- Home

- »

- Medical Devices

- »

-

Funeral And Cremation Services Market Size Report, 2030GVR Report cover

![Funeral And Cremation Services Market Size, Share & Trends Report]()

Funeral And Cremation Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Cremation, Funeral Planning Services), By Provider, By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-313-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Funeral And Cremation Services Market Summary

The global funeral and cremation services market size was estimated at USD 70.61 billion in 2024 and is projected to reach USD 98.57 billion by 2030, growing at a CAGR of 5.8% from 2025 to 2030. Rising funeral costs and the push for financial preparedness are fueling global market growth. Trends like eco-friendly options and digital memorials reflect changing cultural values and expectations.

Key Market Trends & Insights

- The Asia Pacific funeral and cremation services market accounted for the largest share of 40.00% of the global market in 2023.

- The funeral and cremation services market in China is expected to grow over the forecast period.

- In terms of service, the funeral planning services segment led the market in 2023, accounting for 33.19% of global revenue share.

- Based on provider, the funeral director segment dominated the market in 2023, with a revenue share of 21.2%

- On the basis of the application segment, the immediate needs segment dominated the market in 2023, accounting for a revenue share of 45.48%.

Market Size & Forecast

- 2024 Market Size: USD 70.61 Billion

- 2030 Projected Market Size: USD 98.57 Billion

- CAGR (2025-2030): 5.8%

- Asia Pacific: Largest market in 2023

Moreover, widening internet reach, digitalization, and government efforts further fuel market growth, especially in developing countries. Besides, government programs are anticipated to be implemented to curb the rising demand for funeral services and the expenses connected with them, ensuring that everyone receives adequate end-of-life care. As more customers learn about these efforts and insurance firms concentrate on providing end-to-end coverage, the entire industry is anticipated to grow over the estimated period.

Furthermore, a rich tapestry of cultural and religious traditions shapes the death care industry, resulting in a diverse and complex landscape. For instance, in the Asia Pacific region, countries like Japan and South Korea have a strong preference for cremation. India's cultural and religious heritage emphasizes traditional burial and cremation practices. Besides, rapid urbanization drives demand for modern memorial parks and high-tech cremation facilities. Such factors are anticipated to drive the market growth.

Furthermore, there has been an increase in funeral and cremation services requirements during COVID-19. For instance, in China, Zhejiang province, cremations surged by over 70% year-on-year in the first quarter of 2023, coinciding with a COVID outbreak that swept the country. The rise in cremations during this period highlights the impact of the pandemic on funeral practices and the increased demand for cremation services. The funeral and cremation services industry is anticipated to undergo significant changes and initiatives to address challenges such as land scarcity and changing burial traditions. Such factors are anticipated to drive the market growth over the estimated period.

Market Concentration & Characteristics

Market growth stage is stable and is likely to be at a moderate pace over the estimated period. The market are characterized by percentage of cremations, rising aging population, increasing popularity of cremation over traditional burial and specialized capabilities.

Funeral and cremation services are continuously evolving to meet the industry’s demands due to the increased burden of an aging population. Several advancements have shaped the market, enhancing cultural attitudes toward death and mourning.

Compliance with stringent regulatory requirements, particularly in the industry, is critical. The market emphasizes robust quality practices and adherence to regulatory standards, thereby witnessing lucrative growth opportunities. For instance, the UK government has recognized the need for quality regulation of funeral directors, and service providers are expected to meet certain standards of quality and care. Besides, the Cremation Society of Great Britain collects detailed cremation statistics annually, which are used by UK government departments, bereavement organizations, funeral directors, and planning consultants. Such factors are expected to drive the market growth.

The market is highly competitive, with numerous players vying for funeral home and funeral service market share, ranging from small players to large multinational corporations. Besides, funeral and cremation services players in the market leverage strategies such as partnerships, collaborations, and acquisitions to promote the reach of their offerings and increase their product capabilities globally.

The rising number of mergers and acquisitions, the increasing aging population, and the growing disease burden have influenced market dynamics. Higher health expenditure may indicate a better quality of life and healthcare services, potentially leading to increased life expectancy, and consequently, a higher demand for funeral services, which has positively impacted the market.

