- Home

- »

- Foods, Beverages & Food Ingredients

- »

-

Food Emulsifier Market Size & Share, Industry Report, 2033GVR Report cover

![Food Emulsifier Market Size, Share & Trends Report]()

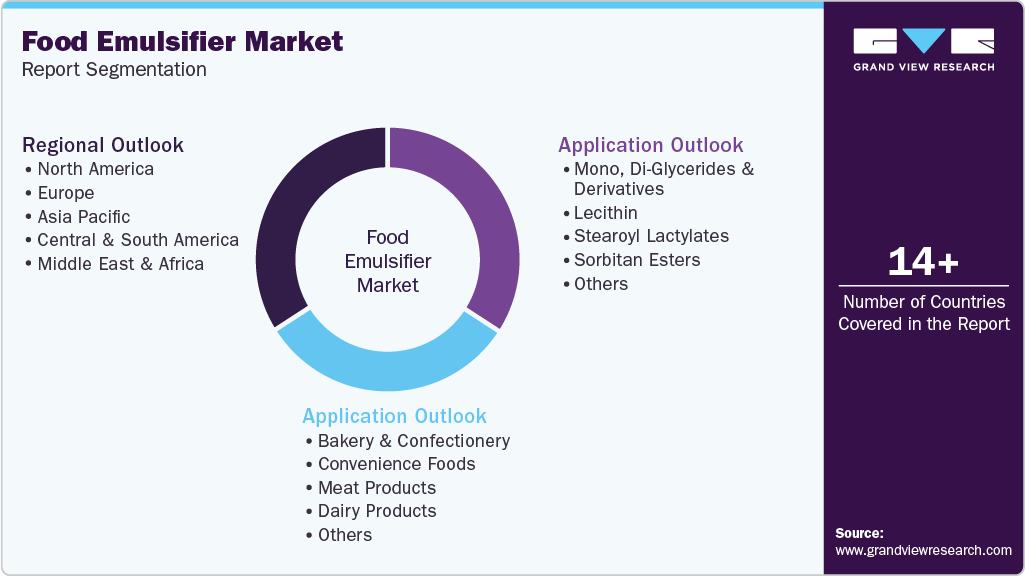

Food Emulsifier Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Mono, Di-Glycerides & Derivatives, Lecithin, Stearoyl Lactylates), By Application (Bakery & Confectionery, Convenience Foods, Meat Products), By Region, And Segment Forecasts

- Report ID: 978-1-68038-372-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Research

