- Home

- »

- Food Additives & Nutricosmetics

- »

-

Flavors And Fragrances Market Size & Trends Analysis Report, 2033GVR Report cover

![Flavors And Fragrances Market Size, Share & Trends Report]()

Flavors And Fragrances Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Natural, Aroma Chemicals), By Application (Flavors & Fragrances), By Region (North America, Europe, APAC, MEA, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-697-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Flavors And Fragrances Market Summary

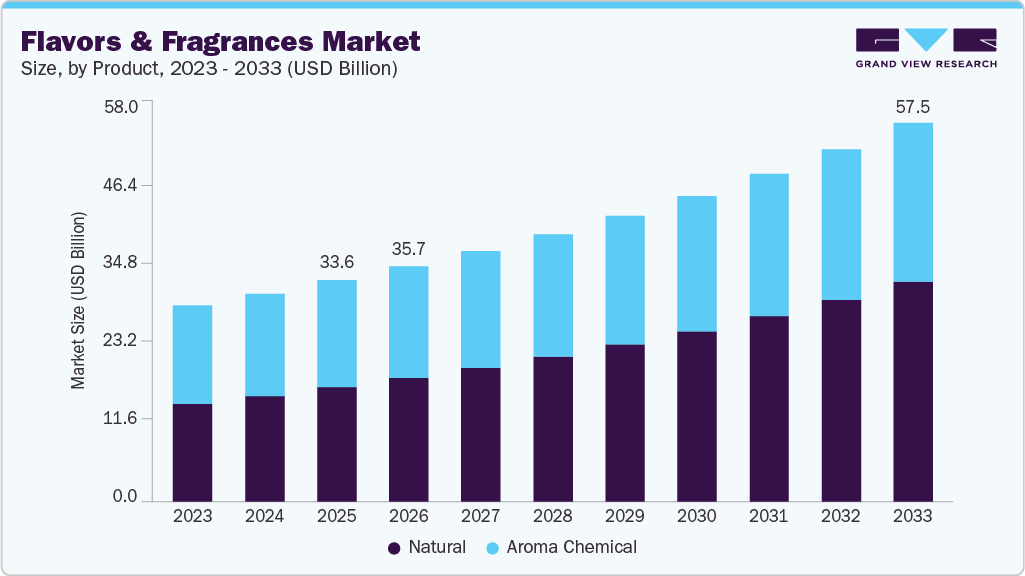

The global flavors and fragrances market size was estimated at USD 33.58 billion in 2025 and is projected to reach USD 57.52 billion by 2033, growing at a CAGR of 7.1% from 2026 to 2033. The market is witnessing strong growth due to rising consumer preference for natural, clean-label, and high-quality products.

Key Market Trends & Insights

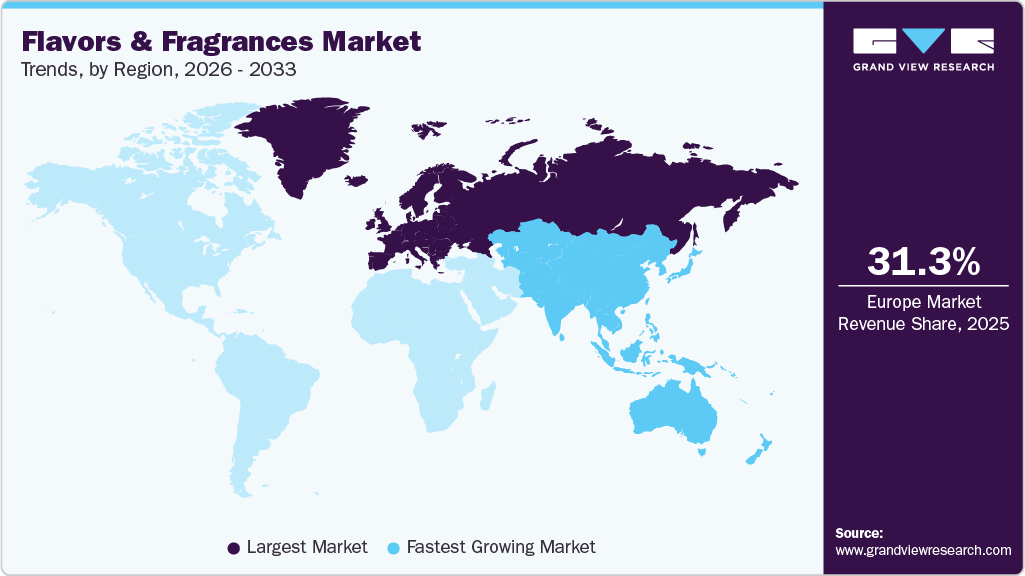

- Europe dominated the market with the largest revenue share of 31.3% in 2025.

