- Home

- »

- Consumer F&B

- »

-

Fresh Fish Market Size And Share, Industry Report, 2030GVR Report cover

![Fresh Fish Market Size, Share & Trends Report]()

Fresh Fish Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Pelagic Fish, Demersal Fish), By Form (Fresh, Frozen), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-928-5

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Fresh Fish Market Summary

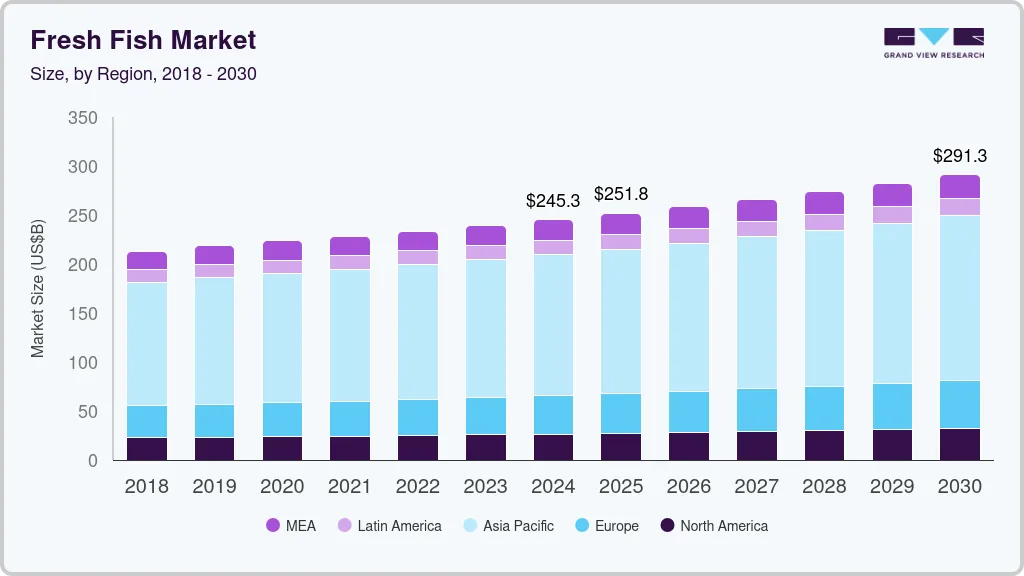

The global fresh fish market size was estimated at USD 245.3 billion in 2024 and is projected to reach USD 291.3 billion by 2030, growing at a CAGR of 3.0% from 2025 to 2030. The market growth can be attributed to evolving consumer preferences, increasing awareness of health benefits, and the rise of sustainable fishing practices.

Key Market Trends & Insights

- The fresh fish market in the Asia Pacific captured a revenue share of over 58.6% of the market in 2024.

- The fresh fish market in China is expected to witness a CAGR of 2.4% from 2025 to 2030.

- By product, the pelagic fish segment accounted for a share of 61.8% of the global revenue in 2024.

- By form, fresh fish accounted for a share of 56.2% of the global revenue in 2024.

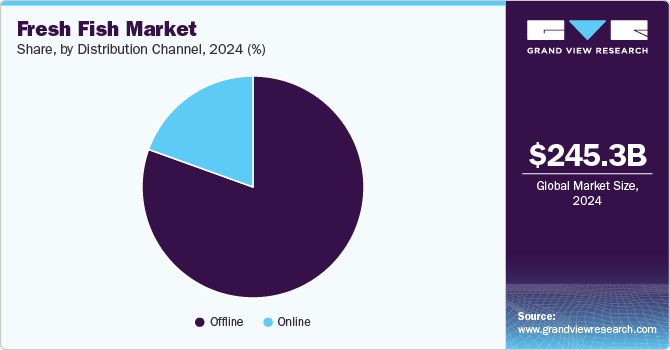

- By distribution channel, the sales of fresh fish through offline channels accounted for a share of 80.5% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 245.3 Billion

