- Home

- »

- Advanced Interior Materials

- »

-

Frac Sand Market Size, Share, Trends, Industry Report 2033GVR Report cover

![Frac Sand Market Size, Share & Trends Report]()

Frac Sand Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Coarse, Fine), By Application (Oil & Gas, Industrial), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-820-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Frac Sand Market Summary

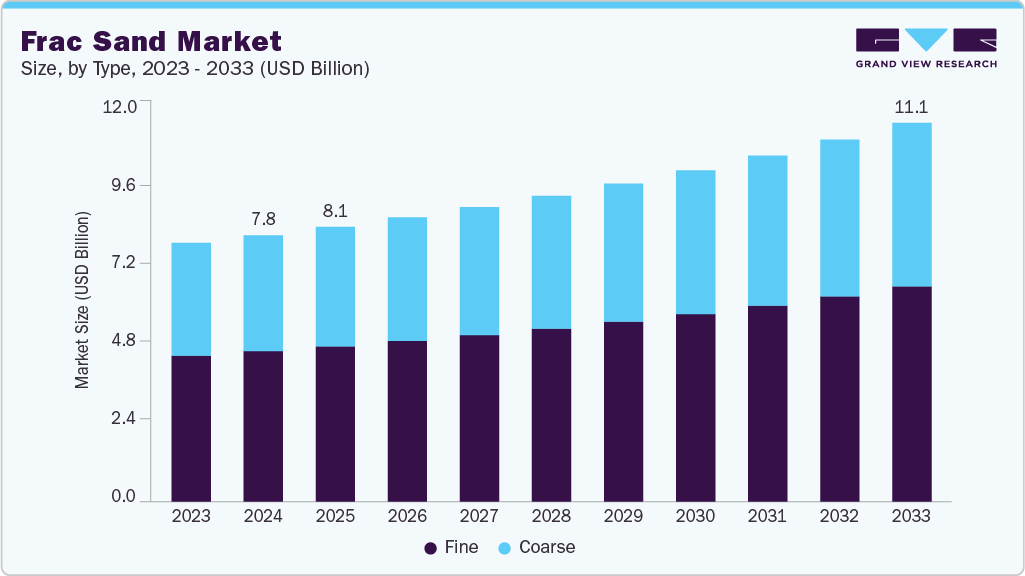

The global frac sand market size was estimated at USD 7.82 billion in 2024 and is projected to reach USD 11.14 billion by 2033, growing at a CAGR of 4.1% from 2025 to 2033. Growth is driven by the increasing demand from unconventional oil & gas exploration activities, particularly in shale formations where longer horizontal laterals and higher-intensity hydraulic fracturing techniques require significantly larger volumes of high-quality proppants.

Key Market Trends & Insights

- North America dominated the frac sand industry with a revenue share of over 55.0% in 2024.

- The frac sand industry in the Middle East & Africa is expected to grow at a CAGR of 4.4% from 2025 to 2033.

- By type, fine sand segment dominated the market with a revenue share of over 56.0% in 2024.

