- Home

- »

- Digital Media

- »

-

France Digital Marketing Software Market Report, 2030GVR Report cover

![France Digital Marketing Software Market Size, Share & Trends Report]()

France Digital Marketing Software Market Size, Share & Trends Analysis Report By Solution (CRM Software, Social Media Advertising), By Service, By Deployment, By Enterprise Size, By End Use, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-935-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

Report Overview

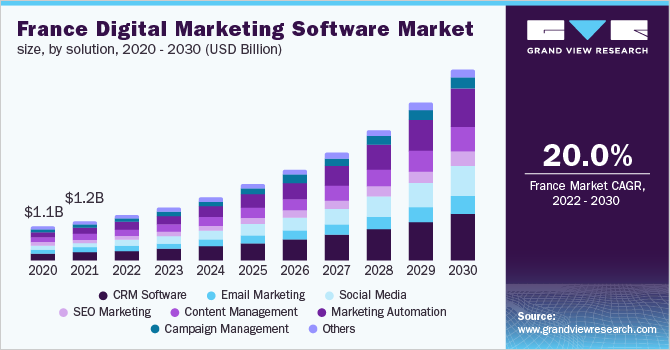

The France digital marketing software market size was valued at USD 1.25 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.0% from 2022 to 2030. The market growth is driven by the rising demand for mobile devices, smartphones, and other latest devices, due to a mix of influences from the development of new technologies, new smartphones, and more competition with social apps. Advertisers rapidly turn to mobile advertising as smartphone usage rises and high-speed mobile networks spread. Digital marketing has been established as the most efficient form of mass communication. Digital marketing has evolved as a thriving sector in France.

As marketers rely on data to make business choices, businesses are experimenting with new technologies to boost transparency and trust. In many end-use sectors and industry verticals, the market has developed through time in response to incumbents' technological improvements and changing needs, according to research conducted by Adobe, Inc., improvement of digital customer experience is the top priority for around 28% of firms in France.

Several businesses are forming strategic partnerships with end-users to help them better their digital marketing efforts. Furthermore, enterprises in France are investing in first-party data; thus, using digital marketing tools to improve client attention and facilitate better first-party data will be beneficial.

The COVID-19 pandemic, which caused a fundamental shift in how people use various apps, has had a favorable impact on the French market for Digital Marketing Software. The market's expansion is attributable to the fast-paced and rapidly changing technological environment of COVID-19 and businesses' dynamic efforts to keep their systems up-to-date on the latest technology to stay ahead of market competitors.

As a result, application developers have been reviewing their advertising settings and bolstering their capacities to encourage greater accountability and transparency with customers throughout the pandemic and in the aftermath of the economic crisis.

Security issues and data concerns hamper the digital marketing software market. With the market vendors expanding geographically, customer reach is expected to increase, and a large amount of data will get registered; thus, security and data concerns are anticipated to pose a challenge.

Key market giants such as Oracle Corporation, Salesforce, Inc., International Business Machines Corporation, and others, on the other hand, are following an organic strategy of acquiring marketing technology startups to produce marketing solutions that would improve their clients' data protection. Despite market vendors' best efforts, this issue continues to be a challenge for the business.

Solution Insights

The CRM software segment accounted for the largest revenue share of over 20% in 2021. In France, CRM software is used by more than half of enterprises in the information and communication sector to handle and analyze customer data. CRM adoption is three times higher in larger businesses than in SMEs.

In the coming years, the CRM market in the country is predicted to grow at an unprecedented rate. According to Statista, 76% of mid-size businesses in France used CRM tools to execute their marketing plan, with 35% declaring that they have fully integrated it.

Social media is expected to grow significantly during the forecast period. Furthermore, social media and digital marketing demand have increased as Artificial Intelligence (AI) and data-driven marketing expand. Many e-commerce companies have used augmented reality in the retail segment, allowing customers to try the items before purchasing them.

