- Home

- »

- Clothing, Footwear & Accessories

- »

-

Footwear Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Footwear Market Size, Share & Trends Report]()

Footwear Market Size, Share & Trends Analysis Report By Type (Athletic, Non-athletic), By End-user (Men, Women, Children), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-396-6

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Consumer Goods

Report Overview

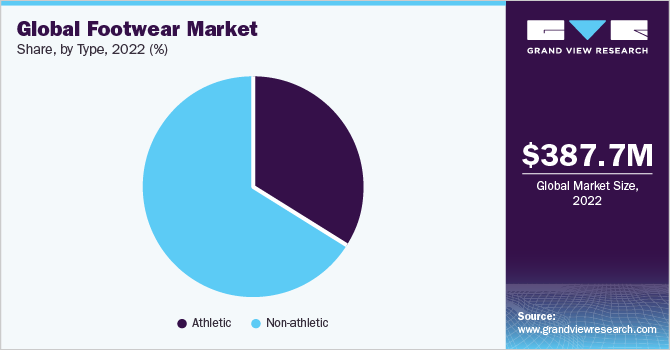

The global footwear market size was estimated at USD 387.74 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The growing sales facilitated by e-commerce, extensive spending on advertising by footwear brands, and rising demand for athletic footwear are the major factors driving the market’s growth. Furthermore, the rising instances of lifestyle-related health issues, such as stress and obesity, are pushing an increasing number of people to engage in sports and fitness activities, which is fueling the demand for comfortable and stylish footwear. Comfort became a top priority for consumers well before 2020. For years, fashion footwear has been losing market share to more comfortable and athleisure-oriented segments.

The increased demand for sustainable footwear is a trend that is gaining traction in the global market. According to the U.S. Department of the Interior, around 20 billion pairs of footwear are created annually, and approximately 300 Billion end up in landfills, with a majority of them containing non-biodegradable materials. There has been a growth in the use of sustainable materials and sustainable footwear brands, that have built sustainability into their brands from their inception. For instance, Nike with Nike Grind experimented with breaking down footwear into pellets, turning them into material for flooring instead of new footwear.

The footwear industry is labor-intensive and is affected by various factors such as land resources, labor costs, material supply, environmental protection, and sales markets. Consequently, in the pursuit of profit maximization, major consumer markets, footwear manufacturers, wholesalers, and retailers worldwide are shifting their focus to lower-cost countries, leading to the constant movement of global shoemaking bases. Japan, Taiwan, India, and China are lucrative markets for footwear.

According to data published in World Footwear Yearbook 2021, the year 2020 was tough for the footwear industry, but it turned out to be better than predicted. In 2020, footwear typeion and exports fell by 15.8% and 19%, respectively. Forecasts for the development of the consumer sector economy in 2020 were the gloomiest, in particular, the fall in global footwear consumption in the year the pandemic began was predicted at 20% or more. The final data for 2020 in the developed countries of Europe and North America correspond to this forecast. But Asia and the less developed countries were in a better position, which was reflected in the fact that the decline in the global footwear industry was not as significant as expected.

Type Insights

The athletic segment will register the fastest CAGR of 5.0% during the forecast period. Athletic shoes are worn by people who are involved in outdoor activities, such as running, walking, gymming, and playing sports like basketball, volleyball, cricket, hockey, and golf. Athletic shoes provide comfort, flexibility, and traction on outdoor platforms such as roads and trails as well as provide benefits like torsional stability, superior cushioning, and better protection to the users. The demand for comfortable, lightweight, and fashionable sports shoes from professional players for usage on wet, soft, and rough ground is propelling the athletic segment’s growth. The increasing participation and inclination of people toward daily physical activities such as running, gymming, and cycling is the major factor driving the growth of athletic shoes across the globe.

The non-athletic segment had the highest contribution of 65.7% in 2022 and will continue to do so during the forecast period. The non-athletic category consists of flats, heels, mules, sandals, sneakers, and boots, which can be worn on different occasions. A large number of niche, big market players, and designers worldwide have been contributing to this broad category of footwear, owing to the growing consumer inclination toward eco-friendly sneakers and footwear. Reduced use of water and plastics, coupled with constant efforts from various multinational corporations in shifting toward sustainable types, has contributed to the rising adoption of sustainable footwear, thereby driving the demand for non-athletic footwear.

End User Insights

Men shared a majority segment in the footwear industry holding a share of 55.4% in 2022. The inclination of men toward outdoor activities has been driving the demand for men’s footwear. Sports such as golf, cricket, hockey, and hiking have always been popular among men. Hence, type launches catering to specific sports categories will help boost the men’s footwear business growth. The emergence of high-end e-commerce sites is expected to act as a growth driver for the men’s footwear industry in the future.

The women’s segment is anticipated to witness the highest CAGR of 5.4% over the forecast period owing to dedicated lines of brands of female footwear. Type launches, collaborations, expansion into new markets, and innovations in sustainable footwear by manufacturers have been driving the women’s segment. For instance, Veja Footwear Company made its debut in the Indian market with the women’s V-10 sneaker series in collaboration with Bhaane, a multi-brand store.

Regional Insights

Asia Pacific held the highest share 39.6% in 2022 and is expected to continue the trend during the forecast period. The footwear industry is labor-intensive and is affected by various factors such as land resources, labor costs, material supply, environmental protection, and sales markets. Consequently, in pursuit of profit maximization, major consumer markets, footwear manufacturers, wholesalers, and retailers worldwide are shifting their focus to lower-cost countries, leading to the constant movement of global shoemaking bases. Japan, Taiwan, India, and China are lucrative markets for footwear in the Asia Pacific. Rising disposable income and improved living standards of the consumers are key factors accelerating type demand in these countries.