- 2030 Projected Market Size: USD 291.3 Billion

- CAGR (2025 - 2030): 3.0%

- Asia Pacific: Largest market in 2024

As individuals become more health-conscious, there is a growing demand for fresh fish as a source of lean protein and omega-3 fatty acids. Nutritional trends emphasizing the importance of seafood in a balanced diet have spurred consumption, particularly in regions where traditional diets heavily feature fish. Additionally, the burgeoning popularity of the Mediterranean diet, which promotes fish and seafood intake, which has transformed consumer behaviors and expanded market potential across various demographics.As concerns about overfishing and the environmental impact of fishing practices rise, consumers are increasingly opting for sustainably sourced fish. Certifications such as the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC) have gained prominence, leading consumers to prefer products that meet sustainable criteria. Retailers and foodservice providers are responding to this demand by emphasizing the traceability and origin of their seafood offerings, often showcasing partnerships with responsible fisheries and aquaculture farms to attract eco-conscious consumers.

The impact of the COVID-19 pandemic has reshaped the landscape of the fresh fish industry, emphasizing the importance of e-commerce and direct-to-consumer sales channels. As consumers turned to online shopping during lockdowns, many fresh fish vendors adapted by enhancing their digital presence and offering home delivery services. This shift not only broadened market access for consumers but also fostered new buying habits that are likely to persist post-pandemic. The fusion of convenience, health consciousness, and sustainability continues to drive demand in the global fresh fish industry, highlighting a dynamic environment poised for further growth and innovation.

Technological advancements in fishing and aquaculture are also significantly influencing the fresh fish market. Innovations ranging from better catch methods and fish farming techniques to improved supply chain logistics have enhanced the quality and freshness of the products available to consumers. Moreover, advancements in storage and transportation technologies have extended the shelf life of fresh fish, allowing for broader distribution and availability across geographical markets. These developments are crucial in meeting the increasing demand for fresh fish in landlocked regions where access was previously limited.

The cultural factors and culinary trends are also driving the global fresh fish market. As global cuisines blend and evolve, diverse cooking methods and recipes incorporating fresh seafood have gained popularity. Ethnic cuisines that highlight fish dishes, such as sushi, ceviche, and grilled fish, continue to inspire consumers seeking new culinary experiences. Furthermore, the growing trend of home cooking, highlighted during the pandemic, has encouraged individuals to experiment with fresh fish, thereby creating greater demand for quality seafood. As consumers seek to elevate their dining experiences at home, fresh fish markets are positioned to capitalize on this opportunity, promoting variety and freshness as essential components of modern gastronomy.

Product Insights

The pelagic fish segment accounted for a share of 61.8% of the global revenue in 2024, spurred by the increasing consumer awareness of the nutritional benefits associated with fish consumption, particularly omega-3 fatty acids found in species such as mackerel, sardines, and herring. The rising health and wellness trend among consumers has fueled demand for pelagic fish, as they are perceived to be healthier alternatives to red meat and processed foods. Additionally, the growing popularity of seafood products among millennials, who favor sustainable and organic food options, has further boosted the market. This demographic is also more inclined towards products such as canned and frozen pelagic fish, enhancing convenience and lagging time from catch to consumption.

The demersal fish segment is expected to grow at a CAGR of 3.3% from 2025 to 2030. This segment includes species including cod, haddock, and sole, which is experiencing notable growth driven by its appeal among health-conscious consumers who prioritize lean protein sources. Increasing awareness of the environmental implications of overfishing has led to heightened interest in sustainably sourced demersal fish. Consumers are increasingly seeking products that carry sustainable certification, as regulatory bodies and conservation groups advocate for responsible fishing practices to ensure the future viability of these fish stocks. The growing trend of cooking at home, amplified by the COVID-19 pandemic, has led to a surge in demand for fresh and frozen demersal fish, as consumers turn to healthier cooking alternatives.

Form Insights

Fresh fish accounted for a share of 56.2% of the global revenue in 2024. As more consumers embrace nutrition-rich foods, fresh fish has gained popularity due to its high protein content, omega-3 fatty acids, and perceived health benefits. Moreover, the increasing awareness concerning sustainability and responsible sourcing has encouraged consumers to seek out fresh fish that is caught or farmed in environmentally friendly ways. Besides, technological advancements in supply chain logistics have played a crucial role in boosting the fresh fish industry. Improved refrigeration and transportation capabilities ensure that fresh fish can be delivered quickly and efficiently from coastal regions to markets worldwide, preserving quality and taste.