The local presence of several established companies and the rising burden of diseases fuel market growth. Other factors contributing to the growth are the rising disposable income among families and the growing demographic landscape of the elderly population worldwide.

Service Insights

In terms of service, the market is segregated into cremation, funeral planning services, transportation, body preparation and interment, resale of merchandise, and others segments. The funeral planning services segment led the market in 2023, accounting for 33.19% of global revenue share. The demand in the segment can be attributed to the increasing number of funeral homes, which has led to a rise in the requirement for funeral arrangements of cremation or burial. Besides, the funeral planning services support collecting and help arrange the tributes and cremation. For instance, in March 2024, Everest Funeral Concierge announced a new PriceFinder tool, the UK’s first-in-market funeral service price comparison capability, available to all. The tool compares funeral prices offered by funeral directors across the UK, including an itemized breakdown of the associated costs.

In 2023, the cremation segment is anticipated to grow at a CAGR of 4.63% over the forecast period. The cremation rate across the globe is rising annually, attributed to the considerable expense of traditional funerals, increasing environmental concerns, and the diminishing space available for cemeteries. For instance, approximately 90% of FCA members across the U.S. opt for cremation as these services are simple, dignified, and affordable, thus contributing to market growth.

Provider Insights

Based on provider, the market is segregated into the funeral director, embalming services, mortician services, funeral homes with crematories, visitation or viewing services, graveside committal, selling funeral supplies, and transporting the deceased segments. The funeral director segment dominated the market in 2023, with a revenue share of 21.2%, which is attributed to the growing service offering with all arrangements for the funeral. The segment is driven by the funeral director’s requirement for managing a funeral home. Besides, the number of funeral directors assisting with funeral planning and cremation services provides a steady demand for funeral services. Moreover, the provider supports and manages operations across the funeral home, cemetery, or sales department.

In addition, the selling funeral supplies segment is expected to grow at the fastest CAGR during the forecast period. The funeral homes with crematories potentially support to save a significant amount of money with funeral supplies. Besides, the spike in deaths globally and the alarming need for funeral homes to manage the increasing demand of managing the deaths and bodies piling up in hospitals is expected to drive the demand for funeral supplies market over the estimated period. Moreover, rising opportunities for key players drive market growth.

Application Insights

On the basis of the application segment, the market is segregated into immediate needs, pre-planned, and others. The immediate needs segment dominated the market in 2023, accounting for a revenue share of 45.48%. The increasing aging population, contributing to a higher mortality rate, has led to the dominance of this segment. Moreover, the prevalence of diseases and the availability of different funeral and cremation service packages are fueling the market growth.

On the other hand, the pre-planned segment growth is anticipated to grow at a rapid CAGR over the forecast period due to the increasing adoption of pre-planned funeral plans that offer families more convenient payment options when compared with immediate needs. Besides, pre-planned funeral services are less stressful and more advantageous. For instance, in October 2023, Prasser-Kleczka Funeral Homes launched the values cremation, tiered cremation service packages that help provide more options for those planning simple cremation services. In addition, the company’s team also anticipates a real need for transparency & accountability with cremation services and wants to educate consumers by providing an alternative.

Distribution Insights

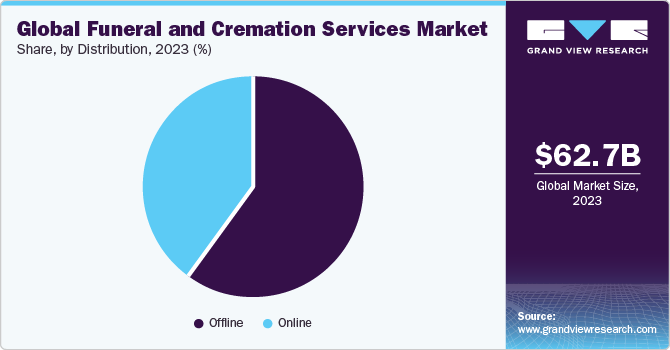

Based on distribution, the market is segregated into online and offline segments. The offline segment dominated the market in 2023 attributed to the increasing prevalence of the growing aging population and rising death rate. The primary advantage of offline funeral and cremation services is the immediate availability of services, thus contributing to market growth. On the other hand, the online segment is expected to grow at the fastest CAGR of 5.04% during the forecast period. The growing trend toward funeral homes and rising consumer preferences for personalized and high-end services fuel the segment’s growth. In addition, online platforms are increasingly becoming popular options for booking funeral services, making it easier for consumers to compare prices and services.

