- Home

- »

- Food Safety & Processing

- »

-

Food Processing Blades Market Size, Industry Report, 2030GVR Report cover

![Food Processing Blades Market Size, Share & Trends Report]()

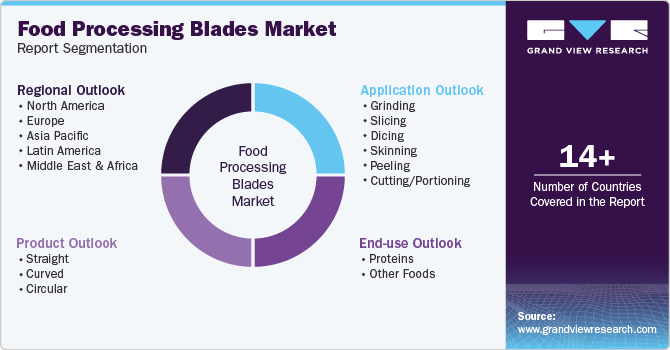

Food Processing Blades Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Straight, Curved, Circular), By Application (Grinding, Cutting/Portioning, Slicing), By End-use (Proteins, Other Foods), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-176-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Processing Blades Market Trends

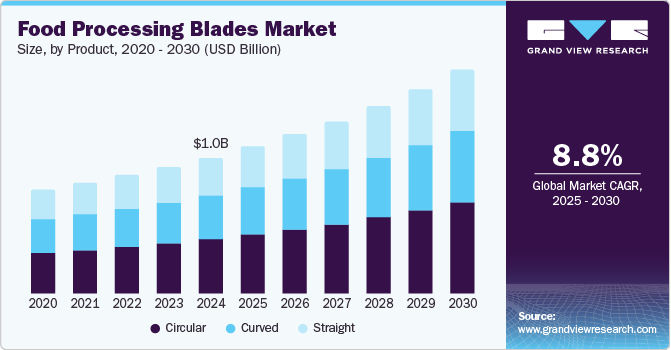

The global food processing blades market size was valued at USD 1.03 billion in 2024 and is expected to grow at a CAGR of 8.8% from 2025 to 2030. This growth can be attributed to rising disposable incomes and increased spending power among the middle class, leading to higher demand for processed food products. In addition, the growing preference for convenience foods, including ready-to-eat meals, is boosting market expansion. Furthermore, advances in technology and blade manufacturing are enhancing product quality and efficiency, while adherence to food safety regulations also supports the need for high-quality food processing blades in production processes.

Food processing blades are essential tools employed in the food industry for various functions, including cutting, slicing, dicing, and chopping. The increasing global population and urbanization are driving a rising demand for processed foods, which are preferred for convenience, longer shelf life, and affordability. As consumer preferences shift towards ready-to-eat meals, the food processing sector is experiencing significant growth, leading to an escalating need for food processing blades.

In addition to changing consumer habits, ongoing technological advancements are transforming the industry. Innovations such as laser cutting and precision machining are enhancing the efficiency and accuracy of food processing operations. These advancements enable manufacturers to produce blades that offer improved performance and durability, thereby creating new opportunities for their use in various applications.

Furthermore, government regulations play a crucial role in shaping the food processing blades market. Increasingly stringent regulations are being implemented to ensure the safety of food products. These regulations often mandate that food processors utilize specific types of blades that meet established safety standards, thus driving demand for compliant food processing blades.

Product Insights

Circular blades dominated the global food processing blades industry, with a revenue share of 39.8% in 2024. This growth can be attributed to their effectiveness and versatility. Circular blades are designed for high-volume cutting, slicing, and portioning, making them ideal for food manufacturers who require consistent and precise results. In addition, their ability to maintain a sharp edge during extensive use enhances productivity while minimizing downtime for maintenance.

The curved blades are expected to grow at the fastest CAGR of 8.7% over the forecast period, owing to their effectiveness in specialized applications such as skinning and filleting. These blades offer superior maneuverability, allowing for intricate cutting tasks that require precision and control. In addition, as the food industry increasingly emphasizes quality and presentation, the demand for curved blades is rising, particularly in meat and seafood processing. Furthermore, their unique design enables processors to achieve cleaner cuts, improving the overall quality of the final product and supporting market expansion.

Application Insights

The grinding application led the market and accounted for the largest revenue share of 23.9% in 2024, primarily driven by its efficiency in reducing food particle size. Grinding blades are essential for processing various food materials, including meat, vegetables, and grains, into smaller, more uniform particles. Furthermore, this capability enhances the consistency and quality of food products, making them more appealing to consumers. Moreover, as the demand for high-quality processed foods rises, the importance of grinding applications in food production continues to drive market growth.

