- Home

- »

- Conventional Energy

- »

-

Gas Turbine Services Market Size & Share Report, 2030GVR Report cover

![Gas Turbine Services Market Size, Share & Trends Report]()

Gas Turbine Services Market Size, Share & Trends Analysis Report By Turbine Type (Industrial, Heavy-duty), By Service Provider (OEM, Non-OEM), By Turbine Capacity, By Service Type, By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-394-2

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Gas Turbine Services Market Size & Trends

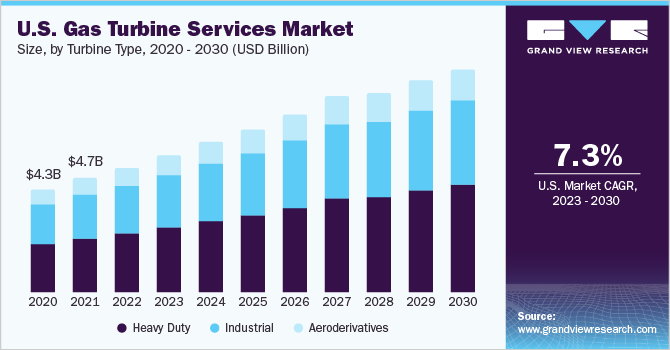

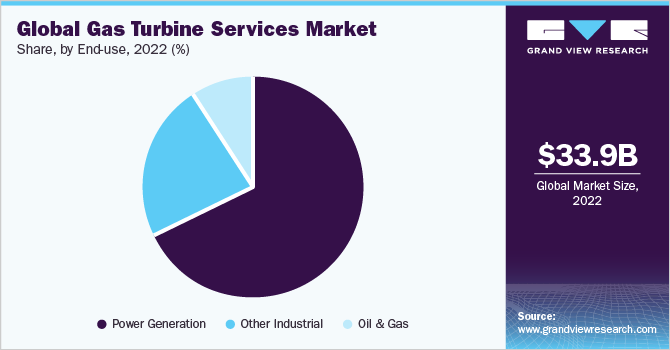

The global gas turbine services market size was valued at USD 33.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. The rise in environmental concerns owing to the high amount of carbon emissions from coal-based power generation has resulted in the adoption of low carbon emission power generation technologies, such as natural gas-powered turbines,which has eventually resulted in a rise in demand for services of these gas turbines globally. Although natural gas-powered turbines are expected to gain popularity globally, patricianly in the North Americaand Europe regions, emerging economies in Asia Pacific, such as India and China, still rely on coal-based power generation owing to its lower costs.

This factor is expected to hinder new gas turbine sales and maintenance contracts in the region. Moreover, limited natural gas reserves will restrict the growth of the market in the coming years. The U.S. has a well-developed natural gas infrastructure coupled with the presence of established key end-user industries, which are the major demand drivers for gas turbine services in the country. Heavy-duty gas turbines accounted for the largest share in 2022 followed by industrial and aeroderivative turbines. Although aeroderivative turbines account for a relatively lesser share as compared to heavy-duty and industrial turbines in the U.S market, the future of small aeroderivative power generation looks promising owing to the development of the aerospace and defense sector in the country, where these turbines are used on a large scale.

This factor will boost thedemand for maintenance services for aeroderivative gas turbines in the U.S. in the future.The rise in multiyear service contracts is one of the major factors driving the market globally. Plant operators find a multiyear agreement as an economical solution in a long term. These agreements can be signed for a range of services, such as basic maintenance or overall maintenance. Basic maintenance includes preventive maintenance to full-service maintenance agreement whereas overall maintenance includes repair for concerned equipment or complete plant for the long term.

Turbine Type Insights

Heavy-duty turbines emerged as the largest product segment, which accounted for more than 51.0% share of the global market in 2022 and is projected to ascend at the fastest growth rate over the forecast period. The growth of the segment is majorly due to the wide application scope of the turbine in chemical plants, refineries, and power utilities. Furthermore, heavy-duty turbines provide improved thermodynamic cycles and optimized production processes. These turbines usually have upgrades, which manufacturers provide to increase the power output and efficiency. Moreover, upgrades can make heavy-duty turbines environmental compatibility, which can be provided under service by manufacturers. These factors are projected to propel the market growth during the forecast period.

Industrial turbines also accounted for a significant revenue share in 2022 and the segment is projected to grow at the second-fastest CAGR during the forecast period. The segment is expected to witness growth owing to the ongoing development in industrial activities across the globe. Positive trends regarding the development of key manufacturing sectors across the globe are supporting the growth potential of the market.Trends signify the industrial gas turbine sector is likely to experience growth over the coming years. This is due to the development of both heavy and light industries, which is further projected to increase the importance of the service sector in the gas turbine business. The growing population and rapid urbanization are creating an increased demand for electricity. This factor is expected to be the biggest demand driver for the market.

