- Home

- »

- Advanced Interior Materials

- »

-

Floor Covering Market Size & Share Report, 2028GVR Report cover

![Floor Covering Market Size, Share & Trends Report]()

Floor Covering Market Size, Share & Trends Analysis Report By Product (Carpet & Area Rugs, Wood Flooring), By Distribution Channel (Online, Offline), By Region (North America, Europe, APAC, MEA), And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-940-4

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Advanced Materials

Report Overview

The global floor covering market size was valued at USD 364.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2028. The market is majorly driven by rising urbanization and the expansion of ultramodern workspaces. Also, the rising demand for wood flooring is expected to be a key trend transforming the global market in terms of growth prospects and market opportunities. Wood flooring has become a key element of floor covering, making it one of the fastest expanding categories in the furniture business. The product demand is projected to be supported by an increase in refurbishment and renovation operations, as well as a rising do-it-yourself trend.

In the flooring business, increasing building expansion is also a major driver. Rising investments in Asian infrastructure and industries are expected to boost product demand. Residential construction activity in developed countries like Germany, the U.S., and the U.K., has seen considerable demand for the product. The covid-19 pandemic has also affected the market for floor covering in various regions. As lockdown was imposed, the supply chain was disturbed. The emergence of the COVID-19 epidemic had a minor influence on the worldwide floor covering industry. This impact is mostly due to significant interruptions in raw material transportation as well as a temporary shutdown of the manufacturing industry and end-use sectors, resulting in a drop in demand and sales for floor covering products and materials during this period.

Furthermore, as governments eased lockdown restrictions, E-commerce sales of flooring materials rose as customers turned to online shopping channels to meet their needs. The worldwide market for floor covering will be pushed in the near future by the construction industry's expansion and increased infrastructure investment. Over the projected period, a plethora of future building projects in both developed and developing nations are likely to present profitable prospects for the global floor coatings market players. The exponentially growing urban population is driving up commercial development activities.

According to the data published by World Bank, the urban population is growing at a high rate creating necessities for commercial and residential buildings. Commercial building projects such as commercial complexes, lodging facilities, hospitals, and shopping malls are being triggered by the expanding urban population. Consumers are heavily investing in high-end residential complexes with attractive flooring finishes, which is fueling the growth of the flooring industry. Customized flooring goods are in high demand due to a rapid shift in lifestyle. Key players operating in the market for floor covering are taking key initiatives and are continuing to create products that outperform current materials and meet ever-evolving consumer demand.

The demand for floor covering is seen increasing as it is required to outfit the workplace and residence area. Also increasing demand for insulation is also expected to boost market growth over the forecast period. An increase in office improvement is witnessed as companies are redecorating office areas to include modular systems furniture. Hence, the market for floor covering is estimated to showcase growth over the forecast period. In the current global market, the increasing focus on home decor and better consumer lifestyles are also promoting renovation and remodeling operations.

Consumers are increasingly spending on home furnishings such as rugs, rugs, and other flooring materials that add to the aesthetic appeal of interiors, due to a growing trend of spending on the style and interiors of living spaces. The market will rise owing to aging infrastructure in North America and Western Europe, as well as an increase in regulating and maintenance operations. The demand for atheistically pleasing flooring materials is increasing as the quality of living in emerging nations improves.

Product Insights

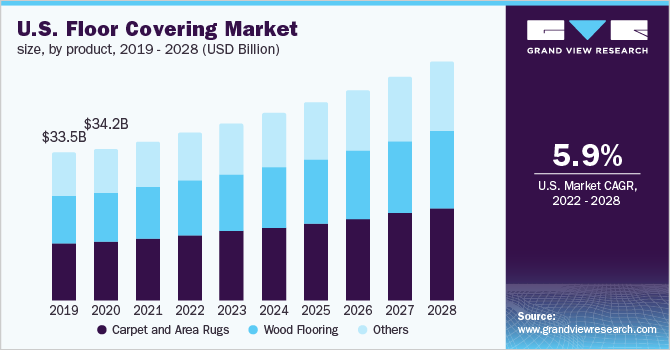

The carpet and area rugs segment dominated the market for floor covering and accounted for the largest revenue share of around 40.0% in 2021 owing to the rapid construction of the IT sector. This can also be credited to constant innovation in the products. Also, it creates a comfortable seating area and helps in improving the overall appeal of office or home décor. Carpets and rugs offer a protective layer to floors. Carpets and rugs are used for their functional properties and aesthetic look, further improving the overall look and finishing of the décor. The materials utilized to make the carpets and rugs include nylon, polyester, and polypropylene. Nylon carpets have high strength, making them ideal for areas with a lot of foot activity, such as industrial and commercial carpeting.

The wood flooring segment is expected to register the highest CAGR of 6.8% from 2022 to 2028 due to its significant increasing demand in the commercial industry. These types of products are in high demand mostly in emerging countries. It is one of the most widely used forms of floor covering product. Growing home renovation owing to construction and non-construction activities and increased disposable income are other factors boosting segment growth over the forecast period. The rise of the wooden flooring sector is fueled by greater house renovations as a result of higher disposable income and quicker growth in building and non-construction activities, particularly in emerging nations. The segment's expansion is being fueled by factors such as a growing emphasis on the usage of environmentally friendly materials such as wood.