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Emulsifier Market Summary

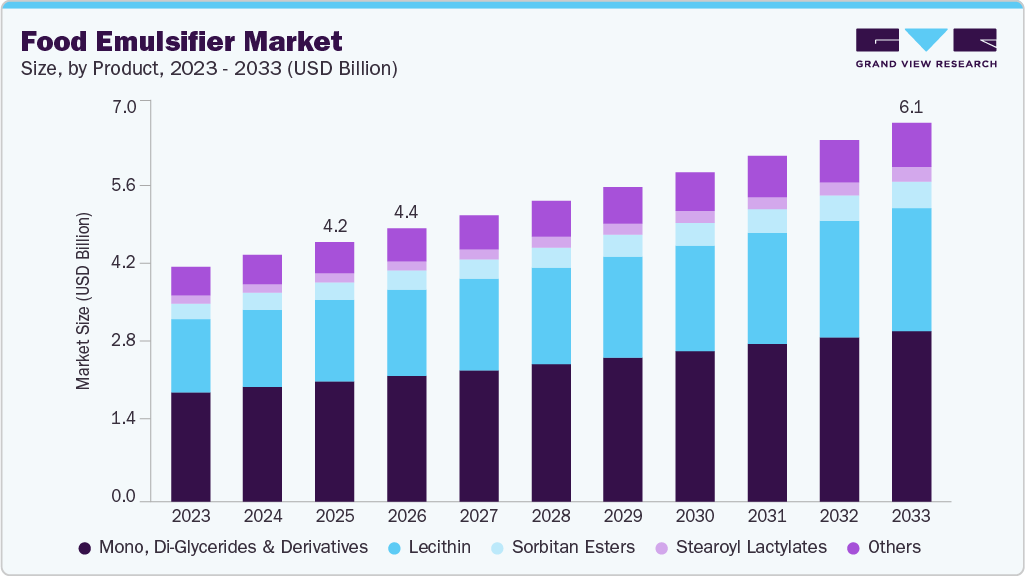

The global food emulsifier market size was estimated at USD 4.22 billion in 2025 and is projected to reach USD 6.15 billion by 2033, growing at a CAGR of 4.8% from 2026 to 2033. The increasing preference for processed and ready-to-eat foods is leading to an increase in demand for emulsifiers.