Regional Insights

The funeral and cremation services in North America is expected to grow at a CAGR of 4.84% during the forecast period. The market is driven by increasing acceptance of cremations, higher disposable income in the region, which can endow both traditional and diverse funeral services, and the growing demographic landscape of the elderly population in the region. Furthermore, in North America, the market is highly competitive, with a large number of players offering a wide range of services, including funeral houses and crematoriums, provide a wide range of services such as choosing a casket, embalming, coordinating and arranging a funeral, transferring remains, and help with the paperwork. Furthermore, the rising demand for online services, such as virtual funerals, is also propelling market growth.

U.S. Funeral And Cremation Services Market Trends

The U.S. funeral and cremation services market held the largest revenue share in the North America region in 2023. This growth is attributed to the increasing demand for funeral and cremation services, growing death incidence, and rapid aging. For instance, according to the CDC, in 2022, there were 227,039 unintentional injury deaths in the U.S., with a death rate of 68.1 per 100,000 population. This ranked unintentional injuries as the 3rd leading cause of death. The most common causes of unintentional injury deaths in 2022 were unintentional poisoning: 102,958 deaths (30.9 per 100,000), Motor vehicle traffic crashes: 44,534 deaths (13.4 per 100,000), Unintentional falls: 44,630 deaths (14.0 per 100,000). Such factors are expected to support market growth.

Europe Funeral And Cremation Services Market Trends

The funeral and cremation services market in Europe is expected to grow significantly due to the aging demographic, which is expected to drive the demand for funeral services. In addition, cremation is gaining popularity due to environmental concerns, costs, and changing traditions, which has led to significant market growth. According to the European Commission's 2021 Aging Report, in 2019, older adults aged 65 and over comprised 20.4% of the total population in EU-27 countries. This percentage is projected to increase to 29.6% by 2050. Moreover, the European Commission data shows significant mortality and life expectancy disparities between EU member states. Factors like healthcare quality, lifestyles, and income levels contribute to the diverging outcomes.

The Germany funeral and cremation services market held the largest revenue share in the Europe region in 2023, owing to a demand for funeral and cremation services. For instance, in 2022, Germany recorded approximately 930,000 deaths in total. The population aged 65 years and over is a significant demographic segment that drives the demand for funeral and cremation services. In Germany, the population aged 65 and over is growing, contributing to the expansion of the funeral market.

The funeral and cremation services market in the UK is anticipated to grow over the forecast period owing to a rising aging population and increasing popularity of cremation over traditional burial, with many funeral directors and crematoriums adapting to meet this demand and changing cultural attitudes towards death and mourning. For instance, in 2022, according to Urnsforashes UK, there were approximately 669,762 cremations in the UK. Besides, as of 2022, 315 crematoriums were operating in the UK. In addition, the Big Future of Funerals survey surveyed 17,135 direct cremation plan holders in 2022, highlighting that 54% chose direct cremation to reduce stress for their family and friends, while only 5% sought the cheapest option. The survey also revealed that 52% of respondents felt to express their life through the ashes' final resting place. Furthermore, according to SunLife's cost of dying report 2023, the pattern of choosing plans was observed as 57%of the surveyed population chose cremation, 25% chose burials, and 18% chose direct cremation. Such factors drive the market growth.

Asia Pacific Funeral And Cremation Services Market Trends

The Asia Pacific funeral and cremation services market accounted for the largest share of 40.00% of the global market in 2023. Asia Pacific market has witnessed significant growth and promising developments in recent years. Some key factors contributing to this growth are the growing trend towards cremation and alternative practices. In addition, the region's increasing urbanization and evolving lifestyles drive a desire for more elaborate and personalized funeral ceremonies, driving up spending on funeral services. Furthermore, the region's economic development and expanding middle-class fuel this growth, as individuals have more disposable income to invest in funeral services that reflect their cultural and personal values.