Moreover, customers adopted virtual reality transitioning from a specialized interest to general acceptance as the virus spread through virtual meetings, virtual exercise, and other activities. All such advanced technologies take a toll on the market, positively impacting the digital marketing software market.

Service Insights

The professional services segment accounted for the largest market share of over 65%% in 2021. Many businesses now hire professionals to help them with their digital offerings. Many innovations and strategy firms, on the other hand, have continued to expand.

Professional services assist companies in making better use of their resources, reducing administrative expenses, and increasing revenues. As the demand for skilled and competent professionals with expertise in managing, installing, and troubleshooting software develops, professional services are expected to increase.

The managed services segment is anticipated to register significant growth over the forecast period. The expanding need for cloud-based managed services and companies' increased reliance on IT assets to improve company productivity are driving the managed services industry forward.

Organizations of all sizes and verticals rely on managed service providers to help them use technology to transform and scale their operations in France to maintain a competitive edge. Managed service providers are partnering with other firms to enhance their range of offerings by providing the proper knowledge, solutions, and pricing structures to fulfill cus1tomers demands.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 70% in 2021, as it helps enterprises to lower costs and establish a command center to track, organize, and coordinate many aspects of their digital marketing campaign. The versatility of cloud-based deployment of Digital Marketing Software is increased, allowing businesses to tailor products and services on a broad scale.

Cloud deployment's ease of use allows even the most experienced users to administer the server themselves, focusing solely on application development and operation. The emergence of cloud-based digital marketing software is part of a trend toward concentrating and accumulating computer services and data to increase a company's efficiency through cost savings and automation.

The on-premise deployment segment is expected to register considerable growth over the forecast period. Many businesses still choose the on-premise deployment strategy because of the security benefits. Vendors in the market are now concentrating on integrating an on-premise data center with the cloud.

End-users in highly regulated industries like healthcare and financial services are more likely to choose an on-premise deployment approach, fueling the growth of the on-premise market. Furthermore, cloud-specific technologies are housed on-premises in a data center with multiple commodity machines running the same system software in a private cloud.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 54% in 2021. Large companies use digital marketing to lower costs and increase flexibility for their marketing efforts. As these organizations have established brand awareness and want to persuade potential customers to convert, large firms want to employ digital marketing to stand out from the competition.

Digital marketing software creates opportunities to incorporate multiple media types into their marketing and increase access to customer purchase journeys through social media and email marketing.

The Small and Medium Enterprises (SMEs) segment is anticipated to register significant growth over the forecast period. SMEs use the digital marketing solution to extend their customer base at a minimal cost, enhance conversion rates, and increase ROI from digital advertising.

The growth is expected to be fueled by the government's increasing engagement in providing finance to small and medium businesses to help them embrace digitization. Since they attempt to break into competitive marketplaces, SMEs employ digital marketing to increase brand awareness.

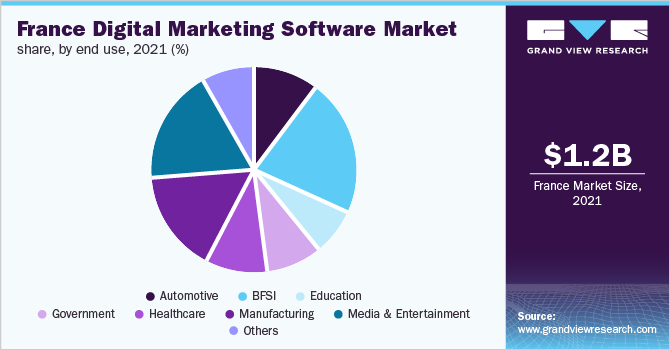

End-use Insights

The BFSI segment accounted for the largest market share of over 20% in 2021. In recent years, online and mobile banking has grown in popularity in France. The number of people using online banking services has risen in tandem with the advancement of new technology. Digital banks are financial technology companies that provide many services as traditional banks, but over the internet and via a digital device.

