- Home

- »

- Petrochemicals

- »

-

Fracking Chemicals And Fluids Market Size Report, 2030GVR Report cover

![Fracking Chemicals And Fluids Market Size, Share & Trends Report]()

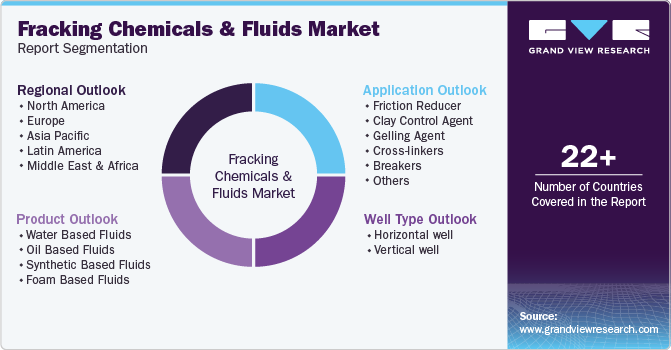

Fracking Chemicals And Fluids Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Water, Oil, Synthetic, Foam), By Well Type (Horizontal Well, Vertical Well), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-441-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fracking Chemicals And Fluids Market Summary

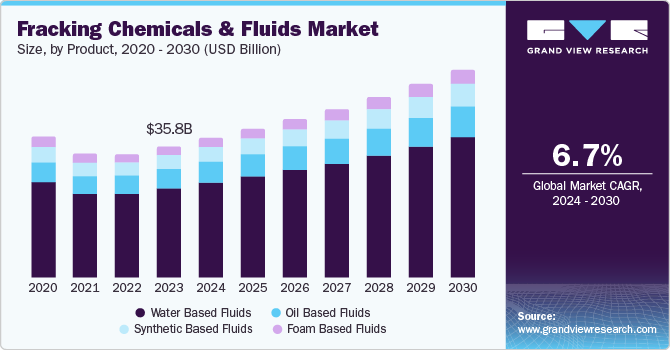

The global fracking chemicals and fluids market size was valued at USD 35.81 billion in 2023 and is projected to reach USD 56.31 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030. The fracking chemicals and fluids market is booming due to escalating global energy demand driven by population growth and industrialization.

Key Market Trends & Insights

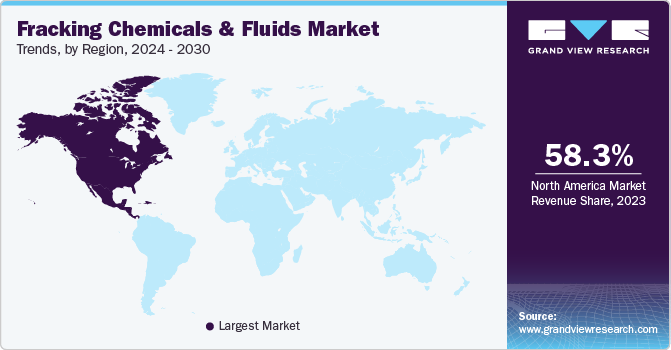

- The North America fracking chemicals and fluids market dominated the market with 58.3% of revenue share in 2023.

- The U.S. fracking chemicals and fluids market held a dominant position with 90.1% market share in 2023.

- By product, water based fluids dominated the market with 68.2% of revenue share in 2023.

- By well type, horizontal well type dominated the market with 83.0% of revenue share in 2023.

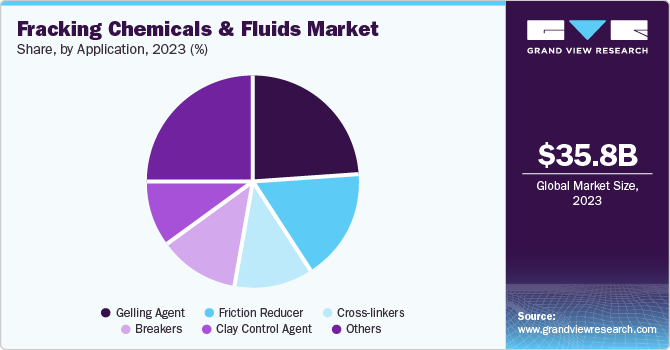

- By application, gelling agent segment accounted for the largest market revenue share of 24.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 35.81 Billion

- 2030 Projected Market Size: USD 56.31 Billion

- CAGR (2024-2030): 6.7%

- North America: Largest market in 2023

Advancements in drilling techniques such as horizontal drilling and hydraulic fracturing have expanded the use of fracking. Economic growth, especially in developing nations, is fueling investments in energy infrastructure.

The increasing global need for energy is driven by population growth, industrialization, and urbanization. As countries strive to meet their energy needs, hydraulic fracking has emerged as a crucial method for extracting oil and natural gas from unconventional sources such as shale formations. This increasing need for energy is a major factor in driving the market for fracking chemicals and fluids. Ongoing advancements in drilling techniques have increased the efficiency and effectiveness of hydraulic fracturing procedures.

The demand for fracking chemicals and fluids is driven largely by the discovery of new oilfields and improvements in offshore drilling methods. There has been a notable shift from vertical to horizontal drilling methods in recent years. Horizontal wells provide better access to oil and gas reserves, allowing for more efficient extraction processes. This trend increases the need for fracking fluids and chemicals that can perform effectively in complex drilling environments, thereby boosting market growth. Supportive government policies have further accelerated fracking operations.