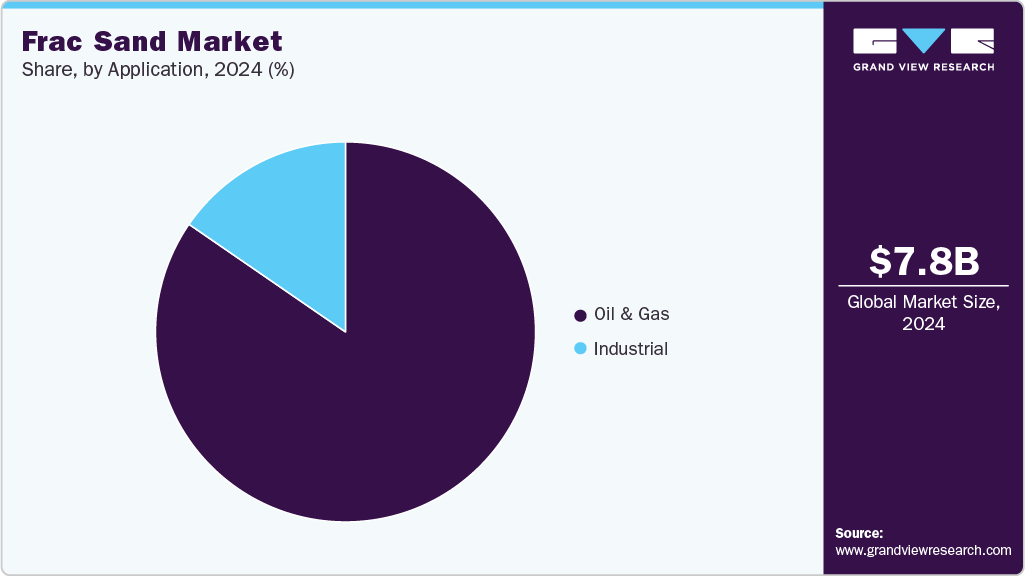

- By application, the oil & gas segment held the largest share, over 84.0%, in the market.

Market Size & Forecast

- 2024 Market Size: USD 7.82 Billion

- 2033 Projected Market Size: USD 11.14 Billion

- CAGR (2025-2033): 4.1%

- North America: Largest market in 2024

- Middle East & Africa: Fastest growing market

In addition, the shift toward multi-stage fracturing, rising drilling efficiencies, and the expansion of in-basin frac sand mines, which reduce transportation costs, are further supporting market expansion across key producing basins.Sustainability has become a central theme shaping the future of the market, with producers increasingly adopting environmentally responsible mining and processing practices. Regulatory pressures, community concerns, heightened scrutiny over land disturbance and dust emissions are driving companies to implement advanced reclamation programs, water recycling systems, and dust-suppression technologies at both mining and transloading sites. In addition, operators are optimizing logistics by shifting toward in-basin sand sourcing, which significantly reduces transportation-related emissions, fuel consumption, and overall environmental footprint. As ESG compliance becomes more integral to the oil and gas value chain, frac sand suppliers are prioritizing transparent reporting, responsible resource management, and the development of sustainable mining frameworks to align with operator expectations.

Technological innovation is transforming frac sand production, handling, and usage, leading to increased efficiency and reduced operational costs. Producers are integrating automated washing, drying, and screening systems to enhance particle consistency and meet stringent proppant specifications. At the wellsite, innovative proppant delivery systems, real-time monitoring, and digital logistics platforms are streamlining proppant supply chains and reducing downtime. Advances in mine automation, drone-based site monitoring, and predictive maintenance are improving productivity and worker safety. Moreover, enhanced characterization technologies such as high-resolution grain analysis and crush-resistance modeling are enabling operators to optimize proppant selection for specific reservoir conditions. Collectively, these technological improvements support higher-intensity fracking operations while enhancing reliability and cost efficiency across the industry.

Drivers, Opportunities & Restraints

One of the primary drivers of the frac sand industry is the increasing intensity of hydraulic fracturing in major shale basins, driven by oil companies’ efforts to improve productivity and lower per-well costs. For instance, in April 2025, Chevron announced plans to “triple-frac” half of its Permian Basin wells, a method that requires ~60% more sand per day compared to conventional operations. This shift reflects a broader trend of operators maximizing lateral lengths and fracture stages, resulting in higher proppant loading per well. In addition, the steady recovery in rig counts and completion activity across North America is reinforcing sustained demand for high-quality frac sand over the forecast period.

A significant opportunity lies in optimizing the frac sand supply chain through localized production and innovative transportation solutions. In January 2025, Atlas Energy Solutions launched the “Dune Express”, a 42-mile conveyor system designed to move up to 13 million tons of sand per year in the Permian Basin, significantly lowering trucking intensity and logistics costs. Such infrastructure improves reliability of supply while reducing emissions and operational disruptions. Furthermore, the expansion of in-basin mines offers producers opportunities to capture premium margins by shortening delivery distances and improving wellsite efficiencies.

Environmental and regulatory constraints continue to limit market expansion, as silica mining generates concerns around dust emissions, land degradation, and water consumption. For example, a 2024 SEC filing from a major silica producer highlighted that several U.S. counties have imposed stricter air-quality and zoning controls, directly impacting new mine approvals and expansions. These restrictions increase compliance costs and slow down the pace of capacity development. Opposition, community, and litigation risks remain significant barriers, particularly in regions where mining operations are located near residential areas.

