- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Float Glass Market Size, Share And Growth Report, 2031GVR Report cover

![Float Glass Market Size, Share & Trends Report]()

Float Glass Market (2025 - 2031) Size, Share & Trends Analysis Report By Product (Clear, Reflective, Tinted, Mirror), By End-use (Building & Construction, Energy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-107-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Float Glass Market Summary

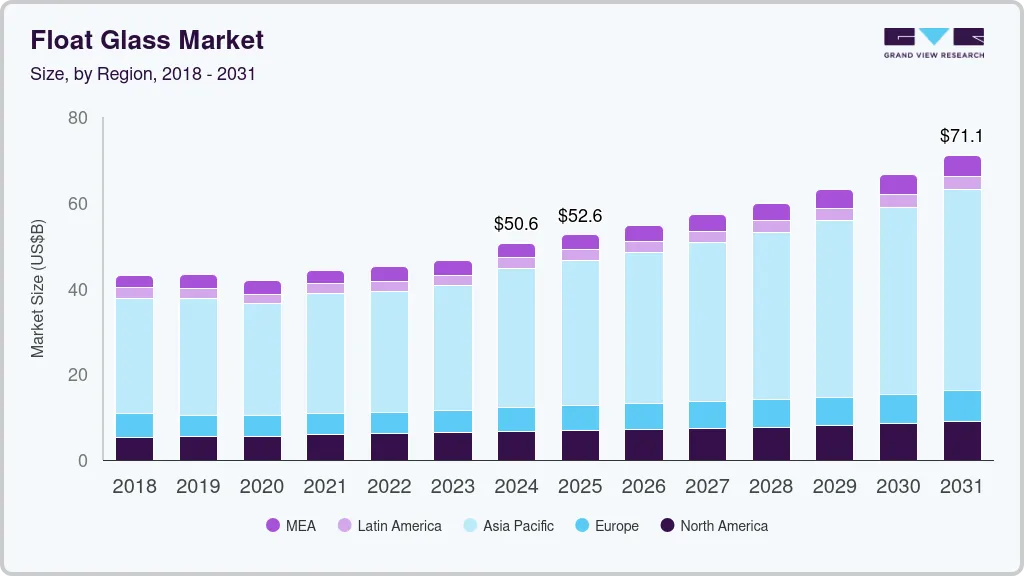

The global float glass market size was estimated at USD 50,575.4 million in 2024 and is projected to reach USD 71,082.9 million by 2031, growing at a CAGR of 5.2% from 2025 to 2031. The penetration of the product has expanded from exteriors to interiors. It applies to flooring, ceiling, reflective & coated windows, tabletops, mirrors, and furniture.

Key Market Trends & Insights

- Asia Pacific dominated the global float glass market with the largest revenue share of 64.1% in 2024.

- The UK float glass market dominated the Europe market and accounted for a revenue share of over 12.5% in 2024.

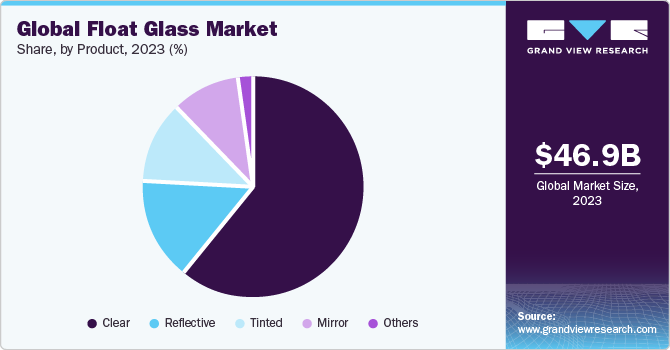

- By product, the clear glass segment accounted for a revenue share of over 61.40% in 2024.

- By end use, the building & construction segment held the dominant position in the market and accounted for the leading revenue share of in 2024.

Market Size & Forecast

- 2024 Market Size: USD 50,575.4 Million

- 2031 Projected Market Size: USD 71,082.9 Million

- CAGR (2025-2031): 5.2%

- Asia Pacific: Largest market in 2024

In addition, the growing product usage in the automotive & transportation industry is expected to drive market growth over the next seven years. Increasing disposable income coupled with industrialization in emerging economies is primarily expected to be a critical factor driving market growth over the projected period.