- By product, the natural segment is expected to grow at the fastest CAGR of 8.6% from 2026 to 2033 in terms of revenue.

- By product, the natural segment held the largest revenue share of 51.6% in 2025 in terms of value.

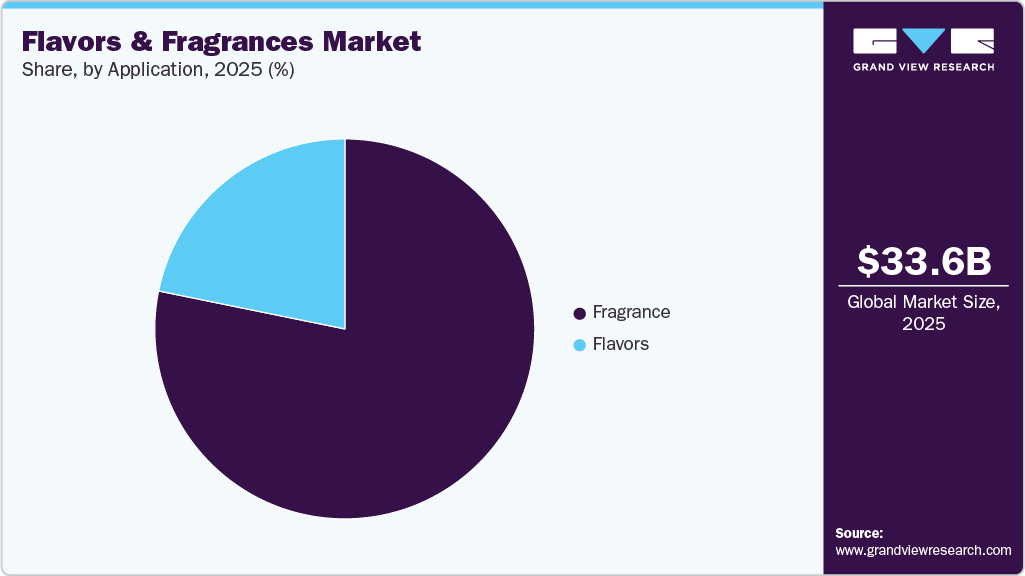

- By application, the fragrances segment held the largest revenue share of 78.2% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 33.58 Billion

- 2033 Projected Market Size: USD 57.52 Billion

- CAGR (2026-2033): 7.1%

- Europe: Largest market in 2025

- Asia Pacific: Fastest growing market

Health-conscious lifestyles, increased awareness of allergens, and growing demand for authentic sensory experiences are driving the adoption of natural ingredients in flavors and fragrances. Consumers are increasingly seeking products that deliver an enhanced taste and aroma while being free from synthetic or harmful additives. This shift toward healthier and more transparent formulations is creating robust opportunities for both natural and synthetic innovations across the edible and fragrance segments.Consumer preferences are rapidly evolving, with health consciousness and transparency shaping the natural edible flavors and fragrances landscape. People are increasingly seeking clean-label and allergen-free products, prompting manufacturers to reformulate their products with botanical extracts, essential oils, and nature-derived components. In the savory and sweet sectors, edible flavor innovation includes botanical infusions, fruit essences, and functional blends that enhance taste without artificial additives. The encapsulated flavors and fragrances industry supports shelf stability and controlled release of taste profiles in food and beverage applications, particularly in snacks, beverages, and dairy products. Meanwhile, the gourmand flavors and fragrances market, characterized by rich, dessert-type profiles such as caramel, vanilla, and chocolate notes, has grown with premium confectionery and bakery trends.

Regional markets have made unique contributions to global dynamics. The Mexico market, for instance, is propelled by expanding food processing, beverage innovations, and personal care sectors, while the young population and rising middle class drive demand for both savory and sweet edible flavors. Similarly, the Saudi Arabia market benefits from increased consumption of flavored foods, luxury perfumery, and cosmetic fragrances. Cultural preferences for rich, exotic scent profiles bolster the gourmand fragrance segment. Urbanization, tourism, and retail expansion in both countries support broad category adoption, making them key growth regions for multinational F&F players.

