- Home

- »

- Homecare & Decor

- »

-

Games And Puzzles Market Size And Share Report, 2030GVR Report cover

![Games And Puzzles Market Size, Share & Trends Report]()

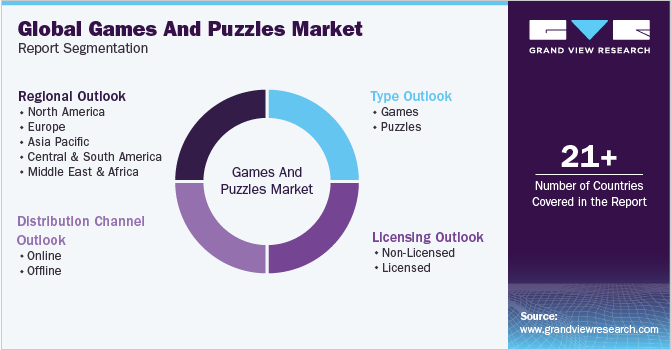

Games And Puzzles Market (2024 - 2030) Size, Share & Trends Analysis Report By Licensing (Licensed, Non-licensed), By Type (Games, Puzzles), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-379-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Games And Puzzles Market Summary

The global games and puzzles market size was estimated at USD 17.04 billion in 2023 and is projected to reach USD 54.19 billion by 2030, growing at a CAGR of 18% from 2024 to 2030. The nostalgia derived from playing games, the scope of social interaction that games and puzzles provide, coupled with intellectual stimulation and growing interest in licensed games and puzzles are some of the factors boosting the market growth.

Key Market Trends & Insights

- North America dominated the market in 2022 with a share of about 30%.

- Asia Pacific is expected to witness a CAGR of 18.2% from 2023 to 2030.

- Based on type, the games segment dominated the market with a share of around 58% in 2022.

- In terms of licensing, the non-licensed games and puzzles dominated the market with a share of approximately 71% in 2022.

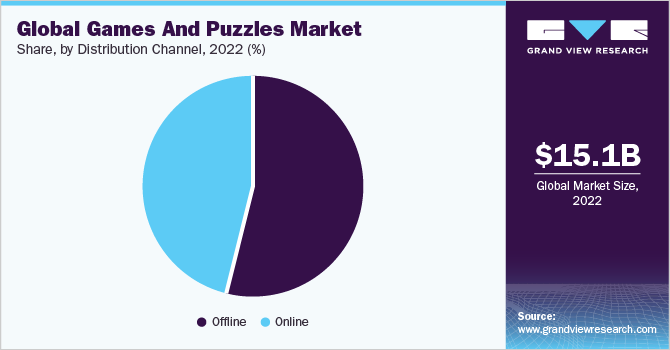

- Based on distribution channel, the offline channel segment held the largest market share of about 54% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 17.04 billion

- 2030 Projected Market Size: USD 54.19 billion

- CAGR (2024-2030): 18%

- North America: Largest market in 2022

According to studies, regularly solving and playing puzzle games promotes the creation of new brain connections, which improves short-term memory. Even people who solve puzzles for 25 minutes a day saw a four-point increase in IQ scores, according to a University of Michigan study. The COVID-19 pandemic created a unique set of circumstances that drove up the demand for tabletop games, card games, and jigsaw puzzles. According to an article in JSTOR Daily published in December 2020, sales of puzzles increased by 300–400%. In the spring of 2020, Ravensburger AG, a significant player in the market, reported sales that were up 370% from the previous year.

In North America, the company sold seven puzzles per minute in 2019, but in 2020, this number increased to around 20 puzzles per minute. The demand for such products is projected to grow post-pandemic due to sustained interest in at-home entertainment, increased awareness about the benefits of such games, growth of the gaming industry, and continued interest in collectibles.

Moreover, the market currently is witnessing increased demand for sustainable games and puzzlesdue to increasing awareness and concern about environmental issues among consumers, as well as a growing trend toward eco-friendly and socially responsible products. Market players have been responding to this trend by developing and promoting eco-friendly products, using sustainable materials, and implementing environmentally conscious manufacturing and distribution practices. For instance, a U.S.-based company called Mattel, Inc. constantly seeks to optimize its resource use to lessen the effects on the environment, support moral sourcing, and promote worker health and safety throughout its supply chain.

