- Home

- »

- Medical Devices

- »

-

Fractional Flow Reserve Market Size & Share Report, 2030GVR Report cover

![Fractional Flow Reserve Market Size, Share & Trends Report]()

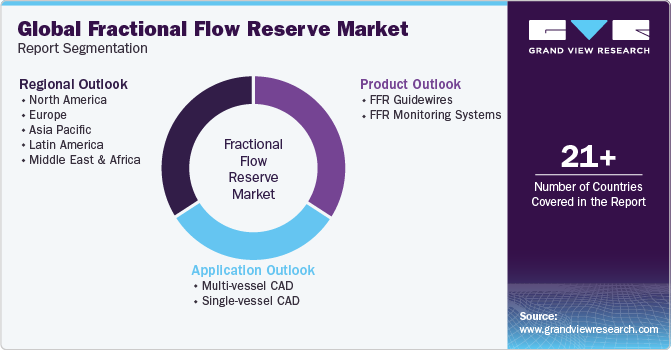

Fractional Flow Reserve Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (FFR Guidewires, FFR Monitoring Systems), By Application (Multi-vessel CAD, Single-vessel CAD), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-825-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

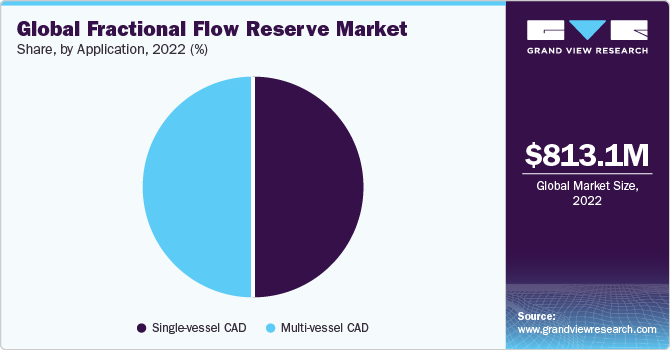

The global fractional flow reserve market size was valued at USD 813.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. There has been an upswing in the cases of cardiovascular diseases (CVD), such as coronary artery diseases and high blood pressure, which has been a key factor in the market growth. According to the American Heart Association 2022 fact sheet update, globally, CVD was estimated to be responsible for 19.1 million deaths in 2020. Central Asia and Eastern Europe had the greatest mortality rates in 2020, attributed to cardiovascular disease; similar rates were observed in North Africa, Oceania, Central Europe, the Middle East, sub-Saharan Africa, and South and Southeast Asia. Regions with high income, including Australasia, Western Europe, North America, and Latin America, had the lowest rates. As the mortality rates due to CVD remain high in these regions, there is a need for improved diagnosis and treatment strategies.

Fractional Flow Reserve (FFR) devices are primarily used to assess and evaluate coronary artery disease (CAD). CAD occurs when the blood vessels that supply oxygen and nutrients to the heart muscle become narrowed or blocked due to plaque buildup. FFR devices offer a minimally invasive alternative to traditional angiography for assessing coronary artery disease. Patients and physicians increasingly prefer less invasive procedures with shorter recovery times, so the demand for FFR devices has increased.

HeartFlow's non-invasive cardiac computed tomography-derived FFR technology enables the calculation of virtual FFR values for the entire coronary tree of a patient using only a computed tomography scan. This valuable information assists doctors in making informed decisions regarding whether a patient with chest pain should be sent to the Cath lab for revascularization or if treatment is more appropriate. This approach can contribute to cost reduction and expedite patient discharge by redirecting patients away from unnecessary invasive diagnostic angiograms. This technology was integrated into the American College of Cardiology Chest Pain Guidelines of 2021. Thus, such guidelines supported the growth during the COVID-19 pandemic. As a result, it positively impacted market growth.

According to an article published by The Society for Cardiovascular Angiography and Interventions (SCAI) in May 2019, FFR provides valuable insights post-angiography and can impact the treatment plans and outcomes in patients with acute coronary syndrome (ACS) stable coronary artery disease (CAD), which reinforces the importance of better patient management, which is anticipated to increase adoption of the same during the forecast period.

