- Home

- »

- Consumer F&B

- »

-

Food Trucks Market Size & Trends, Industry Report, 2030GVR Report cover

![Food Trucks Market Size, Share & Trends Report]()

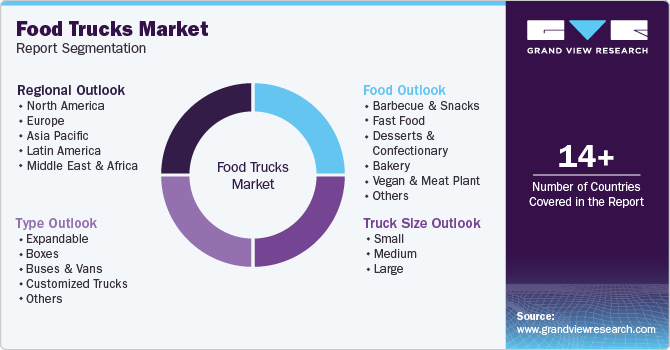

Food Trucks Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Expandable, Boxes, Buses & Vans, Customized Trucks, Others), By Truck Size (Small, Medium, Large), By Food, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-715-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Food Trucks Market Summary

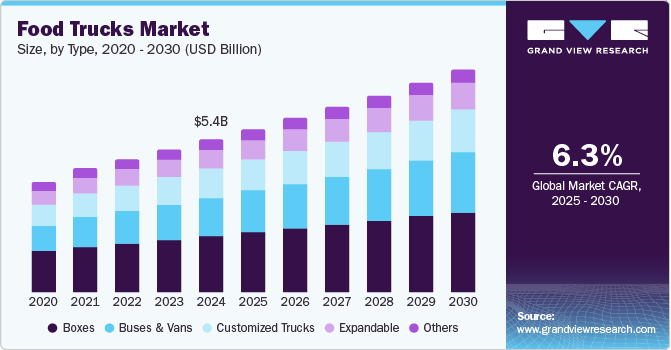

The global food truck market size was valued at USD 5.42 billion in 2024 and is projected to reach USD 7.87 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. A surge in gastronomy worldwide coupled with the rising preference of consumers between the age group of 16-34 years for new meal experiences over a conventional brick-and-mortar restaurant experience is expected to drive the market.

Key Market Trends & Insights

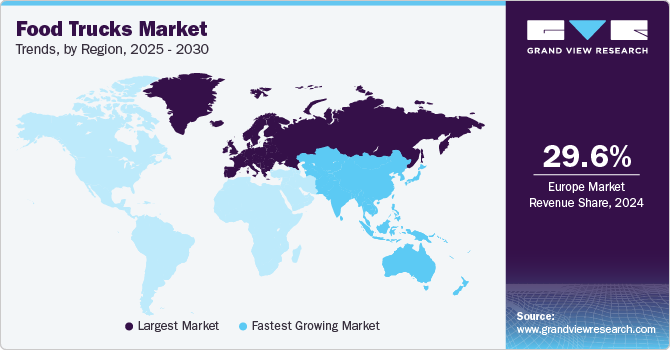

- Europe food trucks dominated the global market with the largest revenue share of 29.6% in 2024.

- The food truck market in the U.S. dominated the regional market with the largest revenue share in 2024.

- Based on type, the boxes segment dominated the food trucks industry with the largest revenue share of 37.1% in 2024.

- Based on truck size, the medium size food truck segment led the market with the largest revenue share in 2024.

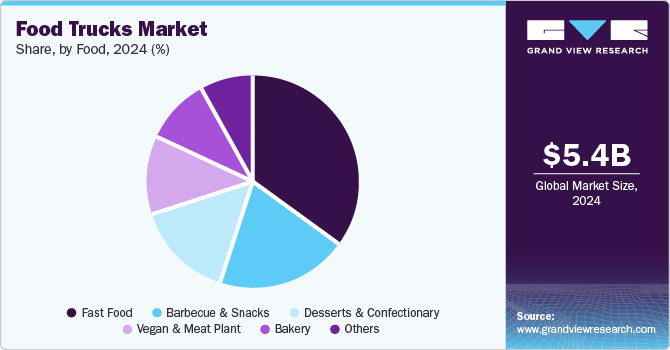

- Based on food, the fast food segment dominated the food trucks industry with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.42 Billion

