propelling its market presence in large-scale commercial and industrial deployments.

-

Gentex Corporation is recognized for its high-performance smoke detection and signaling technologies, especially in residential and institutional environments. Its innovations in photoelectric and dual-sensor detection, along with integrated CO-smoke alarm designs, have strengthened its reputation for reducing false alarms while enhancing occupant safety. Gentex’s focus on cost-effective, reliable detection solutions positions the firm as a preferred supplier for large-volume building projects and OEM partnerships.

Key Fire Safety Equipment Companies:

The following are the leading companies in the fire safety equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Eaton

- Gentex Corp.

- Halma plc

- Hochiki Corp.

- Honeywell International, Inc.

- Johnson Controls

- Napco Security Technologies, Inc

- Nittan Company Ltd.

- Robert Bosch GmbH

- Siemens Building Technologies

- Space Age Electronics

- United Technologies Corp

Recent Developments

-

In June 2025, Gentex Corporation introduced PLACE, a next-generation smart-home safety ecosystem that integrates advanced smoke and carbon-monoxide detection with cloud-connected alerting and mobile app management. The system enhances residential fire safety by combining multi-sensor detection, remote status monitoring, and intelligent notifications designed to reduce false alarms and improve response times. With a modular architecture and seamless compatibility with modern smart-home platforms, PLACE supports large-scale rollouts through retail and builder channels. This launch strengthens Gentex’s position in connected home safety solutions and expands its footprint across the consumer fire-protection market.

-

In December 2025, Halma plc announced a strategic acquisition of E2S aimed at expanding its safety and compliance capabilities within highly regulated industrial environments. The acquisition broadens Halma’s fire-safety detection and notification portfolio, delivered through its group companies, by adding advanced sensing technologies suited for high-risk industrial applications. This move enhances Halma’s ability to provide performance-verified, standards-compliant fire-protection systems across sectors such as manufacturing, energy, and critical infrastructure. By integrating the acquired technologies into its global safety business, Halma strengthens its leadership position and accelerates growth within markets demanding stringent fire-safety oversight.

Fire Safety Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 64.38 billion

Revenue forecast in 2033

USD 96.82 billion

Growth rate

CAGR of 6.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Eaton; Gentex Corp.; Halma plc; Hochiki Corp.; Honeywell International, Inc.; Johnson Controls; Napco Security Technologies, Inc.; Nittan Company Ltd.; Robert Bosch GmbH; Siemens Building Technologies; Space Age Electronics; United Technologies Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fire Safety Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fire safety equipment market report based on solution, application, and region.

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Detection

-

Detector

-

Alarm

-

-

Suppression

-

Extinguisher

-

Sprinkler

-

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Commercial

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fire safety equipment market size was estimated at USD 60.48 billion in 2025 and is expected to reach USD 64.38 billion in 2026.

b. The global fire safety equipment market is expected to grow at a compound annual growth rate of 6.0% from 2026 to 2033 to reach USD 96.82 billion by 2033.

b. North America dominated the fire safety equipment market with a share of over 36.5% in 2025. This is attributable to rapid infrastructural developments and the implementation of stringent fire safety regulations and norms.

b. Some key players operating in the fire safety equipment market include Robert Bosch GmbH; Eaton; Gentex Corp.; United Technologies Corp.; Siemens Building Technologies; Honeywell International, Inc.; Napco Security Technologies, Inc.; and Johnson Controls.

b. Key factors that are driving the fire safety equipment market growth include reconstruction activities and the implementation of building safety codes against fire protection across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.