The rising geriatric population is poised to keep the demand for fractional flow reserves high. Old-aged individuals are more prone to cardiovascular diseases and chronic diseases like diabetes. Type II diabetes can further lead to the development of fatty cells in the coronary artery, which can cause blockage, thereby causing a stroke or heart attack. The global geriatric population is expected to grow exponentially in the next few years, owing to the late baby boomers in countries such as Japan, China, and Brazil. The population of individuals aged 65 years and above was estimated to be 703 million in 2019 by the United Nations, projected to double to 1.5 billion in 2050.

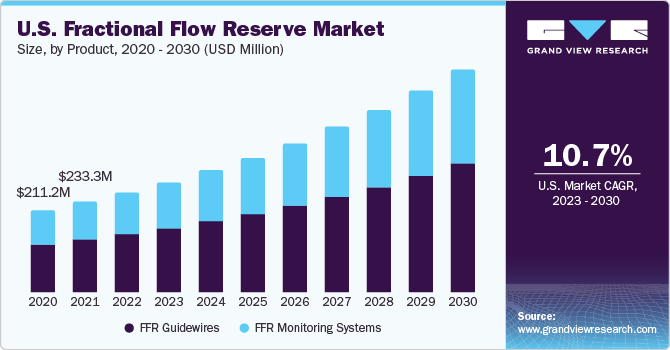

The growing incidence of coronary artery diseases and diabetes in the U.S. favors the market for fractional flow reserve devices. Diabetes cases are on the rise due to the unhealthy eating habits of the populace in the country, which is further leading to obesity and associated diseases. For instance, as per the World Obesity Federation 2022 estimates, by 2030, 1 billion people will be obese worldwide, including 1 in 5 women and 1 in 7 males. In addition, the rising adoption of fractional flow systems in conjugation with OCT, for patients suffering from cardiovascular diseases, especially in the U.S., is likely to broaden the consumer base in the near future.

Application Insights

The single-vessel CAD segment dominated the market and held the largest revenue share of around 50% in 2022. This is attributed to the extensive use of the device in CAD cases, combined with the increasing number of elderly populations. Fractional Flow Reserve (FFR) devices play a crucial role in assessing the severity of blockages in single-vessel CAD. By measuring the pressure differences across the lesion, FFR provides an accurate assessment of the functional significance of the blockage. This information guides treatment decisions, such as performing angioplasty, stenting, or other revascularization procedures to restore normal blood flow. The diagnostic accuracy and treatment guidance offered by FFR devices make them particularly valuable in managing single-vessel CAD cases.

The multi-vessel coronary artery disease CAD segment is expected to grow at the fastest CAGR of 9.5% over the forecast period, as this disease is a matured phase of single-vessel CAD. A person with single-vessel CAD is likely to have multi-vessel CAD soon if proper treatment and medications are not taken.

Regional Insights

North America dominated the fractional flow reserve market and held the largest market share of around 40% in 2022. This is attributed to favorable government policies aimed at promoting the adoption of medical devices and the presence of a well-established healthcare infrastructure. The market in North America is expected to remain highly competitive in the coming years due to the increasing number of mergers and acquisitions by key industry players. For instance, in July 2021, HeartFlow announced its merger with Longview Acquisition Corp. II to transform into a publicly traded company. Once the merger is completed, the entity will operate under HeartFlow Group Inc. and is expected to be listed on the New York Stock Exchange using the symbol HFLO.

Asia Pacific is expected to grow at the fastest CAGR of 9.8% over the forecast period due to increased diabetes and cardiovascular disease cases and rising disposable income. Additionally, the introduction of favorable laws for medical device adoption is also estimated to support the regional market's growth. For instance, in December 2022, Lepu Medical Technology (Beijing) Co. Ltd., a medical technology company based in Beijing, China, received approval from China's National Medical Products Administration (NMPA) for its disposable micro-guidewire. The micro-guidewire has been specifically approved for use in FFR measurements during coronary angiography and interventional procedures in adult patients with coronary artery lesions. This regulatory clearance allows the company to market and distribute the disposable micro-guidewire for FFR measurements, enhancing its portfolio of products for cardiovascular diagnostics and interventions.