The future of the global F&F industry lies in striking a balance between innovation and sustainability. Advances in biotechnology, AI-assisted formulation, and microencapsulation enhance product performance and cost efficiency. The edible flavors and fragrances market continues to integrate functional and experiential profiles, while the gourmand segment taps into indulgence trends. Natural and renewable ingredients help brands meet regulatory and ethical expectations, particularly in developed markets. As regional markets such as Mexico and Saudi Arabia rise, demand for culturally tailored flavors and luxury fragrances will sustain long-term growth.

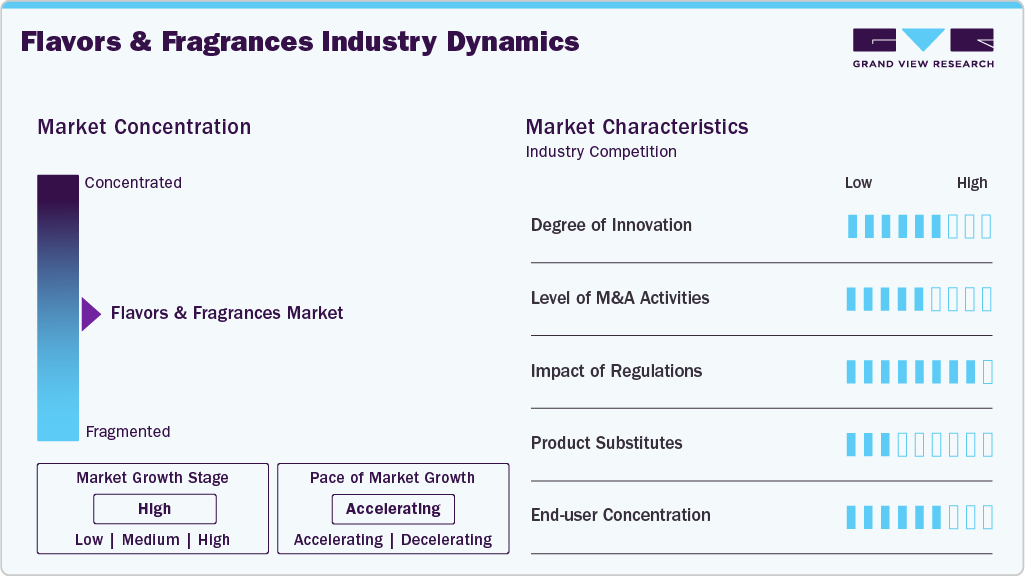

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Sensient Technologies Corp., BASF SE, and Mane SA, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

The leading players in the market are adopting a range of strategic initiatives focused on innovation, sustainability, and regional expansion to strengthen their market share. Companies are heavily investing in R&D to develop novel, clean-label, and functional ingredients aligned with evolving consumer preferences. Strategic mergers and acquisitions are being pursued to enhance product portfolios, strengthen global distribution networks, and enter high-growth emerging markets. In addition, firms are leveraging biotechnological advancements to produce cost-efficient and eco-friendly aroma compounds, while also establishing long-term partnerships with raw material suppliers to ensure quality and traceability.

Product Insights

The natural segment held the largest revenue share of 51.6% in 2025 due to the strong demand for essential oils, oleoresins, and other plant-derived extracts widely used across both flavor and fragrance applications. Rising consumer preference for clean-label, botanical, and sustainably sourced ingredients has significantly boosted adoption in food, beverages, personal care, and fine fragrances. Besides, the premium pricing of natural ingredients further elevates their overall revenue contribution within the market.

Essential oils, under the natural segment, are expected to grow at the fastest CAGR of 9.5% over the forecast period due to increasing consumer preference for clean-label, natural, and sustainable ingredients in flavors and fragrances. Their versatility across food, beverages, personal care, and aromatherapy applications drives demand. Furthermore, rising awareness of the therapeutic and wellness benefits of essential oils, coupled with the expansion of premium and natural product lines, is further fueling their rapid market growth.

Application Insights

The fragrances segment accounted for the largest revenue share of 78.2% in 2025 due to the extensive use of aroma chemicals and essential oils in perfumes, personal care products, home care, and luxury cosmetics. High consumer demand for premium and long-lasting fragrances, combined with the increasing popularity of scented products in emerging markets, has driven substantial revenue growth. Besides, the higher pricing of fragrance ingredients compared to flavors contributes significantly to the segment’s dominant market share.