Key Market Trends & Insights

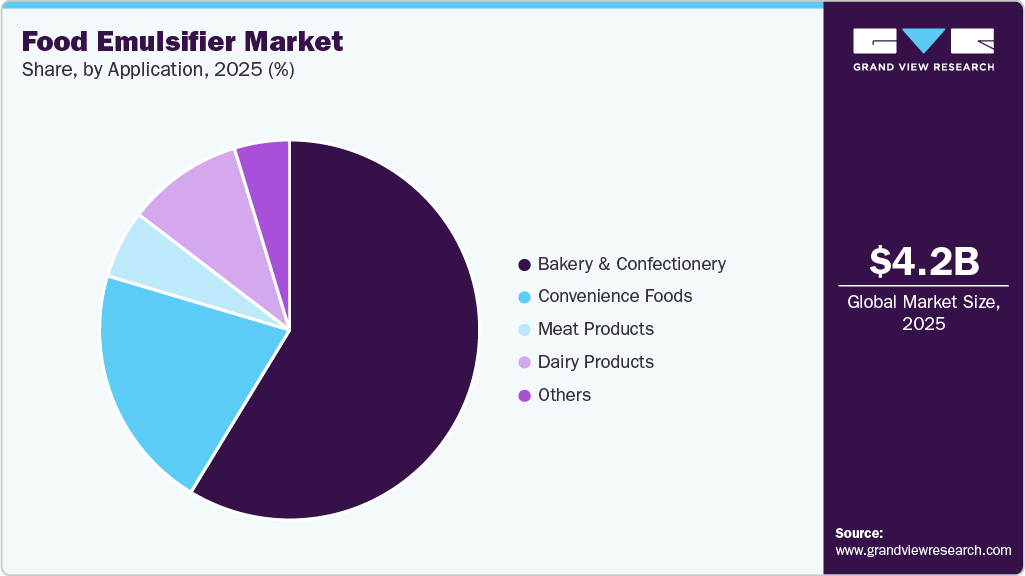

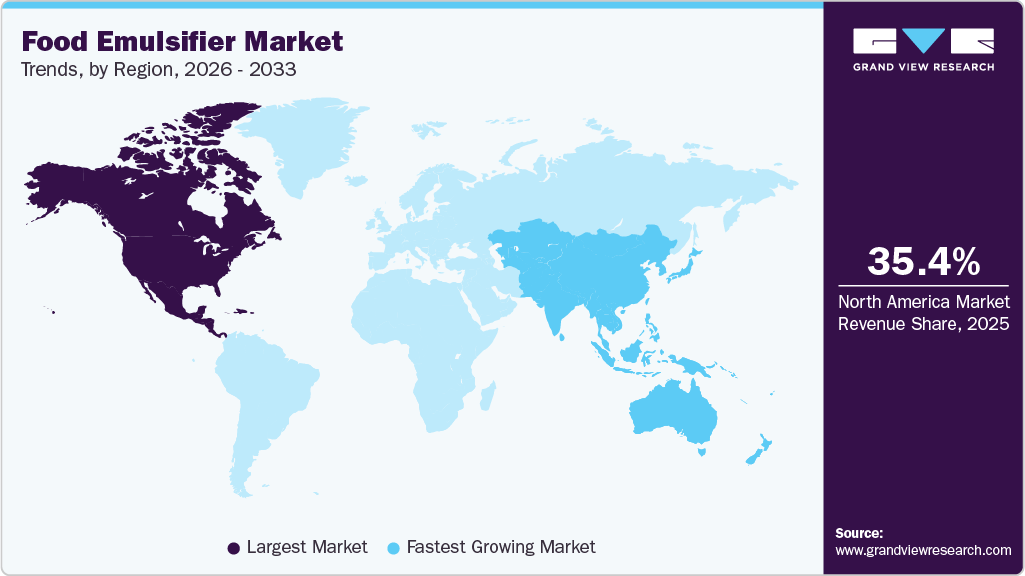

- North America held the largest share of 35.4% of the global food emulsifier industry in 2025. The food emulsifier market in the U.S. is expected to register significant CAGR over the forecast period. By product, the mono, di-glycerides & derivatives segment dominated the market with a share of 46.3% in 2025. By application, the bakery & confectionery segment dominated the market with a share of 58.8% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 4.22 Billion

- 2033 Projected Market Size: USD 6.15 Billion

- CAGR (2026-2033): 4.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Emulsifiers help improve the taste, texture, and appearance of processed foods. They aid in blending ingredients that usually separate, improving product stability, and helping lower fat content. As consumers look for more appealing food options, emulsifiers meet these needs while also extending the shelf life of food products, thereby driving the food-grade emulsifiers market. Rapid urban growth, higher spending power, and changing food habits are driving the demand for packaged and ready-to-eat foods, in turn creating strong opportunities for food emulsifier manufacturers to meet market demand.

The focus on natural and clean-label ingredients is supporting the growth of the food emulsifier industry. Consumers are looking for more natural food options, thereby driving the plant-sourced food emulsifiers market.

There is an increasing demand for emulsifiers derived from natural sources, such as plant-based lecithin. This trend is encouraging manufacturers to develop emulsifiers that are in line with the clean-label requirements. In addition, new emulsifiers with improved performance, such as those that work well under various processing conditions and mix easily with varied ingredients, are supporting market growth. These improvements enable food manufacturers to develop new products with enhanced taste, texture, and longer shelf life. The development and easy availability of natural and consumer-friendly products are significantly contributing to the growth of the market.