By 2030, the company aims to use only recycled, recyclable, or bio-based plastic in all of its products and packaging, while also reducing plastic packaging by 25% per product. Games and puzzles that incorporate STEM concepts and challenges can provide a valuable learning experience for children while also being entertaining and enjoyable. This has led to an increase in the production and sales of STEM-related games and puzzles in the market. Strategy games, such as chess and Settlers of Catan, that involve planning and decision-making based on mathematical and logical principles integrate problem-solving, critical thinking, and logical reasoning, which helps encourage STEM learning and is preferred by parents for their children, favoring the market growth.

The demand for board games and puzzles is positively affected by their use in offices for team bonding activities. Many companies use board games and puzzles as a way to promote teamwork, communication, and problem-solving skills among their employees. This has led to an increase in the demand for board games and puzzles as companies seek out activities that can help improve morale, foster collaboration, and create a more positive work environment. Apples to Apples, Scattergories, Wits & Wagers, Codenames, and Pandemic are some popular games that encourage teamwork, communication, and problem-solving skills while also being inclusive, fun, and challenging for all players.

Type Insights

The games segment dominated the market with a share of around 58% in 2022. These offer a social and interactive experience allowing players to engage with each other and collaborate towards a common goal, providing a fun and engaging way to spend time with friends and family. Moreover, its replay value, versatility, and dynamism are factors pushing this segment. According to Deutsche Welle, a German public, the state-owned international broadcasterreported that the global board games market grew by 20% in 2020.

Games, such as Settlers of Catan, Monopoly, Dominion, Risk, Monopoly, and Carcassone, are some of the worldwide popular games dominating the market. The puzzles segment is estimated to grow at a CAGR of about 18.0% in the forecast period. According to a study by Aviva published in December 2022, more than four-fifth of UK adultsenjoy solving puzzles. Moreover, around 84% of them have completed puzzles like jigsaws, number puzzles, and word problems in the past year, with the majority of them preferring puzzles in a physical format. In addition, the puzzles market is pushed by people over the age of 55 years who are more likely than others to favor puzzles in physical formats.

Licensing Insights

The non-licensed games and puzzles dominated the market with a share of approximately 71% in 2022. Such products allow for greater freedom and originality in design and development, resulting in a wider variety of products and themes available to consumers. Moreover, these appeal to a broader audience, as they do not rely on familiarity with a particular brand or franchise. This allows non-licensed games and puzzles to have a more universal appeal, making them a more reliable and profitable investment for manufacturers.Licensed games and puzzles are projected to grow at a CAGR of about 18.5%.

Licensed games and puzzles featuring popular franchises and characters can be a fun and engaging way to give a gift that is both entertaining and personalized. For instance, in May 2020, Heinz Ketchup released a limited edition impossible-to-solve puzzle that featured 570 red puzzle pieces.In addition, entertainment characters, such as Disney’s Frozen, Baby Yoda, Spiderman, Pinkfong’s Baby Shark, and Friends, are some of the most popular licensed franchises featuring in games and puzzles in the present times.

Distribution Channel Insights

The offline channel segment held the largest market share of about 54% in 2022. Many consumers enjoy the experience of shopping in-store, especially during the holiday season, as it can be a fun and festive activity. Furthermore, many specialty stores and game shops offer a wide selection of games and puzzles, including rare and unique collectibles. According to BookNet Canada, 80% of independent bookshops in Canada saw an increase in puzzle sales between 2019 and 2020. In addition, 45% of bookstores saw an increase in toy and game sales.

The online channel is set to grow at a CAGR of about 18.0% over the forecast period. The pandemic accelerated the shift towards online sales for the market, as consumers looked for safe and convenient ways to shop and stay entertained from home. Ceaco, Inc., a well-known American puzzle manufacturer, reports that in March 2020, one day saw more online sales than the entire month of December 2019. The combination of convenience, consumer comfort with online shopping, and retailer investment in online capabilities point towards continued growth in the online sales channel for games and puzzles.