The flavors segment is projected to grow at a CAGR of 6.7% from 2026 to 2033, driven by the rising demand for processed and packaged foods, beverages, and bakery products. The increasing consumer preference for natural and clean-label flavors, along with innovations in taste profiles and new product launches, is driving market expansion. Furthermore, growth in emerging markets, urbanization, and changing lifestyles that favor convenient and flavorful food options are contributing to the steady growth of the flavors segment.

Regional Insights

The flavors and fragrances industry in Europe dominated the market with a revenue share of 31.3% in 2025, supported by a well-regulated environment and demand for high-quality, sustainable products. Consumers in the region prioritize safety, transparency, and traceability, making natural and bio-based ingredients increasingly popular. The market is also benefiting from strong growth in luxury fragrances, organic personal care products, and specialty foods, particularly in Western Europe. Innovation and compliance with EU regulations remain central to regional competitiveness.

Germany Flavors And Fragrances Market Trends

The Germany flavors and fragrances industry led the European market owing to its strong food processing and cosmetics industries, along with a growing emphasis on sustainability and clean-label formulations. Demand for customized flavors and premium fragrances is increasing, particularly among health-conscious and environmentally conscious consumers. The country also serves as a manufacturing and innovation hub, with several leading global players and niche natural product brands operating in the region.

Asia Pacific Flavors and Fragrances Market Trends

The flavors and fragrances industryin theAsia Pacific has grown due to a combination of abundant raw material availability, cost-effective manufacturing, and a strong consumer base. The region is a major producer of essential oils, oleoresins, and natural extracts, which are widely used in F&F formulations, thereby lowering production costs and increasing adoption. Additionally, rapid growth in the food & beverage, personal care, and cosmetics industries, along with rising demand for premium, natural, and clean-label products, has fueled market expansion. Increasing investments in flavor and fragrance R&D further strengthen Asia Pacific’s leading position.

The China flavors and fragrances industry remains a key contributor to the Asia Pacific’s market leadership, driven by strong domestic demand across food, beverage, cosmetics, and household care sectors. The country’s growing focus on product premiumization, natural formulations, and wellness-related offerings is prompting manufacturers to invest in advanced flavor and fragrance solutions. Government initiatives supporting local manufacturing, coupled with the rise of e-commerce and international brand penetration, are further enhancing market potential in China.

North America Flavors And Fragrances Market Trends

Theflavors and fragrances industry in North America is driven by rising demand for natural, clean-label, and sustainably sourced ingredients, especially essential oils and botanical extracts. Consumers are increasingly opting for functional foods, wellness-oriented products, and premium personal care items. Exotic and ethnic flavors are gaining traction due to multicultural influence, while homecare and fragrance applications continue to expand. Technological innovations, such as microencapsulation and biotechnology-assisted formulations, enhance product performance. Regulatory compliance with FDA, USDA, and IFRA standards ensures safety and transparency.

The U.S. flavors and fragrances industry remained the dominant market within North America, characterized by its strong consumer base, well-established retail infrastructure, and trend-led product innovation. The country is witnessing a growing appetite for organic and artisanal food and beverage offerings, as well as premium personal care products with botanical scents. Strategic investments in green chemistry, supply chain transparency, and wellness-driven formulations are key factors influencing market dynamics in the U.S.

Latin America Flavors and Fragrances Market Trends

Theflavors and fragrances industry in Latin Americais expanding due to rising urbanization, growing demand for processed foods, and increasing personal care consumption. Natural and clean-label ingredients, especially citrus and spice flavors, are gaining preference. Fragrance growth is supported by rising disposable income and increased uptake of beauty products. Supply-chain improvements and local manufacturing investments are strengthening regional capacity, while sustainability and premiumization trends are influencing product development and consumer choices.

Middle East & Africa Flavors and Fragrances Market Trends

Theflavors and fragrances industry in the Middle East & Africais growing on the back of rising demand for personal care, premium fragrances, and processed foods. Urbanization, higher disposable incomes, and expanding retail channels are boosting consumption. Natural and clean‑label ingredients, especially citrus and mint flavors, are increasingly preferred. The region also sees growth in halal and culturally tailored products. Tourism, luxury beauty markets, and investment in local production are strengthening market potential, while sustainability and regulatory compliance continue to shape industry trends.

Key Flavors And Fragrances Company Insights

Key players, such as Sensient Technologies Corp., BASF SE, Mane SA, and Takasago International Corporation, are dominating the market.

