- Home

- »

- Food Safety & Processing

- »

-

Food Preservatives Market Size And Share Report, 2030GVR Report cover

![Food Preservatives Market Size, Share & Trends Report]()

Food Preservatives Market (2024 - 2030) Size, Share & Trends Analysis Report By Label (Clean Label, Conventional), By Type (Natural, Synthetic), By Function (Anti-microbial, Anti-oxidant), By Application, And Segment Forecasts

- Report ID: GVR-2-68038-062-0

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Preservatives Market Summary

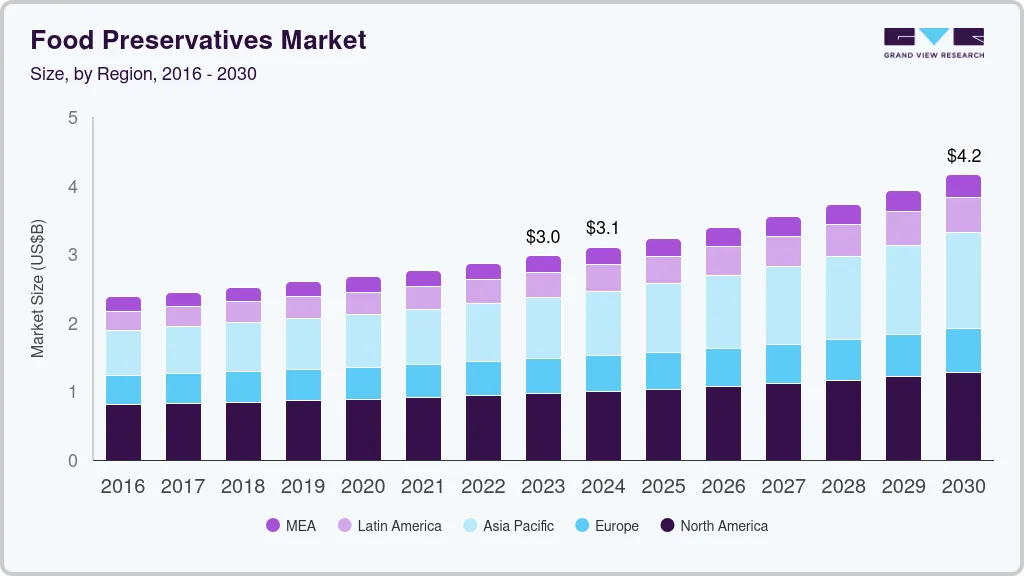

The global food preservatives market size was estimated at USD 2.9 billion in 2023 and is projected to reach USD 4.16 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030. Food preservatives are products incorporated during food processing to increase stability and avoid spoilage.

Key Market Trends & Insights

- The food preservatives market in North America accounted for the largest revenue share of over 30% in 2023.

- By label, conventional food preservatives segment held the largest revenue share of 67.9% in 2023.

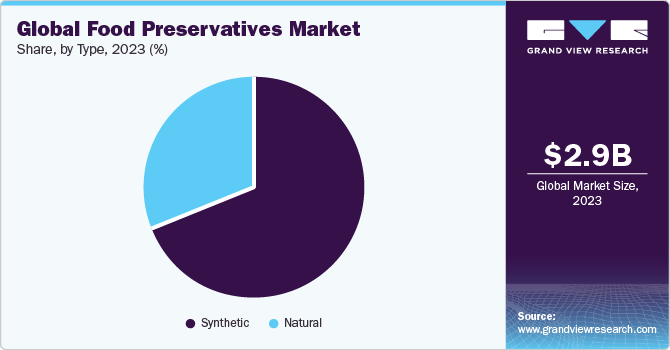

- By type, the synthetic food preservatives market segment accounted for the largest revenue share of over 69.0% in 2023.

- By function, in 2023, anti-microbial food preservatives segment dominated the market with a share of over 75.0%.

- By application, meat and poultry segment accounted for the largest revenue share of over 31% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.9 Billion

- 2030 Projected Market Size: USD 4.16 Billion

- CAGR (2024-2030): 5.0%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

They are added in small quantities to various types of food depending on the need. Traditionally, salt, sugar, and spices were used to preserve meat and other food types. Food preservatives prevent the growth of microorganisms and thus inhibit or delay food spoilage. Depending on the degree of toxicity, they are classified into non-toxic and moderately toxic. Non-toxic preservatives can be used in the processing while moderately toxic are regulated by relevant regulatory bodies such as the U.S. Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) and are identified by appropriate index (INS or E) numbers.