Type Insights

The fine frac sand segment dominated the market with a revenue share of over 56.0% in 2024, and is expected to grow fastest over the forecast period. However, its application remains secondary due to its more limited suitability for high-pressure wells and its greater sensitivity to reservoir conditions. While fine sand is cost-effective and commonly used in certain formations or as a blend to optimize proppant loads, its performance constraints restrict its usage in deeper or more demanding wells. However, operators are increasingly employing fine sand in low-pressure basins or during slickwater fracs to reduce costs, supporting steady but comparatively minor demand growth within this segment.

The coarse frac sand segment held a significant share in the market in 2024 due to its superior crush resistance, higher permeability, and widespread use in high-intensity hydraulic fracturing operations. Coarse grains are preferred in major shale plays such as the Permian and Eagle Ford, where operators continue to increase lateral lengths and fracture stages, requiring proppants that maintain conductivity under extreme downhole pressures. This segment also benefits from stable demand as exploration & production companies prioritize productivity and long-term recovery rates, making coarse sand the most commercially significant material in frac operations.

Application Insights

The oil & gas segment held the largest share, over 84.0% of the frac sand market, accounting for the vast majority of global frac sand consumption in 2024, driven by the continued expansion of shale gas and tight oil development. Hydraulic fracturing activities require massive volumes of proppants, with modern wells consuming thousands of tons of sand per completion. The shift toward high-intensity fracking, multi-well pads, and increased sand per lateral foot has reinforced the oil & gas sector as the primary demand center. The segment’s dominance is expected to persist, driven by drilling efficiencies, improved completion designs, and sustained upstream investment particularly in North America.

The industrial segment, although significantly smaller, remains a crucial niche application for specific grades of silica sand used in glassmaking, foundries, filtration, and construction materials. Although industrial use does not match the scale or growth velocity of oil & gas applications, it provides a stable baseline of demand due to its integration into manufacturing value chains. Growth in this segment is influenced by developments in construction, automotive, and industrial production, offering steady but modest expansion compared to the high-volume requirements of hydraulic fracturing.

Regional Insights

North America dominated the frac sand market with a revenue share of over 55.0% in 2024, driven by extensive shale development, high completion intensity, and a well-established proppant supply chain. The region continues to lead global demand due to its vast inventory of unconventional wells and the adoption of high-sand-loading completion designs, particularly in the Permian, Eagle Ford, and Haynesville basins. Strong logistics infrastructure, widespread use of in-basin sand, and continuous drilling efficiencies further reinforce North America’s dominant position, ensuring steady and resilient consumption throughout the forecast period.

U.S. Frac Sand Market Trends

The frac sand industry in the U.S. is the epicenter of global frac sand demand, accounting for the majority of consumption due to its unique scale of shale oil and gas operations. The nation’s prolific basins, such as the Permian and Appalachia, rely heavily on high-quality coarse sand to maximize healthy productivity and resource recovery. The rapid adoption of longer laterals, multi-well pad drilling, and high-intensity hydraulic fracturing continues to drive proppant usage per well to new highs. In addition, the U.S. hosts the world’s largest frac sand mining and processing network, which enables a reliable domestic supply and reinforces its leadership in the global market.

Asia Pacific Frac Sand Market Trends

Asia Pacific frac sand industry is an emerging growth region, supported by rising energy demand and the gradual expansion of unconventional exploration activities in China, Australia, and parts of Southeast Asia. China is increasing its investment in shale gas development, thereby boosting demand for both locally available proppants and high-quality silica sand imports. Although the region’s current consumption is lower than that of North America, improvements in drilling technologies, supportive government initiatives, and the push for energy security are expected to accelerate long-term market growth.

Europe Frac Sand Market Trends

Europe frac sand industry represents a smaller but stable market for frac sand, primarily driven by industrial applications and limited hydraulic fracturing activity. Countries such as Germany, Poland, and the UK maintain moderate demand due to their industrial manufacturing bases, which use specialized silica sand for glass, foundry, and filtration purposes. Environmental regulations and social opposition to fracking have constrained large-scale shale development, keeping oil & gas-related sand consumption relatively low. Nonetheless, incremental industrial growth and selective energy projects contribute to steady, albeit slower, market expansion across the region.

Key Frac Sand Company Insights

Some of the key players operating in the market include U.S. Silica Holdings, Hi-Crush Inc., Smart Sand Inc., and others.

