- Home

- »

- Semiconductors

- »

-

Flexible Printed Circuit Boards Market, Industry Report, 2030GVR Report cover

![Flexible Printed Circuit Boards Market Size, Share & Trends Report]()

Flexible Printed Circuit Boards Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Single Sided FPCBs, Double Sided FPCBS, Multilayer FPCBS, Rigid-Flex PCBS, Others), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-082-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Printed Circuit Boards Market Summary

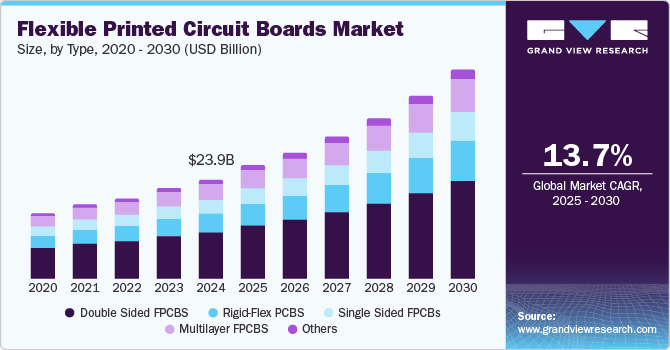

The global flexible printed circuit boards market size was estimated at USD 23.89 billion in 2024 and is projected to reach USD 50.90 billion by 2030, growing at a CAGR of 13.7% from 2025 to 2030. The growth of this market is primarily influenced by factors such as the increasing demand for flexible electronic devices utilized in different sorts of vehicles and the rapid pace of advancements in automotive electronics.

Key Market Trends & Insights

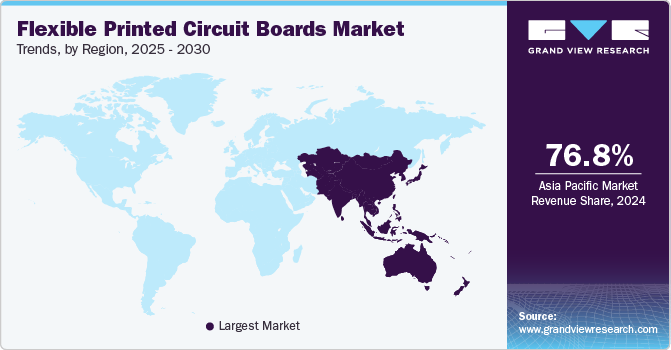

- Asia Pacific dominated the global flexible printed circuit boards industry with a revenue share of 76.8% in 2024.

- The U.S. flexible printed circuit boards market held the largest revenue share of the regional industry in 2024.

- By type, double sided FPCBs segment dominated the global flexible printed circuit boards industry with a revenue share of 46.1% in 2024.

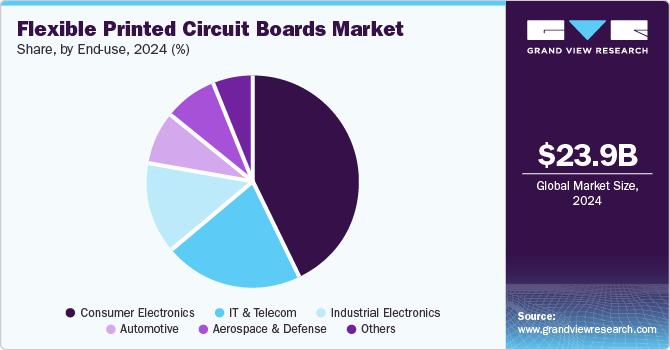

- By end use, the consumer electronics segment held the largest revenue share of the global flexible printed circuit boards industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.89 Billion

- 2030 Projected Market Size: USD 50.90 Billion

- CAGR (2025-2030): 13.7%

- Asia Pacific: Largest market in 2024

In recent years, significant developments in automotive industries and changes in consumer preferences have driven the growing demand for flexible printed circuit boards (PCBs). These boards are often developed with flexible polymer film with lamination of conductive copper-based traces on it. Unlike rigid, traditional PCBs, these boards are adaptable and suitable for bents in case fitting into multiple devices. Additional features associated with FPCBs, such as temperature adaptability and enhanced thermal properties, have been contributing to the growth experienced by this market. Space-saving characteristics of the product and applications in different industries, such as wearables, healthcare technology, and others, are expected to generate a surge in demand for this market.

