- Home

- »

- Plastics, Polymers & Resins

- »

-

Flexible Intermediate Bulk Container Market Report, 2033GVR Report cover

![Flexible Intermediate Bulk Container Market Size, Share & Trends Report]()

Flexible Intermediate Bulk Container Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Type A, Type B, Type C, Type D), By End Use (Food, Chemical, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-695-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Intermediate Bulk Container Market Summary

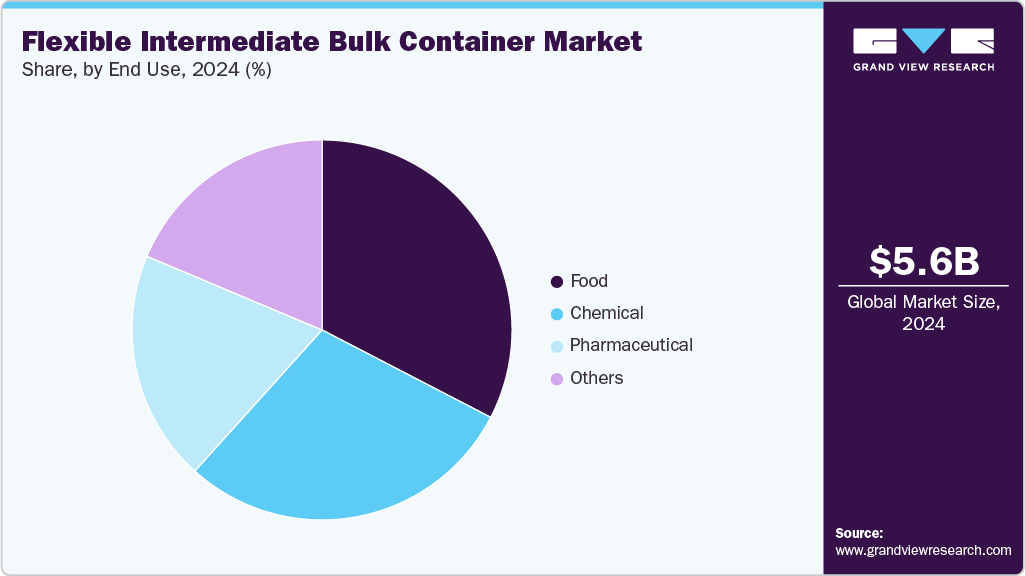

The global flexible intermediate bulk container market size was estimated at USD 5.64 billion in 2024 and is projected to reach USD 9.69 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. The market is driven by growing demand from the food, chemical, and pharmaceutical industries for cost-effective, bulk packaging solutions.