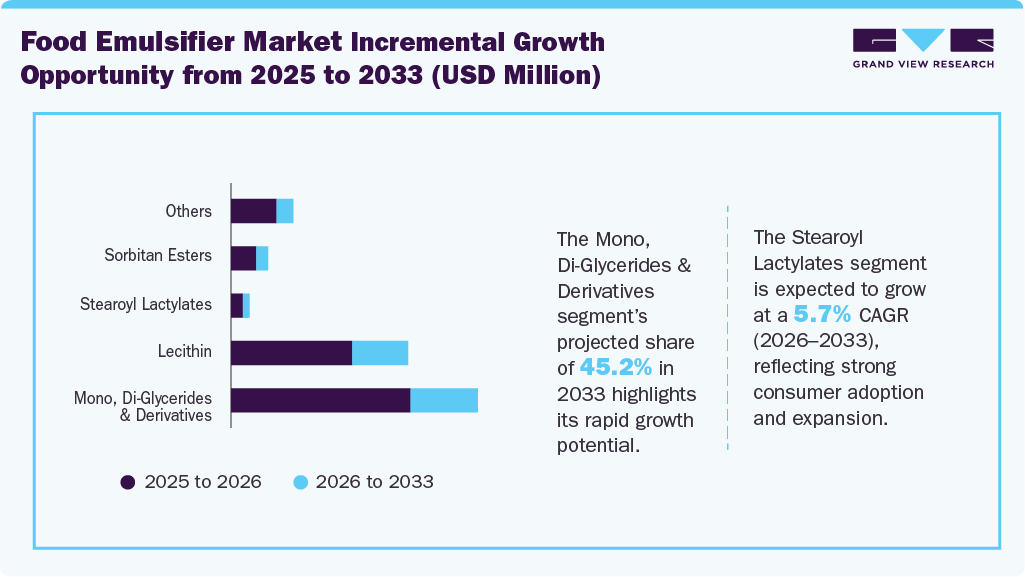

Product Insights

Mono, di-glycerides & derivatives dominated the global market with the largest revenue share of 46.3% in 2025. Mono- and di-glycerides, along with their derivatives, impart texture and enhance the appeal of food products. They help mix ingredients that are difficult to blend, improving the appearance, mouthfeel, and overall quality of the final products. Evolving lifestyles and urban living are leading to an increase in the number of people opting for convenient and ready-to-eat foods. These foods need emulsifiers to maintain stability, improve texture, and extend the shelf life. As a result, the demand for mono- and di-glycerides continues to surge in the food industry.

The stearoyl lactylates segment is expected to grow at a CAGR of 5.7% over the forecast period. These emulsifiers are compatible with a wide range of ingredients and are suitable for use in various food products such as bakery items, dairy products, sauces, and dressings. The wide application scope of stearoyl lactylates makes them a preferred option for food manufacturers. They aid in improving the texture, consistency, and overall product quality by enabling smooth blending of ingredients that are difficult to mix. In addition, they support the clean-label and natural ingredient trends, which are increasingly gaining importance and popularity among consumers. Sodium stearoyl lactylate is a widely used food emulsifier that enhances the texture, consistency, and shelf-life of baked goods, spreads, sauces, and dry mixes. It stabilizes oil‑water mixtures, improves dough handling, enhances creaminess, and spreadability, ensures even distribution of ingredients, and maintains product quality, freshness, and consumer appeal.

Application Insights

The bakery & confectionery segment accounted for the largest share in 2025. The demand for premium and indulgent bakery and confectionery products is driving the need for new and better food ingredients. Emulsifiers help improve taste, softness, creaminess, and the overall eating experience of baked goods and sweets. As people look for unique flavors and textures, food manufacturers use emulsifiers to achieve the desired results. Palsgaard SA 6610 is an activated, non-trans, all-vegetable, and non-GMO powdered emulsifier developed for industrial applications. It is a non-soya solution, designed to ensure speed, uniformity, and stability in automated production, and to provide excellent performance in aerated and non-aerated cake batters.

The convenience foods segment is projected to grow at the fastest CAGR from 2026 to 2033. People are increasingly preferring ready-to-eat and easy-to-cook foods owing to busy lifestyles and tight schedules. Products such as frozen meals, instant soups, and snacks need emulsifiers to maintain their texture and improve shelf life. The use of food emulsifiers is expected to increase with the growth in demand for these food products. These ingredients help manufacturers of convenience foods deliver consistent quality and enhanced taste.

Regional Insights

The North America food emulsifier market held the largest global revenue share of 35.4% in 2025. The growing trend of clean-label and organic food products is helping the growth of the market in North America. Consumers are paying more attention to the ingredients used in their food and prefer simple, natural ingredients. As a result, there is a higher demand for emulsifiers made from natural sources that fit clean-label standards.

U.S. Food Emulsifier Market Trends

The U.S. food emulsifier industry led the North American market in 2025. Busy lifestyles and higher spending on packaged foods are driving the demand for ready-to-eat and easy-to-cook foods. These foods contain emulsifiers that aid in maintaining their texture, quality, and shelf life. As more people choose quick and simple meal options, the need for food emulsifiers in the U.S. continues to increase.

Asia Pacific Food Emulsifier Market Trends

Asia Pacific food emulsifier industry is expected to grow at the fastest CAGR over the forecast period. The rising demand for easy-to-use and premium food products, fast urban growth, and the rising interest in vegan diets in countries such as China and Japan are contributing to the demand for emulsifiers and food processing ingredients. People are increasingly choosing a range of plant-based and packaged foods due to growing awareness and evolving lifestyles. This factor also supports the steady growth of the emulsifier market in the region.