Regional Insights

North America dominated the market in 2022 with a share of about 30%. The U.S. games and puzzles industry continues to be a lucrative segment majorly owing to the presence of popular market players in the region. Buffalo Games, Bits and Pieces, White Mountain, and Dowdle are some of the prominent companies popular in the country that shape the continent’s industry dynamics through strategies, such as product launches, innovation, price competition, and promotion. For instance, in October 2022, Costco made available Dowdle’s 60,000 pieces, 8-foot tall, and 29-foot-wide puzzle named “What a Wonderful World”, which is currently the world's largest puzzle on the market.

Asia Pacific is expected to witness a CAGR of 18.2% from 2023 to 2030. Being home to more than half of the world's population coupled with growing economies in countries, such as India and China, pose lucrative opportunities for market growth in this region. China, in particular, is the largest producer and exporter of kid’s products & toys in the world. For instance, according to an article published by Associated Press, in March 2023, China has increased factory activity following the lockdown. The production, export, and new order indicators all have increased, and the official China Federation of Logistics & Purchasing recovered to pre-COVID levels that indicate growth of production activity, likely favoring the growth of the market.

Key Companies & Market Share Insights

The market is highly competitive with the presence of both large- and small-scale manufacturers. Prominent players have been adopting strategies, such as mergers & acquisitions, partnerships, product launches, innovation, and promotions, to stay competitive in the market.

-

In April 2023, Hasbro, Inc. announced that Spin Master, a major international provider of children's entertainment, has been granted a worldwide licensing agreement for its iconic Barrel of Monkeys game. Utilizing its global footprint, Spin Master will expand retailer distribution while developing new play experiences and original formats for the game

-

In January 2023, Buffalo Games partnered with London-based indie games company, Big Potato, to distribute each other’s products in the UK and the U.S. Buffalo Games' Chuckle & Roar line of toys and games will debut in the UK through Big Potato on Amazon and with a few select retail partners

Some of the key players operating in the global games and puzzles market include:

-

Buffalo Games

-

Hasbro, Inc.

-

Mattel, Inc.

-

Ceaco, Inc.

-

Ravensburger AG

-

Schmidt Spiele

-

Cubicfun 3D Puzzle

-

Educa Borras

-

Castorland

-

Cobble Hill

Games And Puzzles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.47 billion

Revenue forecast in 2030

USD 54.19 billion

Growth rate

CAGR of 18% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, licensing, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Buffalo Games; Hasbro, Inc.; Mattel, Inc.; Ceaco, Inc.; Ravensburger AG; Schmidt Spiele; Cubicfun 3D Puzzle; Educa Borras; Castorland; Cobble Hill

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Games And Puzzles Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the games and puzzles market based on type, licensing, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Games

-

Board Games

-

Card Games

-

-

Puzzles

-

-

Licensing Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Licensed

-

Licensed

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America (CSA)

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The games and puzzles market was estimated at USD 15.09 billion in 2022 and is expected to reach USD 17.05 billion in 2023.

b. The games and puzzles market is expected to grow at a compound annual growth rate of 17.3% from 2023 to 2030 to reach USD 54.19 billion by 2030.

b. North America dominated the games and puzzles market with a share of about 30% in 2022. The growth of the regional market is mainly driven by the presence of popular market players in the geography, combined with constant product innovation and mergers & acquisitions.

b. Some of the key players operating in the games and puzzles market include Buffalo Games; Hasbro, Inc.; Mattel, Inc.; Ceaco, Inc.; Ravensburger AG; Schmidt Spiele; Cubicfun 3D Puzzle; Educa Borras; Castorland; Cobble Hill.

b. Key factors that are driving the games and puzzles market growth include the nostalgia derived from playing such games, the scope of social interaction that games and puzzles provide escapism from technology, coupled with intellectual stimulation and growing interest in licensed games and puzzles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.