Frozen fish is expected to grow at a CAGR of 3.2% from 2025 to 2030. One of the primary demand drivers is the increasing need for longer shelf-life products that reduce food waste in households and commercial settings. The advancements in freezing technology, such as flash freezing, help preserve the texture and nutritional value of fish, making frozen options appealing to both retailers and consumers. Accessibility is another vital factor, as frozen fish broadens the variety of seafood available to consumers far from coastal areas where fresh fish is typically sourced, thus expanding market reach. Additionally, the rise in frozen ready-to-eat meals and meal kits incorporating seafood options has stimulated demand in this market.

Distribution Channel Insights

The sales of fresh fish through offline channels accounted for a share of 80.5% of the global revenue in 2024. The offline channel is primarily characterized by traditional retail outlets such as wet markets, fishmongers, supermarkets, and grocery stores. Consumer preferences for purchasing fresh fish in-store stem from the desire for immediacy and quality assurance. Shoppers often prefer to inspect the fish personally, assessing freshness through visual inspection and sensory evaluation. As the global population becomes increasingly health-conscious, there has been a notable rise in demand for high-quality, sustainably sourced fish. Retailers are responding by offering fresh seafood counters and collaborating with local fisheries to promote freshness and sustainability. Moreover, as local food movements gain momentum, consumers are increasingly supporting community fish markets that provide traceability regarding the origin of the fish, thereby reinforcing trust and demand.

The sales of fresh fish through online channels are expected to grow at a CAGR of 3.8% from 2025 to 2030. As consumers increasingly embrace e-commerce for convenience, many distributors and retailers have adapted by launching online platforms that offer home delivery services for fresh seafood. A pivotal driver of this trend is the growing demand for convenience and the changing lifestyle of consumers, many of whom prioritize time-saving solutions. Thus, platforms that provide pre-packaged meal kits featuring fresh fish options are gaining popularity, as they cater to the needs of busy families and health-conscious consumers seeking dietary variety without the hassle of extensive food preparation. Companies are also investing in cold chain logistics to ensure product freshness during transit, addressing one of the primary concerns consumers may have when purchasing perishable goods online.

Regional Insights

The fresh fish market in North America is expected to witness a CAGR of 3.2% from 2025 to 2030, driven by an increasing consumer focus on health and wellness. With rising awareness regarding the benefits of omega-3 fatty acids and lean proteins, consumers are gravitating towards fresh seafood as a healthier dietary choice. Moreover, key demographics, notably millennials and Gen Z, are steering preferences toward sustainable and environmentally friendly sourcing practices. This shift not only reflects a desire for healthier eating but also a greater accountability toward environmental conservation, which is leading retailers and distributors to focus on sourcing fresh fish from sustainable fisheries.

U.S. Fresh Fish Market Trends

The fresh fish industry in the U.S. is expected to grow at a CAGR of 3.0% from 2025 to 2030. American consumers are becoming more health-conscious and are shifting towards diets rich in omega-3 fatty acids, which are abundant in fish. This trend is further amplified by the influence of culinary trends and social media, which promote seafood as a versatile and appealing choice. Additionally, the rise of the "farm-to-table" movement has spurred demand for locally sourced fish, as consumers become more interested in the origin of their food and its environmental impact. These factors collectively drive a robust market for fresh fish across various segments, including retail, foodservice, and direct-to-consumer channels.

Europe Fresh Fish Market Trends

The fresh fish market in Europe is expected to grow at a CAGR of 3.7% from 2025 to 2030. Theregional market islargely influenced by changing dietary preferences and a growing emphasis on health-conscious eating among the population. With fish being a cornerstone of Mediterranean diets, many European countries exhibit high per capita consumption rates of fresh seafood. The trend towards clean eating and organic food has spurred an increased demand for fresh fish varieties, resulting in a robust market. Moreover, the European Union’s stringent regulations on fishing and sustainability have led to a focus on traceability and quality, encouraging consumers to choose certified sources that adhere to environmental standards.