Construction is one of the world’s largest end-use industries in the market. It possesses high strength and quality and offers unique characteristics, such as protection from UV rays, resistance to temperature change, processing into safety glass, and robustness against scratches. These characteristics make it an ideal material for high-rise buildings’ windows, interior partitions, façades, curtain walls, etc.

Drivers, Opportunities & Restraints

Rising construction expenditure is one of the major growth drivers for the market. According to the U.S. Census Bureau, construction spending in the U.S. rose 7% in 2023 compared to the previous year and was 10% higher in April 2024 compared to April 2023. The surge in spending is attributed to the rise in single-family housing and a decline in mortgage rates.

Artificial intelligence (AI) is a key technology that has the potential to revolutionize the industry by unlocking new opportunities, such as automation, enabling better quality control, and improving the production process. Besides the product’s manufacturing process, AI also finds scope in applications. The product is enabled with intelligence due to smart functionalities and sensors. These intelligent technologies help produce self-tinting glass, touch-sensitive, and dynamic displays.

Raw material price fluctuations often hinder market growth. Volatility in raw material prices puts pressure on manufacturers to increase the costs of their products, thereby affecting their usage in various end-use industries. For instance, the recent Russia-Ukraine war caused an energy crisis across the globe. It negatively impacted the costs of float glass as energy prices spiked and further impacted its consumption in end-use applications.

Price Trends of Float Glass

The prices of glass have been witnessing a growing trend since Q2 2022. As per U.S. Bureau of Labor Statistics, the PPI of glass & glass manufacturing rose by ~10% in April 2023 compared to April 2022. However, the PPI has been in a similar range from April 2023 to April 2024.

In 2023, prices escalated noticeably. The float glass price peaked in China in May, primarily due to dropping inventories and traders' focus on hoarding and speculation. Also, stocking building materials before the real estate industry’s peak season in September-October further propelled the prices.

Growth in prices aided sales of major manufacturers. For instance, Xinyi Glass Holdings Limited reported a 4.1% growth in 2023’s sales revenue compared to 2022. The group attributed the growth to the continuous rise of float glass prices in H2 2023. The Group’s revenue from float glass rose by 5.3% on a y-o-y basis, accounting for over 65% of the overall share.

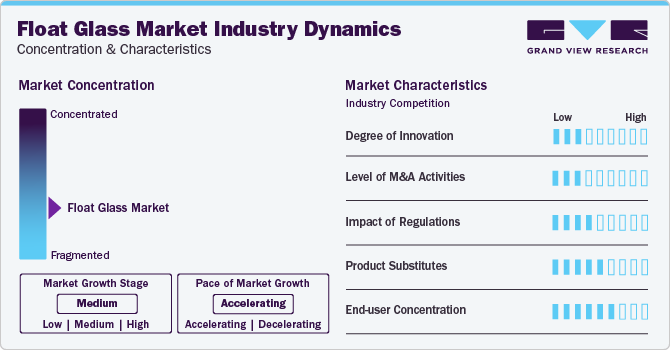

Industry Dynamics

The market is experiencing moderate growth at an accelerated pace. Despite efforts in merger and acquisition activities, the market is fragmented, with both large-scale and small-scale players spread worldwide.

There are numerous substitutes for float glass. However, it is already used as a replacement for other materials, such as polymers and plastics, owing to its recyclability and environment-friendly characteristics, which reduce the threat of substitutes in this industry. Some of the superior features of glass over plastic are resistance to scratch, improved insulation, and better transmittance.

The end user concentration is moderately high, as the product is majorly used in windows, doors, facades, and curtain walls in the construction industry. However, float glass is also used in various other industries such as automotive, solar energy generation, and electronics, where it is mainly used in sunroofs, solar panels, and touch screens of smartphones & tablets.

End-use Insights & Trends

Building & construction is anticipated to continue its dominance over the forecast period. The high share is attributed to a rising emphasis on using energy-efficient materials and sustainable construction practices. Low-E coatings and solar glass have witnessed high demand in recent years as they help reduce energy consumption. Leading architectural & landscape design and structural engineering firms highly prefer high-quality float glass for exterior applications. Rising investments in the construction of housing units in the emerging economies of the Asia Pacific and Middle East regions are anticipated to propel the product demand in this segment over the forecast period.