Key Market Trends & Insights

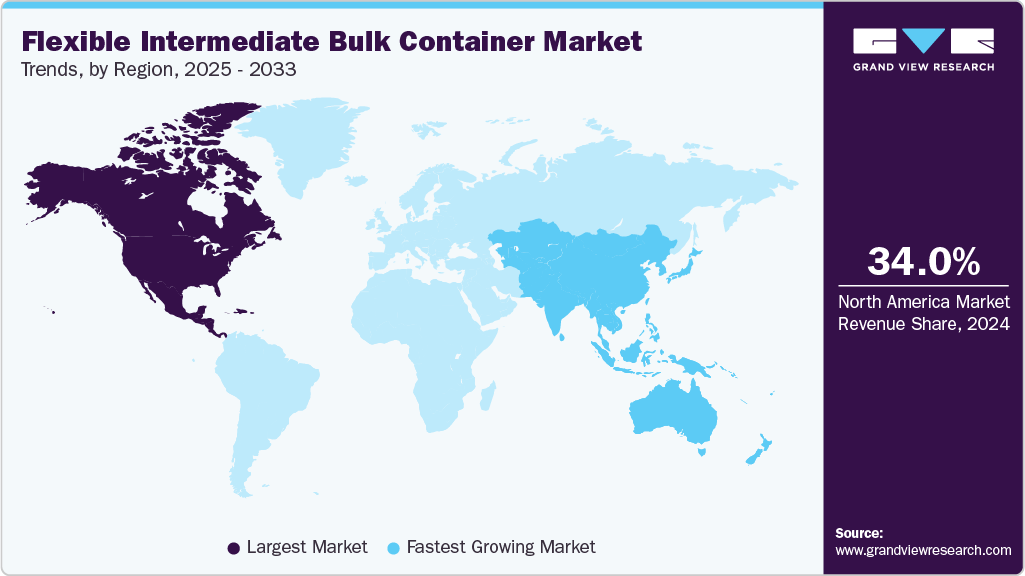

- North America dominated the flexible intermediate bulk container market with the largest revenue share of 34.04% in 2024.

- The flexible intermediate bulk container market in China is expected to grow at a substantial CAGR of 8.3% from 2025 to 2033.

- By product type, the type D segment is expected to grow at a considerable CAGR of 7.6% from 2025 to 2033 in terms of revenue.

- By end use, the pharmaceutical segment is expected to grow at a considerable CAGR of 6.8% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 5.64 Billion

- 2033 Projected Market Size: USD 9.69 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

In addition, increased global trade and logistics activities are fueling the need for durable and lightweight packaging options. One of the primary growth drivers for the FIBC market is the increasing use of bulk containers for packaging and transporting agricultural products such as grains, seeds, sugar, and flour. As global food trade rises, especially in developing regions such as Southeast Asia and Africa, the need for cost-effective, lightweight, and durable packaging solutions becomes critical.

FIBCs offer higher payload capacity and reduce the need for secondary packaging, making them ideal for large-scale food logistics. For instance, in countries such as India and Brazil, agricultural cooperatives are increasingly adopting FIBCs for safe storage and long-distance transport of produce.

The FIBC market is also significantly influenced by the rising demand in the chemical and pharmaceutical sectors, which require robust and secure packaging for powders, resins, and hazardous materials. FIBCs, especially those with electrostatic discharge protection (Type C and D bags), ensure compliance with safety regulations during storage and transport. Pharmaceutical companies are also turning to cleanroom-manufactured FIBCs for sterile, contamination-free operations. With chemical exports rising from countries such as China, Germany, and the U.S., the demand for FIBCs that can handle corrosive and high-purity materials is increasing sharply.

FIBCs are reusable, recyclable, and often made from polypropylene, a material with a lower environmental footprint compared to alternatives such as rigid drums or plastic barrels. Their reusability and stackability reduce storage and transportation costs, making them a preferred option for businesses focused on cost optimization and sustainability. As environmental regulations tighten and ESG (Environmental, Social, and Governance) compliance becomes a strategic business objective, industries are actively replacing traditional packaging formats with eco-friendly bulk bags.

The infrastructure, mining, and construction sectors in developing regions such as Southeast Asia, Latin America, and Africa are experiencing substantial growth. These industries rely heavily on bulk handling of cement, sand, and minerals, for which FIBCs are ideal due to their high load-bearing capacity and ease of handling via cranes and forklifts. For example, the African mining sector’s growth has triggered an uptick in demand for heavy-duty FIBCs to transport bauxite, copper, and other ores. The increased investment in infrastructure development projects, including roads and smart cities, further supports the robust uptake of FIBC packaging solutions.