The fresh fish industry in Germany is experiencing a notable shift towards healthier eating habits and sustainable sourcing, reflecting broader European trends. The demand for fresh, locally sourced seafood is on the rise, driven by increasingly health-conscious consumers who prioritize fresh fish as a primary protein source. The German populace is showing a marked interest in high-quality fish products, with a growing preference for sustainable and traceable species. This trend is further reinforced by the country’s strong culinary heritage, which emphasizes fish dishes, and the burgeoning popularity of Mediterranean and Asian cuisines that feature fish prominently.

The fresh fish market in the UK has seen significant changes in consumer preferences, with a pronounced shift towards healthier eating habits in recent years. The rise of the health and wellness movement has increased awareness of the benefits of consuming fresh fish, which is viewed as a lean protein option rich in essential nutrients. Additionally, the U.K. coastline provides an abundance of marine resources, fostering a culture of support for local fisheries and sustainable fishing practices. With seafood now recognized as integral to the traditional British diet, especially through popular dishes such as fish and chips, the demand for fresh fish remains consistently strong.

Asia Pacific Fresh Fish Market Trends

The fresh fish market in the Asia Pacific captured a revenue share of over 58.6% of the market in 2024, primarily due to its large population and deep-rooted cultural traditions that emphasize seafood consumption. Countries like China, Japan, and India exhibit some of the highest seafood consumption rates in the world. Economic growth and rising disposable incomes in these countries have shifted towards higher-quality, fresh seafood options. Traditional practices and modern dietary trends are converging, with consumers increasingly seeking out healthy, fresh fish that meets their dietary needs while also aligning with cultural preferences.

The fresh fish market in China is expected to witness a CAGR of 2.4% from 2025 to 2030, driven by an enormous population that values seafood as a vital component of its diet. The increasing urbanization and affluence in Chinese society have significantly boosted the demand for diverse seafood options, with fish becoming a staple in everyday meals. Rapid changes in dietary preferences, along with a growing appetite for high-quality and premium seafood products, are compelling market players to explore new and innovative offerings. This factor is exacerbated by China’s rich culinary tradition, which emphasizes fish across various regional cuisines, further driving the demand for fresh fish.

India fresh fish market is experiencing transformational changes driven by a combination of demographic shifts, improving income levels, and a rapidly growing middle class. Seafood is deeply ingrained in various regional cuisines, contributing to a cultural affinity for fresh fish among Indian consumers. As the population continues to urbanize, awareness of the health benefits of including fish in the diet is escalating, prompting more households to incorporate fish into their meals. Moreover, the Indian government is also actively promoting aquaculture as a sustainable means of boosting local fish production to meet the increasing demand. Initiatives aimed at enhancing fishing practices, ensuring quality control, and developing infrastructure for cold chain logistics are becoming more pronounced.

Latin America Fresh Fish Market Trends

The fresh fish market in Latin America is expected to witness a CAGR of 3.0% from 2025 to 2030. Countries including Brazil, Peru, and Chile are home to vast coastlines that not only provide an abundance of local fish and seafood but also have strong cultural ties to fish consumption. The trend of healthy eating combined with the traditional culinary landscape in this region has led to a growing recognition of the nutritional benefits of seafood, promoting increased demand for fresh fish. Furthermore, local markets play a crucial role in distributing fresh seafood, allowing consumers to access high-quality, freshly caught products.

Middle East & Africa Fresh Fish Market Trends

The Middle East and Africa region is witnessing significant growth in the fresh fish market, fueled by rising consumer awareness of the health benefits associated with fish consumption. With a diet traditionally comprising meat-heavy dishes, there is a gradual but noticeable shift toward integrating fish, driven by dietary changes and increasing health consciousness. Furthermore, the growing popularity of Mediterranean and Asian cuisines within the region is prompting consumers to explore diverse fish options, thereby expanding the market.

