- Home

- »

- Advanced Interior Materials

- »

-

Food & Beverage Air Filtration Market Size Report, 2024GVR Report cover

![Food And Beverage Air Filtration Market Report]()

Food And Beverage Air Filtration Market Analysis By Product (Dust Collector, Mist Collector, Cartridge Collector, HEPA Filter, Baghouse Filter), By Application (Food & Ingredients, Dairy, Bottled Water) And Segment Forecasts Till 2024

- Report ID: GVR-1-68038-041-5

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Data: 2013-2015

- Forecast Period: 2016 - 2024

- Industry: Advanced Materials

Growing awareness for health concerns is pushing the food & beverage (F&B) air filtration market

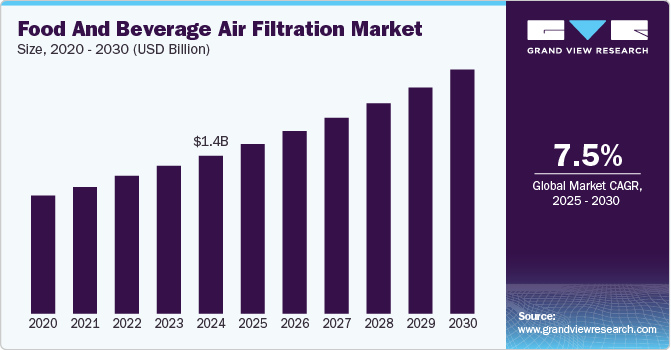

The global F&B air filtration market size was valued at USD 838.1 million in 2015. The increasing awareness about health concerns, such as obesity and heart diseases, has enhanced the demand for better quality products in the market.

Increasing demand for gluten-free products among consumers is also expected to drive the growth over the forecast period. The health benefits associated with fermented foods have led to higher demand, owing to the increased awareness among western consumers. Technologies such as High-Pressure Processing (HPP) are also expected to grow over the forecast period.

Furthermore, clear packaging and clean labels in the F&B industry are anticipated to grow continuously over the forecast period.Global Food & Beverage Air Filtration Market, 2014 - 2024 (USD Million)

Rising popularity of organic farming has prompted concerns over safety with an increase in the use of chemical fertilizers and growth promoters. The increasing demand for finer filtration has induced the expenditure and product demand in the industry.

Furthermore, the high initial cost in terms of investments, which include the purchase and operating costs associated with the F&B air filtration systems, may hinder the demand. However, the impact is expected to reduce over the forecast period with the increased installation of air filters.

HEPA filters are expected to portray the highest growth over the forecast period

Dust collectors are estimated to lead the industry. In 2015, the dust collectors are accounted for the highest share in the F&B air filtration market. One of the important reasons behind this is the growing need for a dust-free environment. Increasing productivity with improved product quality and reduced product contagion caused by contamination during the manufacturing process has influenced the dust collector demand in a positive manner.

HEPA filters are expected to witness the highest growth over the forecast period. The ability to collect dust particles of less than 5 microns, thus reducing the contamination up to 99.97%, is expected to enhance the market growth. HEPA filters are capable of eliminating smoke, dust, bacteria, mold, and pollen in the manufacturing process, improving the indoor air quality as well as the food quality.

Food & ingredients segment is expected to be the largest market over the forecast period

The application segment can be categorized into food & ingredients, dairy, and bottled water. This sector is estimated to dominate the industry in 2015. The demand for high quality products, owing to the high living standards of consumers, is expected to force the manufacturers to upgrade the technology.

The imposition of strict government laws for the enhancement of product quality has led to the installation of filters in the food & ingredients segment. The growing demand for products that deliver improved efficiency and strong performance as well optimize their energy intake is also expected to favorably influence the processing segment.

Rapid industrialization in Asia Pacific has contributed to significant growth from 2016 to 2024

The North American F&B air filtration market is expected to remain the key revenue generating region, accounting for the highest share by 2024. The increased awareness among consumers has led to the improved sales performance of the small and large food manufacturers. Private label foods in the market are expected to drive sales among the small producers; whereas, the locally grown or produced foods are expected to impact the large producers in a positive manner.

According to the United Nations Department of Economic and Social Affairs, the global population is anticipated to be 9.7 billion by 2050 and with the increased population, the F&B air filtration industry is expected to further improve sustainability and food standards.

The Asia Pacific market is anticipated to grow at a higher attributable pace from 2016 to 2024. The regional growth can be attributed to the rapid industrialization along with the economic growth in the region over the forecast period. The regional growth can be attributed to the increasing consumer markets in countries such as India and China. The growing urbanization and increasing concerns for food safety are estimated to be the major reasons for the region’s growth.

Donaldson Company, Inc. and Camfil Group are the major players in the market

Manufacturers emphasize on new product development and innovation for developing energy efficient filters. The key industry competitors include APC Filtration (Canada), Inc., 3M (U.S.), Camfil Group (Sweden), Donaldson Company, Inc. (U.S.), General Electric Company (U.S.), Pall Corporation (U.S.), GEMU Gebr Muller Apparatebau GmbH (Germany) & Co. KG(UK), and Parker Domnick Hunter (UK). For instance, one of the major producers, Parker Domnick Hunter, based in the UK, operates as a subsidiary of Parker Hannifin Corporation (U.S.).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."