Float glass is of vital significance in the automotive & transportation industry as well. Favorable policies by governments worldwide are benefiting the industry. The increasing consumer preference toward good design, aesthetics, comfort, and safety are propelling the product demand. Asia Pacific is the largest automotive market in the world, with China accounting for the major share of global vehicle production in 2023. According to the Ministry of Industry and Information Technology, China is the world’s largest vehicle market in terms of both manufacturing output and sales. Domestic production is projected to reach 35 million units by 2025. Rising investment in automotive production and the adoption of sustainable production practices are expected to further augment market growth.

Product Insights & Trends

The clear glass segment accounted for a revenue share of over 61.40% in 2024 and is anticipated to continue growing over the forecast period. This growth can be attributed to various characteristics of clear glass, such as transparency, uniformity, flatness, thickness, and surface finishing. The growing product demand is encouraging manufacturers to increase their production. For instance, in January 2024, Aria Holding and the Government of Maharashtra signed an MoU at the World Economic Forum 2024 to construct a USD 240 million float glass manufacturing facility in India.

The demand for tinted glass is anticipated to increase owing to the growing demand for façades in buildings, particularly in offices and commercial buildings. It has become an integral part of new-age architectural design, and its demand is expected to grow with changes in the preferences of end users. The increasing importance of sustainable architecture and green building practices further propels the demand for tinted glass. For instance, eyrise, a liquid crystal technology brand of Merck KGaA, provides solar shading glasses for a renovation project to promote sustainable reshaping of the existing commercial space. It has been installed in office locations and premium buildings, with 100% renewable energy utilization in its production.

Regional Insights

The float glass market in North America is flourishing, as the countries are focused on accelerating their economic growth by investing in infrastructure development projects and carrying out residential and commercial construction activities. Growing investments in public infrastructures and construction projects are anticipated to augment the market growth in the region over the coming years.

U.S. Float Glass Market Trends

The U.S. float glass market is largely driven by the construction industry. As per the US Census Bureau, the total construction spending during the first three months of 2024 amounted to USD 461.00 billion, which is around 10.6% higher than the USD 416.7 billion spent during the same period in 2023. This increase in investment is expected to continue to propel the demand for float glass over the forecast period.

Asia Pacific Float Glass Market Trends

Asia Pacific dominated the global industry and accounted for a 64.10% revenue share of the global market in 2024. The regional market is projected to expand further at the fastest CAGR during the forecast period. This high share and rapid growth can be attributed to the increasing requirements across various industries, such as residential & commercial construction, automotive & transportation, energy, and electronics. The construction industry in the region has witnessed significant growth over the past few years owing to ongoing industrial development, coupled with its flourishing economies.

The float glass market in China experienced diminished demand in 2022 due to a slowdown in the domestic market. This downturn was primarily influenced by the weakening of the real estate market, which began in Q4 2021 due to the debt crisis faced by real estate developers. However, the market revamped in 2023. The manufacturers attributed the sales growth to a surge in float glass prices.

Europe Float Glass Market Trends

The float glass market in Europe is impacted by the Russia-Ukraine war, which has adversely impacted the trade of natural gas in the region. This has made it difficult for countries to ensure steady operations in their energy-intensive industries, including float glass. As such, units producing float glass products have halted or temporarily suspended their operations across Europe.

The UK float glass market dominated the Europe market and accounted for a revenue share of over 12.5% in 2024. The market growth is attributed to the rising demand for the product from various industries such as energy, packaging, automotive, and construction.

Central & South America Float Glass Market Trends

The float glass market in Central & South America is projected to witness growth due to the flourishing construction industry. For instance, in March 2024, Hilton announced its accelerated expansion in the Caribbean and Latin America with record room growth in 2023 and a robust pipeline of nearly 110 hotels. Hilton has plans to open more than 15 hotels across the Caribbean and Latin America in 2024.

Middle East & Africa Float Glass Market Trends

The float glass market in the Middle East & Africa is anticipated to grow significantly over the forecast period due to rising investments in construction activities and automotive production facilities. For instance, in May 2023, Oman’s Sultan Haitham announced initiating a new urban project near Muscat, referred to as Sultan Haitham City. The primary objective of this project is to offer affordable housing options for low-income citizens.