Key Fresh Fish Company Insights

The global fresh fish market has been characterized by a strong demand driven by shifting consumer preferences towards healthier eating habits, sustainability, and increased awareness of the nutritional benefits of seafood. In response to these trends, several key players in the industry have adopted strategic initiatives to solidify their positions within the market. Companies like Mowi, Thai Union Group PCL, Cermaq Group AS, and Huon Aqua are leading the charge, focusing on mergers and acquisitions to enhance their supply chains and expand their product offerings. These acquisitions not only allow for a more extensive portfolio of fresh fish products but also enable companies to tap into new markets and consumer bases, facilitating a broader reach and improving market share.

Investments in sustainable fishing practices and technologies further bolster their competitive edge, as consumers increasingly favor responsibly sourced products. Moreover, companies in the fresh fish sector are also launching innovative products and expanding their operational footprints to meet rising demand. For instance, the expansion of processing facilities and distribution networks has been pivotal for companies like Trident Seafoods and High Liner Foods, allowing them to deliver fresher products more efficiently. New product lines focusing on value-added fish products, such as ready-to-cook or marinated options, are also gaining traction, as they align with the busy lifestyles of modern consumers. Besides, partnerships with grocery retailers and food service providers have become an essential strategy to enhance visibility and availability.

Key Fresh Fish Companies:

The following are the leading companies in the fresh fish market. These companies collectively hold the largest market share and dictate industry trends.

- Mowi

- Thai Union Group PCL

- Cermaq Group AS

- Huon Aqua

- Stolt Sea Farm

- Stehr Group

- Leigh Fisheries

- True World Foods

- Grieg Seafood ASA

- Priory Fishery Ltd.

Recent Developments

-

In September 2024, Thai Union launched its Innovation Hub in Wageningen, Netherlands, enhancing its global innovation network. This hub specializes in product and packaging innovations for the company’s ambient seafood brands, staffed by approximately 40 experts including product developers and sensory scientists. By fostering close collaboration with Thai Union’s brands and the Global Innovation Center in Bangkok, the Innovation Hub aims to accelerate creative development and improve consumer offerings. This strategy benefits the company by driving innovation, increasing competitiveness, and responding swiftly to market trends.

-

In April 2024, Cermaq announced plans to invest USD 100 million in the second stage of its Chacao Canal Fish Farm (PCC), featuring a recirculating aquaculture system (RAS) with an expected launch in early 2026. This facility is set to produce 14 million smolts annually, marking it as Cermaq's largest operation. This strategic development is anticipated to enhance production efficiency, support sustainable aquaculture practices, and strengthen the company's market position.

Fresh Fish Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 251.8 billion

Revenue forecast in 2030

USD 291.3 billion

Growth rate (Revenue)

CAGR of 3.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million,and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; France; Germany; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

Mowi; Thai Union Group PCL; Cermaq Group AS; Huon Aqua; Stolt Sea Farm; Stehr Group; Leigh Fisheries; True World Foods; Grieg Seafood ASA; and Priory Fishery Ltd.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fresh Fish Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global fresh fish market report based on product, form, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pelagic Fish

-

Demersal Fish

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh

-

Frozen

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fresh fish market was estimated at USD 245.3 billion in 2024 and is expected to reach USD 251.8 billion in 2025.

b. The global fresh fish market is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 291.3 billion by 2030.

b. Asia Pacific dominated the fresh fish market with a share of 58.6% in 2024, primarily due to its large population and deep-rooted cultural traditions that emphasize seafood consumption. Countries like China, Japan, and India exhibit some of the highest seafood consumption rates in the world.

b. Some of the key market players in the fresh fish market are Mowi, Thai Union Group PCL, Cermaq Group AS, Huon Aqua, Stolt Sea Farm, Stehr Group, Leigh Fisheries, True World Foods, Grieg Seafood ASA, and Priory Fishery Ltd.

b. The fresh fish market has experienced significant growth in recent years, driven by shifting consumer preferences, health consciousness, and sustainability initiatives. As awareness around the health benefits of seafood increases, more consumers are incorporating fresh fish into their diets. Rich in omega-3 fatty acids, vitamins, and minerals, fish is increasingly seen as a healthier alternative to red meat and other protein sources. This trend is particularly pronounced among millennials and health-conscious consumers who prioritize nutrition and wellbeing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.