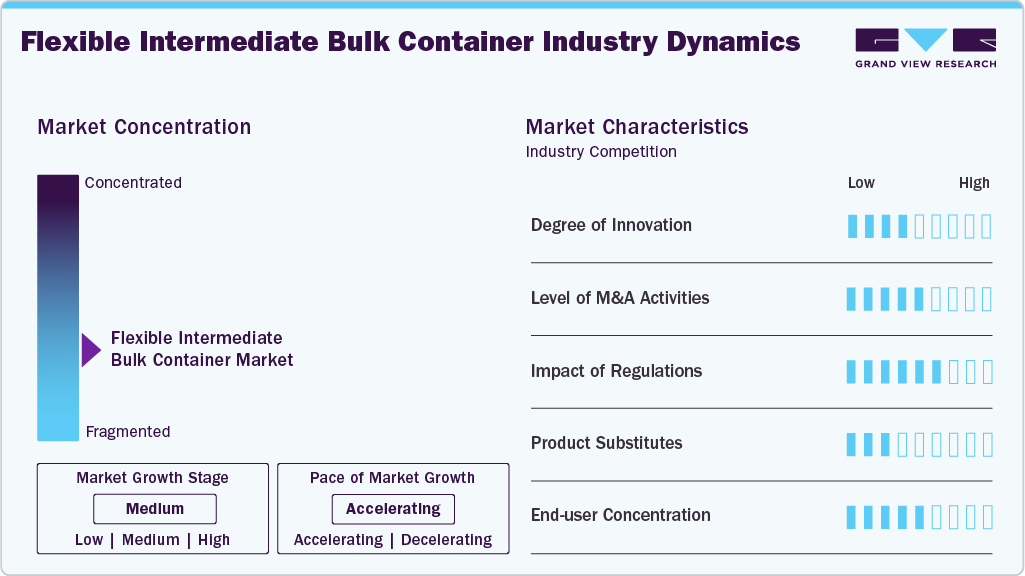

Market Concentration & Characteristics

The industry is characterized by moderate technological complexity. While standard FIBCs are relatively simple to manufacture, there is growing demand for value-added features such as UV protection, moisture barriers, liners, anti-static properties (Type B, C, and D), and pharmaceutical-grade cleanliness. This customization potential gives manufacturers the flexibility to cater to niche markets. Innovations in design (e.g., baffle bags, Q bags) and material advancements (such as bio-based polypropylene) are beginning to influence procurement decisions, particularly in food, pharma, and specialty chemical applications.

FIBC manufacturing is increasingly subject to regulatory standards related to safety, hygiene, and environmental performance. Key regulations include UN Certification for transporting hazardous goods, FDA approval for food-contact packaging, and ISO standards. Sustainability has also become a defining characteristic of the industry. Recyclability of polypropylene and the use of reusable bulk bags have gained importance among buyers focused on reducing carbon footprints and complying with circular economy principles. Companies that can meet both regulatory and sustainability expectations tend to hold stronger positions in the market.

Product Type Insights

The type A segment recorded the largest market revenue share of over 66.0% in 2024. Type A FIBCs are made from plain woven polypropylene (or similar non-conductive materials) and do not have any mechanisms for dissipating static electricity. They are used to transport non-flammable products where there is no risk of static discharge. Type A FIBCs are the most basic and economical option, offering durability and reusability for dry, non-hazardous goods. The primary driver for Type A FIBCs is their cost-effectiveness and widespread availability, making them ideal for general-purpose use across industries such as agriculture, food (non-flammable), and construction.

The type D segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. Type D FIBCs are made from antistatic and static-dissipative fabrics that do not require grounding. They are designed to safely dissipate static electricity into the atmosphere through corona discharge. These bags are used when grounding is not feasible, especially in environments with high flammable vapor concentration or restricted access to grounding infrastructure. The rise in demand for advanced static protection without grounding dependency is driving the market for Type D FIBCs. Their ease of use and enhanced safety features make them ideal for sectors such as pharmaceuticals, food processing, and specialty chemicals.

End Use Insights

The food segment recorded the largest market revenue share of over 32.0% in 2024. The food industry represents a significant share of the FIBC market due to the need for hygienic, safe, and contamination-free packaging solutions for bulk products such as sugar, flour, grains, starch, salt, and dairy powders. FIBCs are preferred in this sector because of their compliance with food safety standards, availability in food-grade variants, and their ability to handle large volumes efficiently. The growing global demand for processed and packaged food, particularly in developing regions, is a major growth driver.

The pharmaceutical segment is expected to grow at the fastest CAGR of 6.8% during the forecast period. In the pharmaceutical industry, FIBCs are used to transport active pharmaceutical ingredients (APIs), excipients, and fine powders. The containers used in this sector are usually produced in cleanroom environments and comply with GMP and hygiene standards. Their design helps in minimizing product loss and ensuring sterility during handling. Rising pharmaceutical manufacturing, increasing cross-border trade of pharmaceutical raw materials, and stringent hygiene requirements drive the adoption of pharma-grade FIBCs.