The funeral and cremation services market in China is expected to grow over the forecast period due to significant investments being made in the transition and expansion towards cremation and other innovative funeral practices.

The Japan funeral and cremation services market held a significant share in 2023. For instance, according to Japan's health ministry, in 2022, deaths reached a record high of over 1.56 million, up 8.9% from the previous year and a 150% increase over the past two decades. This surge in deaths has led to a rise in demand, leading to market growth.

The funeral and cremation services market in India is anticipated to grow at the fastest CAGR over the forecast period, owing to an expanding crematorium service.

Key Funeral And Cremation Services Company Insights

Some of the key players in this industry are StoneMor Partners, InvoCare Australia Pty Ltd., Service Corporation International, Carriage Services, Nirvana Asia Ltd., Dignity Plc, Amar International Repatriations, Arbor memorial service, Park Lawn Corporation, and Ritual Funeral Enterprise among others.

Key Funeral And Cremation Services Companies:

The following are the leading companies in the funeral and cremation services market. These companies collectively hold the largest market share and dictate industry trends.

- StoneMor Partners (Everstory Partners)

- InvoCare Australia Pty Ltd.

- Service Corporation International

- Carriage Services

- Nirvana Asia Ltd.

- Dignity Plc

- Amar International Repatriations

- Ritual Funeral Enterprise

- Last Journey Funeral services

- Arbor Memorial

- Park Lawn Corporation

Recent Developments

-

In October 2022, Invocare Australia Pvt Ltd. announced a USD 1 million investment in Parting Stone, a solidified remains startup, and a joint venture to launch Parting Stone Australia. This partnership aims to bring innovative deathcare solutions to the Australian market.

-

In July 2022, Pure Cremation Financial Planning Ltd, mentioned the approval by the UK's Financial Conduct Authority for providing funeral plans in the region. The Financial Conduct Authority (FCA) announced its regulation of the sale and administration of funeral plans, which came into effect from July 2022. This move was intended to enhance public trust in the sector.

Funeral And Cremation Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.25 billion

Revenue forecast in 2030

USD 98.57 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, provider, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

StoneMor Partners; InvoCare Australia Pty Ltd.; Service Corporation International; Carriage Services; Nirvana Asia Ltd.; Dignity Plc; Amar International Repatriations; Arbor memorial service; Park Lawn Corporation; Last Journey and Ritual Funeral Enterprise

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Funeral And Cremation Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global funeral and cremation services market report based on service, providers, application, distribution channel, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Cremation

-

Funeral Planning Services

-

Transportation

-

Body Preparation And Interment

-

Resale Of Merchandise

-

Others

-

-

Provider Outlook (Revenue, Usd Million, 2018 - 2030)

-

The Funeral Director

-

Embalming Services

-

Mortician Services

-

Funeral Homes With Crematories

-

Visitation Or Viewing Services

-

Graveside Committal

-

Selling Funeral Supplies

-

Transporting The Deceased

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Immediate need

-

Pre-Planned

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global funeral and cremation services market size was estimated at USD 62.72 billion in 2023 and is expected to reach USD 65.58 billion in 2024.

b. The global funeral and cremation services market is expected to grow at a compound annual growth rate (CAGR) of 4.82% from 2024 to 2030 to reach USD 87.00 billion by 2030.

b. The funeral planning services dominated the funeral and cremation services market in 2023 with a market share of 33.19%. Major factors boosting the demand for funeral planning services are increasing number of funeral homes, which has led to a rise in the requirement for funeral arrangements of cremation or burial

b. StoneMor Partners, InvoCare Australia Pty Ltd., Service Corporation International, Carriage Services, Nirvana Asia Ltd., Dignity Plc, Amar International Repatriations, Arbor memorial service, Park Lawn Corporation, last Journey and Ritual Funeral Enterprise among others.

b. The growing demand for funeral services, rapid urbanization, and a rising aging population are key growth drivers for this market. Moreover, the growing trend towards cremation and alternative practices further supports the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.