- Home

- »

- Electronic & Electrical

- »

-

Gas & Electric Pressure Cooker Market Size, Industry Report, 2025GVR Report cover

![Gas & Electric Pressure Cooker Market Size, Share & Trends Report]()

Gas & Electric Pressure Cooker Market Size, Share & Trends Analysis Report By Material (Stainless Steel, Aluminum), By Application (Residential, Commercial), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-467-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

Industry Insights

The global gas and electric pressure cooker market size was valued at USD 6.19 billion in 2018 and is estimated to expand at a CAGR of around 7.11% over the forecast period from 2019 to 2025. Rising preference from urban population leading a busy lifestyle is projected to fuel the growth. Pressure cookers save cooking time and use of gas and electric power helps conserve energy required for cooking. These factors are anticipated to positively influence the product demand in the near future.

Pressure cooker can reduce the cooking time by around 70% than other cooking methods. It preserves nutrients and helps create complex and rich flavors. Depending on the type, it also helps conserve gas and electricity. Awareness regarding these advantages are anticipated to drive the demand for gas and electric pressure cooker products and in turn fuel the growth of the market in near future.

Product innovations such as electric and highly emissive flame burners have positively influenced the demand for gas and electric pressure cookers. Manufacturers invest in R&D and introduction of advanced technologies in terms of materials and cooking methods to cater to the rising demand for nontoxic pressure cookers. High demand for the products coated with hard anodized aluminum and ceramic among other materials is anticipated to drive the overall market.

Electric pressure cookers are more convenient for use than their stovetop counterparts. The innovative technology induced in the electric product automatically switches off the pressure button. The automatic type of cooker also saves the food from getting burnt along with saving the energy. Many top chefs recommend pressure cookers as they preserve essential nutrients more than other methods of steaming and boiling. These factors are expected to positively influence growth of the gas and electric pressure cooker market.

Material Insights

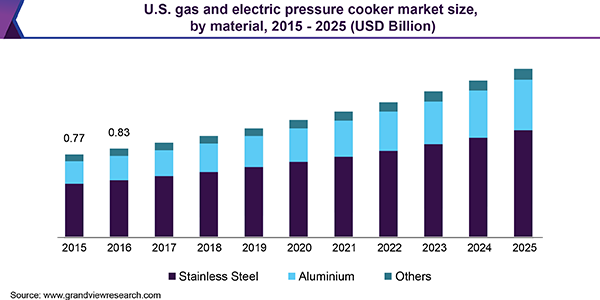

Stainless steel segment held the largest market share of about 63.59% in 2018. Being a heavy duty material, stainless steel is most commonly used for manufacturing gas and electric pressure cooker. It reduces the chances of damage in the form of scratches, stains, and rust caused by constant overheating and cleaning. Moreover, it does not absorb excessive heat during cooking process and saves the food from burning. Such advantages of the material are anticipated to drive the growth of the segment in the near future.

Aluminum segment is anticipated to register the fastest CAGR of around 8.07% from 2019 to 2025 owing to the affordable prices of the product. Being a lighter material, aluminum is very convenient during transportation of goods and easy to carry while cooking. Also, aluminum is a very good conductor of heat, contributing to even and faster cooking of the food. The material is lightweight, which makes it ideal for industrial cooking as well. All these factors are projected to fuel the product demand and in turn drive the market.

Application Insights

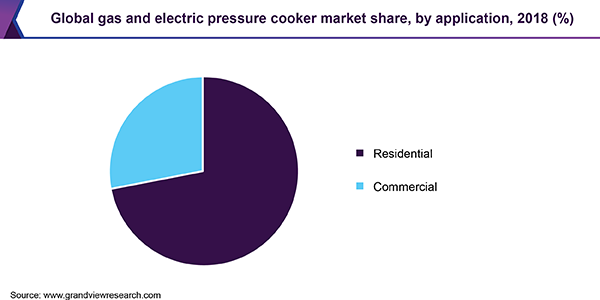

Residential was the largest application segment and generated a revenue of around USD 4.46 billion in 2018. Electric and gas connections are easily available and they do not require external fittings for residential application. Residential areas often have single phase power connections suitable for the use of electric pressure cookers. This is one of the major factors driving product adoption in this application segment. Compact cooking spaces in urban residential often lack proper ventilation. Pressure cookers require a small amount of heat and they cause very low smoke emission. Awareness regarding these advantages are anticipated to bode well for the segment growth.

Commercial application is expected to expand at the fastest CAGR of around 8.36% from 2019 to 2025. Rising need for faster cooking in various commercial spaces such as multi cuisines restaurants and hotels is anticipated to propel the growth. Large sized cookers are widely used for cooking huge amount of food in a limited time. They require a very low amount of heat and energy, which in turn is poised to fuel the product adoption. Growing demand for electric pressure cookers to maintain temperature inside commercial areas is expected to further fuel the demand. Moreover, certain regulations and government standards regarding the use of gas connections for cooking are anticipated to propel the product demand.

Regional Insights

Asia Pacific held the largest market share of more than 37.0% in 2018. Increasing population and number of households coupled with rapid development drives the regional market. Over 90% of global production and consumption of rice is concentrated in Asia Pacific, which is anticipated to drive the regional adoption of rapid cooking methods such as gas and electric pressure cookers. Rise in disposable income and adoption of innovative products is expected to fuel the market. Development of power infrastructure in countries such as China and India has resulted in increased demand for electric products.

Europe is expected to expand at the fastest CAGR of over 9.0% during the forecast period. Initiatives by the European Commission to promote the use of green and low emissive products has resulted in increased sales of pressure cookers. Moreover, the high purchasing power of consumers is also expected to results in the increased sales of electric and coated materials.

Gas and Electric Pressure Cooker Market Share Insights

Rising demand for cookware in China, India, and Japan due to a rise in consumer purchasing power is driving innovation in the market, thereby fueling the demand. The market is identified by several strategic initiatives, such as acquisitions and mergers, material innovations, product launches, and others.

Key market participants include GROUPE SEB, Zwilling, Fissler, Koninklijke Philips N.V., Panasonic Corporation, WMF Group, Zhejiang Supor Co., Ltd., Midea Group Co., Ltd., Joyoung Co., Ltd., and Qingdao Haier Co., Ltd. Rising demand for green, low emissive, and energy efficient products is anticipated to create growth opportunities.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2015 - 2017

Forecast period

2019 - 2025

Market representation

Revenue in USD Billion & CAGR from 2019 to 2025

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, U.K., China, India, Brazil, South Africa

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global gas and electric pressure cooker market report on the basis of material, application, and region:

-

Material Outlook (Revenue, USD Billion, 2015 - 2025)

-

Stainless Steel

-

Aluminum

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2015 - 2025)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."