Food preservatives are used for preserving snacks, confectioneries, bakery products, dairy, meat, and poultry products. Demand for these products is increasing globally owing to various factors, such as a change in customer lifestyle, the surge in imports and exports, an increasing preference for fresh products, and a rise in consumer willingness to pay a premium price.

North America acquired the maximum market share in 2023 and is expected to continue its dominance for the next few years. Increased availability of processed foods and greater acceptance of ready-to-eat foods from consumers in the U.S. and Canada are driving the demand for convenience foods.

Rising demand for meat and poultry products is expected to boost growth. Manufacturers such as Corbion N.V. use vinegar, along with jasmine extract as an anti-oxidant and citrus powder, to prevent moisture migration of the product.

The U.S. food preservatives market was led by chemical preservatives, such as benzoates, nitrites, and propionates. However, manufacturers in the U.S. are shifting from manufacturing synthetic to natural preservatives owing to increasing demand for the latter.

Market Concentration & Characteristics

The market is moderately fragmented and it is growing at a medium pace. Continuous innovation such as advancements in preservation technologies, such as the development of natural and clean-label preservatives, is driving the market growth.

The growing demand for natural preservatives is driving acquisitions and collaborations in the market. Kerry acquired Niacet in 2021, which specializes in food preservation solutions. There is an increased focus on incorporating natural and clean-label ingredients into food products.

Stringent regulations related to food safety and permissible food additives drive the demand for preservatives meeting specific standards. Compliance with these regulations is essential for market players to ensure product approval and consumer trust.

Growing availability of natural preservatives is influencing the market. Increasing consumer preference for natural and organic alternatives may lead to a shift away from synthetic preservatives. Market players are adapting to these changing preferences by offering innovative, natural preservatives or exploring new preservation methods to gain a competitive edge in the market.

Label Insights

Conventional food preservatives held the largest revenue share of 67.9% in 2023. Conventional food preservatives are used alone or in conjugation with other preservation techniques. Conventional preservatives mostly include antioxidants that work as oxygen absorbers or antimicrobial preservatives that inhibit the growth of fungi or bacteria.

Product recalls are rising majorly in the U.S. and also in other countries due to several outbreaks, including E. coli and salmonella infections. Similarly, the recent contamination of ice cream with coronavirus (SARS-CoV-2) in China in January 2021 has led consumers to become more diligent in sourcing food products and, thus, product labeling.

The growth of the clean-label food preservatives market can be attributed to the shifting consumer focus toward trusted and better-understood ingredients. The food industry is rapidly adopting clean-label preservatives that help meet the requirements of food formulators, trying to cope with the demand of a label-conscious consumer base.

Manufacturers have introduced a clean label range that is compatible with food formulations to suit the demand of end-users. For instance, Corbion has developed an enzyme technology that protects bakery products during distribution, handling, and processing so they have a long-lasting fresh quality that consumers expect. The development of innovative clean-label preservatives has resulted in the high demand for clean-label food products over recent years.

Type Insights

The synthetic food preservatives market accounted for the largest revenue share of over 69.0% of the global food preservatives market in 2023. The synthetic type is widely used as it is economical and easy to formulate. They can be formulated depending on the application requirements. Based on type, the market is classified into natural and synthetic types.

Sorbates, among all the chemical types, held the largest share in terms of value in 2023 owing to their widespread application in meat, poultry, and dairy products. Other widely used synthetic types are nitrites, propionates, and benzoates. Sorbates, benzoates, and propionates are often used in combination to improve efficiency. Propionates are gaining wider acceptance owing to their higher permissible limit and applications, including preservation at higher pH, baked goods, snacks, and other confectioneries.

Natural food preservatives market is projected to witness a higher growth compared to synthetic food preservatives demand owing to the acceptance of natural preservatives by relevant regulatory agencies, coupled with rising health consciousness among customers. Numerous manufacturers are adopting new formulation processes for the production of organic products to meet the requirement for clean labeled products.

Rosemary extract is a majorly used natural preservative in North American and European countries. The Asia Pacific witnessed significant demand for edible oil. This can be attributed to its typical applications in the pickling of poultry and seafood, vegetables, and cooking purposes. Edible oil has a significant market share among natural preservative types as it is used in large volumes for pickling and in the preparation of food.