Region Insights

North America dominated the market and accounted for the largest revenue share of over 36.0% in 2024. North America’s FIBC market growth is driven by advanced industrial sectors, stringent safety regulations, and high demand from the food & pharmaceutical industries. The U.S. and Canada use FIBCs extensively in chemical, construction, and agricultural applications due to their durability and compliance with OSHA and FDA standards. For instance, the U.S. chemical industry prefers FIBCs for transporting hazardous materials safely, while the food sector uses FDA-approved bulk bags for grains and powders. In addition, the rise of e-commerce and logistics optimization has increased FIBC usage for bulk shipping.

The U.S. is a major FIBC consumer due to its large-scale agricultural, chemical, and pharmaceutical industries. The country’s focus on workplace safety and efficient logistics drives demand for high-quality bulk bags. For example, U.S. agrochemical companies use FIBCs to transport fertilizers, while food processors rely on them for flour and sugar storage. The shale gas boom has also increased FIBC usage in the petrochemical sector. In addition, the growth of online retail and bulk e-commerce shipments has further accelerated FIBC adoption in the U.S.

Europe Flexible Intermediate Bulk Container Market Trends

Europe’s FIBC market is fueled by strict environmental regulations, a strong chemical industry, and sustainable packaging trends. Germany, France, and the Netherlands are key players, with Germany leading in chemical exports that require high-performance FIBCs. The EU’s Circular Economy Action Plan encourages reusable and recyclable packaging, pushing manufacturers to develop eco-friendly FIBCs. For example, companies such as Langston Companies Inc. produce biodegradable bulk bags for agricultural use. In addition, Europe’s food and pharmaceutical sectors prefer FIBCs for hygienic and contamination-free transport. The region’s focus on reducing plastic waste has also led to innovations in FIBC materials, making Europe a leader in sustainable bulk packaging solutions.

Asia Pacific Flexible Intermediate Bulk Container Market Trends

The Asia Pacific region is a major driver of the FIBC market due to rapid industrialization, growing agricultural exports, and increasing chemical manufacturing. Countries such as India and China are leading demand, as their manufacturing sectors expand and require cost-effective bulk packaging solutions. For example, India’s fertilizer and food grain industries rely heavily on FIBCs for storage and transportation, while China’s chemical sector uses these containers for exporting raw materials. In addition, government initiatives promoting infrastructure development and trade further boost FIBC adoption.

Key Flexible Bulk Container Company Insights

The competitive environment of the flexible intermediate bulk container (FIBC) market is moderately fragmented, characterized by the presence of both global players and regional manufacturers competing on price, customization, quality, and supply chain capabilities. Major players dominate the market through strong production capacities, strategic partnerships, and a broad product portfolio tailored to diverse end-use industries such as food, chemicals, and pharmaceuticals. Meanwhile, regional players gain traction by offering cost-effective and flexible solutions catering to local demands. The market also sees increasing competition driven by sustainability initiatives, with manufacturers focusing on recyclable and reusable FIBCs to meet growing environmental regulations and customer preferences.

-

In May 2025, Chemco Group and Kandoi Group of Industries announced a strategic joint venture to establish two fully integrated greenfield manufacturing facilities in Vapi and Dahej, Gujarat, with a total investment of USD 54 million, dedicated to producing FIBC bags entirely from recycled PET. The plants will implement a closed-loop system covering PET bottle collection, washing, tape extrusion, weaving, and final bag fabrication, ensuring full traceability, consistent quality, and a significant reduction in environmental impact.

-

In March 2024, Greif, a global leader in industrial packaging, partnered with CDF Corporation to launch a redesigned GCUBE intermediate bulk container (IBC) Flex, specifically engineered for transporting highly sensitive and liquid products under sterile conditions. The next-generation GCUBE IBC Flex, now available across Europe and Scandinavia. This innovative solution is ideally suited for industries such as food and beverage, flavors and fragrances, lubricants, and pharmaceuticals, and emphasize sustainability through the collection, reuse, or reconditioning of the entire IBC system, making it well-suited for closed-loop operations.

