- Home

- »

- Medical Devices

- »

-

France Health Insurance Market Size & Share Report, 2030GVR Report cover

![France Health Insurance Market Size, Share & Trends Report]()

France Health Insurance Market Size, Share & Trends Analysis Report By Type Of Insurance Provider (Public, Private), By Age Group (0-14 Years, 15-24 Years, 25-54 Years), By Area (Urban, Rural), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

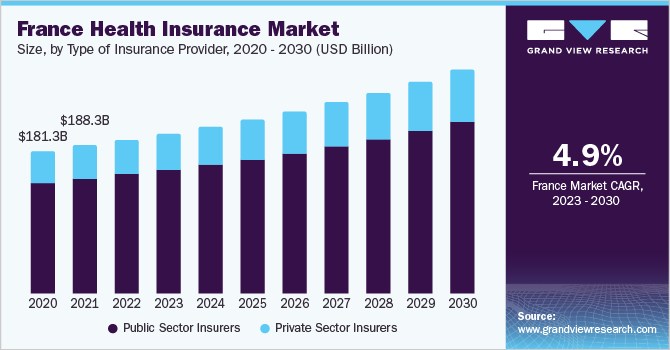

The France health insurance market size was valued at USD 195.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.91% from 2023 to 2030. The rising aging population, government regulations, technological advancements such as digital health adoption, and rising healthcare costs are the major factors driving the growth. The French government has established stringent healthcare regulations that require citizens to have health insurance. This policy has certainly made health insurance a mandatory requirement for all individuals living in France. There are two types of health insurance available in France: private and public. Public health insurance is compulsory and market-based private health insurance is voluntary. In France, the state usually pays up to 70% of the cost of healthcare (depending on the case). On the other hand, companies that offer mutuelle policies provide coverage for a full or a portion of medical expenses that are not covered by the public healthcare system. The insurance and chosen options determine the level of coverage.

Private health insurance is gaining traction in France owing to rising critical illnesses such as cancer and heart disorders. For people with chronic conditions, private health insurance is an excellent alternative because the state does not pay for services like visits to a chiropractor, an osteopath, or a psychologist. The state only pays for a percentage of prescription drugs that are considered "essential," hence it is advantageous for specific prescription drug types. In these instances, private insurance is recommended because some prescription medications can cost more than USD 112 (100 EUR).

Furthermore, in recent years, the adoption of complementary or top-up insurance has increased in the country. According to the health care and insurance survey data available, 95% of the population is insured by a complementary health insurance contract that largely reimburses statutory user charges. Nine out of ten individuals insured have a private contract while the remaining insured individuals receive publically supported complementary coverage, known as Couverture maladie universelle complémentaire (CMUC), due to their low income.

On the other hand, the rising development of digital health is expected to boost the market growth in the country. Real-time experience data is being made available by digital health solutions across the country directly at the point of care. This is expected to have a significant impact on the overall health insurance industry. Industry models that are focused on transparency, flexibility, and customer-centricity are expected to be key drivers of sustainable growth.

Type Of Insurance Provider Insights

The public sector insurers segment dominated the overall market with the largest revenue share of 77.66% in 2022. France runs a statutory health insurance system offering universal coverage for its citizens. Employee and employer contributions, as well as a rising amount of specified taxes on a variety of incomes, are used to fund the system. The cost of necessary medical care, including doctor visits and hospital stays, is covered 70-100% by French national health insurance. Those with chronic illnesses and low incomes often obtain complete coverage.

On the other hand, the private sector insurers segment is expected to progress at a lucrative rate over the forecast period. Several French citizens top up their insurance coverage with a private health insurance policy known as a mutuelle. Individuals’ normal medical expenses, including hospital stays and emergency department visits, are reimbursed in full by private insurance companies. Moreover, private insurance can provide full or partial reimbursements for prescription drugs.

Age Group Insights

The 65 years and over age group segment dominated the market with a revenue share in 2022. This age group tends to have more health concerns and is more likely to require medical care, which leads to a higher demand for higher health insurance plans. Moreover, this age group also is more interested in securing their financial future and protecting their health, making them more likely to invest in health insurance policies.

The 55-64 years age group segment is expected to grow at a significant rate over the forecast period. This is attributed to this age group being more susceptible to illness and medical conditions. Health insurance helps to cover the cost of healthcare services, including doctor’s visits, hospital stays, prescription medicines, and diagnostic tests.

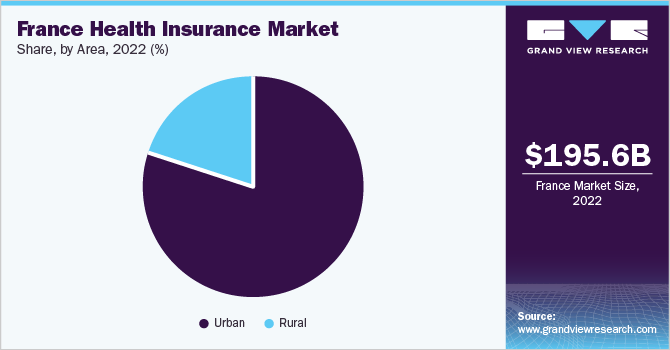

Area Insights

The urban population area dominated the overall France health insurance market in 2022. This is because they typically have higher incomes, better access to healthcare facilities, and are more likely to be employed in jobs that offer health insurance. Moreover, urban areas tend to have a larger population of individuals with chronic health conditions, which increases the demand for health insurance. Additionally, urban areas often offer a wider variety of health insurance options, making it easier for residents to find a plan that meets their needs.

The rural population is expected to account for a significant market share in the coming years. Increasing awareness about healthcare insurance, government initiatives, rising healthcare costs, and increasing availability of private health insurance are expected to drive significant growth in the coming years. With the rise of digital media and internet penetration, rural areas are becoming more aware of the benefits of health insurance.

Key Companies & Market Share Insights

The France health insurance industry is highly concentrated, with the top ten entities holding a major share of premiums. AXA, CNP Assurances, and Crédit Agricole Assurances are leading companies in the market. To maintain their leading position, companies undertake various strategic initiatives such as collaborations, partnerships, and new service launches to strengthen their regional presence. For instance, in January 2022, Allianz France and CNP Assurances declared that they had successfully transferred savings contracts from Allianz France to CNP Assurances. Over 20,000 life insurance and capitalization plans totaling 2.1 billion euros were included in the transfer. Some of the prominent players in the France health insurance market include:

-

AXA

-

Allianz

-

Crédit Agricole Assurances

-

CNP Assurances

-

BNP Paribas Cardif

-

Generali

-

Natixis Assurances

-

Assurances du Credit Mutuel

-

SGAM AG2R La Mondiale

-

Crédit Agricole Assurances

France Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 203.2 billion

Revenue forecast in 2030

USD 284.2 billion

Growth rate

CAGR of 4.91% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Area, type of insurance provider, age group

Country scope

France

Key companies profiled

AXA; Allianz; Crédit Agricole Assurances; CNP Assurances; BNP Paribas Cardif; Generali; Natixis Assurances; Assurances du Credit Mutuel; SGAM AG2R La Mondiale; Crédit Agricole Assurances

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

France Health Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the France health insurance market report based on area, type of insurance provider, and age group:

-

Type of Insurance Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public Sector Insurers

-

Private Sector Insurers

-

Bancassurance Network

-

Employees

-

Brokers

-

General Agent

-

Other Modes

-

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

0-14 years

-

15-24 years

-

25-54 years

-

55-64 years

-

65 years and over

-

-

Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Urban

-

Rural

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."