Function Insights

In 2023, anti-microbial food preservatives dominated the market with a share of over 75.0%. Sorbates, benzoates, and other chemicals act as anti-microbial preservatives and are categorized as generally recognized as safe (GRAS) in the U.S.

Sodium propionate and calcium propionate are used as mold inhibitors in cheese, cake, bread, and other baked and confectionery products. Some of the natural microbial agents of plant or animal origin are rosemary extracts and edible oils. These contain metabolites that retard the development of micro-organisms, such as staphylococcus aureus, Aeromonas hydrophila, salmonella, and escherichia coli.

In addition to propionate, benzoates, and sorbates, sulfites are used as anti-microbial agents in the brewing industry. Other functions include anti-fungal and anti-bacterial properties provided by natamycin and reuterin. Antioxidants are among the essential factors in food labeling as consumers are now aware of the health benefits associated with additives, and they opt for products rich in antioxidants. Green tea extracts, acerola, rosemary extract, and ascorbic acid possess antioxidant properties and are majorly used for preventing food oxidation.

Application Insights

Food preservative demand in meat and poultry accounted for the largest revenue share of over 31% in 2023. The processed meat, poultry, and seafood industry are expanding at a significant rate globally, which is expected to drive the demand during the forecast period. Food preservatives are used in a wide variety of applications, including bakery, meat and poultry, seafood, beverages, confectionery, oils and fats, and dairy and frozen products.

Bakery products are characterized by their limited shelf-life due to microbiological spoilage that results in economic loss as well as a negative effect on the quality characteristic of the food product. Essential oils of lemongrass, cinnamon, and thyme have emerged as an attractive natural alternative in bakery applications.

Food preservatives demand in beverages is expected to witness the fastest growth over the forecast period, driven by the expansion of the beverage industry. Preservatives used in beverages can be classified into three forms, namely antioxidants, antimicrobial agents, and anti-browning agents. For instance, ascorbic acid functions as an antioxidant as well as an anti-browning agent as it is a reducing agent.

The growth of mold over the surface of the cheese is considered a major factor limiting its shelf life. Natamycin, sorbate, and benzoate are the most commonly used food preservatives in dairy products. The compounds are used to inhibit the growth of different types of microorganisms. The use of food preservatives is expected to increase in the dairy industry with the rising consumption of milk and milk-based products.

Regional Insights

North America food preservatives market

The food preservatives market in North America accounted for the largest revenue share of over 30% in 2023. The market in North America was driven by a rise in various applications of the product in the U.S., Canada, and Mexico. Well-established bakery stores and an increase in the consumption of processed meat are expected to boost the growth.

The food and beverage industry is the largest contributor to the market growth in Europe. The exports of the food and beverage industry in Europe are increasing substantially, with the top destinations being the U.S., China, Canada, Australia, Saudi Arabia, and Japan. Products that are predominantly exported are meat products, seafood products, dairy products, and beverages such as spirits, soft drinks, and dairy products. Rising food export from Europe is thus expected to drive the demand for food preservatives that are required for extending shelf life during transit operations.

The increasing working population and consumer preference for ready-to-eat products are expected to benefit the market expansion in the Asia Pacific over the next few years. The Asia Pacific food preservatives market is estimated to emerge as the fastest-growing region and is projected to expand at a CAGR of 6.8% from 2024 to 2030.

India food preservatives market

The food preservatives market in India is driven by rising consumer awareness regarding food safety, coupled with an increasing demand for convenience and processed foods, which has driven the adoption of food preservatives to enhance shelf life and maintain product quality. Additionally, the expanding urban population and changing lifestyles have led to a surge in the consumption of packaged and ready-to-eat foods, necessitating the use of preservatives for extended freshness. The natural food preservatives market in India is expected to grow at a CAGR of 8.5% from 2024 to 2030.

Vietnam food preservatives market

The food preservatives market in Vietnam is influenced by factors such as rapid urbanization, changing lifestyles, and an increasing preference for convenience foods. The expanding food processing sector, coupled with a growing population and disposable income, further accelerates the market's growth. As manufacturers explore eco-friendly and natural preservatives to align with consumer preferences, the Vietnam food preservatives market is anticipated to witness continued expansion in the coming years.

Central and South American countries are among the fastest-growing industries for meat and beverages consumption. Consumption of soft drinks is growing in volumes, led by Brazil and Peru. The rapid growth in the beverage industry is expected to drive the demand for antimicrobial agents over the forecast period in the region.