- 2030 Projected Market Size: USD 7.87 Billion

- CAGR (2025-2030): 6.3%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Ease of accessibility, availability of multiple culinary offerings, convenient servings and packaging, and comparatively lesser initial investments are some of the key factors leading to the increasing growth of this market. The growing inclination among consumers toward gourmet offerings and unique food concepts is projected to propel the demand for food trucks. This has stimulated new launches in various locations and a growing number of food trucks, especially in urban areas. For instance, in March 2025, Cousins Maine Lobster (CML), one of the franchise food truck businesses and fast-casual lobster rolls brand, launched its second franchise food truck in the Buffalo, Rochester, and Syracuse area, known as Upstate New York. Modern food trucks thrive by offering signature dishes and hybrid cuisines. In addition, the fast-casual experience provided by food trucks features a combination of speed and convenience offered by fast food and a high-end quality atmosphere of casual dining, with freshly prepared food servings. Furthermore, starting a food truck costs significantly less than a brick-and-mortar restaurant.

According to a study by Food Truck Operator, Inc., the average cost of starting a food truck business is around USD 0.05 million to USD 0.06 million. In contrast, the average revenue stream from the food truck is approximately USD 0.29 million. This is 10 times lower than the cost of opening a brick-and-mortar restaurant. The study further revealed that gaining necessary food truck permits takes up to a few weeks to several months in the U.S., whereas the same for restaurants goes up to 3 months. Thus, the low startup cost coupled with the ease of gaining business permits is one of the major factors contributing to a rise in demand for food trucks.

Moreover, multiple commercial restaurant businesses have been focusing on the launch of brand-driven food trucks at prime locations worldwide. For instance, in November 2024, vegan, plant-based fast food restaurant brand Odd Burger Corporation launched its Vancouver restaurant and food truck. In addition, it also announced the launch of a food truck in British Columbia.

Type Insights

The boxes segment dominated the food trucks industry with the largest revenue share of 37.1% in 2024. A full kitchen setup is essential for on-site cooking, and a cargo van typically lacks the space for all the necessary equipment. A box truck provides ample room for a complete kitchen, offering the flexibility to add various cooking appliances, storage, and other features. This design supports diverse and elaborate menus catering to different tastes. The versatility and efficiency of box trucks have made them a top choice for food truck owners, allowing for greater culinary possibilities.

The buses and vans segment is expected to grow at the fastest CAGR over the forecast period. Food truck operators are increasingly adopting buses and vans due to their easy mobility and lower costs than expandable or customized trucks. Buses and vans provide a larger workspace than other options, enabling the installation of more extensive kitchens and a broader menu selection. This meets the increasing consumer demand for diverse and unique food choices. Their mobility allows them to easily navigate busy urban areas and reach events or festivals, expanding their customer base.

Truck Size Insights

The medium size food truck led the market with the largest revenue share in 2024. The growth is attributed to the easy mobility and flexibility of moving the kitchen to carnivals, parades, or promotional festivals. Medium-sized food trucks have more interior space than small trucks, allowing the use of more equipment with greater ease. Chefs aiming to offer diverse and high-quality menus find medium-sized trucks suitable for housing specialized equipment and ingredients, enhancing their culinary offerings.

The large size food truck is estimated to grow at the fastest CAGR over the forecast period. Barbecue food trucks have gained a dedicated customer base in the UK by combining convenience, high-quality food, and mouthwatering flavors. Barbecue involves multiple cooking stages, such as grilling and finishing, each requiring separate stations. Larger food trucks offer the space needed to accommodate these cooking zones, ensuring a smooth and efficient preparation. These food trucks are gaining popularity globally, especially in Asia Pacific and the Middle East & Africa, due to a rise in large-scale cultural and commercial events in these regions.

Food Insights

The fast food segment dominated the food trucks industry with the largest revenue share in 2024. Often preferred by young customers, fast food offerings feature various products, including burgers, sandwiches, fries, nuggets, hotdogs, and others. The convenience offered by such products, ease of consumption, hassle-free carry options, adequate packaging, and affordability are some key factors that fuel the demand for fast food. In addition, the availability of such products through food trucks adds greater convenience by reducing long queues, reservations, and order processing time.

The barbeque and snacks segment is estimated to experience substantial growth over the forecast period. Barbeque food items involve equipment that household users do not commonly use. However, Charcoal or gas-driven grills, tools, and accessories such as tongs and skewers are easily accommodated in the food truck models near areas around food trucks. Many customers prefer buying barbeque food servings from food trucks that serve fresh food seasoned with popular flavors and ingredients. New launches related to the category are also expected to drive growth in this segment. For instance, in September 2024, Korean BBQ & Seafood brand OLHSO launched its fully automated mobile restaurant in the U.S.