Turbine Capacity Insights

The >200 MW segment accounted for the largest share of more than 38.0% of the overall revenue in 2022. The growth in the power generation sector along with the increased focus on generating electricity through sustainable energy resources is the major growth driver for this segment. Rapid urbanization is triggering the development in building & construction as well as cement sectors. The projected growth in end-user industries is estimated to trigger market growth. Key OEMs, such as General Electric and Siemens AG, are expanding their operations, distribution, and aftersales facilities globally. Furthermore, they are signing multiyear contracts during the installation of new gas-based power plants.

The 100 to 200 MW segment accounted for a significant market share in 2022. The demand in this segment is primarily owing to the growth of end-user industries, such as sugar mills, pharmaceuticals, O&G, plastic & resin manufacturing, glass manufacturing, and intermediate chemicals. The demand in the <100 MW segment is primarily driven by the growth in aerospace activities along with the increasing application scope of the turbine in the O&G sector.Smaller size of <100 MW turbines results in the lower weight of the product, which makes it ideal for offshore locations where the weight-to-power ratio is an important parameter while deciding to establish a turbine unit. The O&G industry is projected to regain its momentum shortly, which is acting as a major demand driver for the <100 MW segment.

Service Type Insights

Spare parts supply emerged as the largest service type segment, which accounted for more than 64.0% share of the global revenue in 2022 and is projected to account for a dominant share over the forecast period. The growth of the segment is owing to the fact that the components utilized in a gas turbine have a specific lifespan after which they require replacement. Maintenance & repair emerged as the second-largest segment. The maintenance & repair activities are being performed on a regular basis in developed regions, such as Europe and North America. The growth in awareness about the benefits of periodic maintenance and development in data collection technologies will aid the growth of this segment.

Overhaul emerged as the second-fastest-growing segment in 2022. Overhaul consists of inspection, repair, replacement, and disassembly of subcomponents. A gas turbine operates under harsh operating conditions, which includes a variety of corrosion, temperature, and stress condition.The power turbine and generator of the unit are exposed to high-temperature gases, along with thermal and vibration cycling, which produce mechanical and thermal stress in turbine components. Exposer to combustion gases results in the corrosion of power turbine and gas generator sections, which require replacing after a certain interval. This factor is expected to fuel the growth of the overhauling segment in the forecast period.

Service Provider Insights

OEM was the dominant service provider segment in 2022 with a revenue share of more than 61.0%. The dominance of the segment is majorly due to factors, such as technological capability, wide geographical presence, skilled workforce, and brand value of OEMs. In addition, OEMs have well-developed R&D as well as data management centers that enable them to observe the unit from remote locations for knowing the accurate real-time health of the unit, which will drive the market for them. OEMs are strengthening their presence by acquiring small-scale companies. For instance, GE Power acquired Alstom. Similarly, Siemens AG acquired the aero-derivative gas turbine business of Rolls-Royce.

Due to these factors, OEMs will continue to maintain their dominating position in the market. Non-OEMs service provider accounted for a significant market share in 2022. They dominate in price-sensitive markets, such as India, China, and Thailand. Consumers in emerging countries shift from OEM to independent service providers to cut operational costs, whichwill support the growth of non-OEMs in price-sensitive areas in the future.However, OEMs offer multiyear service agreements to buyers, which cover a range of services. In addition, OEMs usually offer multiyear agreements during new gas turbine installations to the buyers. This factor will enable OEMs to consolidate their position further.

End-use Insights

Power generation emerged as the largest end-user segment in 2022 accounting for the maximum share of more than 67.0% of the global revenue. The rise in population and rapid urbanization across the globe are creating more demand for power generation, which, in turn, is driving the application of gas turbines in the power generation sector. The product demand in the power generation application is anticipated to progress at a significant CAGR over the forecast period.

However, key competitors are still skeptical regarding the growing product demand in the power generation segment. Volatility in the prices of natural gas is a restraint that is expected to significantly alter the growth of the market in this segment. Growing population, rise in industrial activities, increasing vehicle ownership ratio, and other factors are leading to the high demand for oil production, which is further projected to increase the product application scope in the O&G industry, which faced a major challenge in the past owing to the decreasing oil prices.

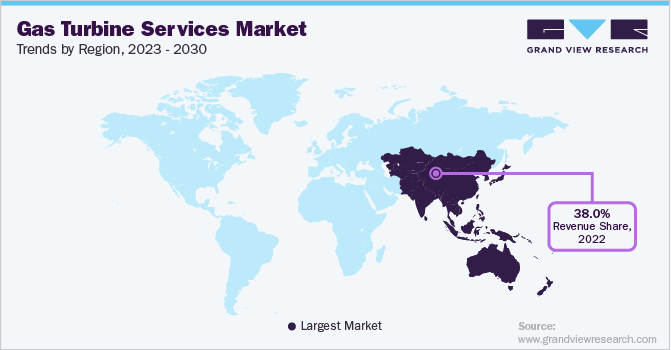

Regional Insights

Led by China, Japan, Indonesia, and India, Asia Pacific emerged as the largest region in 2022 and accounted for a revenue share of 38.0%. Rapid urbanization along with a growing middle-class population is driving the regional demand for electricity in Asia Pacific, which eventually drives the market. China has been heavily dependent on coal; however, coal consumption in this region has witnessed a declining trend in recent years as the country committed its stance to steering the fight against global warming and carbon emissions. There is a progressive rise in gas turbine installations, primarily in medium- and large-scale industries in China. Led by the U.S., Canada, and Mexico, North America accounted for a significant share of the global revenue share in 2022.