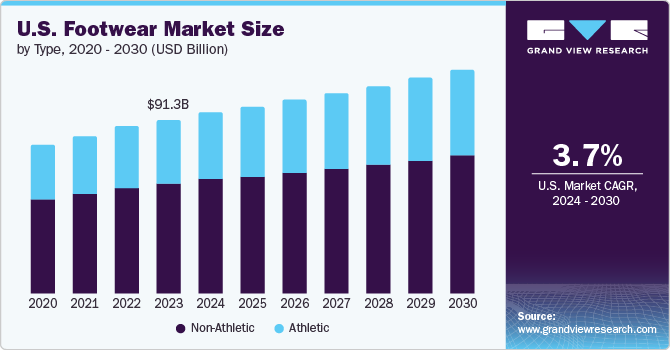

The North America region is projected to grow at a CAGR of 3.4% during the forecast period owing to the presence of major footwear manufacturers in the region. Footwear remains one of the most popular items Americans purchase. Footwear firms invest tens of Billions of dollars each year in their employees, stores, and platforms to ensure that they provide high-quality shoes on time. The footwear industry has one of the world's most resilient supply chains. The increasing demand for stylish and comfortable footwear among consumers is fueling the market. The growing popularity of sports such as football, basketball, and various snow sports is expected to create strong opportunities for the growth of the market in the North America region.

Key Companies & Market Share Insights

The global footwear market is characterized by the presence of several well-established players. The market comprises small-to-midsized players that offer a selected range of footwear. Companies in the market are focusing on collaborations to introduce innovative types to address the evolving needs of customers and to gain a competitive edge over other manufacturers. For instance:

-

In April 2023, Puma SE collaborated with Web3 brand 10KTF, owned by Yuga Labs, to release a limited edition collection of NFT sneakers. The 2,000 pairs of the limited edition ‘Grailed PUMA Slipstream’ sneakers are designed by artist Alexander John.

-

In February 2023, Fila partnered with the retailing division of Paramount Global to launch a special-edition footwear collection ‘Fila x Rock’s Modern Life’ inspired by Nickelodeon’s ‘Rocko’s Modern Life characters

-

In December 2021, Crocs, Inc. announced a deal to acquire privately-held casual footwear company HEY DUDE for USD 2.5 billion. HEY DUDE will function as a separate division after the transaction is completed.

-

In December 2021,PUMA announced the signing of Chelsea and Italy midfield maestro Jorginho. PUMA's new signing is a great move, as Jorginho was introduced as one of the new faces of PUMA's FUTURE Z line-up. Furthermore, in August 2021, Under Armour teamed up with the Baltimore Ravens to provide a grant to Maryland Public Secondary Schools Athletics Association member schools to help build a flag football program for high school girls.

Some of the key players operating in the global footwear market include:

-

Nike, Inc.

-

Adidas AG

-

PUMA SE

-

Geox S.p.A

-

Timberland

-

Skechers U.S.A, Inc

-

ECCO Sko A/S

-

Crocs Retail, LLC

-

Under Armour, Inc

-

Wolverine Worldwide, Inc

Footwear Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 403.18 billion

Revenue forecast in 2030

USD 543.90 billion

Growth rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nike, Inc.; Adidas AG.; PUMA; Geox S.p.A; Timberland; Skechers USA, Inc.; ECCO Ska A/S; Crocs Retail, LLC; Wolverine Worldwide, Inc.; Under Armour Inc

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Footwear Market Report Segmentation

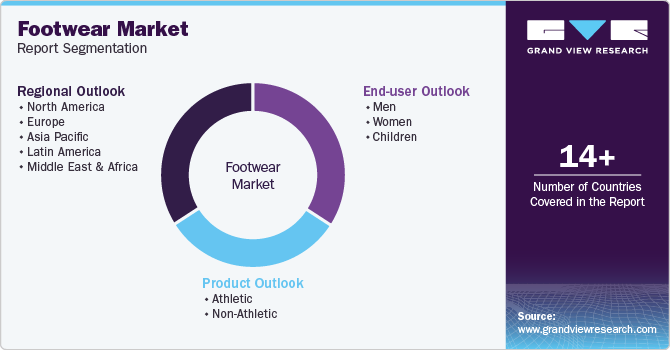

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global footwear market on the basis of type, end user, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Athletic

-

Non-athletic

-

-

End User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Men

-

Women

-

Children

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global footwear market size was estimated at USD 387.74 billion in 2022 and is expected to reach USD 403.18 billion in 2023.

b. The global footwear market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 543.90 billion by 2030.

b. The Asia Pacific dominated the footwear market with a share of 39.3% in 2022. This is attributable to an expanding customer base of fashion-conscious consumers in countries including China, India, and Japan.

b. Some key players operating in the footwear market include Nike, Inc.; Adidas America, Inc.; PUMA; Geox S.p.A.; Timberland; Skechers USA, Inc.; Ecco Sko A/S; Crocs Retail, Inc.; Under Armour Inc.; and Wolverine World Wide, Inc.

b. Key factors that are driving the footwear market growth include the rising popularity of leather shoes and the increasing adoption of footwear made from sustainable materials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."