- Home

- »

- Food Safety & Processing

- »

-

Food Contract Manufacturing Market Size Report, 2030GVR Report cover

![Food Contract Manufacturing Market Size, Share, & Trends Report]()

Food Contract Manufacturing Market Size, Share, & Trends Analysis Report By Service (Manufacturing, Packaging, Custom Formulation And R&D), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-921-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Food Contract Manufacturing Market Trends

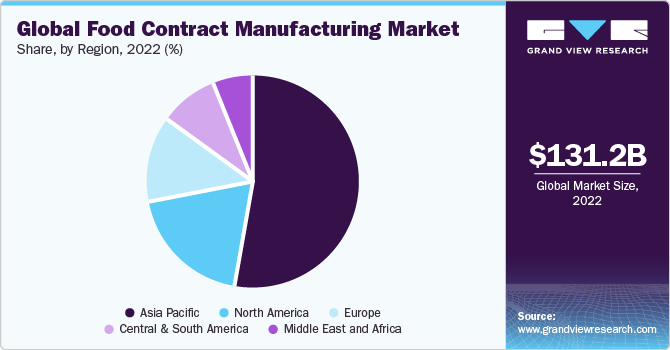

The global food contract manufacturing market size was valued at USD 131.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.7% during the forecast period. Increasing demand for outsourcing food manufacturing is expected to have a positive impact on the industry growth. The increasing R&D spending in food processing technologies is expected to have a positive impact on the market during the forecast period. The inculcation of AI technologies and IoT to execute robotics in the manufacturing facilities are propelling the market growth. Furthermore, factors such as panic buying of comfort food for the duration of the pandemic and rising private equity investment in contract manufacturing are expected to boost industry growth.

The COVID-19 pandemic led to prolonged lockdowns which resulted in a considerable surge in buying convenience foods as consumers were stuck inside their houses. Increasing demand for processed food has resulted in creating opportunities for the new contracts designed for the food contract manufacturers. The pandemic also prompted the restructuring of supply chains, which is expected to augment the industry growth.

OEMs and upcoming food manufacturers have limited manufacturing capabilities due to which contract manufacturing is on the rise. Moreover, food contract manufacturers have started to offer different value-added services such as packaging, research, consulting, and warehousing which has enabled food companies to grow rapidly.

According to Food Drink Europe's Data & Trends 2021 update, The European Union's food and beverage industry employs a total of 4.5 million individuals, generates a turnover of USD 1.23 trillion and generates a value-added of USD 248.9 billion, making it a leading industry in the EU.

As demand surged in 2020, food-processing companies were unable to produce at such a scale due to which they had to rely on contract manufacturers. Many contract manufacturers have been able to bag long-term contracts bringing them to the forefront. Moreover, private equity investment has enabled contract-manufacturing companies for capacity expansion or provide other vital services.

Over the years, the food companies have become smarter to leverage contract manufacturers in a move to distance themselves from the incremental costs that are attached to the manufacturing. It also allows food companies to free up their cash flows, which played a key role during the pandemic, making it a favorable environment for the manufacturers to succeed.

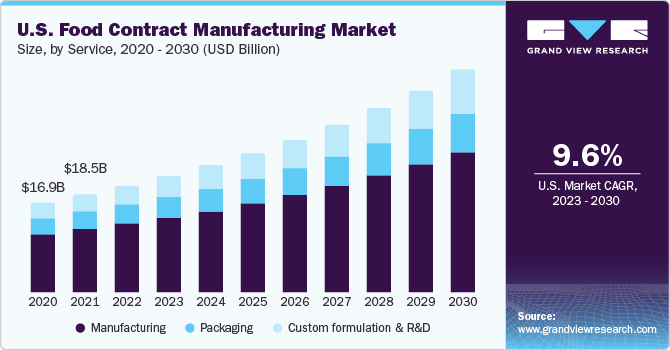

Service Insights

On the basis of services the market is segmented into manufacturing, packaging and custom formulation and R&D. The manufacturing service led the market and accounted for 66.4% of the global revenue share in 2022. Food companies looking to enhance value and efficiency, production constraints, the rise of e-commerce, and private equity investment have been the key factors in augmenting the industry growth.

Food contract manufacturers, through their manufacturing as a core service, offer different processes, which include dry blending, spray drying, and extrusion. Some food companies also offer a specific recipe for food processing, which is expected to boost the industry's growth.

The packaging service for these products majorly involves primary forms of packaging those mainly used to protect the product from contamination. These include stand-up pouches, shrink-wrapping, blister packs, and jars. These manufacturers are also focusing on adding secondary packaging to create a one-stop shop for food manufacturing.

Custom formulation and R&D are expected to grow at the fastest CAGR of 11.4% over the forecast period. Small and medium-scale food companies often do not have a dedicated R&D team to formulate new products or the consumer insights needed to further growth. Food contract manufacturers have the personnel, equipment, and expertise to assist them.

Regional Insights

Asia Pacific led the global food contract manufacturing market and accounted for 53.0% of the global revenue in 2022 and is expected to grow at the fastest CAGR of 10.3% over the forecast period. Rising population, increase in household income and industrialization has rapidly transformed the food industry. India and China are the two most populated countries which has created a huge requirement for food manufacturers in the region. China dominates the market share due to the global demand for food products.