Neo-banks are imposing their model on France as part of this new financial system, gaining increasing attention. Banks and credit unions are adopting digital marketing software to explore new markets, improve awareness, and reinforce corporate culture messaging, which has increased demand for these solutions; thus, the sector has various growth opportunities over the forecast period.

Media and entertainment companies are focusing on developing online advertising tactics to capitalize on the widespread use of smartphones and the ongoing deployment of high-speed data networks. Compared to traditional marketing methods, the sector uses digital marketing software to increase interaction, which has increased audience connection and decreased numerous administrative expenditures.

Media and entertainment will continue to adapt swiftly to industry-wide changes and pandemic-driven demographic shifts. Digital marketing software has aided businesses in improving content, video marketing, and other critical details, resulting in improved profitability for enterprises; as a result, the need for digital marketing has grown in the country.

Key Companies & Market Share Insights

Several market players are active in the market, including both established players with worldwide operations and regional and local market players catering to a limited number of clients. Hence, the France Digital Marketing Software market can be described as a highly fragmented market characterized by intense competitive rivalry.

In response to the intensifying competition, some market players are upgrading their existing products and launching new products. For instance, in January 2021, SAP SE invested around USD 68.4 million to accelerate the country's multi-cloud strategy and empower customers toward digital transformation.

Market incumbents are tweaking their business strategies in line with the proliferation of smartphones and the growing preference for personalized advertising. They are also pursuing various initiatives, such as strategic partnerships and acquisitions, to remain competitive in the market.

For instance, in February 2021, HubSpot, Inc. announced its agreement to acquire The Hustle, a media company that provides newsletters, podcasts, and premium research content. With this acquisition, HubSpot aims to provide its network of scaling businesses with more valuable content across a broader range of topics and media. Some prominent players in the France digital marketing software market include:

-

Adobe, Inc.

-

Hewlett Packard Enterprise Company

-

Hubspot, Inc.

-

International Business Machines Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

Salesforce.com, Inc.

-

SAS Institute, Inc.

-

SAP SE

-

Sendinblue

France Digital Marketing Software Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.46 billion

Revenue forecast in 2030

USD 6.27 billion

Growth rate

CAGR of 20.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end use

Country scope

France

Key companies profiled

Adobe, Inc.; Hewlett Packard Enterprise Company; Hubspot, Inc.; International Business Machines Corporation; Marketo, Inc.; Microsoft Corporation; Oracle Corporation; Salesforce.com, Inc.; SAP SE; SAS Institute, Inc.; Sendinblue

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the France digital marketing software market report based on solution, service, deployment, enterprise size, and end-use:

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

CRM Software

-

Email Marketing

-

Social Media

-

SEO Marketing

-

Content Management

-

Marketing Automation

-

Campaign Management

-

Others

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

BFSI

-

Education

-

Government

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The France digital marketing software market size was valued at USD 1.25 billion in 2021 and is expected to reach USD 1.46 billion in 2022.

b. The France digital marketing software market is expected to grow at a compound annual growth rate of 20.0% from 2022 to 2030 to reach USD 6.27 billion by 2030.

b. The BFSI segment dominated the market with a share of over 20% in 2021. The large share of this segment is primarily attributed to the growth in the number of people using online banking services has risen in tandem with the advancement of new technology. Banks and credit unions are adopting digital marketing software to improve awareness, explore new markets, and reinforce corporate culture messaging, which has increased demand for these solutions, thereby providing numerous growth opportunities to the market over the forecast period.

b. Some key players operating in the France digital marketing software market include Adobe, Inc., Hewlett Packard Enterprise Company, Hubspot, Inc., International Business Machines Corporation, Marketo, Inc., Microsoft Corporation, Oracle Corporation, Salesforce.com, Inc., SAS Institute, Inc. and Sendinblue

b. Key factors that are driving the market growth include growing demand for mobile devices, smartphones, and other latest devices, due to a mix of influences from the development of new technologies, new smartphones, and more competition with social apps.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."