FPCBs limit the use of wires in overall assembly design, resulting in simplification of designs and ease of installation in various devices. Enhanced performance, packaging flexibility, and adaptability offered by the FPCBs are likely to increase utilization during the forecast period significantly. Market participants in the Asia Pacific region have developed low-cost variants in the Asia Pacific region, which has posed significant competition for players operating in North America and Europe. Gradual increases in adopting FPCBs in the electronics industry add to the competition. Portfolio enhancements, newly signed supply contracts, significantly growing demand for smartphones, and increasing utilization of automotive technology are expected to add lucrative growth opportunities for this market in the forecast period.

Type Insights

The double sided FPCBs segment dominated the global flexible printed circuit boards industry with a revenue share of 46.1% in 2024. Such boards enable designers to access circuit trails from the top and bottom sides of the circuit, which adds better flexibility to the overall design. Additionally, the advantages of double sided FPCBs associated with potential wiring errors, circuit complexity, and weight have attracted many users.

The multilayer FPCB segment is projected to experience the highest growth during the forecast period. Increasing demand for compact, flexible, and user-friendly devices in multiple industries is likely to surge demand for this type. Industries such as consumer electronics, healthcare technology, automotive, and others have been experiencing noteworthy changes in consumer requirements, which has stimulated the demand for compact-size devices developed with tailored approaches.

End Use Insights

The consumer electronics segment held the largest revenue share of the global flexible printed circuit boards industry in 2024. This segment is primarily influenced by the focus of multiple manufacturers operating in the consumer electronics industry on developing compact-size devices equipped with advanced features while maintaining the expected quality. This includes smartphone accessories, wearables, and more. FPCBs provide unmatched flexibility, enabling manufacturers to fit complex structures in the devices.

The IT & telecom segment is expected to experience a significant CAGR during the forecast period. This is attributed to the increasing adoption of modern technology advancements such as 5G and the growing penetration of technologies such as Artificial Intelligence and the Internet of Things, which require accessibility to high-performance PCBs. The miniaturization trend also increases demand for FPCBs in the IT & telecom industry.

Regional Insights

Asia Pacific dominated the global flexible printed circuit boards industry with a revenue share of 76.8% in 2024. This market is mainly influenced by the growing availability of low-cost variants of FPCBs developed in the region and the presence of key electronic manufacturing industry participants in Asia. Rapid growth in the ubiquity of smartphones in countries such as India, China, and others also adds to the growth. Increasing growth experienced by the automotive manufacturing industry and demand for flexible PCBs in the automotive technology industry is likely to add growth opportunities for this market.

China held a significant revenue share of the regional industry in 2024. This market is mainly driven by the strong manufacturing industry operating in the country, the presence of multiple electronics industry manufacturers in China, and a significant share in the global trade of products such as FPCBs. Government support offered to manufacturers has enabled participants to provide products at lower prices to multiple global partners. Additionally, the large number of electronic cars developed in the country also contributes to the growth of this market.

Europe Flexible Printed Circuit Boards Market Trends

Europe was identified as one of the key regions of the flexible printed circuit boards industry in 2024. The growing ubiquity of consumer electronics devices such as wearables, smartphones, and others and the rapid pace of digital transformation embraced by multiple industries in the region are adding to the growth opportunities for this market. Significant demand from aerospace, automotive technology, and the IT and telecom industry also drives the growth experienced by this market.

The UK flexible printed circuit boards market held a substantial share of the regional industry in 2024. This market is mainly driven by the growing demand for miniature-sized devices, increasing automotive and healthcare technology utilization, and the availability of low-cost variants. The growing penetration of modern technologies such as artificial intelligence and others is also adding to the growth.