Regional Insights

North America food trucks market held a substantial market share in 2024. Growing urbanization in the region has led to changing consumer preferences. Many young consumers prefer fast food or other convenient food options served by food trucks across key cities over dining and restaurant settings with comparatively higher costs, longer serving times, and less convenient experiences. The diverse population in the region also influences the products offered by popular food trucks in cities such as New York, Toronto, Vancouver, Los Angeles, and Mexico City.

U.S. Food Trucks Market Trends

The food truck market in the U.S. dominated the regional market with the largest revenue share in 2024. In 2023, immigrants accounted for nearly 14.3% of the overall population. This has resulted in growing demand for multiple cuisines and food servings that belong to various culinary affiliations. Diversity in consumer backgrounds and increasing demand for convenient food options are expected to drive the growth of this market. The U.S. has multiple food trucks run by local communities and individuals serving fast food, regional delicacies, and more.

Europe Food Trucks Market Trends

Europe food trucks dominated the global market with the largest revenue share of 29.6% in 2024. Europe has a long-standing street food tradition, with numerous events and festivals celebrating culinary offerings. This deep-rooted passion for street food has helped build a strong and loyal customer base for food trucks. A large number of tourists visiting the region, a growing number of young customers, and emerging trends in the food industry are also facilitating the growth of this market.

Italy held the largest revenue share of the regional market in 2024. The convenience offered by food trucks, increasing demand for local street food by visitors, and the variety of offerings served by food trucks in cities such as Rome, Venice, Milan, Bologna, Naples, and others are mainly driving the growth. Significant growth in the inflow of international visitors is expected to add lucrative opportunities.

Asia Pacific Food Trucks Market Trends

Asia Pacific food trucks industry is expected to grow at the fastest CAGR over the forecast period. Consumers in Asian countries, such as China, Japan, and South Korea, have a higher preference for fast food from the streets, which is anticipated to increase the product demand in the region. The presence of well-established manufacturers in Asia Pacific, such as Ante Trailers and Hanyi Machine, along with the growing demand for street food, is expected to support the market growth.

Japan food trucks dominated the Asia Pacific industry with the highest revenue share in 2024. Food trucks offer an accessible entry point for aspiring chefs and entrepreneurs, avoiding the high costs of traditional restaurants. In recent years, Japan has experienced the emergence of multiple food truck businesses originating from Western Trends. These trucks often offer products that combine local food preferences and global culinary affiliations.

Key Food Trucks Company Insights

Some of the key companies include Prestige Food Trucks, United Food Truck, M&R SPECIALTY TRAILERS AND TRUCKS, Veicoli Speciali, and others. Major market players in this market focus on innovation, customizable designs, and the use of durable, energy-efficient materials to address changing demands for food truck businesses.

-

Prestige Food Trucks manufactures custom-built food trucks, trailers, and carts. It offers fully equipped mobile kitchens tailored to its clients' specific needs. It provides comprehensive support, including design consultation, branding services, and maintenance.

-

United Food Truck is a food truck manufacturer that offers custom-built mobile kitchens and food trucks for businesses in the food service industry. Its offerings include 18 and 14-foot food trucks, vans, containers, food trailers, and more.

Key Food Trucks Companies:

The following are the leading companies in the food truck market. These companies collectively hold the largest market share and dictate industry trends.

- Prestige Food Trucks

- United Food Truck

- M&R SPECIALTY TRAILERS AND TRUCKS

- Veicoli Speciali

- Futuristo trailers

- MSM CATERING TRUCKS MFG. INC.

- The Fud Trailer

- Food Truck Company

- Bostonian Body, Inc.

Recent Developments

-

In September 2024, United Food Truck, one of the market participants in the food truck industry, unveiled a custom-designed food truck. A 20-foot custom-built design was delivered for UTEC, a non-profit organization.

Food Trucks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.79 billion

Revenue forecast in 2030

USD 7.87 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, truck size, food, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., Italy, France, Spain, China, India, Japan, Australia, South Korea, Brazil, and South Africa

Key companies profiled

Prestige Food Trucks; United Food Truck; M&R SPECIALTY TRAILERS AND TRUCKS; Veicoli Speciali; Futuristo trailers; MSM CATERING TRUCKS MFG. INC.; The Fud Trailer; Food Truck Company; and Bostonian Body, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Food Trucks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global food trucks industry report based on type, truck size, food, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Expandable

-

Boxes

-

Buses & Vans

-

Customized Trucks

-

Others

-

-

Truck Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

Food Outlook (Revenue, USD Million, 2018 - 2030)

-

Barbecue & Snacks

-

Fast Food

-

Desserts & Confectionary

-

Bakery

-

Vegan & Meat Plant

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.