Product Insights

The FFR guidewires segment dominated the market with the largest revenue share of over 55% in 2022. This is attributed to their extensive usage in diagnostic cardiovascular procedures and coronary arteries. The increasing prevalence of these diseases is likely to drive segment growth. For instance, in 2019, according to the Centers for Disease Control and Prevention (CDC), about 360,900 individuals died owing to coronary artery disease in the U.S. Additionally, aged people are more prone to cardiac disorders. Therefore, the widening base of geriatrics is benefiting the segment's growth.

The FFR monitoring systems segment is expected to grow at the fastest CAGR of 9.5% over the forecast period. FFR monitoring systems incorporate advanced technologies such as wireless connectivity, cloud-based data management, and real-time monitoring capabilities. These systems continuously monitor FFR values during various activities, such as exercise or daily life, offering valuable insights into the dynamic changes in coronary blood flow. Integrating advanced technologies and enhanced monitoring capabilities make FFR monitoring systems attractive to healthcare professionals, driving their adoption and contributing to market growth.

Key Companies & Market Share Insights

Companies operating in the industry focus on launching novel products and expanding their business outreach by adopting merger and acquisition, collaboration, and new product launch strategies. For instance, in April 2023, Shanghai Pulse Medical Technology, Inc. launched an advanced calculation software approved by the National Medical Products Administration for CT Fractional Flow Reserve (CT-FFR). This innovative software aids clinicians in determining the likelihood of coronary artery stenosis leading to myocardial ischemia. By utilizing coronary CT angiography images, the software calculates CT-FFR, providing valuable insights to help clinicians make informed decisions regarding additional examinations and treatment for patients. This medical device offers a non-invasive approach to obtaining CT-FFR and enhances the diagnostic capabilities for assessing coronary artery conditions.

In July 2022, Medtronic established a strategic partnership with CathWorks, an Israeli-based company. Under the partnership, Medtronic agreed to invest USD 75 million and initiated joint promotion of CathWorks' FFRangio System in the U.S., Japan, and Europe, where the system is already commercially available. The FFRangio System offers an innovative approach to assess CAD, and this collaboration aims to advance its adoption and utilization in key markets worldwide.

Key Fractional Flow Reserve Companies:

- OpSens Medical

- Abbott

- Boston Scientific Corporation

- ACIST Medical Systems

- Koninklijke Philips N.V.

- Opsens, Inc.

- HeartFlow, Inc.

- Siemens Healthineers

- Pie Medical Imaging

- CathWorks

- Medis Medical Imaging Systems BV

Fractional Flow Reserve Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 897.4 million

Revenue forecast in 2030

USD 1,668.8 million

Growth rate

CAGR of 9.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa ;UAE; Kuwait

Key companies profiled

OpSens Medical; Abbott; Boston Scientific Corporation; ACIST Medical Systems; Koninklijke Philips N.V.; Opsens, Inc.; HeartFlow, Inc.; Siemens Healthineers; Pie Medical Imaging; CathWorks; Medis Medical Imaging Systems BV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fractional Flow Reserve Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fractional flow reserve market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

FFR Guidewires

-

FFR Monitoring Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Multi-vessel CAD

-

Single-vessel CAD

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global fractional flow reserve market size was estimated at USD 813.1 million in 2022 and is expected to reach USD 897.4 million in 2023.

b. The global fractional flow reserve market is expected to grow at a compound annual growth rate of 9.3% from 2023 to 2030 to reach USD 1,668.8 million by 2030.

b. North America dominated the fractional flow reserve market with a share of over 41% in 2022. This is attributable to favorable government policies for medical device penetration and the presence of well-developed healthcare infrastructure.

b. Some key players operating in the fractional flow reserve market include OPSENS Medical, Abbott Laboratories, Koninklijke Philips N.V., Acist Medical Systems Inc., and Boston Scientific.

b. Key factors that are driving the fractional flow reserve market growth include increasing cases of cardiovascular diseases such as coronary artery diseases and high blood pressure, a rising geriatric population and prevalence of diabetes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.