North America Flexible Printed Circuit Boards Market Trends

North America flexible printed circuit boards market is projected to experience the highest CAGR during the forecast period. The robust IT & telecom industry operating in the region, growing demand for advanced automotive technologies, and ease of availability are factors influencing the growth of this market. In recent years, the emergence of multiple supplier contracts has also added to the growth opportunities for this regional industry.

U.S. Flexible Printed Circuit Boards Market Trends

The U.S. flexible printed circuit boards market held the largest revenue share of the regional industry in 2024. This market is primarily influenced by factors such as the growing demand for a strong automotive manufacturing industry active in the country and the increasing demand for compact wearables and healthcare technology devices.

Key Flexible Printed Circuit Boards Company Insights

Some key global flexible printed circuit boards companies include AT&S; Benchmark Electronics; Cicor Management AG; Eltek Ltd.; Flex Ltd; IEC Electronics and others. To address pricing point competition multiple companies are focused on innovation and checking suitability of alternate locations for manufacturing units in Asia Pacific region.

-

AT&S, one of the key participants in the technology and innovation industry, offers a range of products such as IC substrates, HDI printed circuit boards, ECP printed circuit boards, high-frequency, high-speed printed circuit boards, tests and reference boards, double-sided printed circuit boards, and more. Its flexible and rigid-flex printed circuit board portfolio mainly features products for the medical technology sector.

-

Sumitomo Electric Industries, Ltd. specializes in multiple technology-driven industry solutions associated with environment & energy, info-communication, automotive, electronics, and more. Its electronics portfolio features electronic wire, Flexible printed circuits (FPC), Heat-shrinkable tubing (SUMITUBE), and more. It offers highly flexible FPCs, shape-keeping FPCs, high heat-resistant FPCs, and others.

Key Flexible Printed Circuit Boards Companies:

The following are the leading companies in the flexible printed circuit boards market. These companies collectively hold the largest market share and dictate industry trends.

- AT&S

- Benchmark Electronics

- Cicor Management AG

- Eltek Ltd.

- Flex Ltd

- IEC Electronics

- Jabil Inc.

- SigmaTron International, Inc.

- SMTC Corp

- Sumitomo Electric Industries, Ltd.

- TTM Technologies

Flexible Printed Circuit Boards Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.84 billion

Revenue forecast in 2030

USD 50.90 billion

Growth Rate

CAGR of 13.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Australia, South Korea, Japan, Brazil, UAE, Saudi Arabia

Key companies profiled

AISIN CORPORATION; AMF Reece - Cars s.r.o.; BERNINA; Brother; DÜRKOPP ADLER; Elna International Corporation; Jack Flexible printed circuit boardss; JANOME Corporation; SEIKO FLEXIBLE PRINTED CIRCUIT BOARDS CO., LTD.; PEGASUS CO.,LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

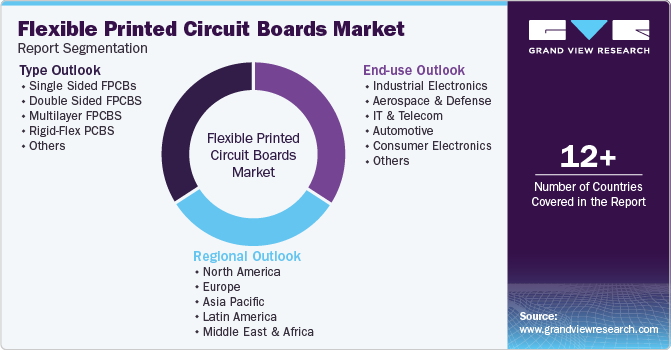

Global Flexible Printed Circuit Boards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flexible printed circuit boards market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Sided FPCBs

-

Double Sided FPCBS

-

Multilayer FPCBS

-

Rigid-Flex PCBS

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial Electronics

-

Aerospace & Defense

-

IT & Telecom

-

Automotive

-

Consumer Electronics

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Italy

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.