The demand is primarily driven by the shale gas reserve and technological development in extraction & mining technology, which are consistently lowering the operational cost of extraction.Mexico is expected to witness higher demand owing to the launch of the Development Program of the National Electric System 2018 – 2032 in May 2018; under which, the government has planned to add 66.91 GW of additional power capacity across the country to satisfy the expected power demand till 2032. Under the newly installed capacity, combined cycle power plants will account for the maximum share of around 42%. Moreover, 48 combined cycle power projects would be deployed till 2032, which will boost the market growth in the country.

Key Companies & Market Share Insights

Major players are utilizing strategies, such as providing multiyear service contracts to the existing and new power plant owners to enhance their position further. Competition among the vendors is based on the performance and efficiency of their manufactured gas turbines as well as the associated services provided by them.Technological capability and R&D became important factors for companies to perform in the industry owing to the rapid change in technology, intense competition, and high demand. OEMs hold a dominating position in the gas turbine service market.

This is owing to their sound understanding of the product and well-structured data management techniques. OEMs are launching upgrades of the existing gas turbines under service contracts to existing customers. For instance, General Electric in September 2018 launched a new 6B Repowering upgrade for the turbine. This fits into the existing 6B footprint and can advance performance in both gas turbine and combined-cycle operation. This development will enable General Electric to enhance its share in the market further. Some of the key companies in the global gas turbine services market include:

-

General Electric

-

Siemens Energy

-

Mitsubishi Power, Ltd.

-

Kawasaki Heavy Industries, Ltd.

-

Solar Turbines Inc.

-

Ansaldo Energia

-

Bharat Heavy Electricals Ltd.

-

OPRA Turbines

-

Man Energy Solutions

-

Centrax Gas Turbines

Gas Turbine Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 37.5 billion

Revenue forecast in 2030

USD 67.3 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Turbine type, turbine capacity, service type, service provider, end-use, region

Regional scope

North America; Europe; Asia Pacific; Commonwealth of Independent States; Central & South America; Middle East & Africa

Country scope

U.S.; Mexico; Canada; Germany; U.K.; France; China; India; Japan; Indonesia; Malaysia; Vietnam; Bangladesh; Pakistan; Singapore; Thailand; South Korea; Taiwan; Saudi Arabia; Iraq; Lebanon; Oman; Qatar; UAE; Kuwait; Algeria; Tunisia; Ghana; Egypt; South Africa; Russia; Ukraine; Turkey; Turkmenistan; Kazakhstan; Azerbaijan; Brazil; Argentina; Uzbekistan

Key companies profiled

General Electric; Siemens Energy; Mitsubishi Power, Ltd.; Kawasaki Heavy Industries, Ltd.; Solar Turbines Inc.; Ansaldo Energia; Bharat Heavy Electricals Ltd.; OPRA Turbines; Man Energy Solutions; Centrax Gas Turbines

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gas Turbine Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global gas turbine services market report based on turbine type, turbine capacity, service type, service provider, end-use, and region:

-

Turbine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Duty

-

Industrial

-

Aeroderivatives

-

-

Turbine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 MW

-

100 to 200 MW

-

>200 MW

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Maintenance & Repair

-

Overhaul

-

Spare Parts Supply

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Non-OEM

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Oil & Gas

-

Other Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Malaysia

-

Vietnam

-

Bangladesh

-

Pakistan

-

Singapore

-

Thailand

-

South Korea

-

Taiwan

-

-

Commonwealth of Independent States

-

Russia

-

Ukraine

-

Turkey

-

Turkmenistan

-

Kazakhstan

-

Azerbaijan

-

Uzbekistan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Iraq

-

Lebanon

-

Oman

-

Qatar

-

Kuwait

-

Algeria

-

Tunisia

-

Ghana

-

South Africa

-

Saudi Arabia

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global gas turbine services market size was estimated at USD 33.9 billion in 2022 and is expected to reach USD 37.5 billion in 2023.

b. The global gas turbine services market is expected to grow at a compounded annual growth rate of 8.7% from 2023 to 2030 to reach USD 67.3 billion by 2030.

b. Asia Pacific emerged as the largest market for gas turbine services market in 2022. The region is led by China, Japan, Indonesia, and India is projected to reach more than 38.0% of the total market revenue by 2030. Rapid urbanization along with the emerging middle class is driving the regional demand for electricity in the Asia Pacific region which eventually drives the market.

b. Some key players operating in the gas turbine services market include General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd. (MHPS), MAN Energy Solutions, Kawasaki Heavy Industries, Ltd., and Ansaldo Energia S.p.A.

b. Key factors driving the gas turbine services market growth include rising environmental concerns owing to the high amount of carbon emissions from coal-based power generation has resulted in the adoption of low carbon emission power generation technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."