Key Flexible Intermediate Bulk Container Companies:

The following are the leading companies in the flexible intermediate bulk container market. These companies collectively hold the largest market share and dictate industry trends.

- Greif

- Halsted Corporation

- Langston Bag

- IPG

- Palmetto Industries International Inc.

- Commercial Syn Bags Limited

- Codefine

- SafeFlex International Ltd.

- Dewitt

- JohnPac

- Bulk Corp International

- K-PACKING

- FORMOSA SYNTHETICS PVT. LTD.

Flexible Intermediate Bulk Container Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.99 billion

Revenue forecast in 2033

USD 9.69 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Greif; Halsted Corporation; Langston Bag; IPG; Palmetto Industries International Inc.; Commercial Syn Bags Limited; Codefine; SafeFlex International Ltd.; Dewitt; JohnPac; Bulk Corp International; K-PACKING; FORMOSA SYNTHETICS PVT. LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

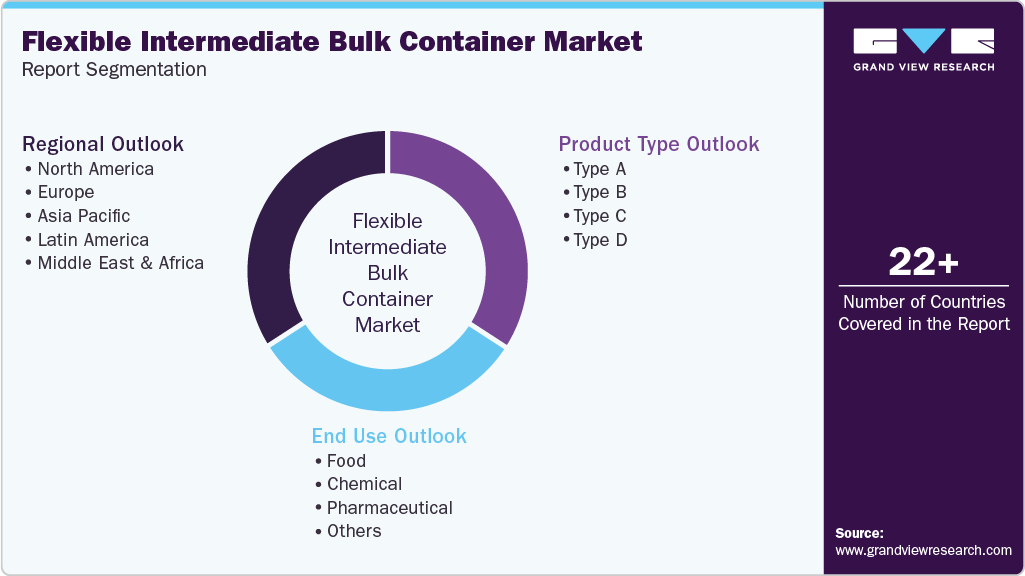

Global Flexible Intermediate Bulk Container Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global flexible intermediate bulk container market report based on product type, end use, and region:

-

Product Type Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Type A

-

Type B

-

Type C

-

Type D

-

-

End Use Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Food

-

Chemical

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global flexible intermediate bulk container market was estimated at around USD 5.64 billion in the year 2024 and is expected to reach around USD 5.99 billion in 2025.

b. The key players in the flexible intermediate bulk container market include Greif; Halsted Corporation; Langston Bag; IPG; Palmetto Industries International Inc.; Commercial Syn Bags Limited; Codefine; SafeFlex International Ltd.; Dewitt; JohnPac; Bulk Corp International; K-PACKING; FORMOSA SYNTHETICS PVT. LTD.

b. The market is driven by growing demand from the food, chemical, and pharmaceutical industries for cost-effective, bulk packaging solutions.

b. The global flexible intermediate bulk container market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach around USD 9.69 billion by 2033.

b. The food segment dominated the flexible intermediate bulk container market in 2024 with over 32.0% value share due to rising global demand for bulk food exports and the growing preference for hygienic, contamination-free packaging solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.