The cutting/portioning application segment is expected to grow at the fastest CAGR of 9.4% over the forecast period, as manufacturers focus on optimizing food preparation processes. Food processing blades designed for cutting and portioning ensure uniformity and precision in slicing ingredients, which is crucial for maintaining product quality and presentation. In addition, the increasing popularity of convenience foods and ready-to-eat meals further fuels the demand for efficient cutting solutions. Furthermore, as food processors strive to meet consumer expectations for consistency and quality, the cutting and portioning segment is poised for continued expansion in the market.

End-use Insights

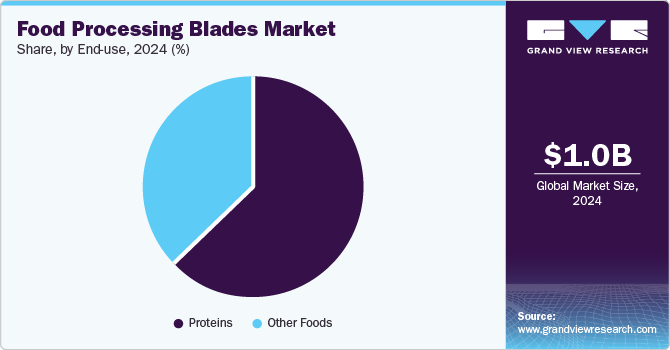

The proteins segment held the dominant position in the market with the highest revenue share of 63.4% in 2024, driven by the increasing consumption of meat and seafood products. As consumers seek high-quality protein sources, food processors are optimizing their operations to meet this demand. In addition, efficient cutting and processing techniques are essential for maintaining product quality and safety, leading to a higher demand for specialized blades. Moreover, advancements in blade technology enhance precision and durability, further supporting the growth of this segment.

The other foods segment is expected to grow at a CAGR of 9.3% from 2025 to 2030, owing to the rising popularity of processed fruits, vegetables, and convenience foods. In addition, as consumer lifestyles become busier, there is a growing preference for ready-to-eat and pre-packaged food items that require efficient processing. Furthermore, food processing blades play a crucial role in ensuring uniformity and quality in these products. Moreover, innovations in blade design and materials are improving performance, making them indispensable in various food applications, thereby driving growth in this segment.

Regional Insights

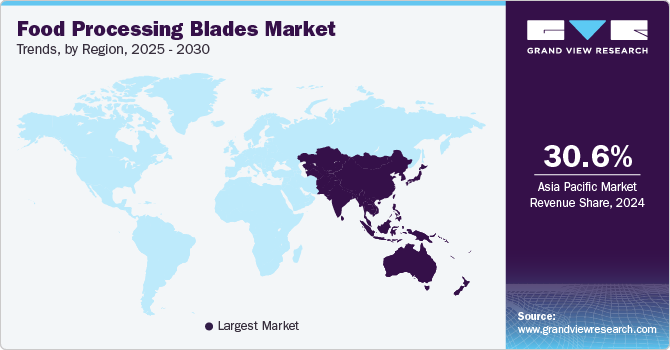

The Asia Pacific food processing blades market dominated the global market and accounted for the largest revenue share of 30.6% in 2024, primarily driven by rapid urbanization and an expanding food and beverage industry. Increasing disposable incomes and changing consumer preferences for convenient and ready-to-eat food products are further fueling demand. In addition, the region's large agricultural base necessitates efficient processing equipment, leading to heightened investments in food processing technologies. Furthermore, as consumers increasingly prioritize quality and safety in food products, the demand for advanced food processing blades continues to rise.

China Food Processing Blades Market Trends

The food processing blades market in China led the Asia Pacific market and held a significant revenue share in 2024, driven by its booming food processing sector. The country's vast population and rising urbanization have led to a surge in demand for processed foods, including meat and seafood. Furthermore, technological advancements are enhancing production efficiency, prompting manufacturers to invest in high-quality processing equipment. Moreover, the government's focus on food safety regulations also drives the need for compliant food processing blades, solidifying China's position as a key player in this market.

North America Food Processing Blades Market Trends

The North America food processing blades market is expected to grow significantly over the forecast period, fueled by a strong emphasis on convenience foods and ready-to-eat meals. As lifestyles become busier, consumers increasingly turn to processed options that save time while ensuring quality. In addition, the region's established food processing industry is also adopting advanced technologies to improve efficiency and maintain high safety standards. Furthermore, innovations in blade design and materials contribute to enhanced performance, driving demand among manufacturers seeking competitive advantages.

The U.S. food processing blades market dominated the North American market and accounted for the largest revenue share in 2024. This growth can be attributed to the rising consumption of processed foods across various demographics. In addition, the growing trend towards health-conscious eating has led to increased demand for high-quality meat, poultry, and seafood products that require efficient processing solutions. Furthermore, regulatory pressures regarding food safety standards compel manufacturers to invest in advanced processing equipment, including specialized blades that ensure compliance.