BASF SE

-

BASF SE is a leading global player in the global market, known for its extensive portfolio of aroma ingredients, functional raw materials, and sustainable solutions catering to personal care, home care, and food industries. Leveraging its strong R&D capabilities and advanced chemical expertise, BASF offers a wide range of high-performance aroma chemicals, including esters, alcohols, and aldehydes, that enhance the olfactory and sensory profiles of consumer products. The company is actively investing in green chemistry and biotechnology to expand its range of bio-based and biodegradable ingredients in response to growing consumer demand for clean-label and eco-friendly formulations. With a strategic focus on innovation, regulatory compliance, and supply chain integration, BASF continues to strengthen its global footprint through partnerships, capacity expansions, and localized product development tailored to the needs of emerging markets.

Key Flavors And Fragrances Companies:

The following are the leading companies in the flavors and fragrances market. These companies collectively hold the largest market share and dictate industry trends.

- Sensient Technologies Corp.

- BASF SE

- Mane SA

- Takasago International Corporation

- Givaudan

- Alpha Aromatics

- Ozone Naturals

- Elevance Renewable Sciences, Inc.

- Firmenich SA

- Symrise AG

Recent Developments

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In January 2023, Symrise AG invested in Ignite Venture Studio. It is B2C startup ventures in the personal care sector. Symrise has invested in Ignite Venture Studio to drive product innovations in fragrance and cosmetic ingredients.

-

In March 2024, BASF Aroma Ingredients expanded its Isobionics® portfolio with Natural beta-Caryophyllene 80, a biotech-derived natural flavor offering high purity, consistent supply, and broad food, beverage, and fragrance applications.

-

In March 2024, DSM‑Firmenich AG opened two advanced production facilities in Castets, France, producing pine-based, bio-sourced ingredients and biodegradable musk Habanolide®, boosting fragrance ingredient capacity, supporting sustainability, and enhancing global supply for perfumery applications.

Flavors And Fragrances Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 35.69 billion

Revenue forecast in 2033

USD 57.52 billion

Growth rate

CAGR of 7.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Portugal; China; India; South Korea; Japan; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Sensient Technologies Corp.; BASF SE; Mane SA; Takasago International Corp.; Givaudan; Alpha Aromatics; Ozone Naturals; Elevance Renewable Sciences, Inc.; Firmenich SA; Symrise AG

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flavors And Fragrances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global flavors and fragrances market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Natural

-

Essential Oils

-

Orange Essential Oils

-

Corn mint Essential Oils

-

Eucalyptus Essential Oils

-

Pepper Mint Essential Oils

-

Lemon Essential Oils

-

Citronella Essential Oils

-

Patchouli Essential Oils

-

Clove Essential Oils

-

Ylang Ylang/Canaga Essential Oils

-

Lavender Essential Oils

-

Others

-

-

Oleoresins

-

Paprika Oleoresins

-

Black Pepper Oleoresins

-

Turmeric Oleoresins

-

Ginger Oleoresins

-

Others

-

-

Other Natural

-

-

Aroma Chemical

-

Esters

-

Alcohol

-

Aldehydes

-

Phenol

-

Terpenes

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Products

-

Beverages

-

Animal Feed

-

Others

-

-

Fragrance

-

Fine Fragrance

-

Cosmetics and Toiletries

-

Soaps and Detergents

-

Aromatherapy

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Portugal

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global flavors and fragrances market size was estimated at USD 33.58 billion in 2025 and is expected to reach USD 35.69 billion in 2026.

b. The global flavors and fragrances market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2033 to reach USD 57.52 billion by 2033.

b. The natural segment held the largest revenue share of 51.6% in 2024 due to rising consumer demand for clean-label, plant-based, and sustainable ingredients across food, beverage, and personal care applications. This shift was further supported by regulatory pressures on synthetic additives and the growing popularity of wellness-focused and premium products.

b. Some of the key players operating in the flavors and fragrances market include Sensient Technologies Corp., BASF SE, Mane SA, Takasago International Corp., Givaudan, Alpha Aromatics, Ozone Naturals, Elevance Renewable Sciences, Inc., Firmenich SA, and Symrise AG.

b. The flavors and fragrances market is driven by rising demand for natural and clean-label ingredients, growing consumption of processed foods and beverages, and increased spending on personal care and home care products. The evolving consumer preferences toward wellness and sensory-driven experiences are fueling innovation across both flavor and fragrance applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.