The China food emulsifier industry accounted for a significant share in the Asia Pacific region. The growing popularity of bakery products in China is increasing the demand for food emulsifiers. This is mainly due to the habit of snacking on the go and the spread of Western-style bakeries in second- and third-tier cities. Emulsifiers help improve the softness, texture, and taste of baked goods. They also help keep products fresh for a longer time. As bakery consumption continues to grow, the use of emulsifiers in this segment is expected to rise further.

Europe Food Emulsifier Market Trends

The food emulsifier industry in Europe held a significant share in 2025. Food emulsifiers impart the right texture and consistency to these foods, which enhances their application scope in the food industry. They also help extend shelf life and improve the overall quality of packaged foods, making them more appealing to consumers. This is encouraging manufacturers to use natural emulsifiers in their products and contributing to a surge in product demand in the region.

Key Food Emulsifier Company Insights

Many brands in the global food emulsifier industry have recognized untapped opportunities within their product portfolios and are actively working to capitalize on these gaps. This includes launching innovative designs, expanding customization options, and tailoring marketing strategies to align with evolving consumer tastes and cultural trends. By addressing niche segments and emerging preferences, these brands aim to increase their market share and strengthen their competitive positioning worldwide.

- Cargill, Incorporated is a global food and agriculture company operating across 70 countries and serving customers in over 125 markets. The company helps connect farmers, manufacturers, and consumers by producing, storing, and transporting food and agricultural products. Cargill focuses on sustainability, innovation, and diversity in its operations. Its goal is to provide safe, high-quality food while solving global food and agriculture challenges.

Key Food Emulsifier Companies:

The following are the leading companies in the food emulsifier market. These companies collectively hold the largest Market share and dictate industry trends.

- Cargill, Incorporated.

- Palsgaard

- Ingredion

- RIKEN VITAMIN CO., LTD.

- Corbion

- ADM

- Kerry Group

- BASF SE

- DuPont

Recent Developments

-

In June 2025, Cargill extended its partnership with Cubiq Foods to co-develop plant-based fat technologies, including the Go!Drop emulsion, aiming to enhance taste and texture in plant-based meat and dairy products while accessing Cubiq’s broader ingredient portfolio.

-

In June 2025, Palsgaard inaugurated a state‑of‑the‑art Application Centre in Navi Mumbai, India, to strengthen regional customer support, boost product development capabilities, and provide localized technical support across key food categories.

-

In March 2023, Azelis expanded its partnership with Corbion, integrating their lactic acid, lactates, and fermentation-based ingredients into Malaysia and Singapore’s Food & Nutrition portfolio, enhancing clean-label solutions across bakery, dairy, beverages, snacks, and plant-based products.

Food Emulsifier Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 4.44 billion

Revenue Forecast in 2033

USD 6.15 billion

Growth rate

CAGR of 4.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilo tons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Cargill, Incorporated; Palsgaard; Ingredion; RIKEN VITAMIN CO., LTD.; Corbion; ADM; Kerry Group; BASF SE; DuPont

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Emulsifier Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global food emulsifier market report based on product, application, and region.

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Mono, Di-Glycerides & Derivatives

-

Lecithin

-

Stearoyl Lactylates

-

Sorbitan Esters

-

Others

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

Bakery & Confectionery

-

Convenience Foods

-

Meat Products

-

Dairy Products

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global food emulsifiers market size was estimated at USD 4.22 billion in 2025 and is expected to reach USD 4.44 billion in 2026.

b. The global food emulsifiers market is expected to grow at a compound annual growth rate of 4.8% from 2026 to 2033 to reach USD 6.15 billion by 2033.

b. North America food emulsifier market held the largest global revenue share of 35.4% in 2025.

b. Some key players operating in the food emulsifiers market include Cargill, Incorporated; Palsgaard; Ingredion; RIKEN VITAMIN CO., LTD.; Corbion; ADM; Kerry Group; BASF SE; DuPont

b. Key factors that are driving the market growth include the demand for innovative baked products, especially those that are gluten-free and exhibit longer shelf life

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.