Middle East & Africa Food Processing Blades Market Trends

The Middle East and Africa food processing blades market is expected to grow at a CAGR of 9.0% over the forecast period, owing to urbanization and increasing disposable incomes. The evolving food and beverage industry is adapting to changing consumer preferences, leading to a higher demand for processed and packaged foods. In addition, investments in modernizing food processing facilities are rising, enhancing productivity and product quality. Furthermore, as local manufacturers seek to meet international standards, the demand for efficient and reliable food processing blades is expected to grow significantly in this region.

Europe Food Processing Blades Market Trends

The food processing blades market in Europe is expected to experiencing growth driven by stringent food safety regulations and a strong preference for high-quality processed foods. The region's established culinary traditions and modern consumer demands for convenience foster innovation in food processing technologies. Furthermore, sustainability concerns are prompting manufacturers to adopt eco-friendly practices and materials in blade production. Moreover, as European consumers increasingly seek transparency regarding their food sources, the demand for efficient and compliant food processing blades continues to rise.

Key Food Processing Blades Company Insights

Major companies in the global food processing blades industry include Simonds International, Urschel Laboratories, Inc., Dexter Russell, and others. These players are adopting several key strategies to enhance their brand presence. Strategic collaborations and partnerships are being formed to leverage shared expertise and resources, fostering innovation in blade design and manufacturing. In addition, strategic acquisitions are also prevalent, allowing companies to expand their product portfolios and enter new markets effectively. Furthermore, a strong focus on new product development and launches is evident, as firms aim to meet evolving consumer demands and enhance operational efficiency across the food processing sector.

-

Norwood Commercial Products specializes in manufacturing a wide range of food processing blades designed for various applications within the food industry. The company focuses on producing high-quality cutting tools that cater to the needs of different sectors, including meat, poultry, and seafood processing. Operating within the food processing segment, the company provide innovative solutions that enhance efficiency and precision in food preparation and production processes.

-

Fortifi Food Processing Solutions manufactures a variety of blades used for cutting, slicing, and portioning across multiple food segments, including proteins and other processed foods. Operating primarily within the food processing segment, the company leverages innovative technologies to deliver high-performance solutions that meet the evolving needs of their customers.

Key Food Processing Blades Companies:

The following are the leading companies in the food processing blades market. These companies collectively hold the largest market share and dictate industry trends.

- APV Engineered Coatings

- Simonds International

- Urschel Laboratories, Inc.

- Dexter Russell

- M.K. Morse LLC

- Norwood Commercial Products

- Fortifi Food Processing Solutions

- Grote Company

- Cardinal/AGSCO

- Waring Commercial

- Wilbur Curtis

- Jarvis India

- Hallde

- Talsabell S.A.

Recent Developments

-

In April 2024, Fortifi Food Processing Systems, a global frontrunner in food processing equipment and automation, announced its acquisition of Nothum Food Processing Systems. Nothum is renowned for designing and manufacturing advanced lines for batter, tempura, breading, and frying, primarily targeting the protein processing sector. This acquisition allows Fortifi to further elevate its service excellence to customers.

-

In March 2024, Fortifi Food Processing Solutions officially launched as a comprehensive platform for leading brands in food processing equipment and automation. With operations in over 15 countries, Fortifi enhances productivity and worker safety across various sectors, including protein, dairy, and fruits and vegetables. The recent acquisition of MHM Automation strengthens their offerings with innovative systems that improve product quality.

Food Processing Blades Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.11 billion

Revenue forecast in 2030

USD 1.69 billion

Growth Rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in million units, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; South Korea; UK; Germany; France; Italy; Brazil; Argentina

Key companies profiled

APV Engineered Coatings; Simonds International; Urschel Laboratories, Inc.; Dexter Russell; M.K. Morse LLC; Norwood Commercial Products; Fortifi Food Processing Solutions; Grote Company; Cardinal/AGSCO; Waring Commercial; Wilbur Curtis; Jarvis India; Hallde; Talsabell S.A.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Processing Blades Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global food processing blades market report based on product, application, end-use, and region.

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Straight

-

Single Edge

-

Double Edge

-

Serrated

-

-

Curved

-

Single Edge

-

Serrated

-

-

Circular

-

Flat Edge

-

Beveled Edge

-

Scalloped Edge

-

Toothed

-

Notched

-

Semi-circular

-

Involute

-

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Grinding

-

Slicing

-

Dicing

-

Skinning

-

Peeling

-

Cutting/Portioning

-

-

End-use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Proteins

-

Fish

-

Poultry

-

Bovine

-

Pork

-

-

Other Foods

-

Fruits

-

Vegetables

-

Nuts

-

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.