-

U.S. Silica Holdings, established in 1900 and headquartered in Katy, Texas, is involved in the mining, processing, and distribution of industrial minerals, including silica sand used in oil and gas, industrial, and specialty applications. The company supplies a range of frac sand grades designed for hydraulic fracturing and proppant-related operations. U.S. Silica works on improving operational efficiency through process enhancements, product consistency initiatives, and the integration of advanced material-handling technologies.

-

Hi-Crush Inc., founded in 2010 and based in Houston, Texas, operates as a producer and supplier of proppant solutions for the oil and gas industry. The company manages mining, processing, and logistics assets that support the delivery of frac sand to major shale basins. Hi-Crush maintains a focus on improving supply chain reliability through efficient transportation systems, last-mile delivery services, and the adoption of site-level handling and storage technologies.

-

Smart Sand Inc., established in 2011 and headquartered in The Woodlands, Texas, engages in the production and supply of silica sand used primarily in hydraulic fracturing operations. The company offers various sand grades sourced from its mining and processing facilities, servicing operators and service companies across multiple drilling regions. Smart Sand focuses on operational continuity through effective resource management, logistics optimization, and the implementation of structured processes for material quality control.

Key Frac Sand Companies:

The following are the leading companies in the frac sand market. These companies collectively hold the largest market share and dictate industry trends.

- Atlas Energy Solutions

- Badger Mining Corporation

- Black Mountain Sand

- Covia Holdings

- Emerge Energy Services

- Hi-Crush Inc.

- Pattison Company

- Sibelco

- Smart Sand Inc.

- U.S. Silica Holdings

Recent Developments

-

U.S. Silica Holdings, in March 2025, reported the completion of upgrades at one of its Texas processing facilities to expand the production capacity of regionally sourced frac sand. The improvement aims to support the rise in offtake from oil and gas operators and strengthen supply reliability during peak drilling activity. The company noted that the updated unit incorporates process-control systems intended to maintain consistent product specifications.

-

Hi-Crush Inc., in February 2025, announced the expansion of its last-mile logistics infrastructure in the Permian Basin through the addition of new storage and handling units. The initiative aims to streamline proppant delivery operations and reduce transportation-related delays at well sites. According to the company, the added infrastructure will utilize automated loading systems to enhance operational continuity.

-

Smart Sand Inc., in January 2025, introduced an enhancement to its rail-based transloading network to increase throughput for frac sand shipments to key shale basins. The upgrade is designed to enhance material movement during peak demand periods and support long-term customer contracts. The company stated that the new configuration enables more efficient coordination between mining, transport, and distribution activities.

Frac Sand Market Report Scope

Report Attribute

Details

Market Definition

The frac sand market size represents the total annual value of frac sand supplied for end-use industries.

Market size value in 2025

USD 8.07 billion

Revenue forecast in 2033

USD 11.14 billion

Growth rate

CAGR of 4.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; China; India; Japan; Australia; Brazil; South Africa; Iran

Key companies profiled

Atlas Energy Solutions; Badger Mining Corporation; Black Mountain Sand; Covia Holdings; Emerge Energy Services; Hi-Crush Inc.; Pattison Company; Sibelco; Smart Sand Inc.; U.S. Silica Holdings

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Frac Sand Market Report Segmentation

This report forecasts global, country, and regional revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global frac sand market report by type, application, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Coarse

-

Fine

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global frac sand market size was estimated at USD 7.82 billion in 2024 and is expected to reach USD 8.07 billion in 2025.

b. The global frac sand market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2033, reaching USD 11.14 billion by 2033.

b. By type, fine sand dominated the market with a revenue share of over 56.0% in 2024.

b. Some of the key vendors in the global frac sand market include Atlas Energy Solutions, Badger Mining Corporation, Black Mountain Sand, Covia Holdings, Emerge Energy Services, Hi-Crush Inc., Pattison Company, Sibelco, Smart Sand Inc., and U.S. Silica Holdings.

b. The global frac sand market is driven by rising shale oil and gas activity, which requires higher volumes of proppants for hydraulic fracturing. Increasing use of longer laterals and multi-stage fracs is boosting sand consumption per well. Steady growth in completion activity across major basins further supports demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.