Distribution Channel Insights

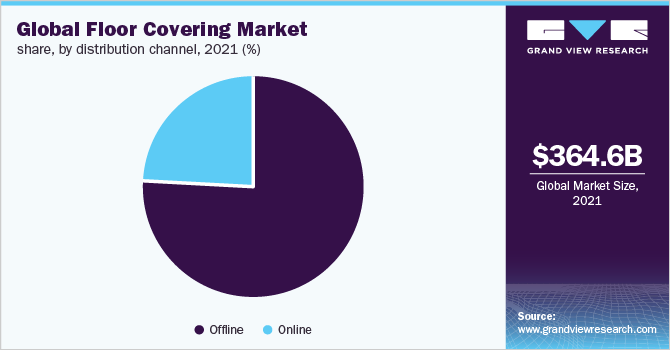

The offline segment dominated the market for floor covering and accounted for the highest revenue share of more than 75.0% in 2021. The demand for floor covering is growing among customers due to more sustainability offered by these offline stores than any other channel. Hence, the segment is projected to show growth during the assessment period. Additionally, the growth of supermarkets and hypermarkets is expected to open up new revenue opportunities for key market players.

The online segment is expected to witness high growth over the forecast period. Online platforms may be used to obtain floor covering at a reduced cost. Such channels can give a variety of perks, such as coupons, free delivery, and other special deals. Furthermore, several popular online items from the growing number of app-based vendors are propelling the market forward during the projection period. Additionally, key players are showcasing their product portfolio on online websites and e-commerce portals such as Amazon, Flipkart, and Home Depot to attract new customers and drive revenue. Additionally, the availability of stable internet connection, consumer awareness regarding online purchasing, and government initiatives to boost e-commerce growth are some of the major factors driving the growth of the market.

Regional Insights

Asia Pacific dominated the floor covering market and accounted for around 50.0% revenue share in 2021 due to high demand in India and China. Also, the increasing purchasing power of the commercial industry towards these products will drive the segment growth. As the region presents various opportunities for the consumer goods sector, the industry is projected to showcase significant growth. Rapidly rising nations such as China, India, and Vietnam are driving the building business in Asia Pacific. China, as the region's largest economy, is likely to fuel regional market expansion. India is expected to increase construction spending and is expected to create numerous opportunities for market players to strengthen their footprints in the region.

In Europe, the market for floor covering is expected to witness a CAGR of 7.2% from 2022 to 2028. This can be credited to the increasing demand for floor covering in this region. The changing lifestyle of the commercial industry has led to rising demand for floor covering products. Hence this region is estimated to show the fastest growth rate over the forecast period. North America is expected to showcase strong growth in the near future. North America is a developed region with a large number of employment opportunities. High living standards and greater prospects attract a highly trained workforce from all over the world. The number of expats residing in the region is growing due to increased immigration. As a result, demand for residential units, including single-family homes and flats, is increasing. Furthermore, the global floor covering will be fueled by expanding building projects.

Key Companies & Market Share Insights

Companies are focusing on innovating new products of floor covering to meet the ever-increasing consumer demand. The increasing demand for floor covering offers an opportunity for product development. The influence of products on the environment is being recognized and addressed by manufacturers. The development of green products will be pushed by increasing consumer awareness of the impact of building on global warming. Some of the prominent players in the floor covering market include:

-

Shaw Industries Group Inc.

-

Mohawk Industries Inc.

-

Armstrong Flooring

-

Gerflor Group

-

Forbo Holding

-

Mannington Mills Inc.

-

TOLI Corporation

-

Tarkett Group

-

Dixie Group Inc.

-

Milliken & Company

Floor Covering Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 386.1 billion

Revenue forecast in 2028

USD 566.5 billion

Growth Rate

CAGR of 6.5% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Brazil; Germany; U.K.; France; China; Japan; South Africa

Key companies profiled

Shaw Industries Group Inc.; Mohawk Industries Inc.; Armstrong Flooring; Gerflor Group; Forbo Holding; Mannington Mills Inc.; TOLI Corporation; Tarkett Group; Dixie Group Inc.; Milliken & Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global floor covering market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2028)

-

Carpet and Area Rugs

-

Wood Flooring

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising urbanization and expansion of ultramodern workspaces, rise in the number of residential and commercial construction activities, and high investments in high-end residential complexes with attractive flooring finishes.

b. Some key players operating in the floor covering market include Shaw Industries Group Inc., Mohawk Industries Inc., Armstrong Flooring, Gerflor Group, Forbo Holding, Mannington Mills Inc., TOLI Corporation, Tarkett Group, Dixie Group Inc., and Milliken & Company.

b. The global floor covering market size was estimated at USD 364.6 billion in 2021 and is expected to reach USD 386.1 billion in 2022.

b. The global floor covering market is expected to grow at a compound annual growth rate of 6.5% from 2022 to 2028 to reach USD 566.5 billion by 2028.

b. Asia Pacific dominated the floor covering market with a share of 49.0% in 2021. This is attributable to rapidly rising construction business in China, India, and Vietnam and demand for residential units, including single-family homes and flats.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."