Key Companies & Market Share Insights

The market is characterized by a large number of synthetic preservatives manufacturers. However, due to the rising demand for organic preservatives, the market has witnessed new entrants marking their presence. Global manufacturers include ADM, BASF SE, and Celanese Corporation.

Demand for natural food products is gradually increasing owing to consumer awareness about health and an increase in customer willingness to pay for premium products. As a result, a large number of natural food manufacturers have entered the market, further intensifying the competition. Global natural food preservatives manufacturers include Royal DSM N.V.; Galactic S.A.; and Kemin Industries, Inc.

New entrants such as Kemin Industries, Inc. and Galactic S.A. are competing by introducing new products formulated from various natural sources, such as vinegar and rosemary extracts, and made using new technologies. For instance, in August 2021, Conagen, Inc. launched its new product ‘p-Coumaric Acid’ (PCA), which is a natural and clean-label preservative that is prepared by fermentation.

Collaborations and mergers are a part of the growth strategies that manufacturers deploy to gain a larger share and expand their product portfolio and geographical presence. BASF SE has collaborated with China’s state-owned SINOPEC to expand its production capacity and cater to the stringent safety regulations in China.

Key Food Preservatives Companies:

The following are the leading companies in the food preservatives market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these food preservatives companies are analyzed to map the supply network.

- Cargill, Inc.

- Kemin Industries, Inc.

- ADM

- Tate & Lyle

- Koninklijke DSM N.V.

- BASF SE

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry

Recent Developments

-

In July 2023, BioVeritas, a Texas-based startup, developed a clean-label mould inhibitor using a proprietary upcycling and fermentation process. The inhibitor, derived from upcycled biomass, has been shown to be as effective as traditional petrochemical-based ingredients in preserving the flavor and texture of baked goods. The company is seeking GRAS status and plans to establish its first commercial plant in 2026, targeting the North American baked goods industry. Additionally, BioVeritas is exploring applications for its ingredient in processed meat and food and is currently collaborating with global ingredient and food manufacturers.

-

In January 2022, Florida Food Products (FFP) launched a new clean label antioxidant ingredient, VegStable Fresh, at the International Production & Processing Expo. This plant-based solution aims to address the growing demand for natural food preservatives in the meat and poultry industry. With benefits such as extended shelf life and rancidity prevention, VegStable Fresh reflects the trend towards cleaner, more natural ingredients in the food preservatives industry.

Food Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.10 billion

Revenue forecast in 2030

USD 4.16 billion

Growth Rate (Revenue)

CAGR of 5.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Label, type, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Cargill, Inc.; Kemin Industries, Inc.; ADM; Tate & Lyle; Koninklijke DSM N.V.; BASF SE; Celanese Corporation; Corbion N.V.; Galactic S.A.; Kerry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Preservatives Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global food preservatives market report on the basis of label, type, function, application, and region:

-

Label Outlook (USD Million; 2018 - 2030)

-

Clean Label

-

Conventional

-

-

Type Outlook (USD Million; 2018 - 2030)

-

Natural

-

Edible Oil

-

Rosemary Extracts

-

Natamycin

-

Vinegar

-

Chitosan

-

Others

-

-

Synthetic

-

Propionates

-

Sorbates

-

Benzoates

-

Others

-

-

-

Function Outlook (USD Million; 2018 - 2030)

-

Anti-microbial

-

Anti-oxidant

-

Others

-

-

Application Outlook (USD Million; 2018 - 2030)

-

Meat & Poultry Products

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global food preservatives market size was estimated at USD 2.77 billion in 2021 and is expected to reach USD 2.87 billion in 2022.

b. The food preservatives market is expected to grow at a compound annual growth rate of 4.6% from 2022 to 2030 to reach USD 4.16 billion by 2030.

b. North America dominated the food preservatives market with a share of 32.9% in 2021. This is attributable to the increased availability of processed foods and greater acceptance of ready-to-eat foods from consumers in the U.S. and Canada are driving the demand for convenience foods.

b. The food preservatives market includes major players such as Cargill Inc., ADM BASF SE, Celanese Corporation, Royal DSM N.V.; Galactic S.A.; and Kemin Industries, Inc.

b. Key factors that are driving the food preservatives market growth include the growing use of natural preservatives, which are witnessing higher demand owing to their acceptance in processing by relevant regulatory agencies coupled with rising health consciousness among customers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.