Product Insights

Water based fluids dominated the market with 68.2% of revenue share in 2023due to their cost-effectiveness, environmental compatibility, and ease of handling. The increasing focus on reducing the environmental impact of fracking operations has led to advancements in water-based fluid formulations, making them more efficient and effective.

Oil based fluids are anticipated to witness the significant growth rate of 7.5% over the forecast period. This upward trend is due to their ability to carry proppants efficiently and improve well productivity. The rising demand for oil and gas from these formations, coupled with technological advancements in oil-based fluid formulations to enhance performance and reduce environmental concerns, has contributed to the growth of this segment.

Well Type Insights

Horizontal well type dominated the market with 83.0% of revenue share in 2023. This is due to their significantly higher production rates compared to vertical wells. This well type allows for greater exposure of the reservoir to fracturing fluids, leading to increased hydrocarbon recovery. As a result, the demand for specialized chemicals and fluids designed for horizontal well completions has surged, driving market growth.

Vertical well type is anticipated to witness the significant CAGR of 7.7% over the forecast period due to its established technology and lower initial investment costs compared to horizontal drilling. The continued exploration and development of new vertical well projects, along with the need for enhanced recovery techniques, support the demand for fracking chemicals and fluids in this segment.

Application Insights

Gelling agent accounted for the largest market revenue share of 24.2% in 2023. Gelling agents are crucial for creating viscous fracturing fluids that effectively carry proppants into the rock formation, thereby enhancing oil and gas recovery. The increasing complexity of shale formations and the need to transport larger proppants have driven the demand for higher viscosity fluids, consequently boosting the consumption of gelling agents.

Cross-linkers are projected to grow at the fastest CAGR of 7.7% over the forecast period. Cross-linkers play a vital role in maintaining the viscosity of fracturing fluids under downhole conditions, preventing premature fluid breakdown, and improving proppant placement. The growing emphasis on optimizing well productivity and extending well life has led to increased usage of cross-linkers. Moreover, advancements in cross-linker technology have resulted in the development of more efficient and environmentally friendly products, contributing to market growth.

Regional Insights

The North America fracking chemicals and fluids market dominated the market with 58.3% of revenue share in 2023. It is attributable to abundance of shale formations, advanced drilling technologies, and robust infrastructure in the region. The region has a long history of oil and gas exploration and production, leading to a well-established supply chain and experienced workforce.

U.S. Fracking Chemicals And Fluids Market Trends

The U.S. fracking chemicals and fluids market held a dominant position with 90.1% market share in 2023. The country's strong economic growth, coupled with a focus on energy independence, has spurred increased fracking activities. Furthermore, the presence of major oil and gas companies and a thriving service industry has created a favourable environment for the development and deployment of innovative fracking chemicals and fluids.

Europe Fracking Chemicals And Fluids Market Trends

The Europe fracking chemicals and fluids market was identified as a lucrative region in 2023. Due to geopolitical tensions and oil price fluctuations, countries in the region are making an effort to decrease their dependence on imported fossil fuels by examining their own shale gas reserves. Furthermore, advancements in fracking technologies have improved efficiency and reduced environmental impacts, making it a more attractive option for energy production.

The UK fracking chemicals and fluids market held a substantial market share in 2023. The UK government has recognized the potential of shale gas as a transitional fuel that can help bridge the gap between traditional fossil fuels and renewable energy sources. This recognition has led to increased investment in hydraulic fracturing projects, supported by regulatory frameworks aimed at ensuring safety and environmental protection.

Asia Pacific Fracking Chemicals And Fluids Market Trends

The Asia Pacific fracking chemicals and fluids market is anticipated to grow at a CAGR of 3.6% during the forecast period. During the forecast period, the market is expected to grow due to the rapid industrialization, urbanization, and increasing energy consumption. In addition, the discovery of new shale and tight oil reserves in the region is encouraging exploration and production activities, thereby driving the need for specialized chemicals and fluids.

The China fracking chemicals and fluids market held substantial market share in 2023. The country's initiatives to reduce reliance on imported energy sources have spurred investments in unconventional hydrocarbon exploration and production.

Key Fracking Chemicals And Fluids Company Insights

Some key companies in fracking chemicals and fluids market include Akzo Nobel N.V., Pioneer Engineering Services, Dow, SLB, and others. Fracking chemical manufacturing companies are forming partnerships, collaborations, and joint ventures in order to increase market penetration and cater to the changing technological requirements.

-

SLB is a leading global provider of technology and services for the energy industry. It is recognized for its innovative solutions in hydraulic fracturing (fracking) chemicals and fluids. It specializes in various sectors of the oil and gas industry, offering a comprehensive range of products and services that span the entire lifecycle of hydrocarbon exploration and production.

Key Fracking Chemicals & Fluid Companies:

The following are the leading companies in the fracking chemicals & fluid market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- Pioneer Engineering Services.

- Halliburton Company

- Dow

- SLB

- Baker Hughes Company

- BASF

- DuPont

Fracking Chemicals And Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.99 billion

Revenue forecast in 2030

USD 56.31 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, well type, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, Japan, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia UAE

Key companies profiled

Akzo Nobel N.V.; Pioneer Engineering Services; Halliburton Company; Dow; SLB; Baker Hughes Company; BASF; DuPont

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fracking Chemicals And Fluids Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fracking chemicals and fluids market report based on product, well type, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Water Based Fluids

-

Oil Based Fluids

-

Synthetic Based Fluids

-

Foam Based Fluids

-

-

Well Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Horizontal Well

-

Vertical Well

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Friction Reducer

-

Clay Control Agent

-

Gelling Agent

-

Cross-Linkers

-

Breakers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.