Key Float Glass Company Insights

Some of the key players operating in the market include Saint-Gobain, AGC Inc., and Nippon Sheet Glass Co. Ltd.

-

AGC Inc., formerly known as Asahi Glass Co., Ltd., was established in 1907 and is headquartered in Tokyo, Japan. The company offers products ranging from automotive to architectural glass. It has organized its operations into four reportable segments: glass, electronics, chemicals, ceramics, and others.

-

Nippon Sheet Glass Co. Ltd., established in 1918 and headquartered in Tokyo, Japan, is one of the world's largest manufacturers of glass and glazing products. The company offers its products through three business segments: architectural, automotive, and creative technology.

-

Saint-Gobain was established in 1665 and is headquartered in Courbevoie, France. It is a multinational corporation that manufactures building materials and, most prominently, glass products. It also produces plastics, ceramics, gypsum, and abrasives. The company operates primarily through its business segments including innovative materials, construction products, building distribution, etc.

Key Float Glass Companies:

The following are the leading companies in the float glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain S.A.

- SCHOTT Group

- Şişecam Group

- Taiwan Glass Ind Corp

- Xinyi Glass Holdings Limited

Recent Developments

-

In April 2024, AGC Inc. announced obtaining an Environmental Product Declaration for its architectural float glass produced in the Kashima plant.

-

In March 2024, NSG Group announced to cease production of a float line in Weiherhammer, Germany, a year ahead of planned repairs. The decision was made after reviewing the current demand and supply situation in the central European architectural glass market while expecting steady market growth in the long term.

-

In January 2024, Aria Holding and the Government of Maharashtra signed an MoU at the World Economic Forum 2024 to construct a USD 240 million float glass manufacturing facility in India.

Float Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52,550.7 million

Revenue forecast in 2031

USD 71,082.9 million

Growth rate

CAGR of 5.2% from 2025 to 2031

Actual data

2018 - 2023

Forecast period

2025 - 2031

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2031

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East; Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Brazil; GCC; South Africa

Key companies profiled

AGC Inc.; Asahi India Glass Limited; Cardinal Glass Industries, Inc.; Central Glass Co., Ltd; Fuyao Glass Industry Group Co., Ltd.; Guardian Industries; Nippon Sheet Glass Co. Ltd.; Saint-Gobain S.A.; SCHOTT Group; Şisecam Group; Viracon; Taiwan Glass Ind Corp; Xinyi Glass Holdings Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

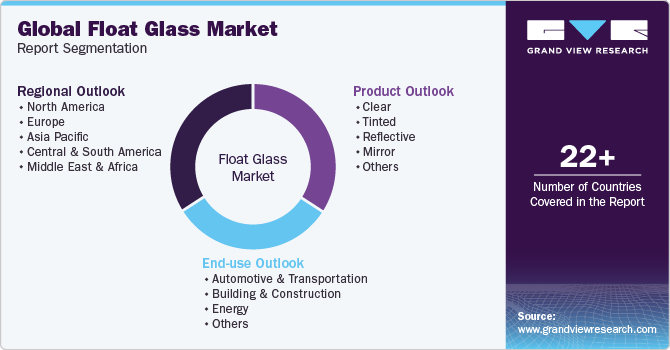

Global Float Glass Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2031. For this study, Grand View Research has segmented the global float glass market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

Clear

-

Tinted

-

Reflective

-

Mirror

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

Automotive & Transportation

-

Building & Construction

-

Energy

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2031)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East

-

GCC

-

-

Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global float glass market size was estimated at USD 46.88 billion in 2023 and is expected to reach USD 48.81 billion in 2024.

b. The global float glass market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2031 to reach USD 66.70 billion by 2031.

b. By product, clear glass dominated the market with a revenue share of over 61.0% in 2023.

b. Some of the key vendors of the global float glass market are AGC Inc, Asahi India Glass Limited, Central Glass Co., Ltd., Fuyao Glass Industry Group Co., Ltd, Guardian Industries, Nippon Sheet Glass Co. Ltd, Saint-Gobain S.A., Şisecam Group, among others.

b. The key factor driving the growth of the global float glass market is the rising investments in developing high-rise buildings and the growing automotive industry worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.