North America especially the U.S. is under a transition phase. Food companies are becoming more reliant on contract manufacturers for product formulation, quality control, and production capabilities. Moreover, this industry consolidation is happening rapidly which is expected to boost industry growth.

Manufacturers are benefiting from the robust food processing equipment industry in Europe. The BREXIT and the pandemic are expected to prompt food companies to restructure their supply chains relying on Asia Pacific countries, which is expected to open up capacity expansions for this industry in Europe.

The demand for convenience foods in the manufacturing service in Australia is estimated to witness a lucrative growth over the forecast period. Favorable government support, focus on quality and producing clean and natural food products are some of the factors, expected to result in augmenting the industry growth within the country.

Key Companies & Market Share Insights

Major manufacturers are witnessing rapid consolidation across the value chain. Moreover, companies have started providing additional value-added services such as packaging, R&D expertise, and storage, which has triggered industry growth. Food contract manufacturers have set up innovative strategies leading to co-development opportunities. Food companies have increasingly started to adopt a renewed supply chain strategy where manufacturing plays a central role, creating a competitive advantage. This results in mitigating cross-border risks and maximizing sales. Some prominent players in the global food contract manufacturing market include:

-

Fibro Foods

-

Hindustan Foods Limited

-

Hearthside Food Solutions LLC

-

Nikken Foods

-

Christy Quality Foods (CQF)

-

De Banketgroep B.V.

-

HACO AG

-

SK Food Group

-

Pacmoore Products Inc.

-

Cremica

-

Kilfera Food Manufacturers Ltd

-

Nutrascience Labs, Inc

-

Thrive Foods LLC.

-

Orion Food Co., Ltd

-

Omni blend

Recent Developments

-

In July 2023, Annapurna Swadisht entered manufacturing contract with Gopal Food Products. The facility has a production capacity of 1000 MT of biscuits, 150 MT of snacks and 60 MT of namkeen per month. The production unit can cater to North West and Central India.

-

In June 2023, Thrive Foods, a global manufacturer of dried freeze products, announced the acquisition of Groneweg Group also known as Freeze-Dry Foods. Groneweg Group is a supplier and manufacturer of air-dried and freeze ingredients. The acquisition is expected to close in 2023.

-

In January 2023, SK Food Group, a custom food manufacturers, announced fourth production facility in the U.S. The building is expected to be completed by 2025, including a special partnership with PIE center to provide specialized employee training.

-

In August 2022, Hindustan Foods formally inaugurated an ice cream plant in Uttar Pradesh with a capacity of producing 20,000,000 litres of ice cream in forms of sticks, party packs, cones, tubs, cups and more. This is the 26th factory of Hindustan Foods.

-

In April 2022, Berlin Packaging. a packaging supplier, acquired Panvetri, a family owned metal and glass packaging supplier, for the wine and olive oil industries. The acquisition is expected to increase the European Footprint of Berlin Packaging.

-

In December 2021, Hearthside Foods Solutions LLC acquired Weston Foods Ambient Division providing six North America locations producing cookies, wafers, crackers, cones and related baked products. With this acquisition the company now has 43 facilities in Europe, U.S. and now in Canada.

Food Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 143.2 billion

Revenue forecast in 2030

USD 274.7 billion

Growth Rate

CAGR of 9.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, region

Regional scope

North America, Europe, Asia Pacific, Central and South America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, Argentina, Saudi Arabia, South Africa ,UAE

Key companies profiled

Fibro Foods; Hindustan Foods Limited; Hearthside Food Solutions LLC; Nikken Foods; Christy Quality Foods (CQF); De Banketgroep B.V.; HACO AG; SK Food Group; Pacmoore Products Inc.; Cremica; Kilfera Food Manufacturers Ltd; Nutrascience Labs, Inc; Thrive Foods LLC.; Orion Food Co., Ltd; Omni blend

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food contract manufacturingmarket on the basis of service, and region:

-

Service Outlook (Revenue in USD Million, 2018 - 2030)

-

Manufacturing

-

Convenience Foods

-

Bakery Products

-

Dietary Supplement

-

Confectionery

-

Dairy Products

-

Others

-

-

Packaging

-

Convenience Foods

-

Bakery Products

-

Dietary Supplement

-

Confectionery

-

Dairy Products

-

Others

-

-

Custom formulation and R&D

-

Convenience Foods

-

Bakery Products

-

Dietary Supplement

-

Confectionery

-

Dairy Products

-

Others

-

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global food contract manufacturing market size was estimated at USD 131.2 billion in 2022 and is expected to reach USD 143.2 billion in 2023.

b. The food contract manufacturing market is expected to grow at a compound annual growth rate of 9.7% from 2023 to 2030 to reach USD 274.7 billion by 2030.

b. Asia Pacific dominated the food contract manufacturing market with a share of 52.9% in 2022, owing to the rising spending capability of consumers and the growing emphasis on dietary supplements in the region

b. Some of the key players operating in the food contract manufacturing market include Fibro Foods, Hindustan Foods Limited, Hearthside Food Solutions LLC, Nikken Foods, Christy Quality Foods (CQF), Kilfera Food Manufacturers Ltd, Nutrascience Labs, Inc, Thrive Foods LLC., Orion Food Co., Ltd, Omniblend, among others

b. The key factors that are driving the food contract manufacturing market include rising demand for manufacturing capabilities from OEMs and an increase in convenience foods and dietary supplements

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."